Social Media Market Research: How to Extract Actionable Insights From Your Online Audience

Transform your marketing strategy with in-depth social media market research. Analyze trends and audience insights to boost your brand's presence.

Social media is your loudest, most honest focus group. Your audience shares their wows and woes online 24/7, and all you need to do is listen with intention.

That’s why social media market research has become such a reliable way to understand your market, your audience, and your next move. When I need clarity on why a campaign feels off or how competitors are moving, I always start with social.

In this guide, I’ll walk you through how I use social media as a research tool. And together with senior social media manager Mya Shell, we’ll break down how to read the signals your market sends you every day.

Let’s get cracking!

Key takeaways

-

Why is social media market research necessary in today’s digital landscape? Social media market research is necessary because it gives brands real-time, unfiltered insights into audience behavior, sentiment, and market shifts that traditional methods can’t capture quickly enough.

-

When to use social media research vs. traditional methods? Use social media research when you need fast, authentic, real-world signals, and rely on traditional methods when you need structured, in-depth insights from controlled audiences.

-

What types of social media market research should you conduct? You should conduct audience research, competitive intelligence, brand health monitoring, trend forecasting, and product innovation analysis to get a full view of your market.

-

What are the essential tools needed for effective social media market research? Effective social media market research requires a mix of analytics tools for performance and competitor insights, and social listening tools for tracking conversations, sentiment, and emerging trends.

Why is social media market research necessary in today’s digital landscape?

Social media is everywhere. It’s the heart of brand-customer relationships, with millions of conversations across platforms, market trends, audience preferences, and swinging brand sentiment.

As a brand, I have to be just as swift to stay relevant and know what floats my audience’s boat today, not last quarter.

Social media market research gives me this adaptivity through:

- Revealing who my audience is, and most importantly, what they care about and how their interests shift.

- Helping me benchmark my performance against competitors and spot new opportunities early.

- Tracking sentiment changes in real time, so I can anticipate risks, catch crises before they snowball, and stand guard over my brand’s reputation.

Ultimately, when guessing just doesn’t cut it anymore, social media market research is what lets me move from gut feeling to grounded decisions.

When to use social media research vs. traditional methods?

When I need structured insights, clear parameters, or a deep dive into a specific audience group, I go for traditional research methods: surveys, interviews, or long-form studies.

But they’re slow and expensive. I can’t conduct a full-scale traditional research every time a new viral TikTok trend shakes the audience.

Social media research steps in when I need insights that feel current and closer to real behavior. I use it when I want:

- Real-time reactions and quick sentiment shifts

- Honest (and sometimes brutal) audience opinions that aren’t shaped by a controlled environment

- A pulse read on how my content compares to competitors

- Early signs of rising topics or trends

- Observations based on what people really do on platforms, instead of what they say they do

When asked whether social media is better for market research than traditional methods, Mya Shell says it’s about balance. But she also pointed out the unique things social media can reveal:

“Social media is great when you want to hear real thoughts from real people. You get to see things in action, like how a product works, what the outfit looks like, or what a travel spot has to offer. It’s not the polished version you find on a website. It’s the imperfect, real moments.

Another great part of social media is that you can see the general community and consensus on something or someone by checking the comment section. And even when something is staged or part of a paid collab, that still gives you information about a brand — how they spend, what they prioritize, and what the community around them looks like.”

For me, it’s never only one or the other. Big market studies offer depth and structure, but they don’t happen every month. Social media market research fills the space between them. It gives me quick pulse reads that help refine my strategy and adjust to shifts.

What types of social media market research should you conduct?

Social media as a research tool can help us uncover a handful of different insights about our audience, content, and brand. You just need to know what you’re looking for.

Here are the five different angles you can explore through social media:

Audience research and consumer insights

Social media is the direct line of contact with your audience. Social media audience analysis can help you understand who’s on the other side of the screen and what they expect from you.

There are four core things I usually do through social media audience analysis:

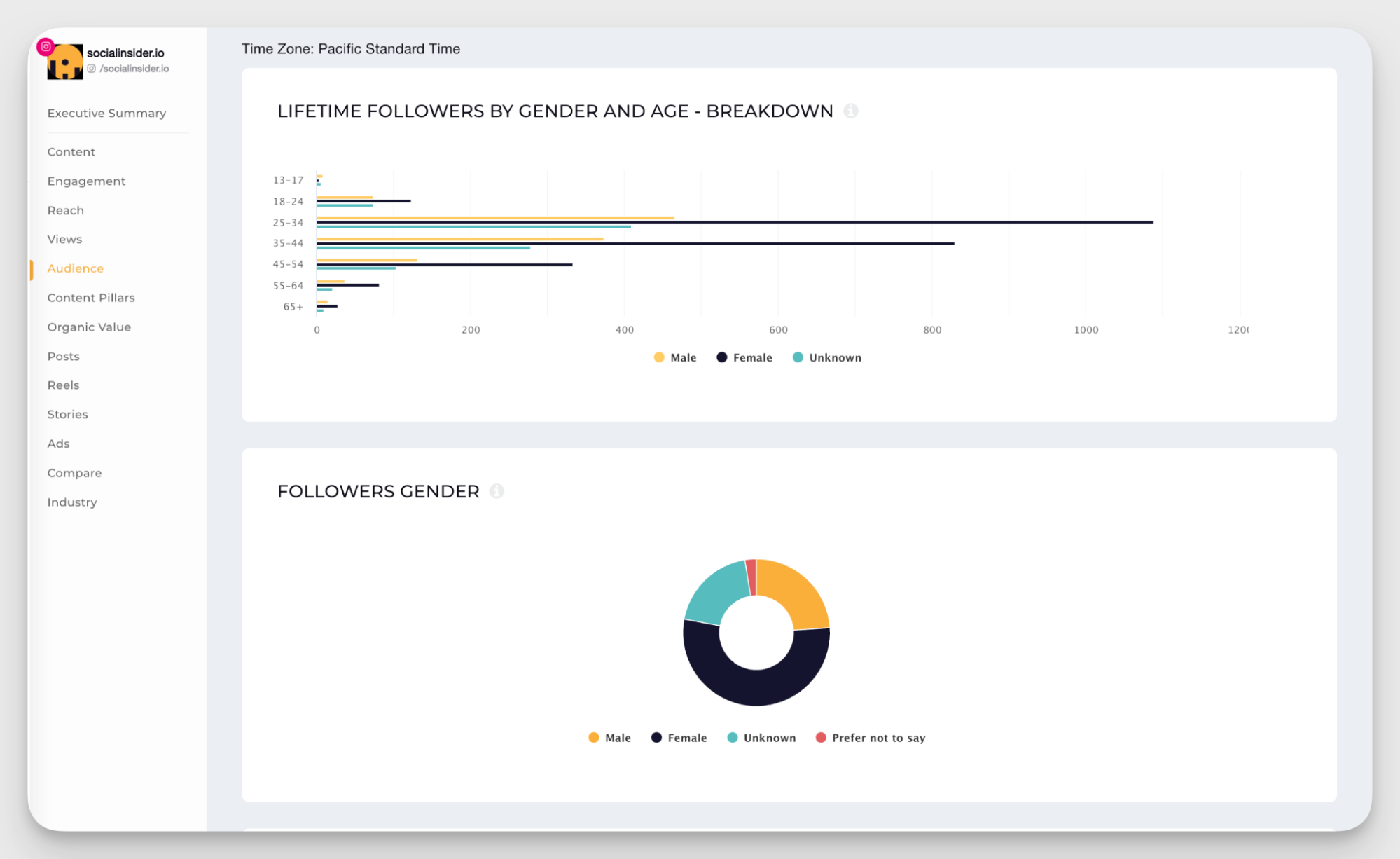

- Investigate customer demographics. Audience demographics are the baseline: gender, age, and location. This helps me choose the initial course of communication and get a general idea of my persona.

- Analyze the audience’s interests and pain points. This data defines the content I create and the messages I lean into. Without this layer, every post is more of a guess rather than a response to what my audience needs.

- Identify emerging audience segments. New groups pop up all the time. Keeping an eye on who joins the conversation helps me spot potential communities and audiences I can nurture early.

Competitive intelligence research

Market research always implies understanding the landscape you’re working in. And you can’t do that without knowing who else is in the field.

Social media is one of the easiest ways to keep an eye on competitors. It’s all public data, and it reveals a lot about their focus, priorities, and strategy. I usually look at three things:

- Track competitor content performance and engagement. I watch what they post, how often they try new formats, and how their audience reacts. This helps me see what’s resonating in the market and gives me context for my own experiments.

- Analyze competitor audience demographics and behavior. A quick look at who engages with their content can reveal overlaps or untapped segments. Sometimes I notice groups they reach, but I don’t, which could be a new opportunity for my brand.

- Benchmark against industry leaders. I compare my own performance with brands that set the pace in my space. It gives me a clearer sense of where I stand and what’s realistic for my KPIs in the context of the current market.

Brand health and reputation monitoring

The most interesting conversations about your brand happen when you’re not in the room. Social media is where people share unfiltered thoughts about products, experiences, and the companies behind them.

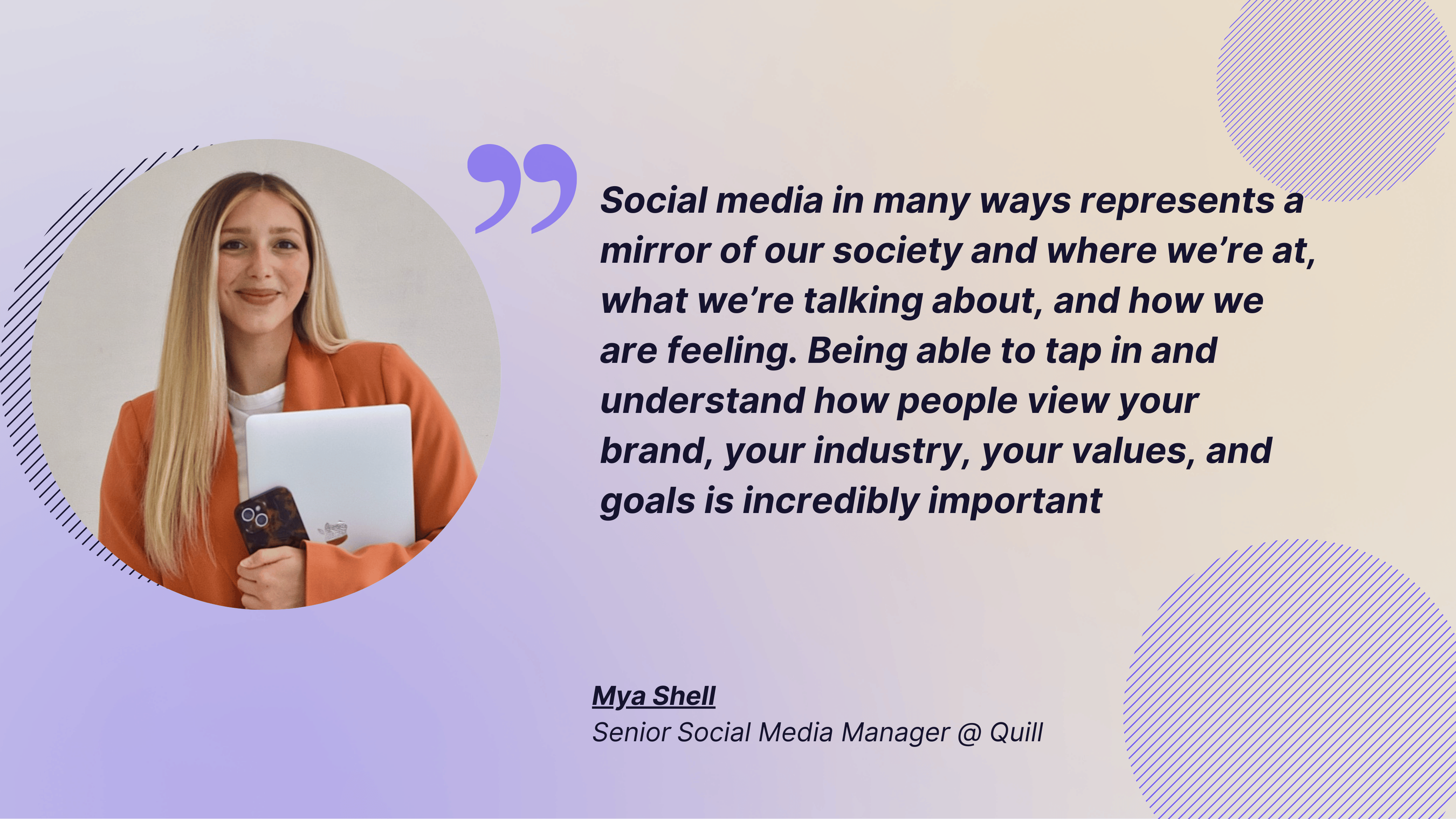

When asked how much weight she puts on reputation monitoring in her research, Mya Shell says:

“Being able to use social media for reputation monitoring is huge. Social media in many ways represents a mirror of our society and where we’re at, what we’re talking about, and how we are feeling. Being able to tap in and understand how people view your brand, your industry, your values, and goals is incredibly important.”

Social media research helps me stay close to that mirror. Here’s how:

- Measure share of voice vs competitors. There are many brands in any given space, and I want to know where I stand. Share of voice shows how visible my brand is within the market and how often it’s mentioned compared to others.

- Track brand sentiment over time. Sentiment doesn’t shift overnight (unless something goes very wrong), so I look at it as a long-term signal of how my work performs. It helps me understand how well campaigns land, how the brand is perceived, and whether any concerns need attention.

- Detect crises and plan a response. If something feels off, it’s usually being discussed online. Monitoring helps me spot early signs of trouble and prepare a response before it grows.

Trend identification and market forecasting

Most trends don’t start on TV or in magazines anymore. They start on social media. It’s the first place where people test ideas, share opinions, and shape what becomes mainstream later.

That’s why social media research has become one of my go-to ways to understand where the market is headed. Here’s what I use it for:

- Spot emerging trends before they go mainstream. Being a trend follower is fine, but being an early adopter is better. Social media research helps me pick up subtle signals before they turn into universal knowledge, so I can shape campaigns or content before it’s too mainstream to be effective.

- Track seasonal patterns and consumer behavior shifts. People don’t follow the same buying calendar. My audience may become more active in early Q1 when budgets reset, or right before summer, instead of Black Friday. Tracking these patterns helps me decide when to launch products and campaigns, and when to stay put.

- Identify influencer impact on purchasing decisions. Influencer Marketing Hub says 69% of marketers admit influencer campaigns bring a better ROI than other digital channels. But does it work the same for my brand? If I see that a specific creator drives conversations around topics tied to my product, it might be wise to onboard them for a partnership.

Product development and innovation research

The best products are born from the pain points and needs of our customers. And where does one go to vent about these things?

On social media.

Social media research is a huge source of valuable information for your product team. Here’s what I gather for them:

- Mine the user-generated content for feature requests. I go over UGC related to my product or similar ones to see if there are any requests coming from the audience directly. One “I wish products did XYZ” post on LinkedIn can be a coincidence. Ten such posts are an opportunity.

- Test product concepts through social engagement. I ran multiple validation campaigns for my clients to see if the new concepts sit well with the target audience. If a concept is not gaining any traction on social, it might not be worth the investment.

- Find needs and market gaps. People share frustrations online long before brands notice them. I track what feels missing in their workflows or experiences to spot spaces where a new feature or product could make a real difference.

Essential metrics and data points for social media research

Although general sentiment and awareness are important, marketing research on social media hinges on data.

That means that besides the vibes, your research also has to have quantitative social media metrics to define realistic KPIs, analyze the performance, and set benchmarks.

But don’t just track everything. Focus on the things that matter:

Engagement metrics

Engagement is the telltale sign that something’s taking off or flopping on social media.

Specific metrics can vary based on your goals. But globally, there are four main things I pay attention to.

First is the engagement rate. It’s a high-level metric that takes into account all engagements, including likes, comments, and saves. Tracking this gives me a comprehensive vitals check and answers the main question: do people care about this content at all?

In some cases, engagement rate might be enough. But if I want to go more nitty-gritty, I analyze each engagement action separately.

So then come the comments. It takes more attention and effort to leave a comment than to just like a post. A high number of comments signals that the content resonates enough for users to open the comment section and engage in a dialogue.

Next, we have saves. In my practice, saves are one of the most useful metrics for the B2B sector. They indicate how valuable the content is and whether it has evergreen potential.

And finally, shares. For some platforms, like Instagram, shares are the most important for the algorithm. If a post gets shared a lot, that means it has social potential, and people want to pass it along to their network.

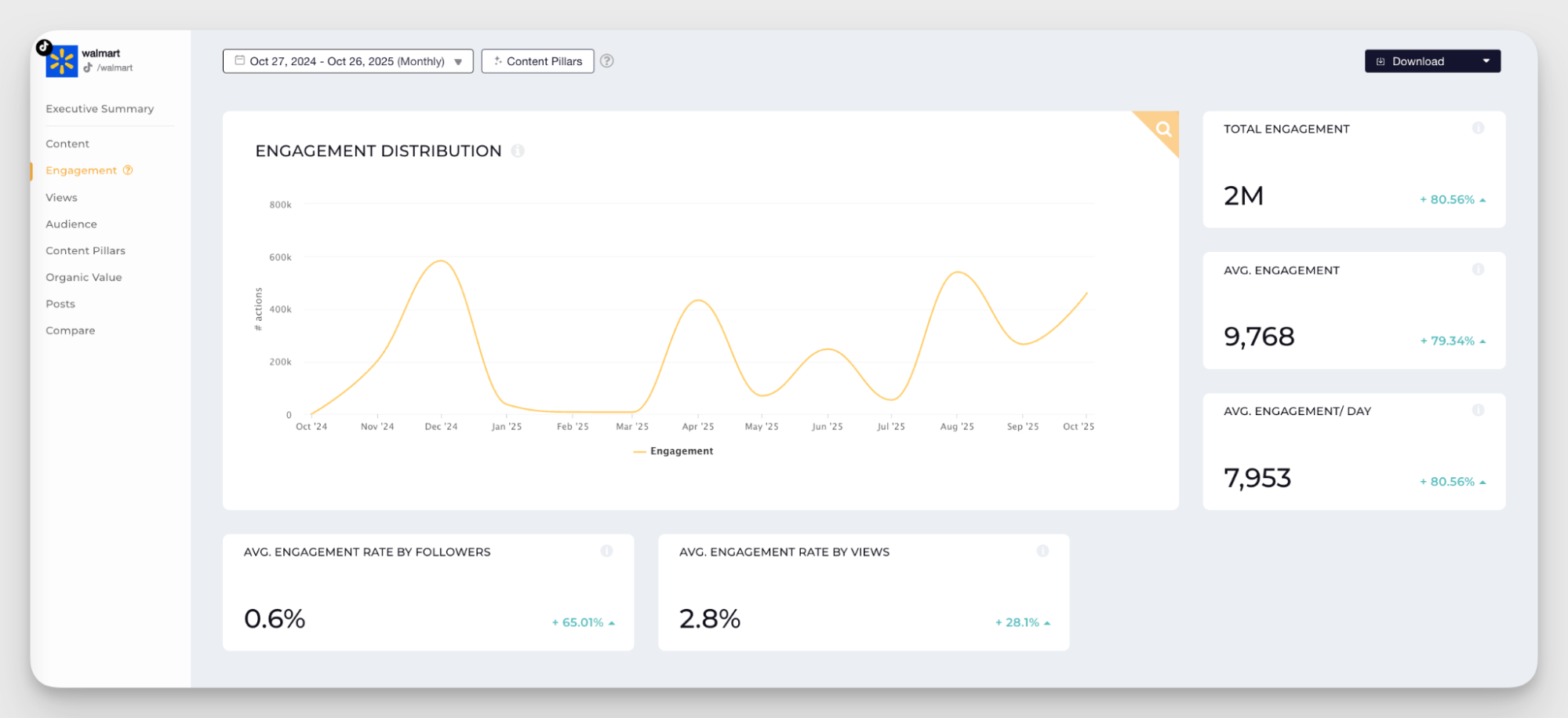

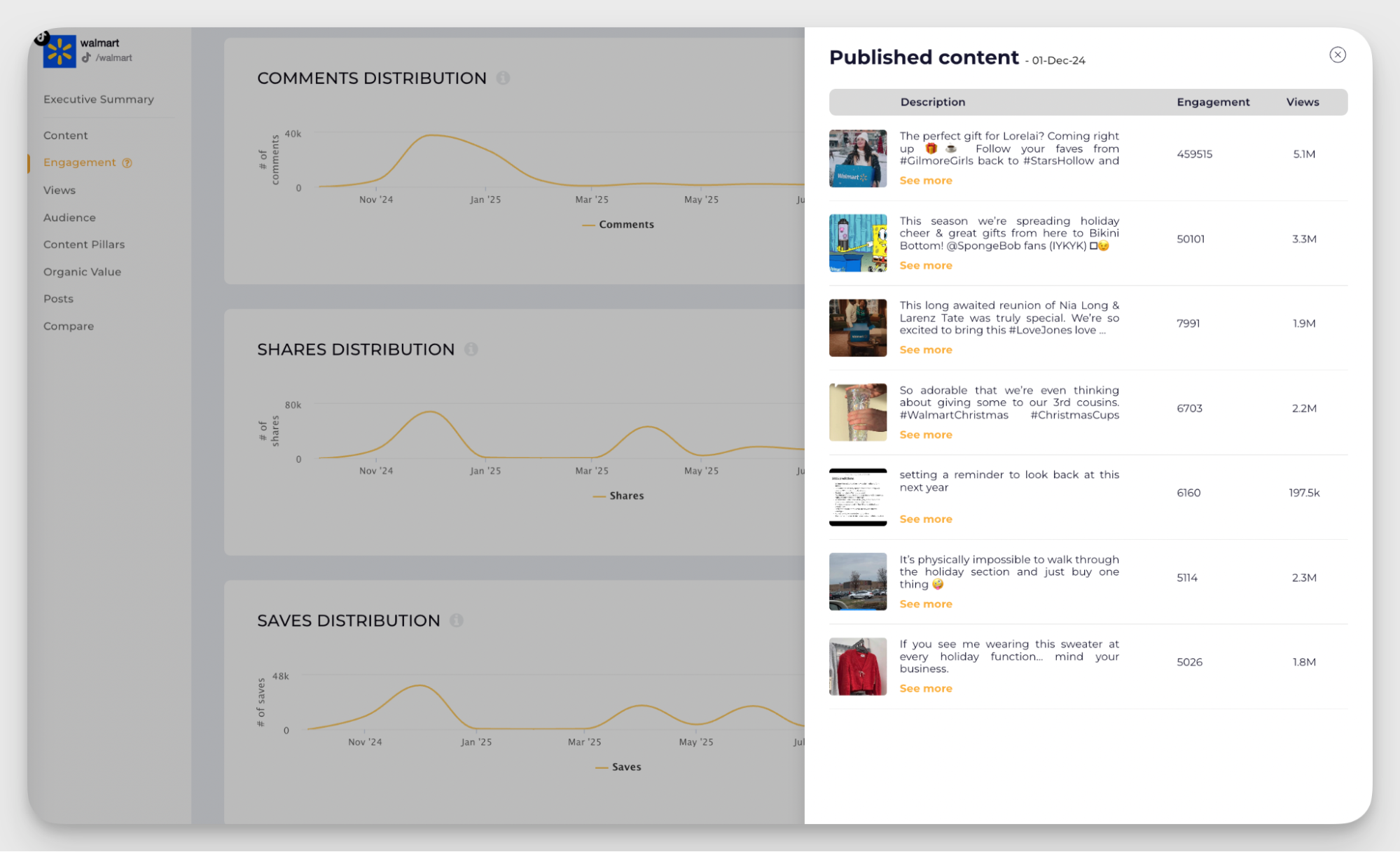

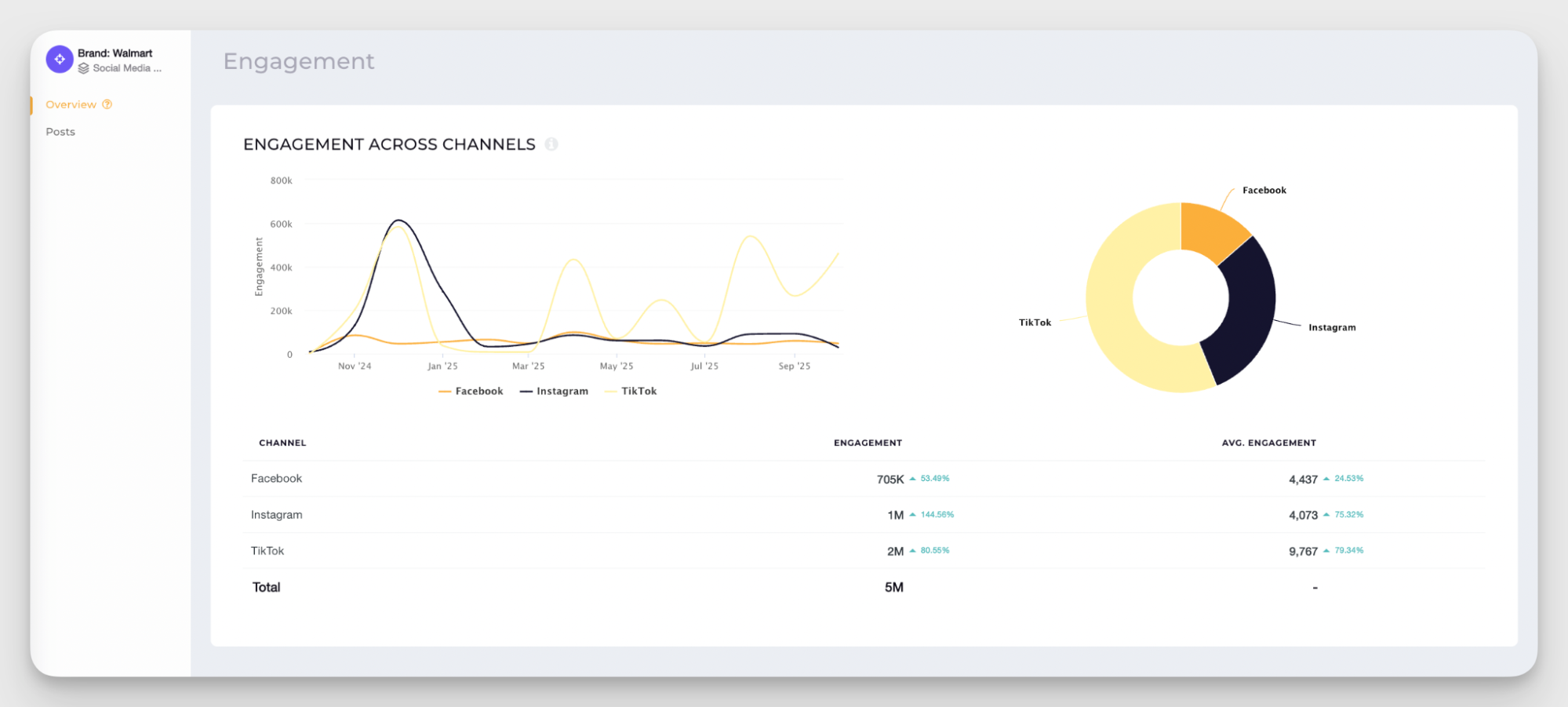

Gathering this data manually is incredibly time-consuming. Socialinsider allows you to have all of this data in one dashboard to analyze the spikes and understand what you can replicate in the future.

For example, if we take a look at Walmart’s content, there’s a significant spike in saves and shares around December:

And then, if we analyze content published throughout this period, we’ll see that it correlates with Christmas time and seasonal posts:

Both spikes can be explained by the holiday season, when people save and share ideas for gifts. If you also work in retail and track Walmart as your competitor, patterns like this can help you decide whether you should double down on seasonal content in the future.

Sentiment analysis and how to interpret it

Sentiment shows me how people feel about what my brand does online. It’s the emotional layer behind all the content, campaigns, comments, and organic mentions.

There are two main origins of sentiment data: my own brand accounts and the broader conversations happening on other accounts about my brand.

This is what I sample when I’m analyzing sentiment:

- Comments. The comment section is the quickest way to read the room. Keep in mind, though, that comments are notorious for excessive sarcasm, so make sure you read into them.

- UGC from creators and opinion leaders. I check how creators and community voices talk about my product when I’m not part of the conversation. Their tone, examples, and reviews give me a realistic picture of how the product is perceived.

- DMs and customer support requests. These messages reveal recurring questions, concerns, or pain points. Even small patterns here help me understand where users struggle and what they appreciate.

When talking about UGC, Mya Shell warns not to mix paid and organic:

“Take your time to differentiate between organic UGC vs paid UGC. You want to base your understanding on public sentiment from organic and free takes, not sponsored. Sponsored content is where you’ll want to learn how a brand wants others to talk about it.”

Share of voice and competitive benchmarking

Share of voice is a part of competitor research. It shows how visible your brand is compared to others in the same market. In my experience, B2B brands care about this slightly more than B2C, because expert content plays a bigger role in defining your place in the industry.

Think of a SaaS product in a crowded niche, like project management tools. If teams are quoting you in articles or referencing your features in LinkedIn posts, it means your tool is seen as the go-to source in that space.

But measuring your visibility is only half of the story. You also need solid competitor benchmarks to understand how you perform compared to other players in the market.

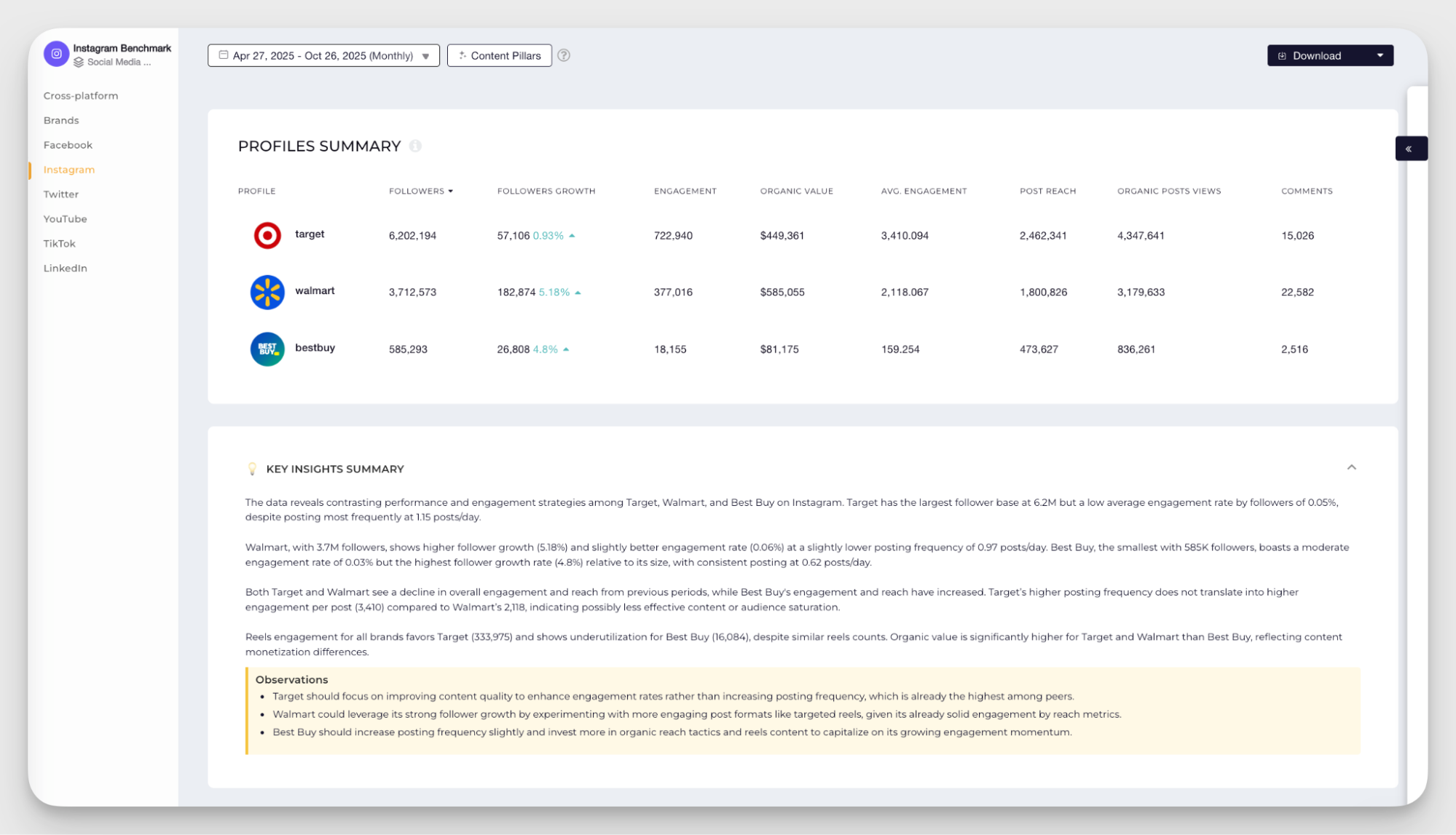

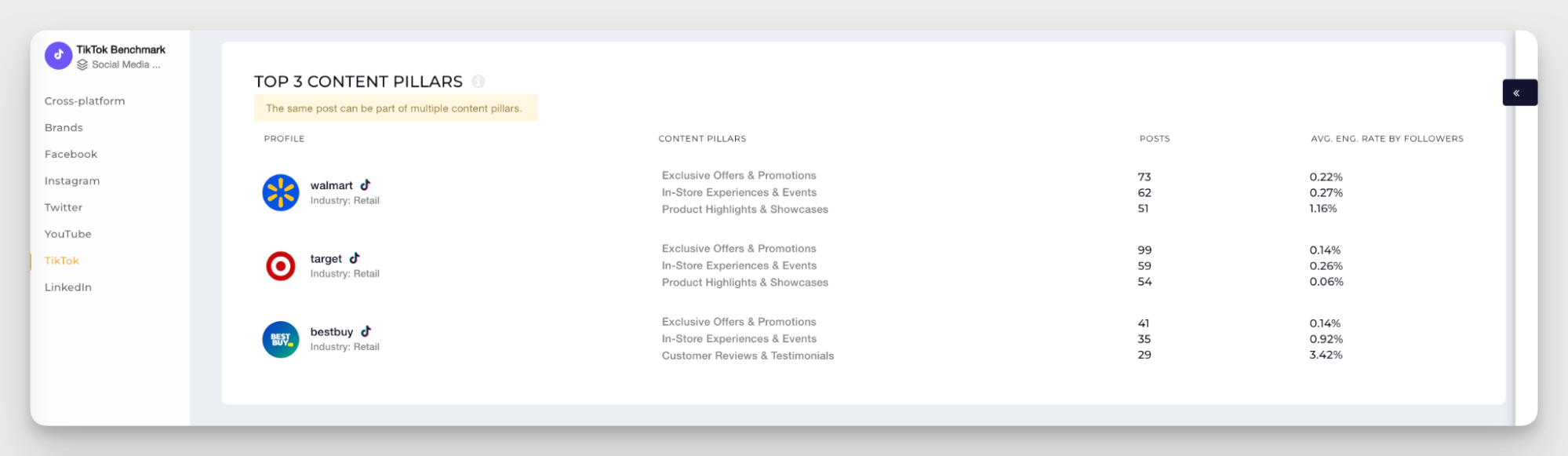

Socialinsider gathers competitive insights across multiple accounts and platforms so you can see the bigger picture. For instance, if I work in US retail, I can track Target, Walmart, and Best Buy from a single dashboard and use their performance as benchmarks for my own.

This helps me understand what “good” looks like in my industry and use those takeaways to support my strategy.

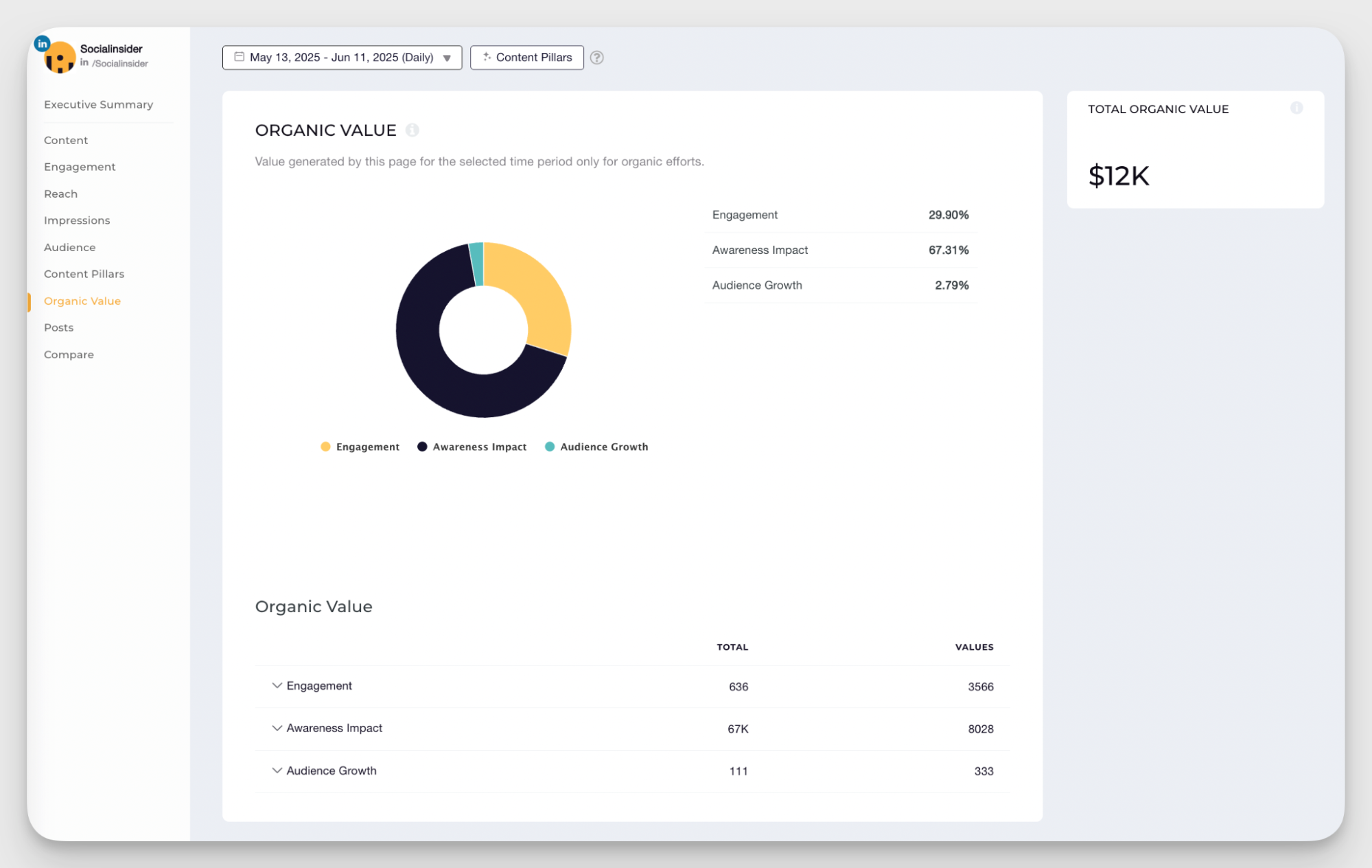

Organic Value: measuring the true ROI of organic social content

ROI is one of the hardest things to estimate, even for your own social media accounts, let alone your competitors. Still, it’s often the first thing executives ask about when they want to understand how valuable social media is for the business.

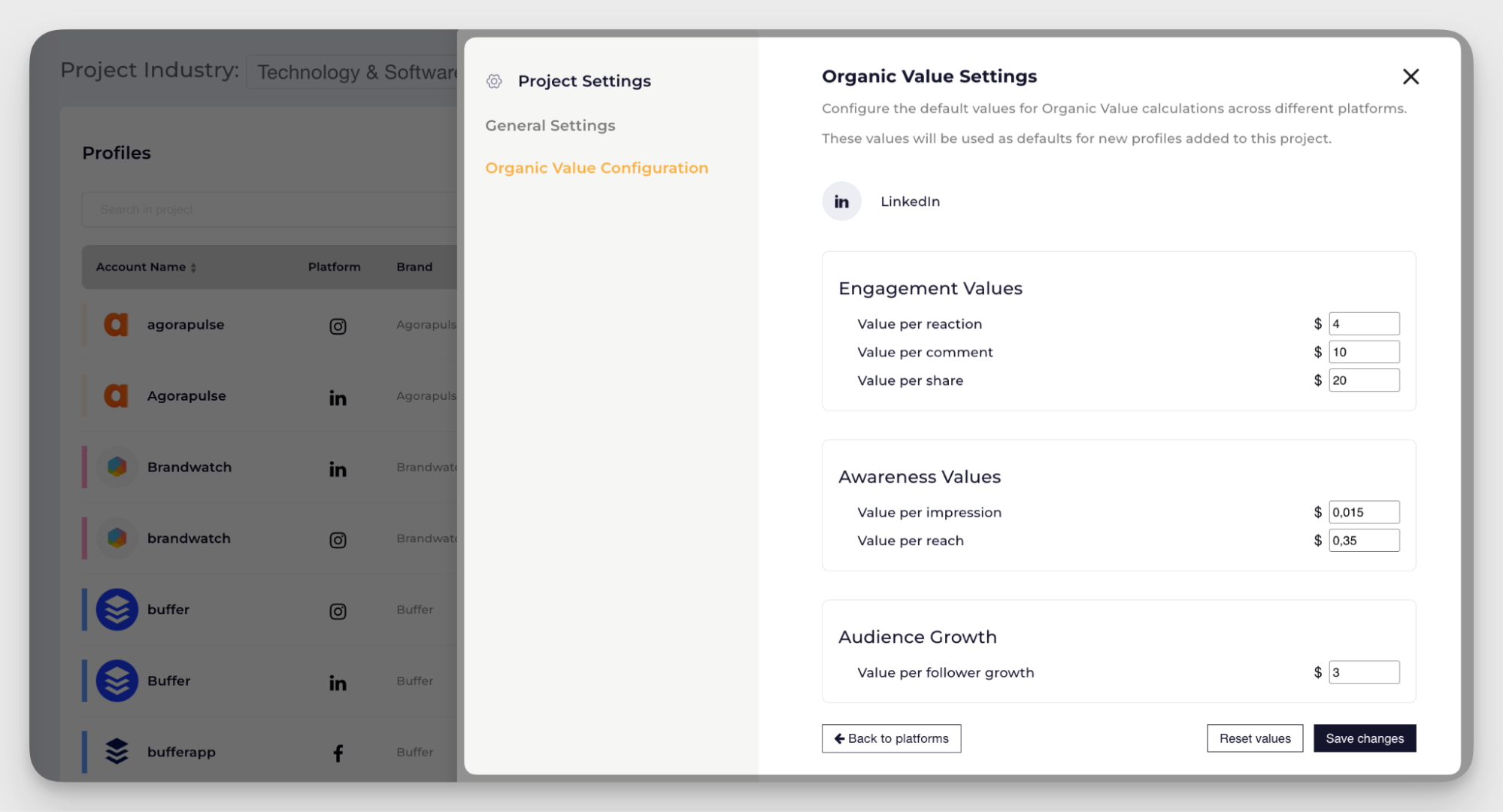

So Socialinsider made Organic Value a separate custom metric. It estimates how much it would cost in ad spend to achieve the same results an account got organically.

The calculation uses industry benchmarks for price per follower, engagements, and reach. For competitor analysis, I stick to the platform-specific benchmarks for our shared industry.

And if I want to check my own Organic Value, I can plug in the numbers from past paid campaigns to keep the estimate grounded in real costs.

Content performance indicators across platforms

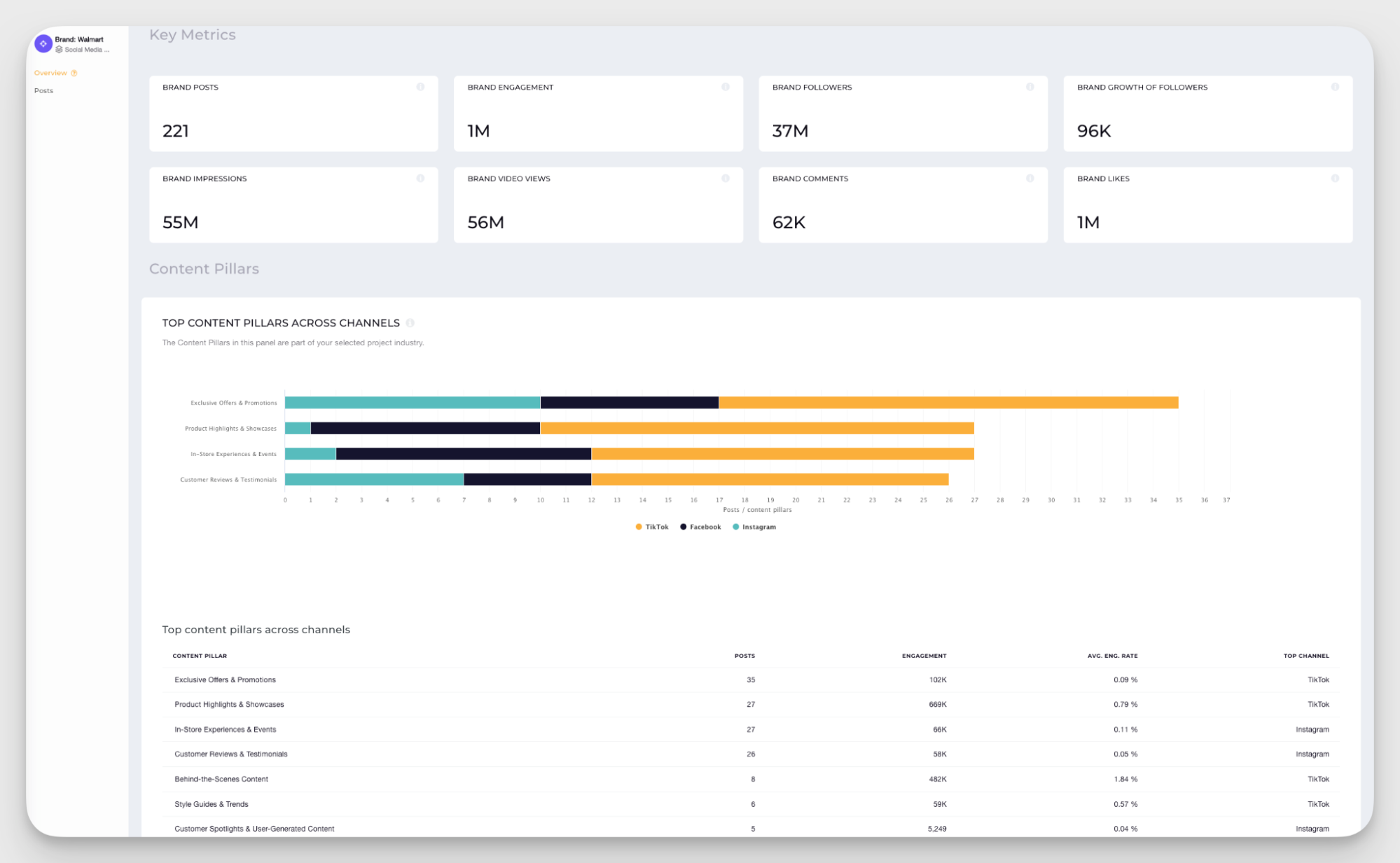

When I run social media market research, I need to see how a brand performs across all its social channels, not just one.

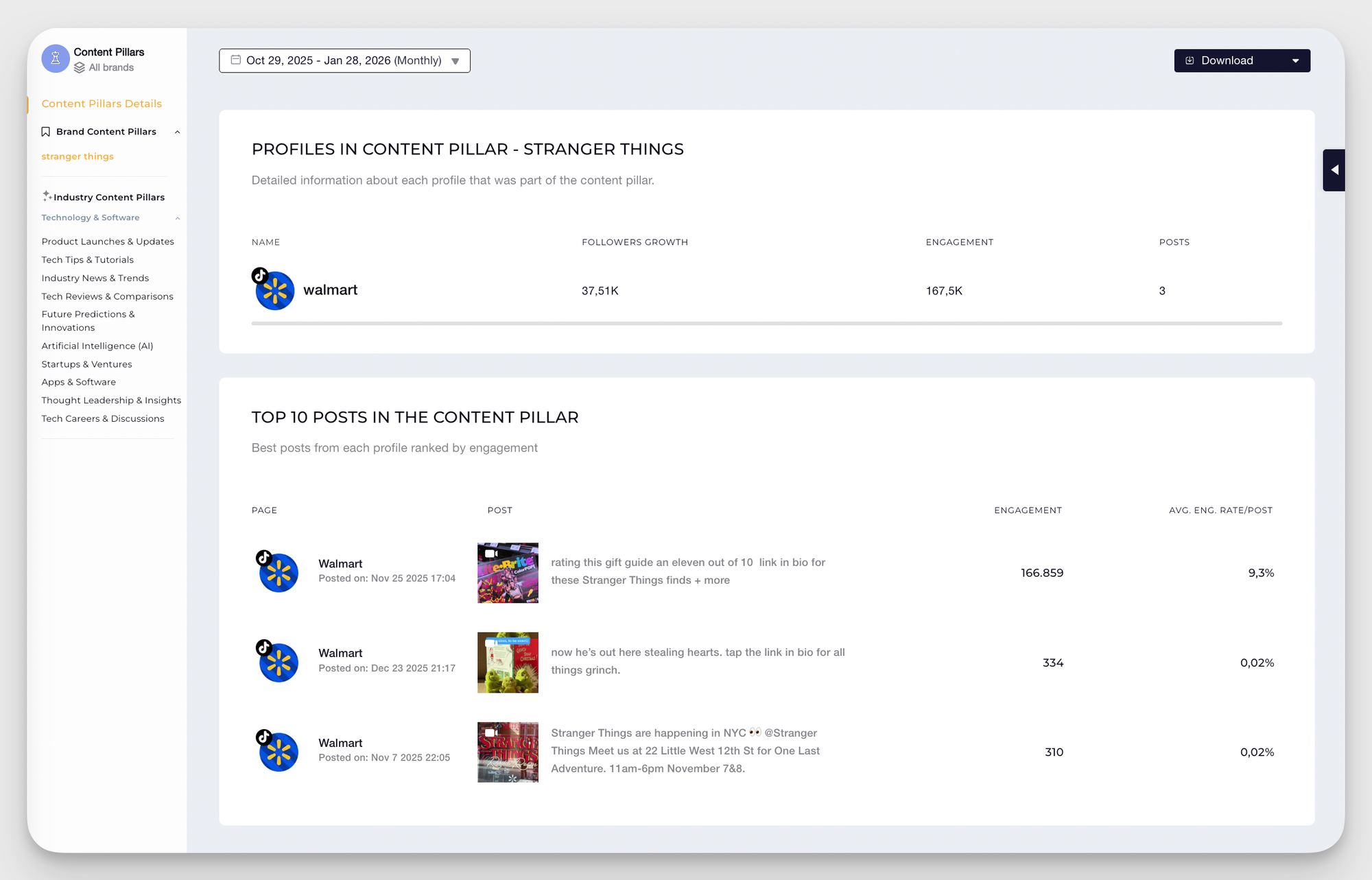

Socialinsider’s Brands feature makes this part of the research much easier. I can group all social media profiles under a single brand and look at their combined performance in one place.

Make sure to check these content performance metrics:

- Follower growth across channels. This helps me see where the brand is picking up momentum and which platforms attract new audiences faster.

- Engagement levels across platforms. When I compare engagement across all the profiles grouped under a brand, I can see which platforms host the most active conversations and which ones lag.

- Video views and format traction. With videos spread across TikTok, Instagram, YouTube, and Facebook, the Brands view shows me where video content performs best and which platforms push it further.

Eventually, this cross-platform comparison allows me to see where the audience is more active and what content is driving this activity. I can look at the whole landscape in one dashboard and identify which platforms deserve more attention from my side.

Essential tools needed for effective social media market research

Social media research is a big task, and doing it manually is not fun. The right tool stack speeds up the process and gives you consistent, reliable insights.

My stack for social media market research consists of two major parts: analytics and social listening.

Social media analytics tools

I use analytics tools to understand performance across platforms and keep all my data in one place. When I evaluate an analytics tool, I look for:

- Aggregated data from all major platforms

- Detailed engagement metrics

- Audience demographics and behavior

- Competitor benchmarks

- Performance breakdowns by content type and format

Native analytics can cover part of this, and some platforms offer very nuanced performance and audience insights. But they rarely include competitor data, and none of them can group everything into aggregated, cross-platform reports.

That’s where third-party analytics tools step in. So my personal stack usually includes third-party tools (like Socialinsider) for the main social media analysis, and bits and pieces from native analytics to double-check some data and fill in the gaps.

Social listening tools

Not every post about your product is tagged, so tracking all mentions of your brand manually can be a pickle.

Social listening tools help me track conversations happening outside my own channels. I recommend choosing a tool that has these key features:

- Keyword and topic monitoring

- Real-time alerts for brand or product mentions

- Analytics that show spikes in conversations and shifts in tone

- Cross-platform tracking for all social media and forums

- Sentiment analysis (even though tools are bad at detecting undertones and sarcasm, they still speed you up)

These tools are a great help in monitoring sentiment around my product, anticipating crises, and spotting upcoming trends early.

Advanced research techniques to boost your efforts

Good research pulls in the numbers. Great research looks for what sits behind them.

These extra techniques help me back my marketing decisions with data, spot long-term opportunities, and better understand the market I’m trying to break into.

Trend tracking

A lot of social media research comes down to spotting patterns. I look at what content consistently performs well and how engagement shifts over time.

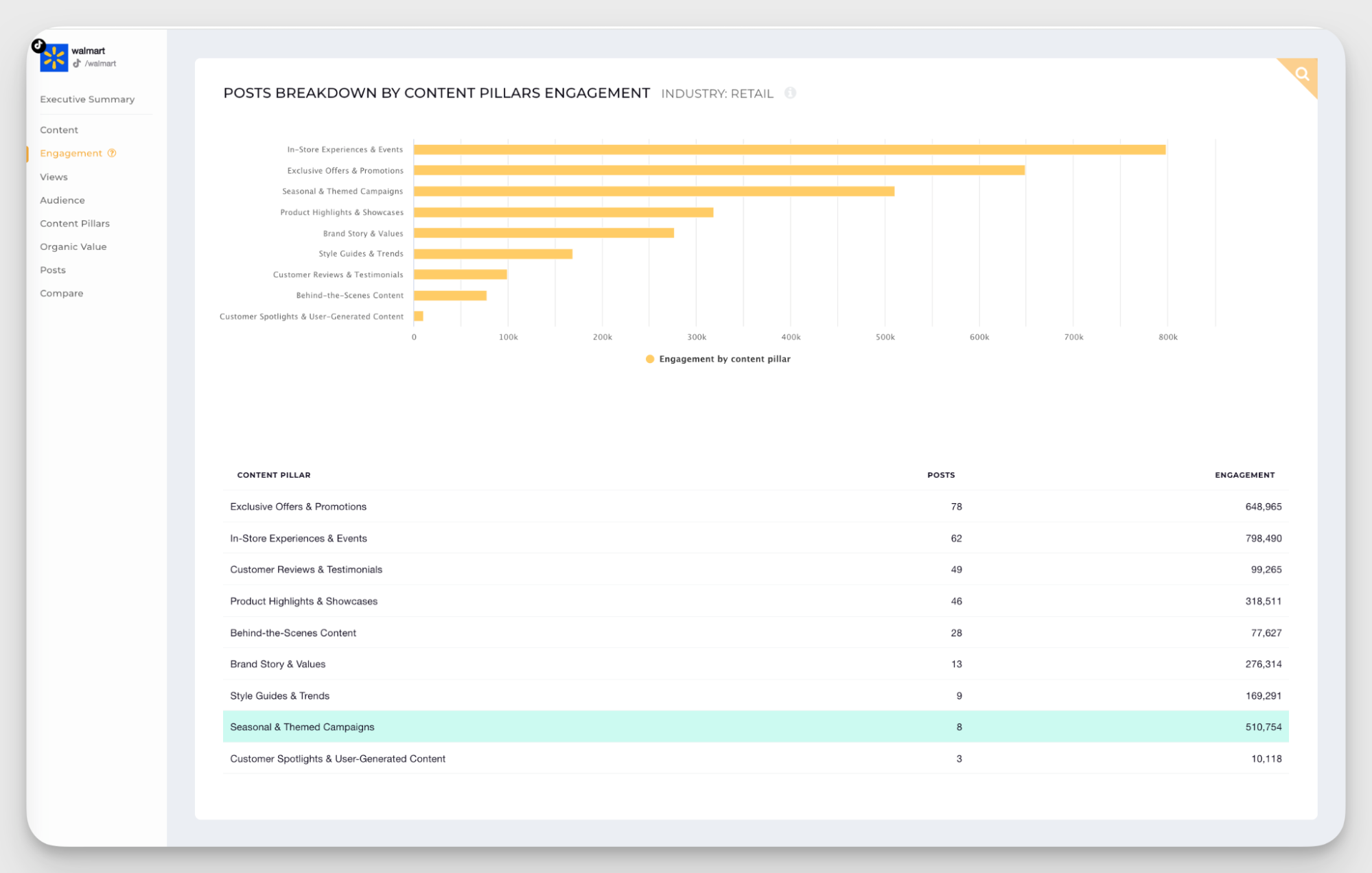

For example, Walmart’s seasonal and themed TikTok posts pulled in more than 500K engagements from only eight posts. That kind of spike tells me something is working.

My next step would be to check last year’s performance to see if this pattern repeats. If it does, that’s a potential tactic for my own brand’s holiday season.

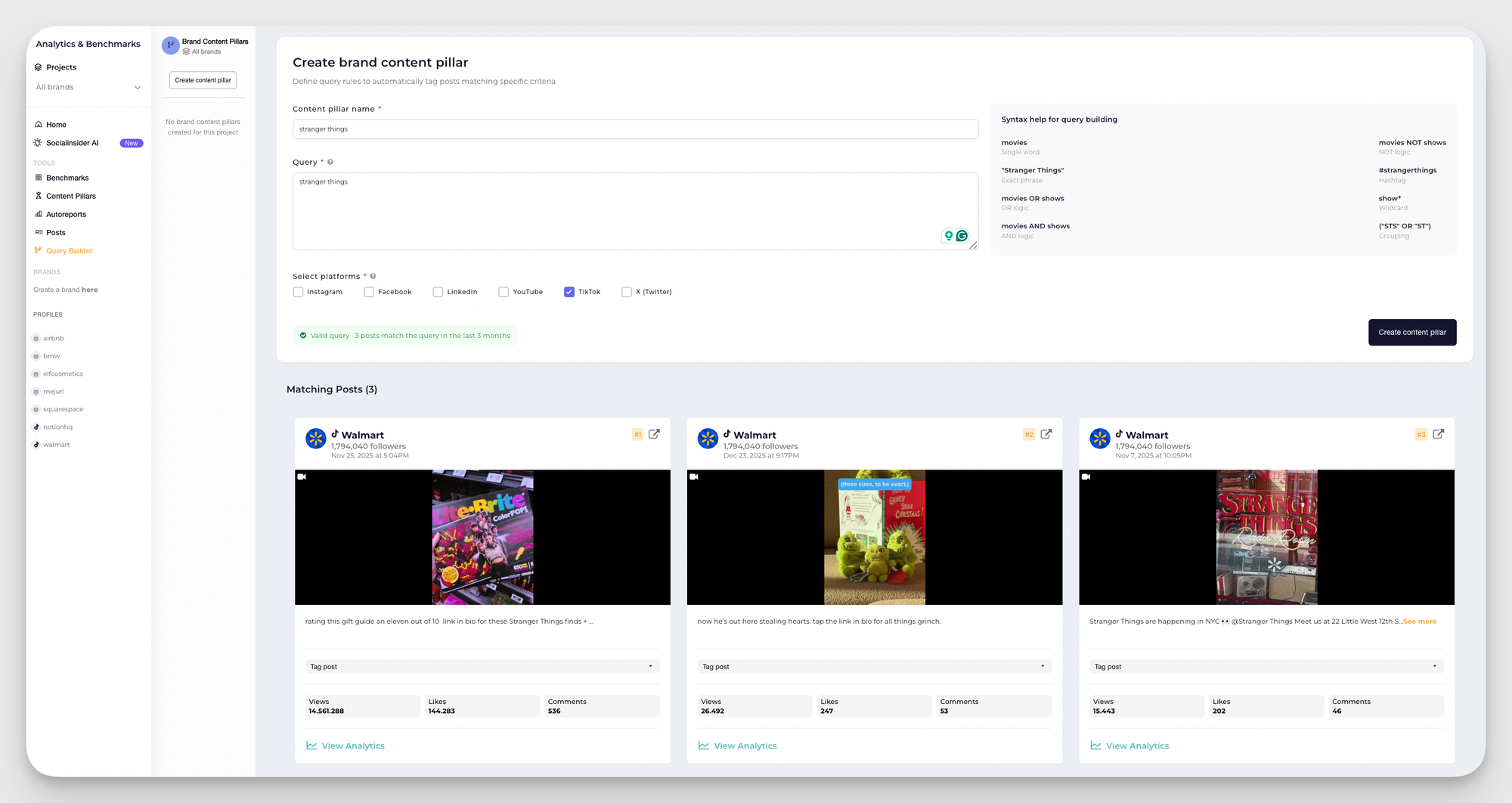

This allows you to track and analyze the performance of specific branded topics.

Competitor content gap analysis

Every brand leans on a few content pillars that feel safe and familiar. That creates blind spots both for them and for the market. By breaking down competitor pillars, I look at what they double down on, what they test, and what they ignore.

See how Best Buy’s customer reviews and testimonials outperform every other content pillar on TikTok? Yet neither Target nor Walmart is using this pillar in their content.

Suppose I were to hold market research for a similar brand. In that case, I’d say testing a highly engaging content pillar that works for my competitor but is overlooked by others is a good opportunity.

Cross-platform analysis for holistic insights

When I run market research on social media, I’m interested in both the big picture and the smaller elements of it.

Understanding how each platform performs separately helps me on a more fine-grained, tactical level. I can see specific benchmarks, content types, and tone of voice that the brand is using on each channel.

However, the holistic picture of how a brand is performing on social media comes from uniting these platform pieces in one cross-platform picture. In here, I can see how cohesive a brand’s presence is, which platforms perform better, and why.

How to effectively handle social media market research?

Managing social media market research comes down to discipline, curiosity, and a sustainable process you can repeat month after month.

So I have a short cheat sheet for running social media market research. Check this:

- Define your research questions. Start with specific questions. Not “How are we doing on social?” but something I can actually answer with data and confidence, like “Which content themes resonate most with our core audience on Instagram?” Focused questions lead to actionable answers.

- Set up monitoring and data collection. I choose to automate where possible without losing the quality and let the tools do the heavy lifting. With tools like Socialinsider, I collect data from all relevant social networks. This saves time and keeps the process (and data) consistent.

- Gather and organize data. Raw numbers are not as helpful as digested and organised data. I categorize posts, tag content pillars, and keep benchmarks updated. A clean structure makes analysis much easier later on.

- Analyze patterns, trends, and anomalies. This is where things get interesting. I don’t only gather numbers, I look for anomalies: spikes, dips, repeating trends. Maybe engagement jumped in December, or short-form video started outperforming last quarter? Pattern-hunting helps me spot what worked and why.

- Validate your findings. I don’t rely on one data point alone. If sentiment looks off, I cross-check it with qualitative data like comments, competitor activity, and industry updates to make sure I’m seeing the full picture.

- Turn insights into action. Ok, so I held a market research — what now? Every research cycle ends with 2–3 clear recommendations to answer that. It might be testing a new format, adjusting timing, or leaning into a trend that’s gaining traction. Insights only matter when they lead to action.

Final thoughts

Social media is where people talk, react, complain, celebrate, and share what they care about. That makes it one of the most valuable data sources you can tap into for market research. When done right, it gives you clarity, helps you get unstuck, and keeps your strategy rooted in what your audience wants right now.

It’s a big task, but you can make it easier and sustainable with a solid process and the right stack. Socialinsider can support you with analytics and competitor insights — start your 14-day free trial today!

FAQs about social media market research

What is social media market research?

It’s the process of gathering and analyzing data from social platforms to understand audience behavior, brand perception, industry trends, and competitor activity. It turns online conversations and engagement metrics into actionable business insights.

How often should I conduct social media market research?

Ideally, on an ongoing basis. Regular monitoring helps you catch shifts in audience sentiment, trending topics, or competitor moves. At a minimum, review insights monthly or quarterly.

Which social media platforms are best for market research?

It depends on your goals and audience. LinkedIn is ideal for B2B insights, Instagram and TikTok for consumer behavior, X (Twitter) for real-time sentiment, and YouTube for content engagement trends.

What business questions does social media research answer?

When I look at social media data day to day, I can answer a whole range of questions that shape my strategy:

- Who’s engaging with my brand right now, and how are their interests shifting over time?

- What types of content or campaigns evoke the reactions I’m aiming for?

- What competitors are doing well, and where can I offer something sharper or more relevant?

- How do people talk about my brand, products, or industry, and what might put my reputation at risk?

- Which creators, communities, or partners influence my audience?

- Where are the gaps in the market that could guide new products, services, or campaign ideas?

Social media research gives me clearer direction, so I can adapt proactively instead of reacting to change.

How to measure the ROI of your social media market research?

- Compare the cost with traditional research. Social research gives you ongoing insights for a fraction of the price of focus groups or large surveys. Traditional methods offer a single snapshot, while social data keeps updating itself.

- Build a business case for investment in social analytics tools. Frame the conversation around the risks of flying blind, like guessing, reacting late, or missing shifts in audience behavior. Then highlight the wins: faster reporting, smarter content decisions, and clearer competitive context.

- Use metrics that tie back to real outcomes. Pick indicators that leadership understands: engagement quality, sentiment changes, share of voice, or new audience segments you’ve uncovered. Visual examples or quick before-and-after stories make the value easier to see.

Kseniia Volodina

Content marketer with a background in journalism; digital nomad, and tech geek. In love with blogs, storytelling, strategies, and old-school Instagram. If it can be written, I probably wrote it.

Analyze your competitors in seconds

Track & analyze your competitors and get top social media metrics and more!

You might also like

Improve your social media strategy with Socialinsider!

Use in-depth data to measure your social accounts’ performance, analyze competitors, and gain insights to improve your strategy.