The world of financial institutions used to be a very serious, sterile industry, one not likely to have cross paths with any social media networks. But these days, few businesses can afford to escape the digital revolution and not have a social media presence.

Therefore, social media is now rewriting the banking industry playbook, allowing banks to connect with their existing or potential customers, increase touchpoints, build trust and offer value, without compromising on quality and security.

Curious to learn how the banking industry is leveraging social media to reach their goals? Carry on reading and find out how social media banking is reaching new highs every day.

Social media banking explained

- Why should banks be on social media?

- Traditional banks vs online banks

- UK vs US banks on social media

- Social media banking best practices

1.Why should banks be on social media?

Considering all the industry regulations they need to comply with and customer data privacy they absolutely need to protect, you would think banks wouldn’t bother establishing their presence on social media.

But, as it turns out, they figured out that the effort is worth it, and many banks (particularly from the U.S. and UK) are highly active on social media.

To answer the question of whether social media banking makes sense or not, it’s enough to consider the benefits that this medium brings to the banking industry.

Generating awareness for their brand

People no longer turn to social media just to pick what coffee machine to buy, they also rely on it for bigger decisions such as choosing a bank for a money loan.

To that end, banks benefit from being on social media because it helps them build awareness, as well as an image of trust, transparency and reliability, which are crucial factors people take into account when choosing a bank to handle their finances.

Establishing a dialogue with their audience

Traditionally banks would engage with their potential customers through advertisements, calls or email. But with social media in their corner, banks can now have two-way conversations with their audience and learn valuable insights about their needs and preferences.

Improving customer support

Nowadays, people are eager to express their feelings towards a certain brand or product as soon and clearly as possible. (Pro tip: You can track sentiment and emotion towards your brand using Socialinsider's new Instagram Listening tool).

Comment sections have become the new message boards and customer support chats.

Therefore, social media can help banks keep an eye on, capture and resolve many more customer issues than ever before. For that to happen, social media and customer support teams need to work very closely so that no client feedback slips through the cracks.

Educating their users

Different banks have different takes on social media, but the common denominator across most social media accounts for banks is that they are determined to educate their users on how to use their product and how to navigate the financial sector in general.

This approach ends up benefiting both the end users and the banks.

2. Traditional banks vs online banks on the social media banking scene

It may come as a surprise that the social media banking world is more diverse than one may expect. Perhaps the most important distinction to be made is between traditional, brick-and-mortar banks that also have an online presence and banks that operate exclusively online and are also active on social media.

From my analysis of the social media banking industry, the difference in how banks use social media can be explained by looking at the type of bank that’s doing the posting.

It’s not a hard-and-fast rule, but generally speaking, traditional banks tend to be more conservative in their tone of voice on social media, while online banks have a bolder tone and a more vibrant personality on social networks.

Let me show you what I mean.

Here are the top 3 Instagram posts (by engagement) from the past 3 months for Bank of America, one of the largest (traditional) banks in the U.S.:

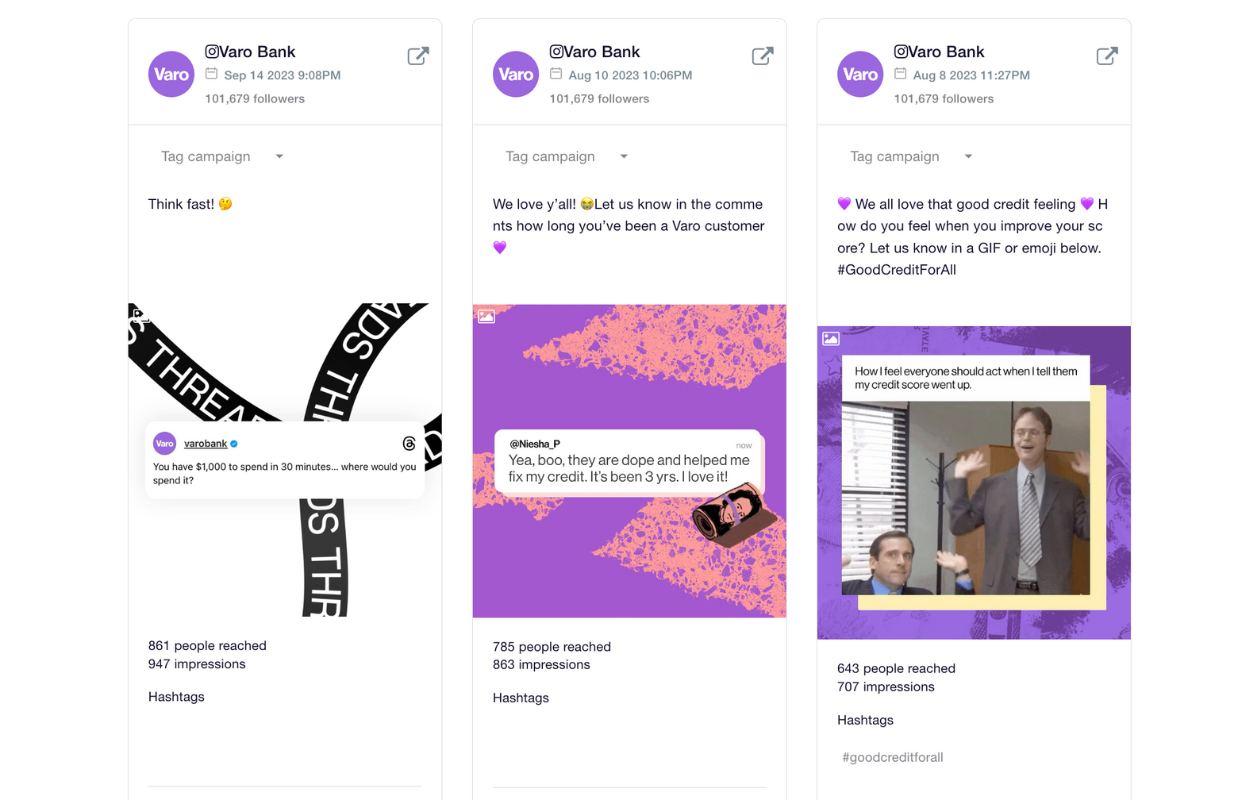

And here are top 3 best-performing Instagram posts for Varo Bank, an up-and-coming online bank from the U.S:

Looking at these posts, it becomes obvious that the two banks have contrasting approaches to social media, and that they target different audiences. Bank of America is speaking to a broader age range, while Varo Bank is intentionally speaking the language of younger generations using slang, memes and informal questions.

To dive deeper into what defines each approach to social media banking, I took a look at 5 traditional banks and 5 online banks that are active on Instagram and uncovered the top 5 topics for each category over the past 12 months.

Based on my findings, traditional banks like Citibank, Bank of America and the like are more likely to talk these topics:

While online banks such as Monzo, Starling and Vero are more interested in topics such as:

As you can see, there is some overlap in the topics we discovered, but online banks seem to be branching out into topics such as beauty which is a highly popular interest amongst younger generations. On the other hand, traditional banks tend to prioritize business since they are targeting a more mature audience.

3. UK vs U.S. banks on social media: a comparative view

Looking to get an even broader view of the social media banking industry and do a proper comparative analysis, I picked 5 major banks from the U.S. and 5 major banks from the UK, added their Instagram profiles into Socialinsider and set a course for the Benchmarks section.

Here, I grouped them by geography using the Brands feature and obtained some interesting insights.

As it turns out, in the last year, UK brands lead by almost every metric, including engagement, number of posts, engagement rate and reach. U.S. brands, however, have collectively attracted a higher number of fans on Instagram than their British counterparts.

UK banks such as Monzo and Revolut are absolute winners when it comes to engagement and engagement rate, compared to all other banks analyzed (US and UK both). Their strong performance is most likely what's lifting up the UK banks category.

It’s no surprise then, that the majority of top-performing posts from the past year also belong to UK banks.

The U.S. banks I analyzed were:

The UK banks I analyzed were:

4. Social media for banks: 5 best practices

So how do these banks do it? How do they manage to turn an industry and subject matter that might seem cold and appealing to some people into something fun, useful and sure enough, profitable?

Well, there are some best practices for social media banking that can serve as a guide for those just starting out.

- Become a hub for educational content

Unfortunately, financial education is not something that gets much attention during our school years, and yet it is something that we could all benefit from as we grow up and start becoming responsible for our finances.

Besides, sharing tips, insights and advice that helps your customers is a great way to gain their trust in your bank.

Many banks that are active on social media are already in on this “secret”, and they prioritize sharing educational content that is useful to their audience. Some do it in a more conservative way, like Chase Bank:

Others, such as Monzo, make it really fun and accessible to younger audiences, hoping that it will reach more people and be easier to absorb:

One content idea that’s easy-to-implement and replicate would be infographics. Because they allow you people to visualize and understand data much easier than written text, they are much more engaging and therefore, they are a good way to organize educational content.

2. Build trust and be human

As a financial institution, it can be hard to have a human-like presence on social media, as well as earn and keep your clients' trust. But social media can facilitate a deeper connection between banks and their clients.

3. Use hashtags

No matter what kind of business you’re representing on Instagram, hashtags remain essential. They’re a great way to group posts and target industry niches.

To get some ideas, I added the industry hashtag - #banking - into Socialinsider’s Instagram Listening tool and explored the many options:

As you can see, there are many related hashtags you can use to target specific niches or touch upon popular topics, such as insurance, investing, career, education and real estate.

4. Link back to your website or app

Attracting people to your social networks is essential, but the end goal should be to get them to use your service. To do that, you need to provide links to your website or app as frequently as you can, so when they do decide to make the leap, they have all they need to reach you.

For Instagram, that translates to links in your bio (up to 5) or links in Stories.

5. Connect customer support and social media teams

Since part of your social media channels’ job is to capture user feedback and mitigate crises before they blow up, it’s crucial for the support team and social media team to be in close contact at all times.

Consolidating this side of business will allow you to increase touchpoints and build trust with your clients.

Final thoughts

Despite the many challenges banks face while marketing online, they are right to give social media banking a chance.

By tapping into the human side of marketing, being responsive and staying on top of industry trends and current affairs, banks can actually thrive on social media, while at the same time building long-lasting relationships with their clients.