How to Run an Effective Content Competitor Analysis to Gain Powerful Content Insights

Learn how to run a content competitor analysis and get insights on how to enhance your social presence. Find content gaps and elevate your brand.

If you’re a marketer, competition can feel exhausting.

I am sure I am not the only one posting consistently, testing new ideas, and still watching a competitor pull ahead.

Some days, it’s easier to scroll past their content and pretend they don’t exist.

But once I realized the goldmine of information I can gather from a well-executed content competitor analysis, I could no longer ignore it. Suddenly, those high-performing posts stop being annoying and start becoming useful.

To help you get the most insights from how to do competitor’s content analysis, I talked to Julia Holmqvist, social media manager at Semrush, the brand that reaches over 1.3M people on social media daily.

She shares her behind-the-scenes on how competitor analysis can help brands optimize their social media strategies.

Key takeaways

-

Why conduct a content competitor analysis? A content competitor analysis helps you uncover content gaps, understand audience preferences, generate stronger ideas, and benchmark performance so you can outperform competitors instead of guessing what works.

-

How to conduct a social content competitor analysis? A social content competitor analysis involves systematically studying competitors’ pillars, formats, posting habits, top-performing posts, partnerships, and community engagement to turn proven patterns into actionable strategy.

-

Top content competitor analysis tools: Tools like Semrush and Socialinsider simplify content competitor analysis by revealing what topics, formats, and distribution strategies drive real results across search and social.

What is content competitor analysis?

Content competitor analysis is the process of systematically reviewing your competitors’ content to understand what they publish, how they structure it, and how it performs so you can spot gaps and opportunities in your own strategy.

It typically covers:

- On-site content such as blog posts, pillar pages, reports, ebooks, templates, case studies, and other resources.

- Social content including posts, formats, content pillars, and engagement patterns across platforms.

Why conduct a content competitor analysis?

Here are four key reasons you should invest in a content competitor analysis.

Find content gaps to capitalize

A content competitor analysis helps you see what everyone else is talking about and, more importantly, what they are avoiding or overlooking.

Maybe competitors publish endless ‘what is’ blogs but never explain how to apply those ideas in real scenarios. Maybe their social media is filled with comments like “I wish you talked more about this topic” .

Those gaps are your opening. You can create content that answers the real follow-up questions, adds practical examples, or targets a content pillar your competitor is missing out on.

Understand audience preferences

Are you just starting out with content? Or are you still figuring out what your audience prefers?

Lean in to competitor data to understand what the audience is looking for.

Julia mentioned this as a strong benefit of conducting a content competitor analysis. She said:

A content competitor analysis helps you understand what your audience or target audience likes and doesn’t like, especially since you often share the same audience as your competitors. When you analyze competitors’ social media, you can see what has worked for them and what hasn’t. That’s a great source of inspiration for your own strategy and content.

She gave an example to illustrate her point.

If you notice a competitor doubled down on video last quarter and engagement went up, that’s a strong signal your audience might also like video.

These kind of insights save you from guessing. Instead of testing ideas blindly, you build on proven behavior.

You learn how your audience prefers to consume information, how deep they want to go, and what tone keeps them engaged.

Get new content ideas

Many brands use competitor analysis to find content ideas. Which content formats are working the best for your audience? Which pillars are getting them the most engagement? Are they using a particular tone that is working well?

Instead of copying your competitor’s strategies, you can take these ideas and put your own spin to them. For example, if ‘product updates’ as a content pillar is working well for your competitor, think about how you can showcase unique product features or use cases. Maybe you can invite customers to talk about them. Or approach it with your brand tone and style.

Benchmark performance

A content competitor analysis gives you context for your numbers so you are not celebrating wins that are average for your industry.

Maybe your social media engagement looks solid until you see competitors getting double the interaction with fewer posts. Maybe your blog traffic is flat while others grow by focusing on fewer, stronger topics.

Julia mentioned the same in our interaction. She said:

I was thinking about this from different perspectives, because it’s a bit different when you work for a big company with a larger team. But for any company, it’s a great way to show stakeholders or clients how you’re actually doing on social media.

If you just show numbers like, ‘This month we got 5,000 engagements,’ it doesn’t really mean anything without context. When you compare month over month, quarter over quarter, or against competitors, you can actually tell if that number is good or bad. Is 5,000 engagements only 10% of what competitors get, or is it triple? That context makes it much easier to present results or justify trying a new idea.

How to conduct an on-site content competitor analysis?

Looking to draw inspiration from your competitor’s blog? Or want to see which pages they highly rank for? Here’s how to do that step-by-step.

Audit their core content types

Start by mapping what competitors publish. Open their site and scan it like a first-time visitor. Then get systematic. For example, I go through their core content formats.

- Blog articles and pillar pages: Note topics, depth, and structure. Are posts short and fluffy, or long and practical? Do pillar pages truly connect related content or just collect links?

- Landing pages and solution pages: Look at positioning. What problems do they lead with? What proof do they use? For example, do they sell outcomes or just features?

- Case studies and customer stories: Check how specific they get. Named results beat vague success every time. If competitors stay high-level, that’s your chance to go concrete.

- Guides, resources, and gated content: Ask what they’re trading for an email. If it’s generic PDFs, you can win with templates or tools.

- Product-led educational content: See how they teach users to succeed. Weak onboarding content is an open door.

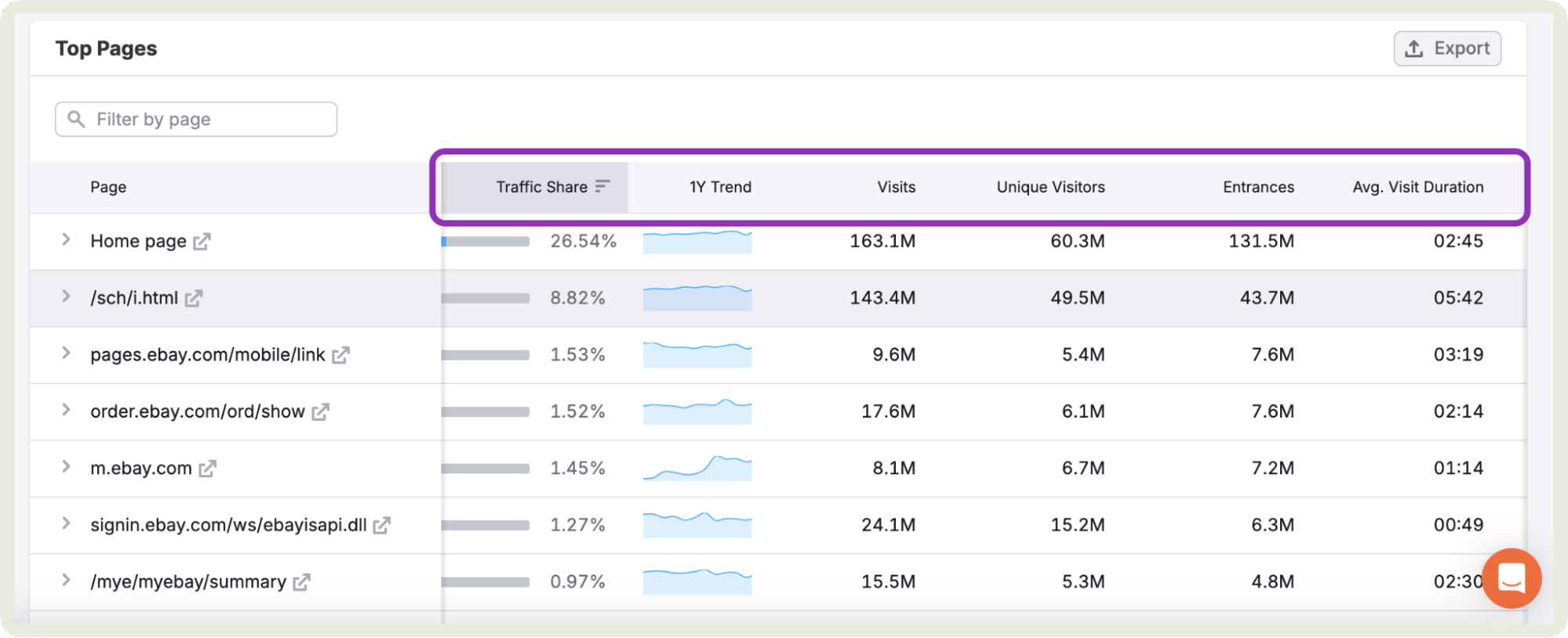

Analyze topics and structure

Once you know what competitors publish, dig into how they do it. This is where patterns and shortcuts show up.

- Core topics and recurring themes: List what appears again and again. Do they create a lot of product-led content? Or is the focus on informational content?

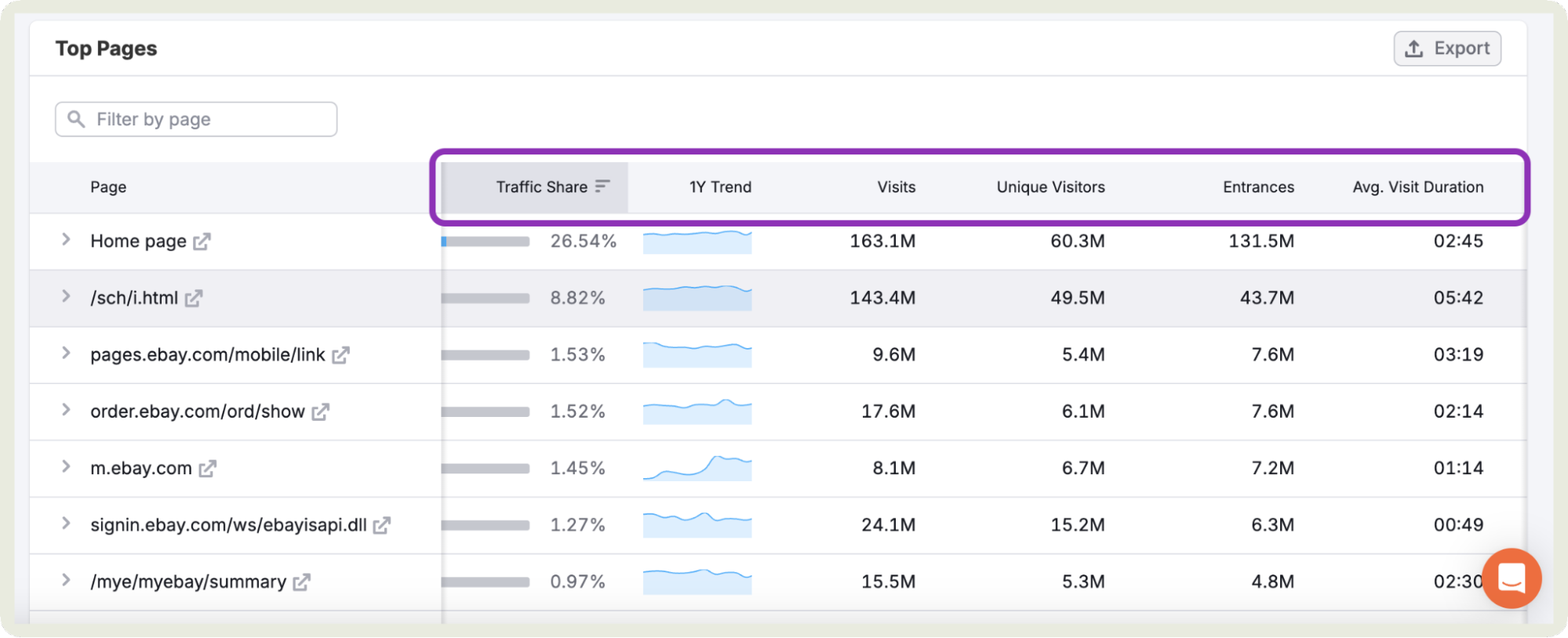

- Pages that get the highest traffic: Use SEO tools like Semrush to spot priority pages.

These are their money makers. Do they coincide with your highest ranking pages? If not, can you create a similar opportunity for your brand?

- Content depth and format length: Are they winning with 800-word explainers or 3,000-word deep dives?

- Page structure: Scan headings, sections, and visuals. Clean structure usually beats clever writing.

- Use of examples, data, and internal links: Notice where they stop short. Thin content creates opportunity.

- Search intent alignment: Ask a simple question. Does the page actually answer why someone searched in the first place?

Assess performance signals

Now look past the words and study the signals that tell you whether the content is actually doing its job.

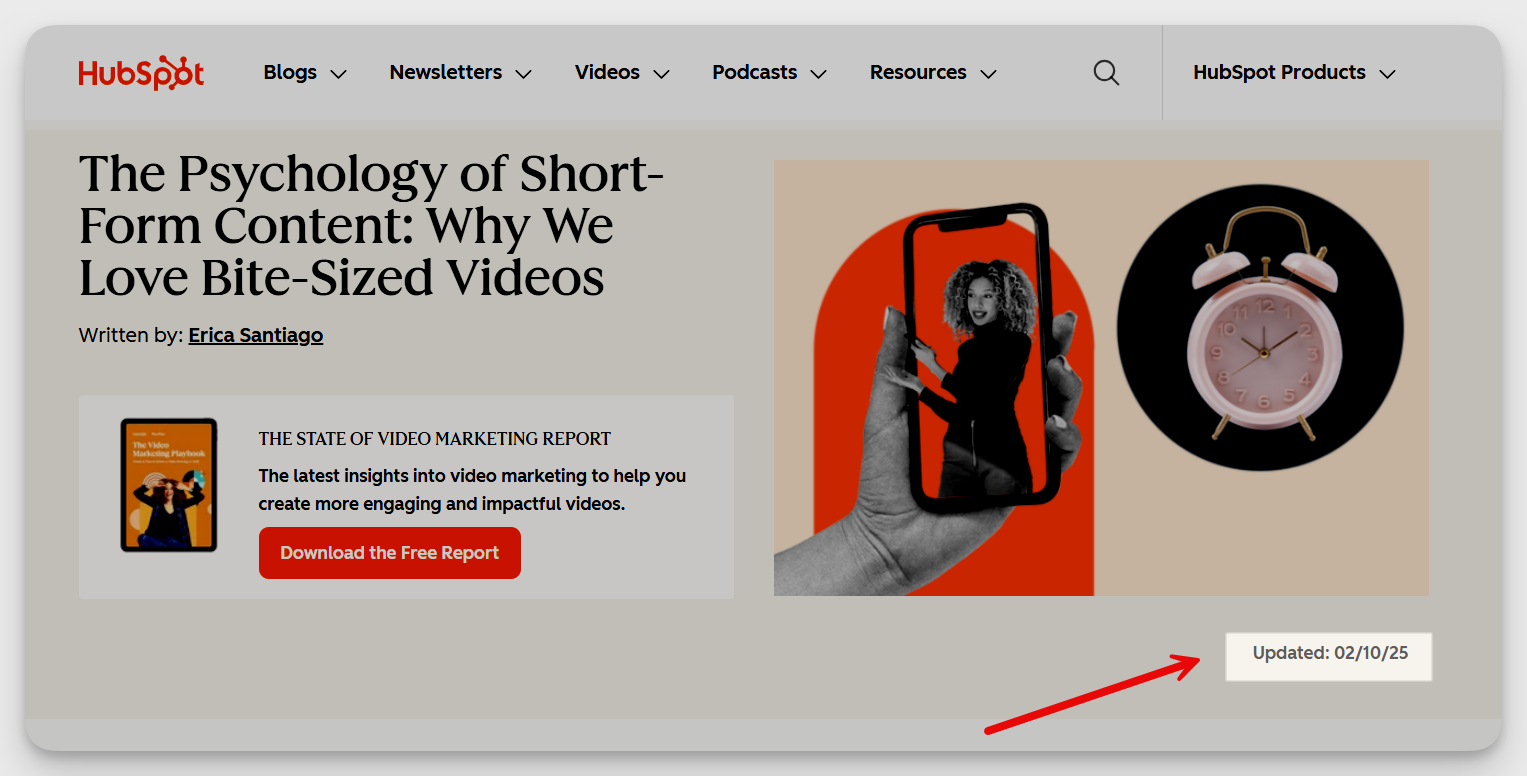

Content freshness and update frequency: Check publish and update dates. In my experience, the pages that rank well are usually maintained and updated frequently. Some blogs, like HubSpot,t even have the ‘Updated’ section on the article itself.

- CTAs and conversion paths: Notice what happens after the scroll. Strong pages guide readers to the next step instead of leaving them stranded.

- Internal linking and navigation: Follow the links. Smart linking keeps users moving and signals which pages matter most.

- Use of social proof: Logos, testimonials, and stats reduce hesitation. If competitors rely on buzzwords instead, you can win with proof.

Spot gaps and opportunities

This is the part of content competitive analysis that actually matters. Without this, all the data collected amounts to nothing.

Here’s how you can spot these gaps and opportunities.

- Topics competitors over-index on: If everyone is publishing the same advice, it’s crowded. That’s a signal to come up with something unique.

- Topics or formats they’re missing: Look for unanswered questions, skipped formats, or shallow explanations. I even search for keywords that my competitor isn’t targeting but can bring great value to the audience.

- Areas where content lacks clarity or depth: Vague posts and half-answers are invitations. Finish the thought they abandoned.

- Ways to differentiate: Go deeper with expertise, simplify with better explanations, or shift the tone from generic to practical.

- Ideas that better serve user intent: Ask what the reader actually wants next. Then build content that gets them there faster.

How to conduct a social content competitor analysis?

Want to take your social media strategy to the next level? Here’s a step-by-step process on how a social content competitor analysis can help.

Step 1: Identify your competitors

You don’t want to analyze too many competitors. At the same time, you need to incorporate relevant competitors to get the most out of your analysis.

I divide my competitors into three main categories and select 3-5 key competitors in total.

- Direct competitors: Brands offering the same product or service to the same audience. If your audience is actively comparing you to them, they belong here.

Their content shapes expectations and benchmarks performance.

- Indirect competitors: Brands, creators, or media accounts that do not sell what you sell but still win your audience’s attention.

Think podcasts, influencers, or tools your audience follows daily. They influence content strategy and engagement norms.

- Aspirational references: Best-in-class accounts in your category or adjacent spaces. These are not competitors you are trying to beat tomorrow.

They show what excellent content execution looks like and help raise your standards.

Julia talked about the process she would ask companies to follow while selecting competitors to analyze:

Consider your company and your goals. If you’re already a leader on social media in your industry, comparing yourself to much smaller competitors doesn’t make a lot of sense, because you’re already winning in that space. In that case, it’s more useful to look at bigger players in adjacent or similar industries.

On the other hand, if you’re a smaller or local business, comparing yourself to global brands like Nike isn’t helpful either. You’re better off looking at businesses in your niche or at a similar scale. For example, a real estate agency doesn’t need to analyze only agencies in the same city, but comparing against agencies across a wider region can give a better perspective.

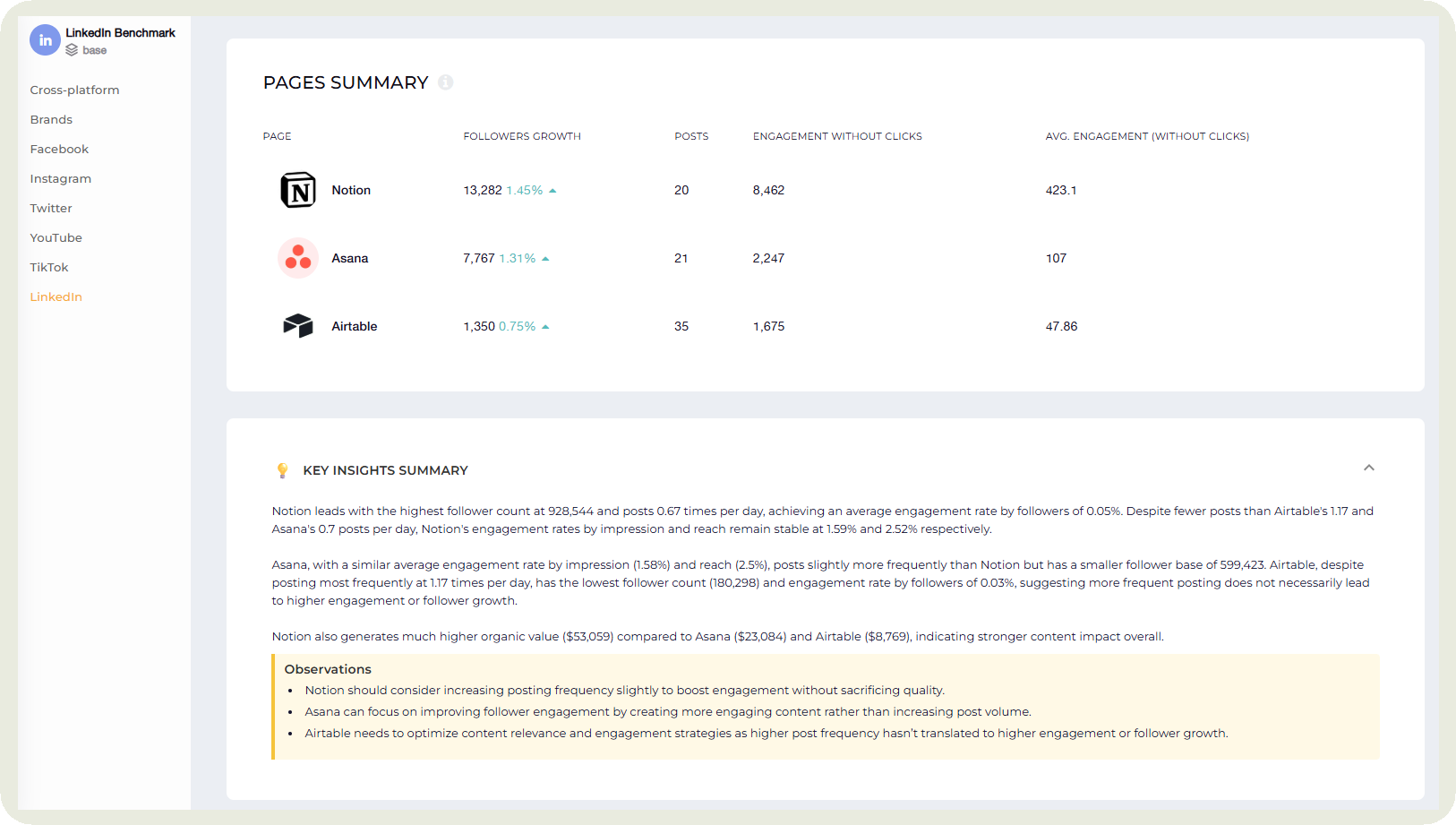

Once you have selected all the competitors, you can add their profiles on Socialinsider to conduct a thorough content analysis.

Step 2: Conduct a content pillar analysis

Before you delve into the nitty-gritty of content format and style, look at the themes they are targeting.

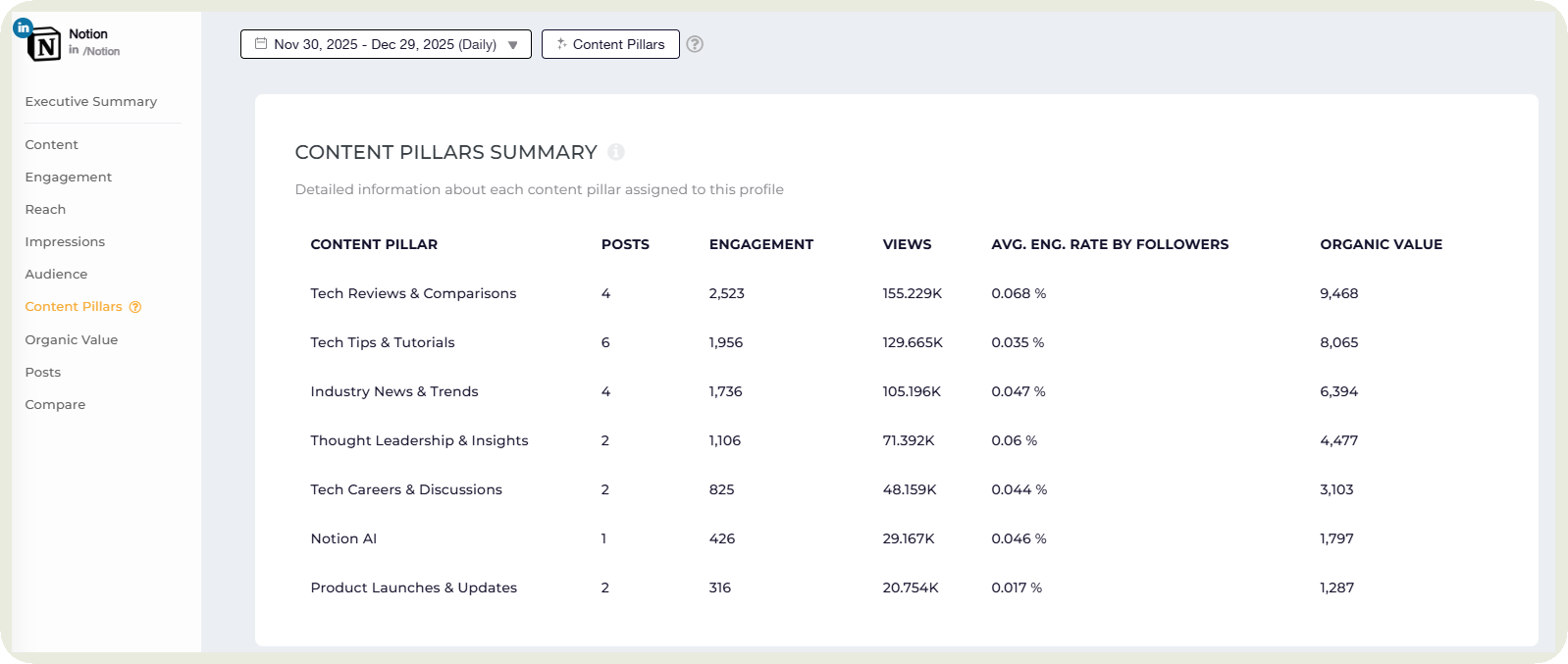

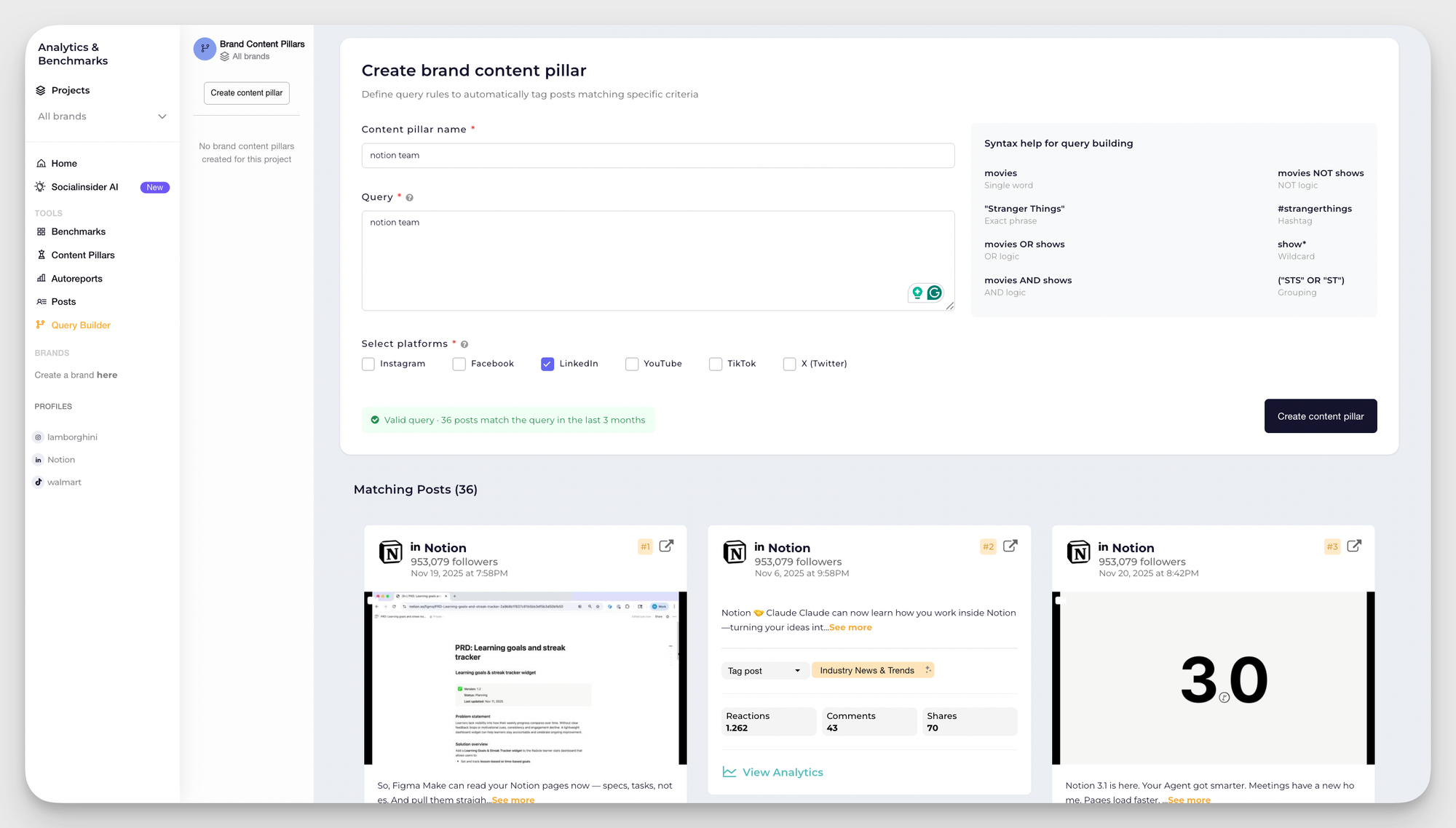

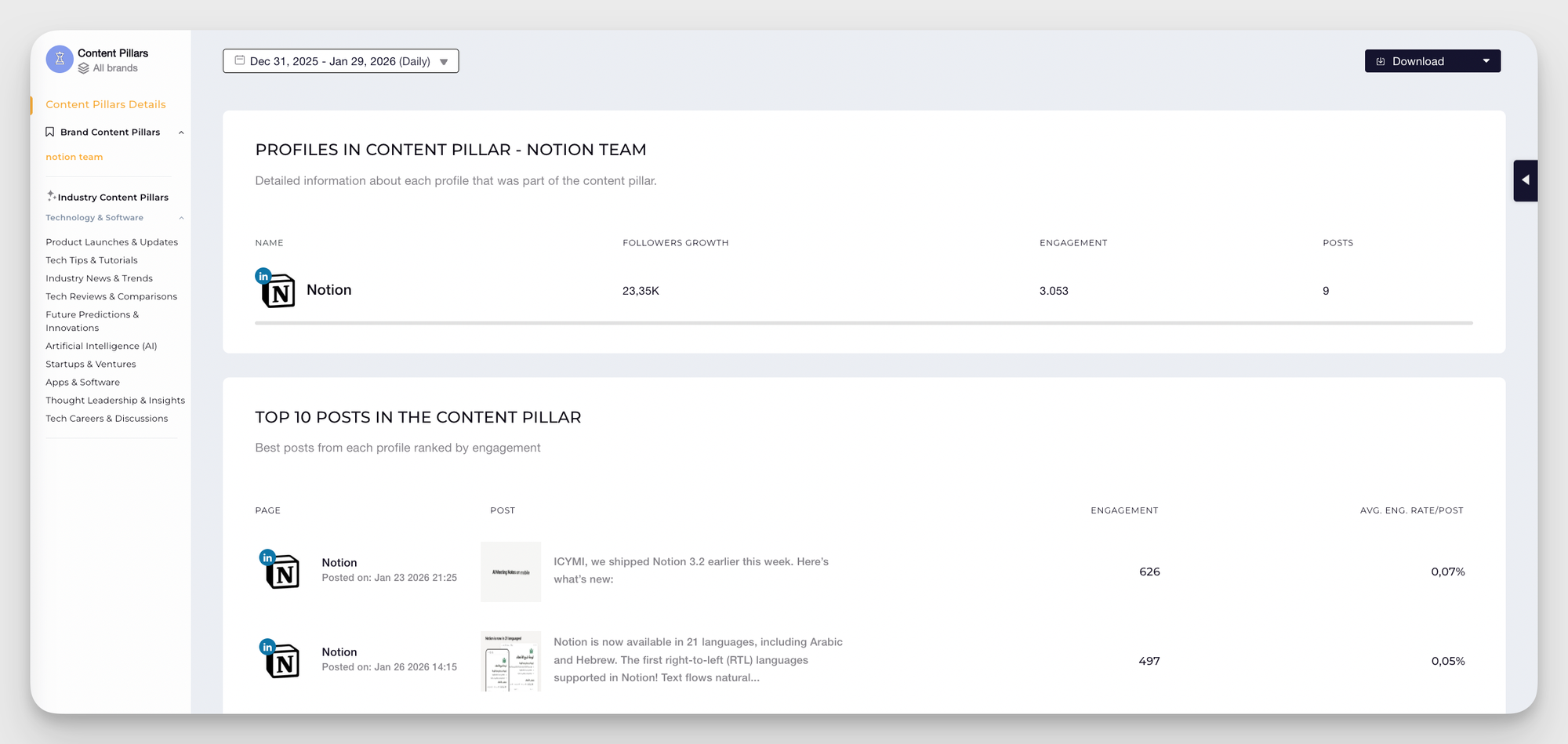

Instead of manually sorting posts into different themes, I turn to Socialinsider to get an automated analysis of each competitor’s content pillars, using the platforms AI-generated industry-based conte pillars.

Here’s what I do next to analyze competitors content:

- Identify their top-performing content pillars based on engagement. These are the themes that repeatedly spark likes, comments, and shares.

- Check how often those winning pillars appear in their posting mix. Are they constantly targeting these pillars or do they pair it with some other content pillar often?

- Spot pillars that consistently underperform but still get posted. Either you can dig deep and find out why the pillar is underperforming and implement those tactics. Or you can decide to do away with those pillars.

- Track shifts over time. Is a content pillar suddenly performing very well? Is it because of a change in storytelling or have audience preferences changed?

- Look for gaps where competitors are quiet and your brand could show up strong.

This way, you can monitor how your own unique content topics perform.

When asked how Julia validates whether they can adopt a content pillar that a competitor is utilizing, she shared her process:

When I do a content pillar analysis and see that a certain type of content, like educational content, works really well for competitors, and their top posts are from that pillar three months in a row, I can assume it would work for us too. That gives me a clear understanding of what the target audience likes and doesn’t like. If a pillar consistently performs well for them, it’s a strong signal to base our own content strategy on it.

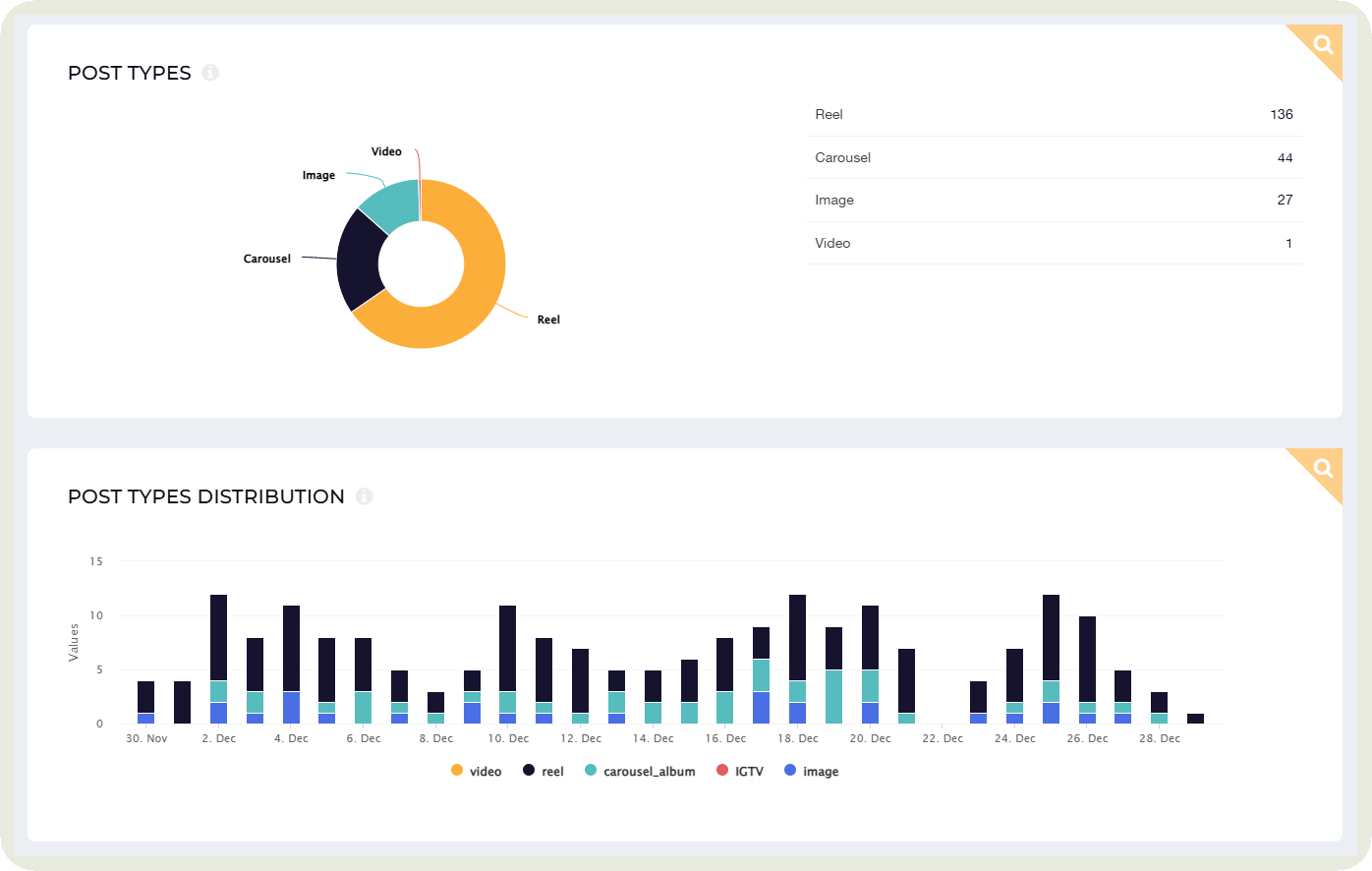

Step 3: Break down their content format strategy

Now that you know what your competitors talk about, it’s time to look at how they package it. Because on social media, format often matters just as much as the message.

Start by mapping the content formats they rely on for each platform. Short videos, carousels, Stories, Lives, static images, text posts.

I use Socialinsider to gather this information about each competitor quickly.

I also dig deep into other competitor insights like:

- Which formats do they use most often versus which ones actually perform best? Are they the same formats?

- Do they specifically lean into platform-native like Stories, Lives, or Threads? You can also review social media benchmarks to see which format performs best on each platform. And if your competitor is prioritizing the same.

- Have they started experimenting with new or emerging formats on specific platforms? For example, Stories on TikTok to build community engagement.

- Any formats that get strong engagement but appear surprisingly underused?

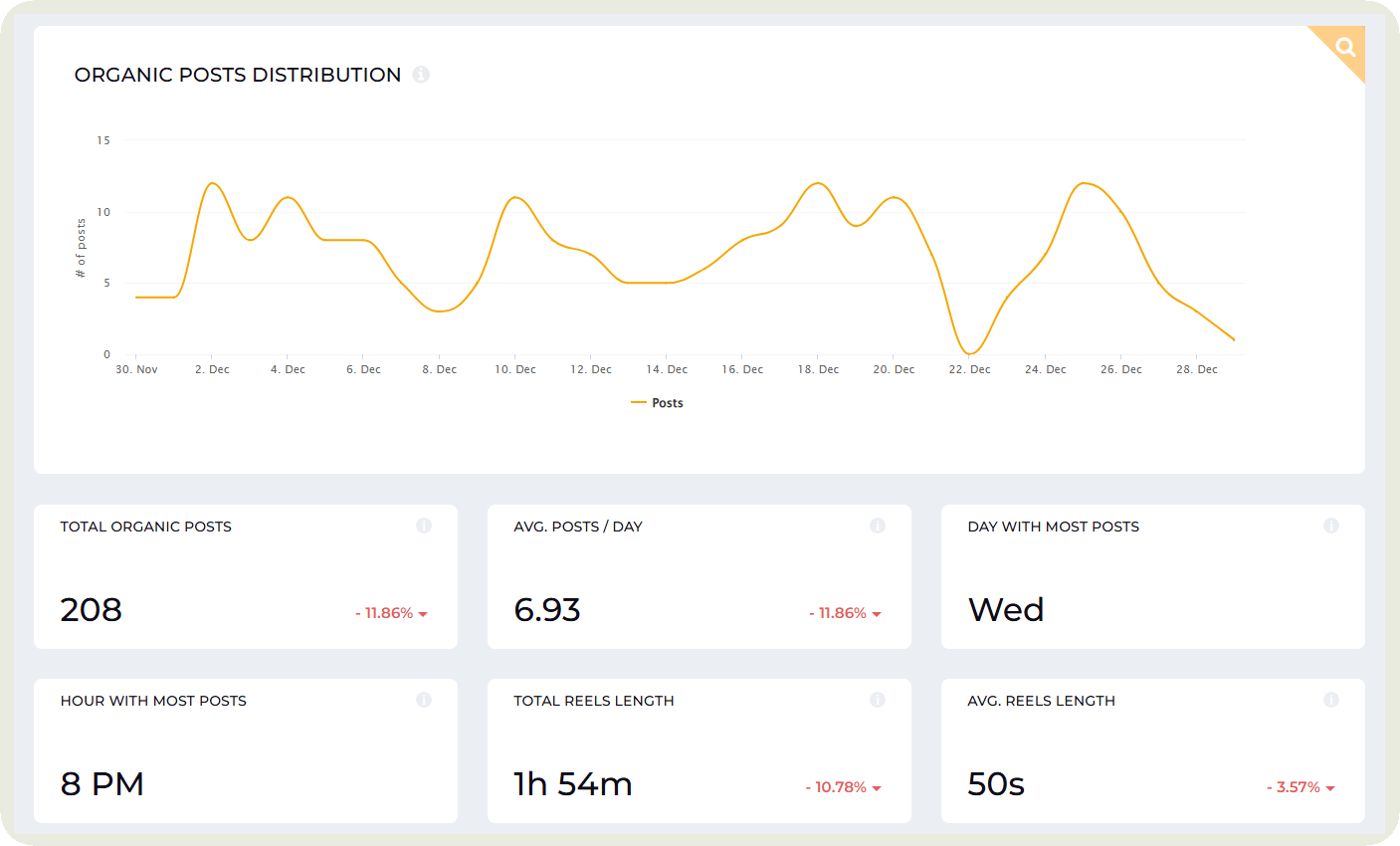

Step 4: Look at their posting strategy and cadence

Are you confused about how often should you post? Too little and you may not be remembered. Too much and you may overwhelm your audience.

The easiest way is to look at the frequency that is already working for your competitors.

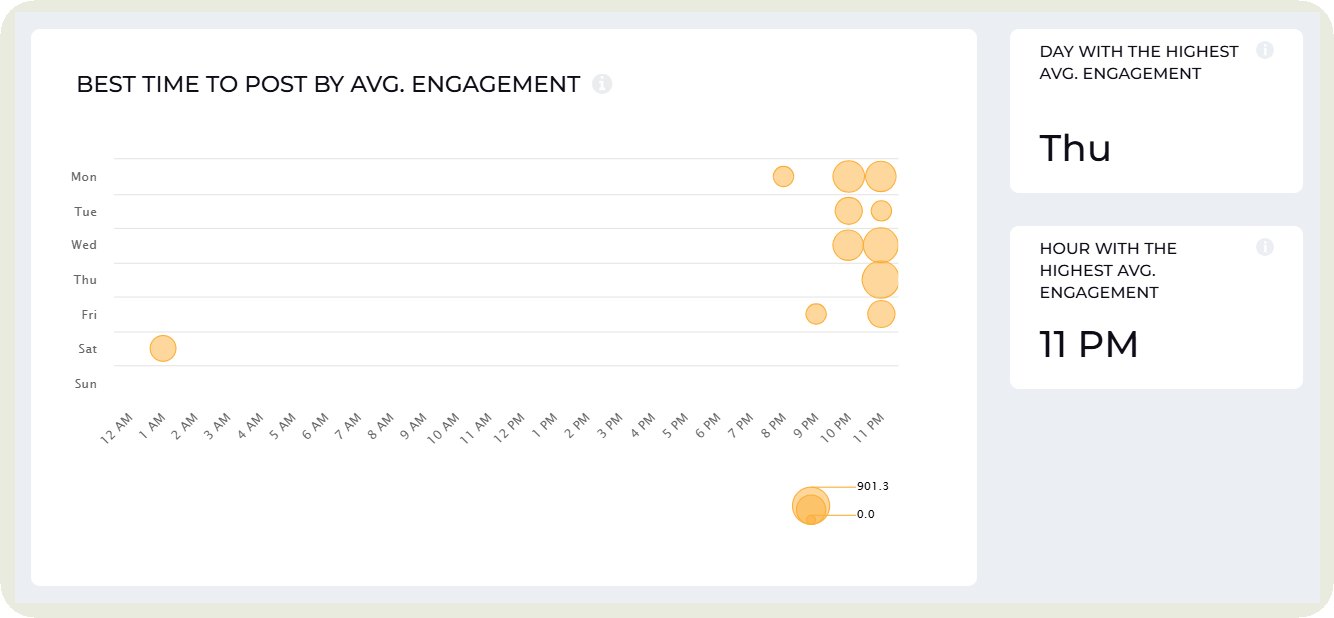

Here’s what you can track while running a social media content analysis:

- Posting frequency by platform: How often they publish on each channel. Some brands prioritize one platform heavily while treating others as secondary. You can get this data on Socialinsider.

- Best-performing posting times: Look for days and time slots that repeatedly drive higher engagement. These patterns usually signal when their audience is most active. Since you might have an overlap with their audience, you can test posting at those times as well.

The only way to track this is by using third-party analytics tools like Socialinsider.

- Consistency versus bursts: Notice whether they post steadily over time or go quiet and then flood the feed around campaigns or launches.

- Format rotation strategy: Check how they alternate between formats like videos, carousels, and static posts. Intentional rotation often leads to stronger overall performance.

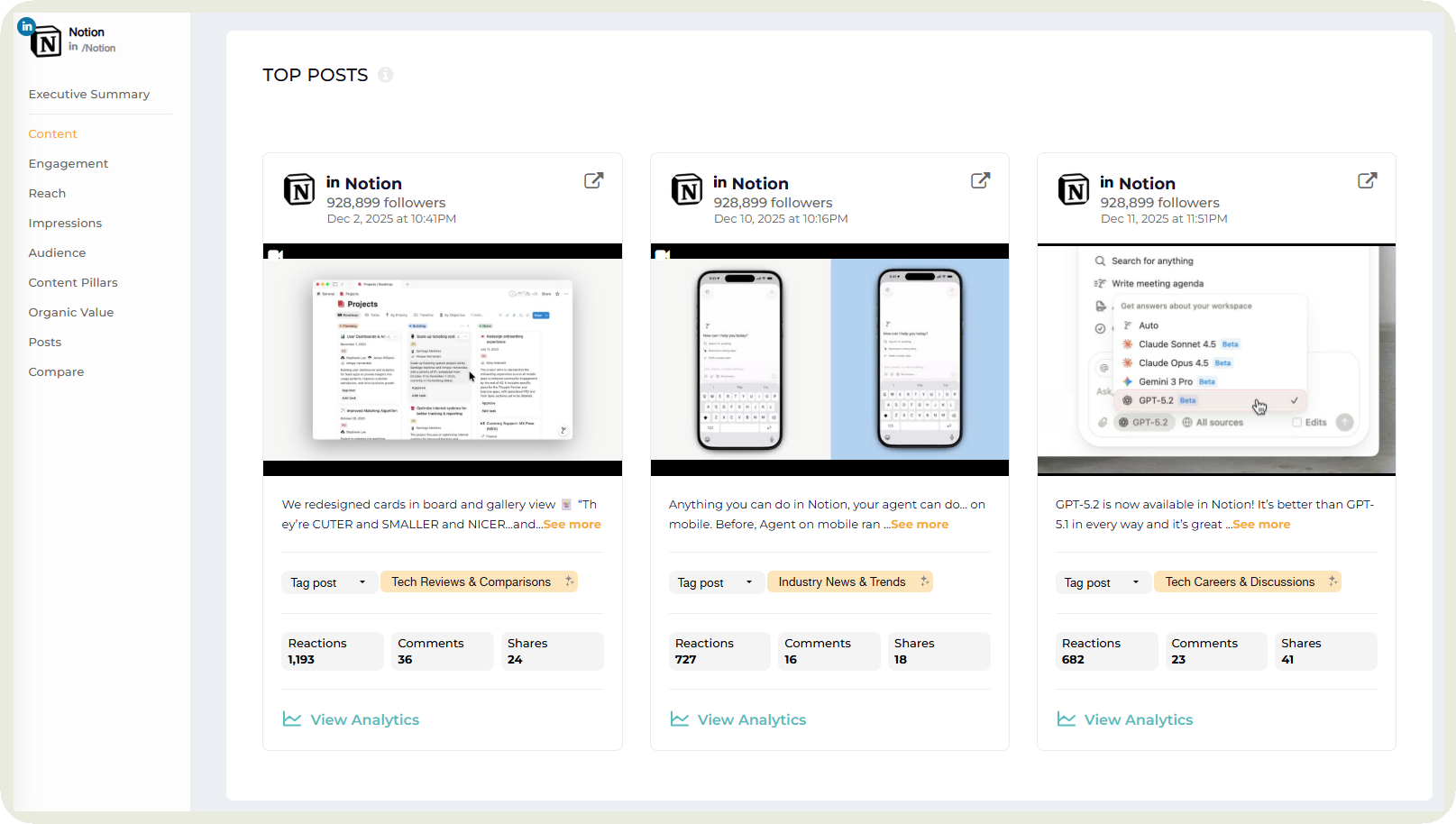

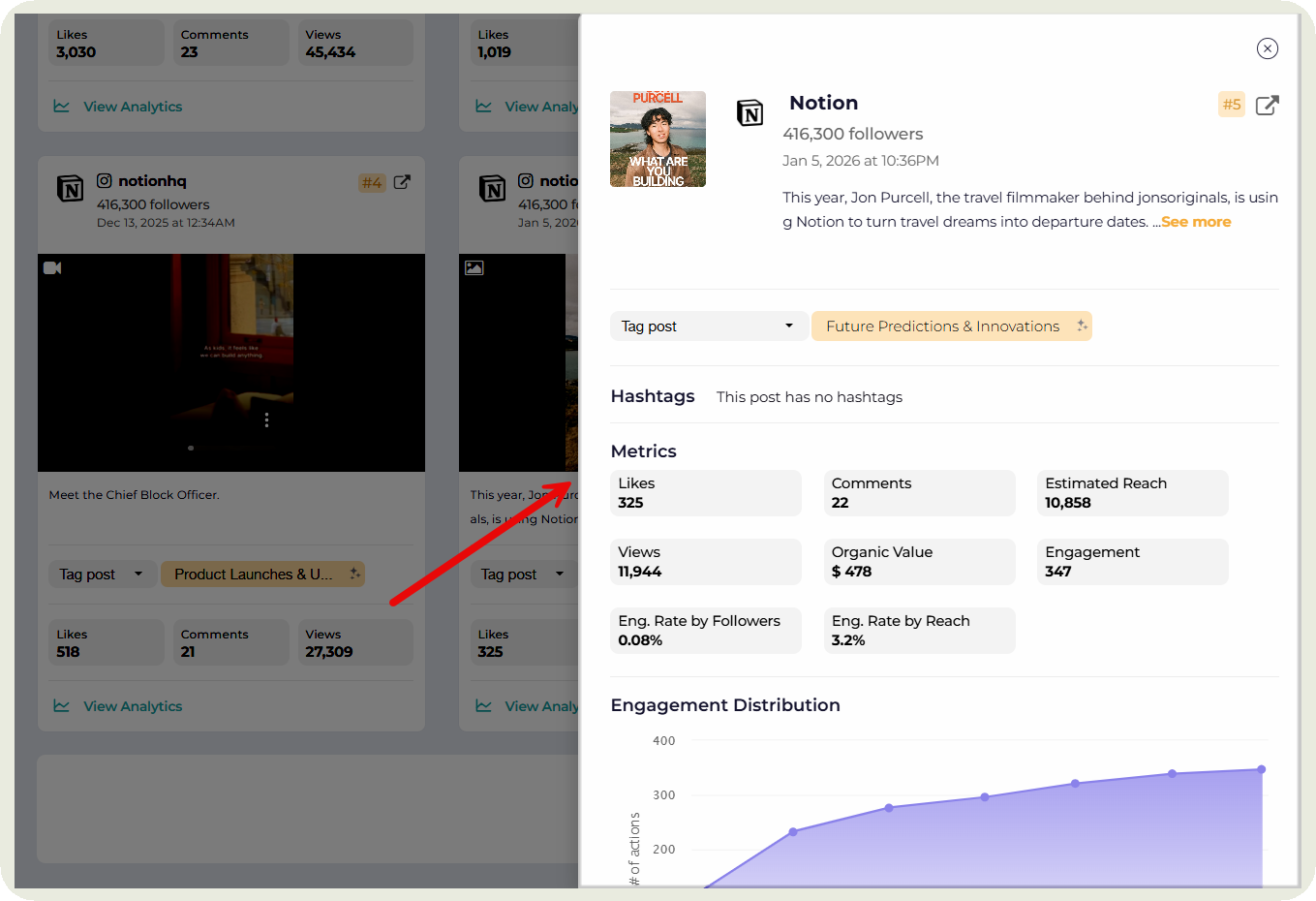

Step 5: Analyze their top-performing content and other qualitative factors

Start by identifying your competitors’ top-performing content across platforms. Not one-off viral hits, but posts that clearly outperformed their usual baseline. These are your real learning opportunities.

I use Socialinsider to quickly sort through their top-performing content.

Next, I zoom in and study the details of why those posts performed well:

- The hooks and openers that helped stop the scroll in the first few seconds

- The pattern changes that break predictability, like sudden cuts, unexpected visuals, or shifts in pacing

- The core theme or idea driving the post

- The storytelling techniques, whether it’s problem-solution, behind-the-scenes, or personal insight.

Once I have done that, I also like to see which qualitative factors my competitors use across content. These could be:

- Overall tone and personality

- Caption style, from long-form explanations to sharp one-liners

- Visual identity consistency, including colors, framing, and layouts

- Use of music, trends, or sound cues

Remember, this step isn’t about copying what they are doing. It’s about understanding what your audience responds to emotionally and stylistically. Then using those insights to sharpen your own content.

Julia mentioned the same, noting that you should look for patterns rather than one-off successes while considering qualitative factors. She said:

When I review a competitor’s top-performing posts, I don’t look at one-off wins. I look for patterns. I pay close attention to the hooks, whether it’s a bold opinion, a strong point of view, or a question. I also look at the emotional trigger. Is it creating curiosity, FOMO, or authority?

I look at the language too. Is it polished or more casual? And finally, the call to action. Are they driving comments, saves, or link requests? When you see these elements repeat across top posts, you start to understand what actually makes the content work and how to apply those patterns to your own strategy.

Step 6: Look at their partnerships and content collaborations

According to a recent Influencer Marketing Report, 86% of consumers make a purchase inspired by an influencer’s recommendations at least once every year.

This is why many brands go heavy on partnerships and creator collaborations.

Instead of shooting arrows in the dark, I like to look at my competitor’s collaborations to get an idea of what’s working in the niche.

Here’s how Julia recommends going through the process:

- Start by identifying who your competitors collaborate with. Are they regularly featuring creators, customers, or industry experts in their content? For example, if you look at Notion’s partnerships, you’ll see that most of them are their customers, which makes the partnership look very genuine.

- Look at the frequency of partnerships. Is it an occasional campaign tactic or a consistent part of their strategy? Consistency usually signals that collaborations are working for them.

Here's how Julia looks at it:

Are they partnering with the same creators repeatedly, which usually signals trust and performance, or constantly rotating influencers, which can indicate experimentation or underperformance?

- Zoom in on the type of creators they partner with. Some brands focus heavily on micro influencers for credibility and tighter communities. Others lean into macro creators for scale and visibility. Both choices reveal what they value more: trust or reach.

Julia also mentioned:

I pay close attention to the creator mix. Are they relying only on big names, or are they also working with niche or regional influencers who speak directly to the target audience?

- Analyze how these partnerships actually perform. Do collaboration posts outperform regular content? Do they drive higher comments, shares, or follower growth? Are there any creators that has helped the brand reach a lot of people?

I can access metrics for these creator-driven posts in Socialinsider.

Other than metrics, I focus on the signals in the comments. Are people asking follow-up questions? Are they requesting links, templates, trials, or more information? That’s a strong indicator the partnership is driving real interest, not just surface-level engagement.

I also look for signs that the content is starting conversations outside the post itself, like people tagging teammates or decision-makers. A red flag is when comments are mostly emojis or generic reactions, which often points to low-quality or bot engagement.

Step 7: Study their community strategy

This step is easy to overlook, but it reveals a lot about how seriously a brand takes its audience.

I pay attention to a few key signals:

- How often they reply to comments: Do they respond consistently or only when a post performs well? Notice if replies are thoughtful or generic, and whether comment replies turn into follow-up posts or content ideas.

- Whether they seed conversation: Look for questions, opinion prompts, or light debates in captions and comments. Brands that invite conversation usually see stronger engagement over time. For example, Canva often prompts its audience to reply to short questions.

- How they show up on others’ content: Check if they comment on industry peers, creators, or partners’ posts. This kind of visibility builds familiarity and positions them as active participants.

Step 8: Turn these insights into an action plan

All this analysis only matters if it changes what you do next.

I start by organizing everything I’ve learned into three clear lists:

- Copy uniquely: Identify formats, hook styles, and content angles that clearly work for competitors. Use them as inspiration and add your own spin to them. For example, keeping the structure, but bringing your own voice, examples, and perspective.

- Improve: Look for areas where you can outperform what already exists. Better clarity in the message. Stronger proof points. Tighter pacing. More creative execution.

- Differentiate Spot the gaps competitors consistently ignore. Audience questions that go unanswered. Formats no one is using. Topics everyone avoids. This is where real advantage lives.

Julia talked about prioritizing gaps instead of copying exact strategies while creating an action plan.

When translating competitor insights into an actionable content strategy, the goal isn’t to imitate, it’s to outperform. I wouldn’t copy an exact post. Instead, I use what I see to create guiding principles. I look for content gaps. What are they not saying? What are they oversimplifying or playing safe on?

Competitive analysis isn’t just about top-performing posts. You also learn a lot from the posts that don’t work. What should we avoid? Or could this work better with a clearer takeaway or stronger point of view?

I use those patterns, both what works and what doesn’t, to pressure-test ideas and shape the strategy.

Once the ideas are clear, set a simple action plan with social media KPIs. This helps you achieve specific results with your content and aligns your team on what they need to do.

Track performance over time so you can see which changes actually move the needle.

Top content competitor analysis tools

For SEO and on-site content competitor analysis — Semrush

Semrush is one of the best competitive analysis tools that can help you see exactly why competitors rank and where you can beat them.

I use it to break down competitor content at a granular level. You can see which keywords drive traffic to specific pages, how those pages rank over time, and which topics competitors double down on.

The Content Gap tool shows keywords they rank for that you do not, which is perfect for finding missed opportunities fast.

You can also get insights into backlinks, internal linking patterns, and SERP features competitors own.

For social content competitor analysis — Socialinsider

Socialinsider is a competitor analysis tool built specifically for social media.

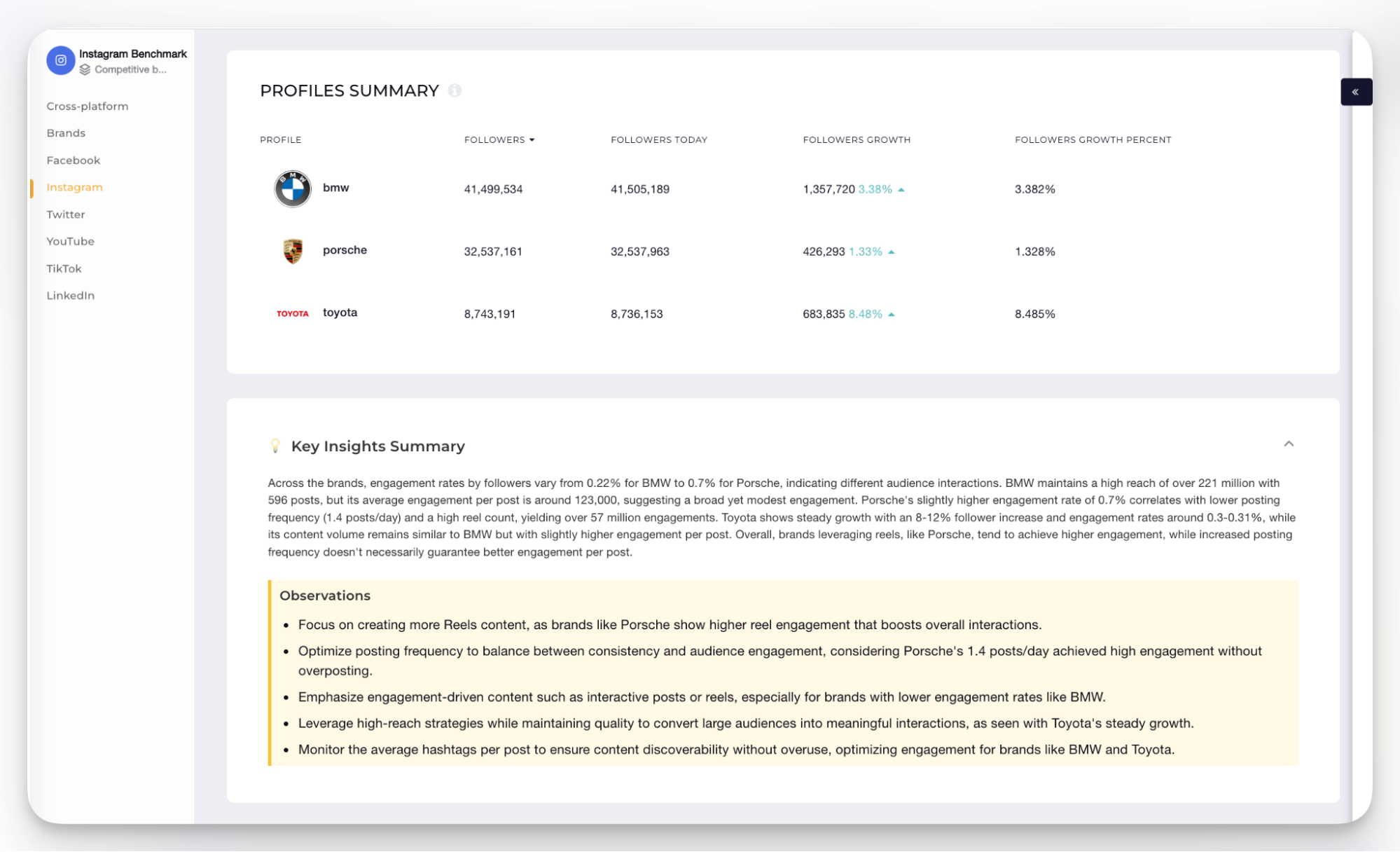

You can benchmark accounts across platforms, compare engagement rates, posting frequency, and follower growth over time, and track performance by content pillars and formats.

The platform also makes it easy to spot which posts, topics, and formats consistently work for competitors and which ones fall flat. Historical data storage is a big win, especially for trend analysis and reporting.

Instead of exporting screenshots and guessing patterns, you get clear graphs, side-by-side comparisons, and automated reporting so you can share reports with your management and clients easily.

Final thoughts

Content competitor analysis is most effective when it directly informs what you do next.

Start by using it to decide which topics deserve more focus, which formats to prioritize, and which ideas no longer justify the effort.

As you review competitor patterns, translate them into clear actions. Double down on areas where competitors see consistent engagement. Improve content where their messaging lacks depth, clarity, or proof. And finally, deprioritize themes and formats that repeatedly underperform.

I would also recommend treating competitor analysis as an ongoing process rather than a one-time exercise.

And if you need a high-powered analytics tool that is built to run competitor analysis well, give Socialinsider a try for free for 14 days.

Analyze your competitors in seconds

Track & analyze your competitors and get top social media metrics and more!

You might also like

Improve your social media strategy with Socialinsider!

Use in-depth data to measure your social accounts’ performance, analyze competitors, and gain insights to improve your strategy.