The Ultimate Facebook Competitive Analysis Toolkit

Learn how to do a Facebook competitive analysis to track key metrics and unlock actionable insights about competitors' strategies.

How do you squeeze real value out of a Facebook competitor analysis? Do you scroll through a few viral posts and call it a day? Or do you also dig into the messy details, the qualitative metrics, and the lesser-known content pillars?

Worry not. To help you get it right, I called up someone who’s been living and breathing social media for 15 years. Meet Adina Jipa, CMO and co-founder of Socialinsider.

Adina has worked with thousands of clients, picked the brain of top social media experts, and seen what actually clicks on Facebook.

This guide pulls her playbook apart piece by piece so you can run a Facebook competitive analysis that truly matters.

Key takeaways

-

Step 1: Find and vet competitors → Identify direct, indirect, and aspirational competitors to get a 360° view of your competitive landscape.

-

Step 2: Choose relevant metrics → Focus on audience, content, and engagement metrics to uncover what truly drives competitor performance.

-

Step 3: Analyze competitors’ content → Break down their content pillars, top formats, and post-level performance to refine your own content strategy.

-

Step 4: Create a SWOT analysis → Translate competitor strengths, weaknesses, opportunities, and threats into actionable strategic insights.

-

Step 5: Make a final optimization plan → Turn findings into a clear roadmap of quick wins, medium-term improvements, and long-term shifts backed by benchmarking data.

What is a Facebook competitive analysis?

A Facebook competitive analysis is the process of digging into your competitors’ presence on the platform to uncover their strategies, measure their performance benchmarks, and spot their strengths and blind spots.

Why is a competitor analysis on Facebook important?

Focusing only on your metrics can be a trap. You risk missing the bigger picture of what competitors are already doing well.

Here are my three key reasons for conducting a competitive analysis.

- Helps refine your content strategy: Are educational Reels working great for you? That’s awesome. But what if some other content theme might get you more engagement? This discovery and much more can be possible, thanks to competitor analysis.

Adina mentioned the same.

I have seen that numbers like engagement or follower growth tell only part of the story. The real value comes from understanding why those numbers look the way they do — what formats competitors use, how often they post, and which content pillars they lean on, whether it’s funny, educational, or thought leadership.

Once you dive deeper, you get the insights you need to refine your own strategy and decide what to publish next.

- Aids setting performance benchmarks: Your engagement rate may be slowly increasing. But how does it compare to your competitors? Do they get a massively high engagement rate on the same content pillars as you work on?

By running an analysis, you can determine the ‘why’ behind such answers and set realistic but high goals for your content team.

- Helps gain credibility as a social media manager: Telling your boss or client “We’re crushing it” hardly ever works, right?

That’s why Adina sees credibility as one of the biggest wins of a Facebook competitive analysis.

She explains:

As a social media manager, it’s important to prove to your manager, or to your clients if you’re on the agency side, that you’re doing a great job and outperforming competitors.

Having competitor data in your reports or when you walk into meetings gives you credibility. You build confidence, not just in yourself, but in your strategy. And you prove that Facebook still matters for the industry you’re in.

How to run a comprehensive Facebook competitor analysis

Here’s the step-by-step process Adina and her team follows while conducting a competitor analysis on Facebook.

Step 1: Find and vet the competitors you will analyze

Instead of picking competitors at random, we divide them into three categories to compare Facebook pages.

- Direct competitors: These are competitors that offer similar products or services as your brand.

Adina mentioned discovering these competitors in two simple ways: (i) by running surveys and interviews where customers mention competitor names and (ii) by checking out review sites and third-party platforms like Reddit where people discuss and compare similar products.

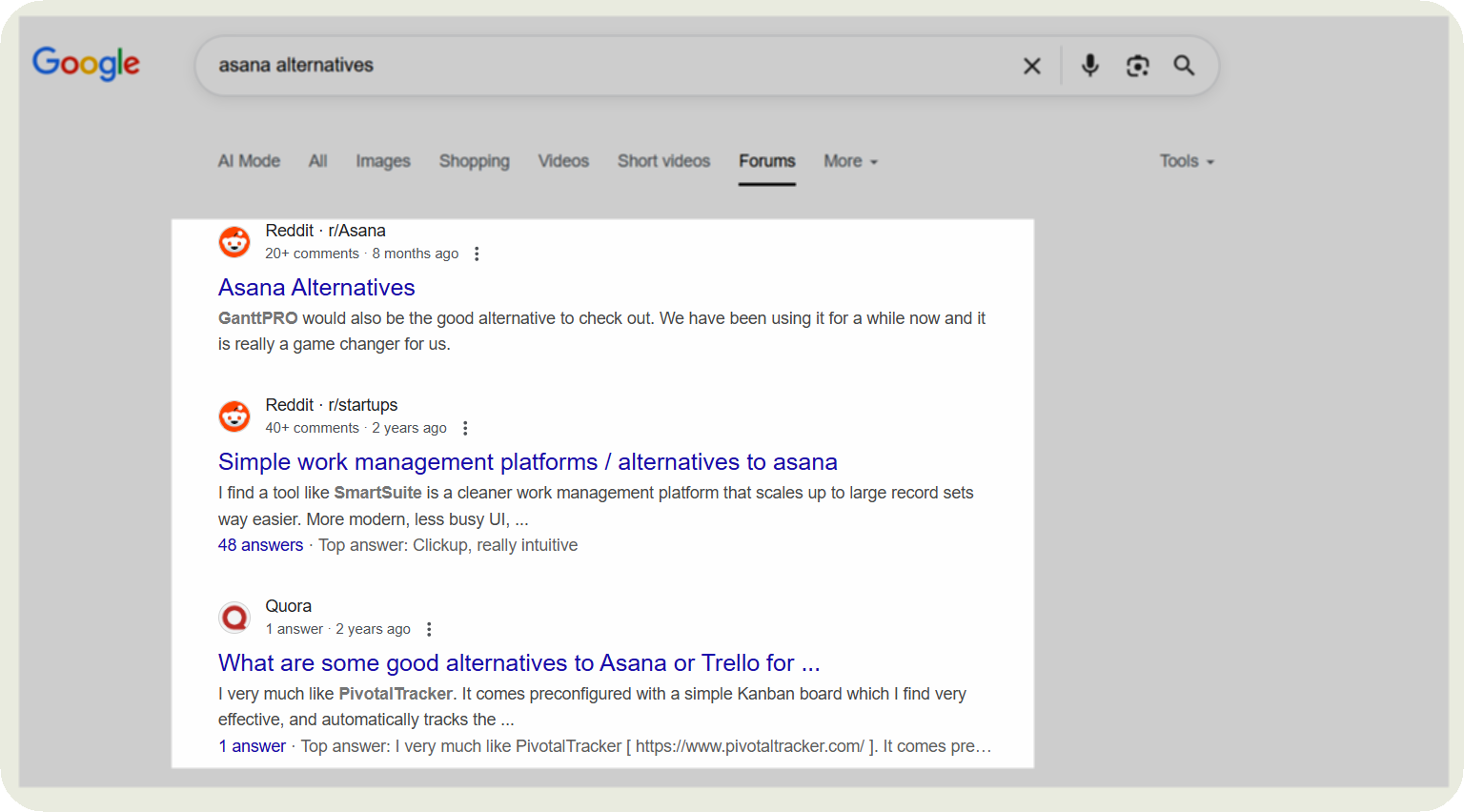

For example, upon searching Asana alternatives, I could find three forum links where I can find direct competitors. I just need to then go to Facebook and find their accounts.

- Indirect competitors: These competitors do not have similar offerings but cater to the same target market.

Adina talked about its importance while saying:

You need to look beyond direct competitors and include the wider industry landscape. In our case, that meant tracking not just other tools and software companies, but also the top voices and publishers in social media, because that’s where our ideal customers were active.

Real-life success story

By adding indirect competitors, we at Socialinsider looked at a top industry voice and found out that they were using text posts with backgrounds on Facebook and driving huge engagement.

To give you context, the format was totally new on Facebook at that time and none of our other competitors were using it.

When we adopted that format at Socialinsider, it quickly became our top-performing content before we moved to Reels.

Adina mentioned, “It was an insight I never would have gained if I had only looked at head-to-head competitors.”

To run through the same example as Asana, I would look for productivity influencers, coaches, or even different tools that cater to the same purpose, say Notion.

- Aspirational competitors: These are brands that may be outside your exact niche, but whose presence, strategy, or positioning you aim to emulate.

To find who this competitor could be for your brand, Adina suggests performing social listening.

We are a part of a lot of communities and we read through comments actively. We pay special attention to comments that mention brands our ideal customers look up to, the brands they believe are life-changing for them.

Step 2: Choose relevant metrics for your Facebook competitive analysis

There will always be a lot of metrics to track. But is tracking each one really necessary? Or how should you prioritize the different metrics?

Here’s how Adina categorizes and tracks them for Socialinsider.

Audience metrics analysis

These metrics give you insights into your competitor’s audience and how they are growing.

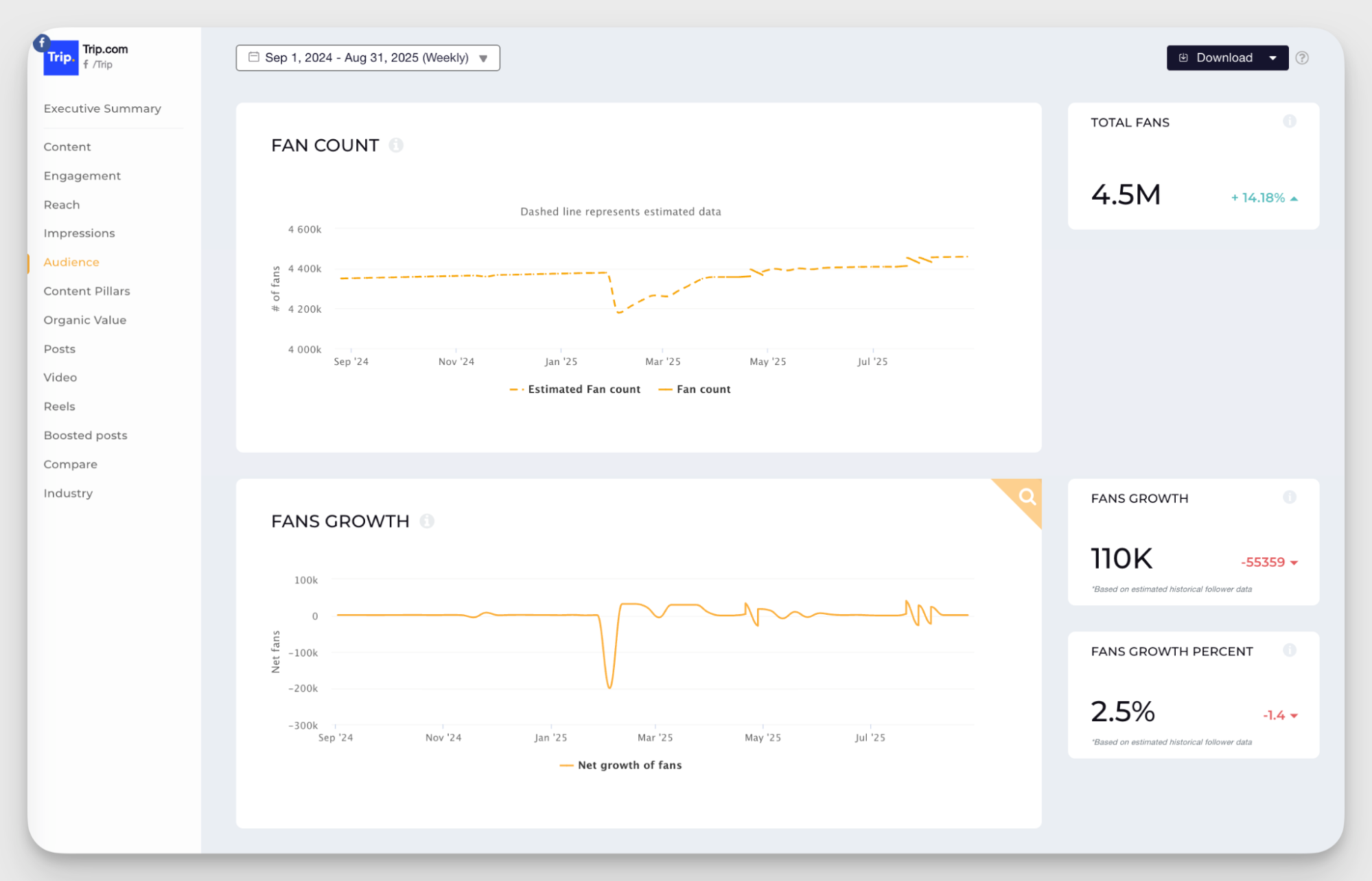

- Follower count and growth rate: What is their follower count? How many new followers have they added in a particular period? Sudden spikes can be especially telling.

For instance, when I spot a sharp uptick in Socialinsider, I always check the posts published around that time to see what might have triggered the growth. Was it a campaign, a viral post, or a new content format?

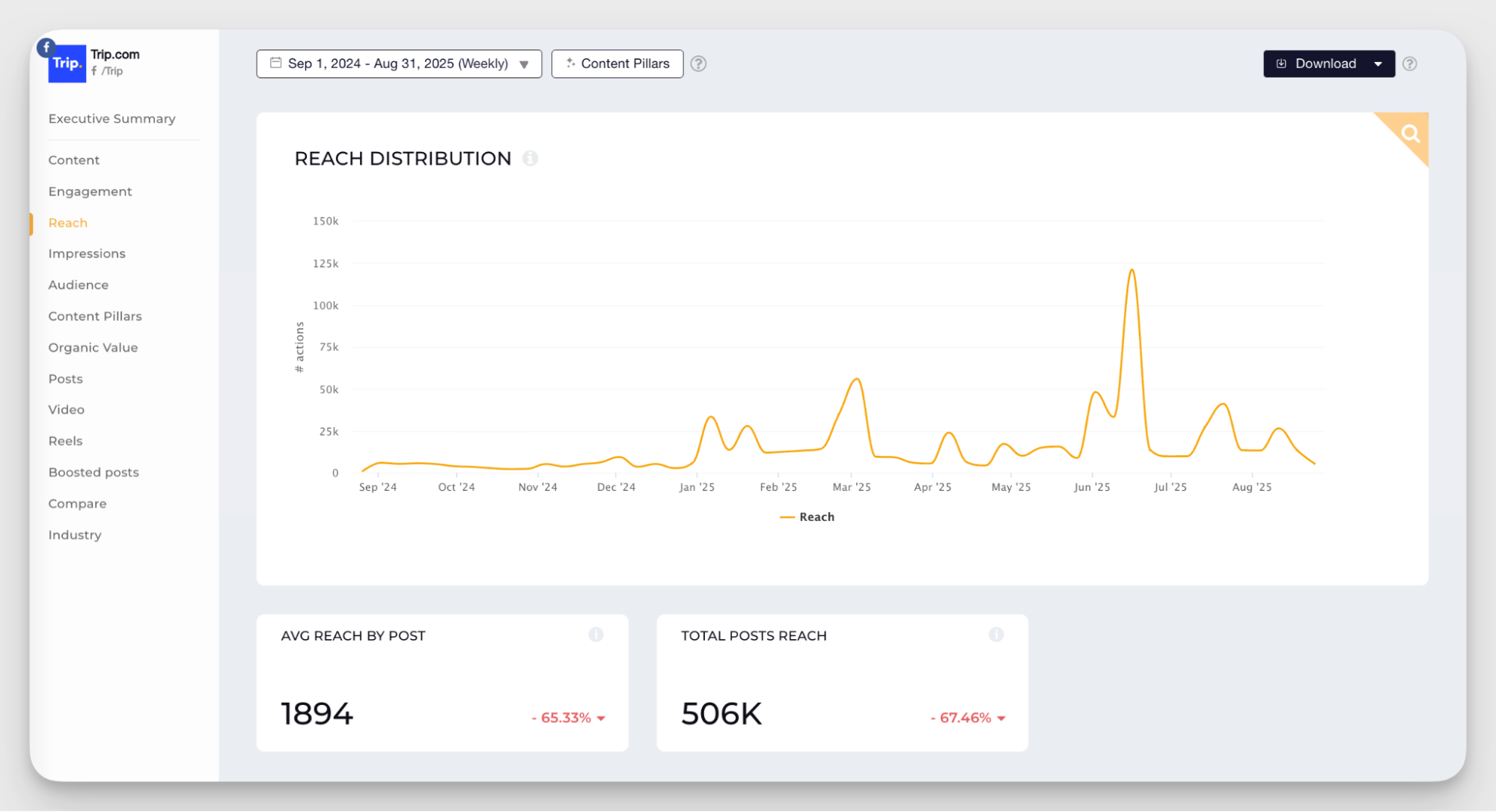

- Reach and impressions: Check how many people are seeing your competitors’ content and how often it’s being shown. Consistently high reach or impressions can signal strong distribution strategies or boosted campaigns worth noting.

Content metrics analysis

Content metrics will give you a sneak peek into the strategies that work well for your competitors. Here are the ones we measure for Facebook page comparison.

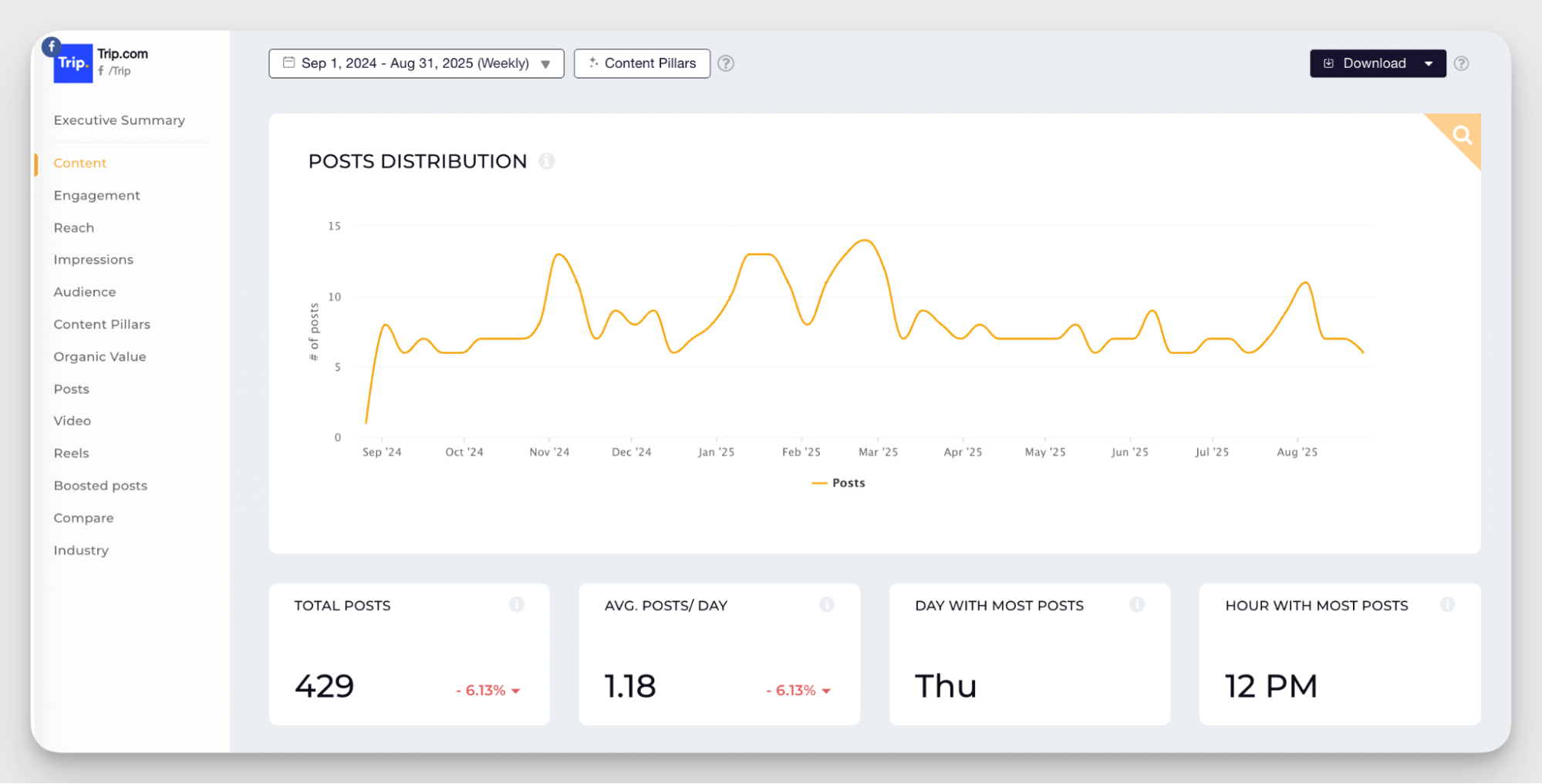

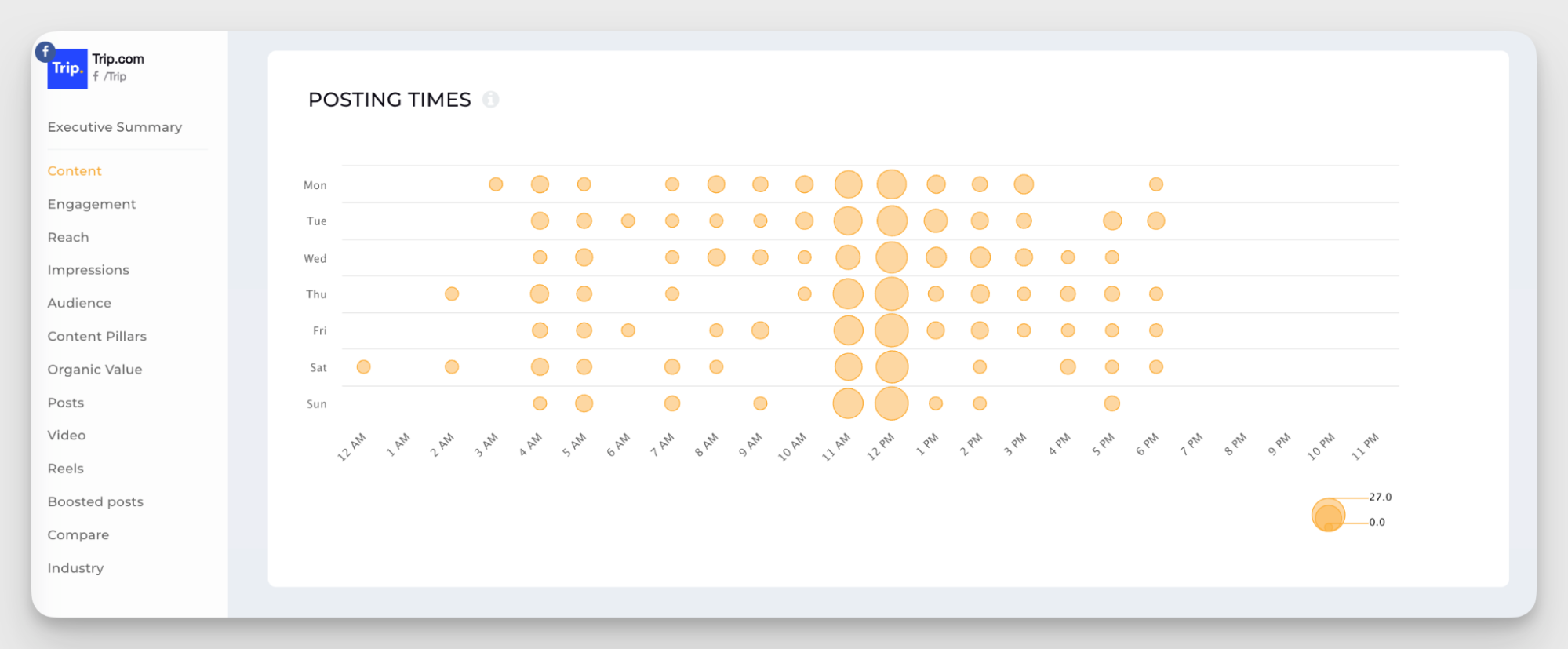

- Posting frequency and timing: How often do they post content on Facebook? Are there any particular days when they tend to post more? You can also check for the reason behind it — do they get a lot of engagement during those days?

Post this analysis, see the timing when they get the highest engagement. If you have been struggling with engagement, you can experiment with these timings.

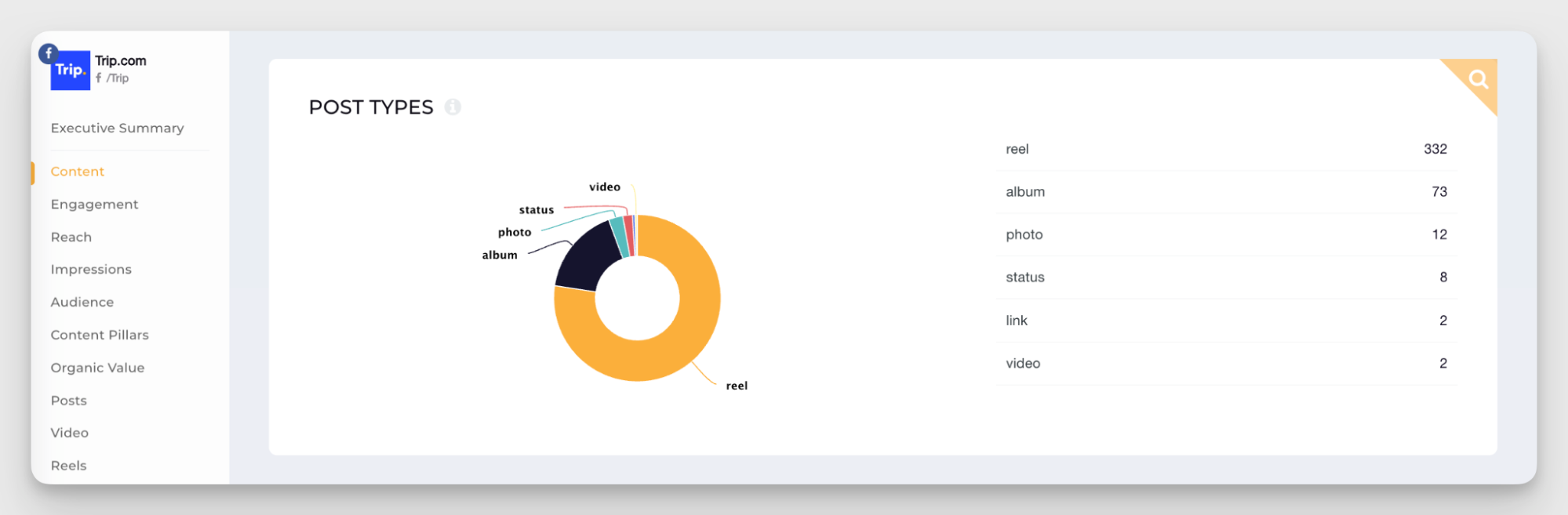

- Content format distribution: Look at the mix of posts competitors publish: images, videos, Reels, carousels, or links. Spotting which formats they use most (and which drive the most engagement) reveals where they’re focusing their efforts.

- Tone of voice and copy length: Spy on competitors posts to see if their style is casual or formal, playful or authoritative. I recommend focusing on whether they use short, punchy captions or longer storytelling formats to engage their audience.

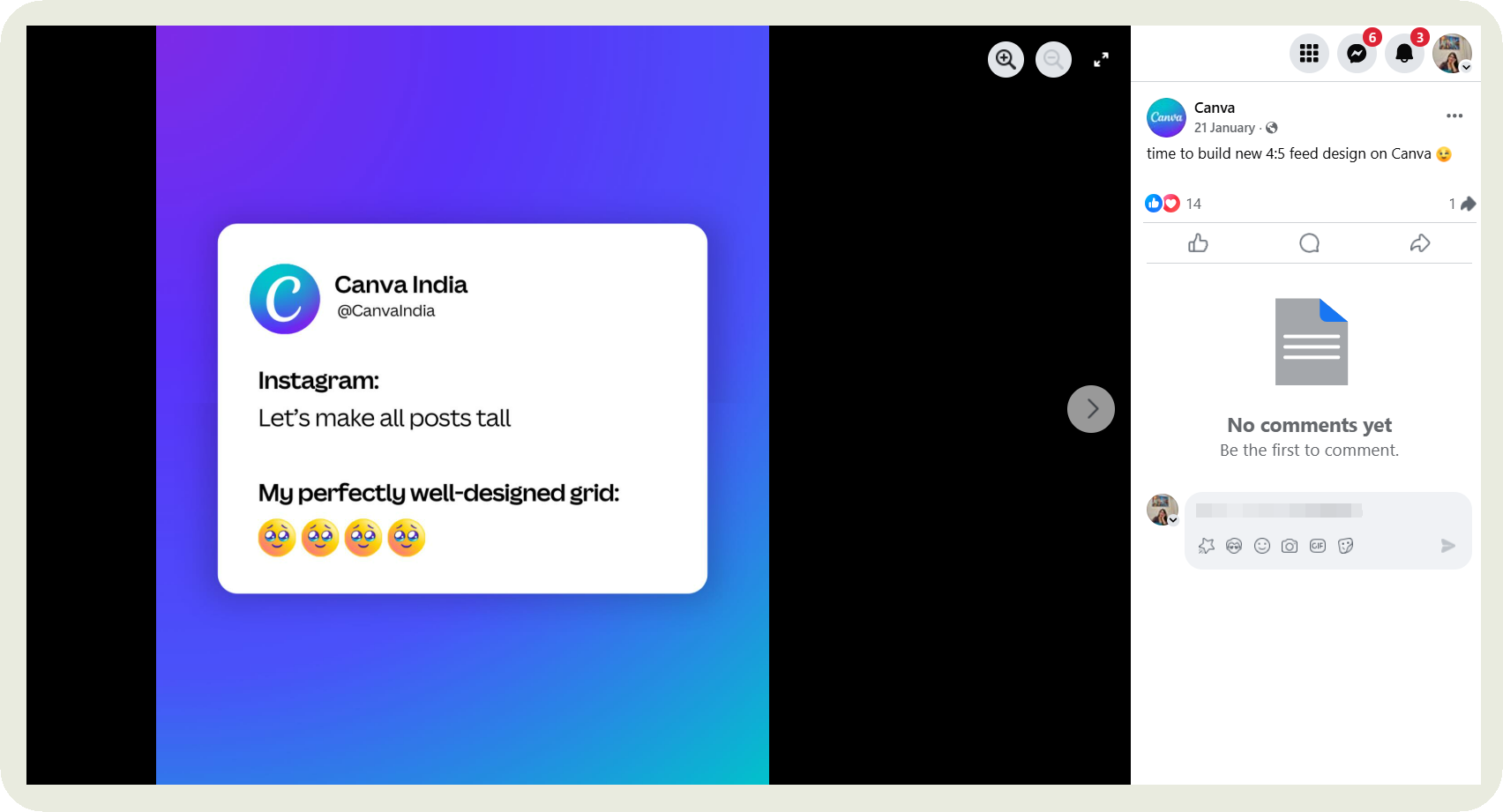

For example, one of the brands we aspire to be like is Canva.

We analyze their posts and we love how they mix educational content with playful and humorous content.

We follow the same approach with our posts sometimes.

Engagement metrics analysis

This is one of the key metrics brands monitor, and for good reason. It shows how much your shared target audience actually enjoys engaging with your competitors’ content. It will also help you benchmark competitor’s KPIs.

- Engagement rate: In addition to comparing the overall engagement rate for a particular period, I also compare engagement rate by followers to get a better understanding of how my brand stacks up against competitors.

Adina also mentions looking for patterns instead of studying standalone Facebook metrics.

She mentioned:

It’s important to track metrics like follower growth, engagement rate, and total engagement, but the real insights come when you correlate them. Don’t just look at numbers in isolation. Look for patterns. For example, if there’s a spike in engagement, does it also show up as a spike in followers?

The same applies to reach and views, especially with Reels becoming more important on Facebook. If a post drives higher reach, did it also attract new followers? By connecting these dots, you uncover the bigger story behind the metrics rather than just staring at standalone numbers.

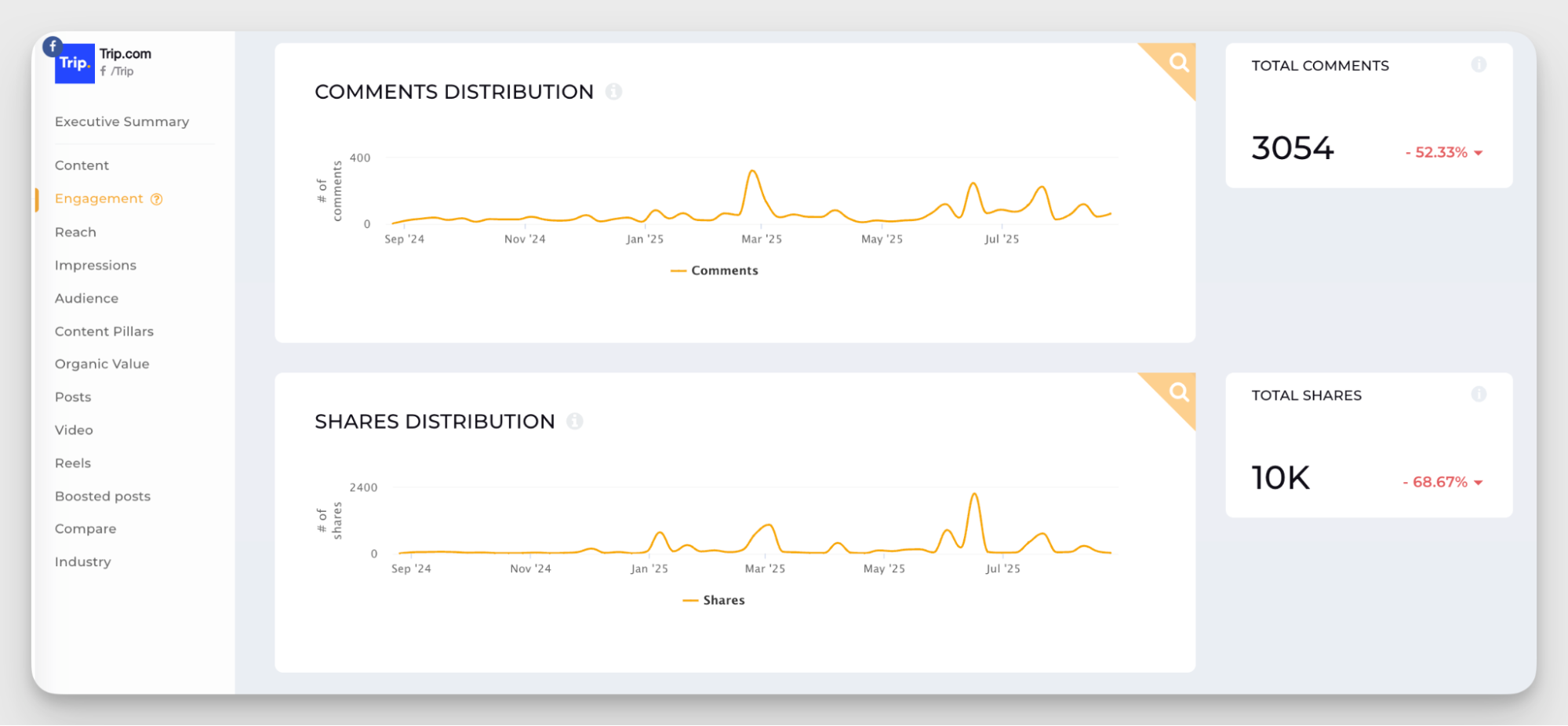

Comments and shares analysis: Many times, we forget to measure engagement metrics that really matter. And that is if the competitor’s audience actually wants to join the conversation or spread the content. Comments reveal the depth of interaction, while shares show whether the message is strong enough for people to endorse it publicly.

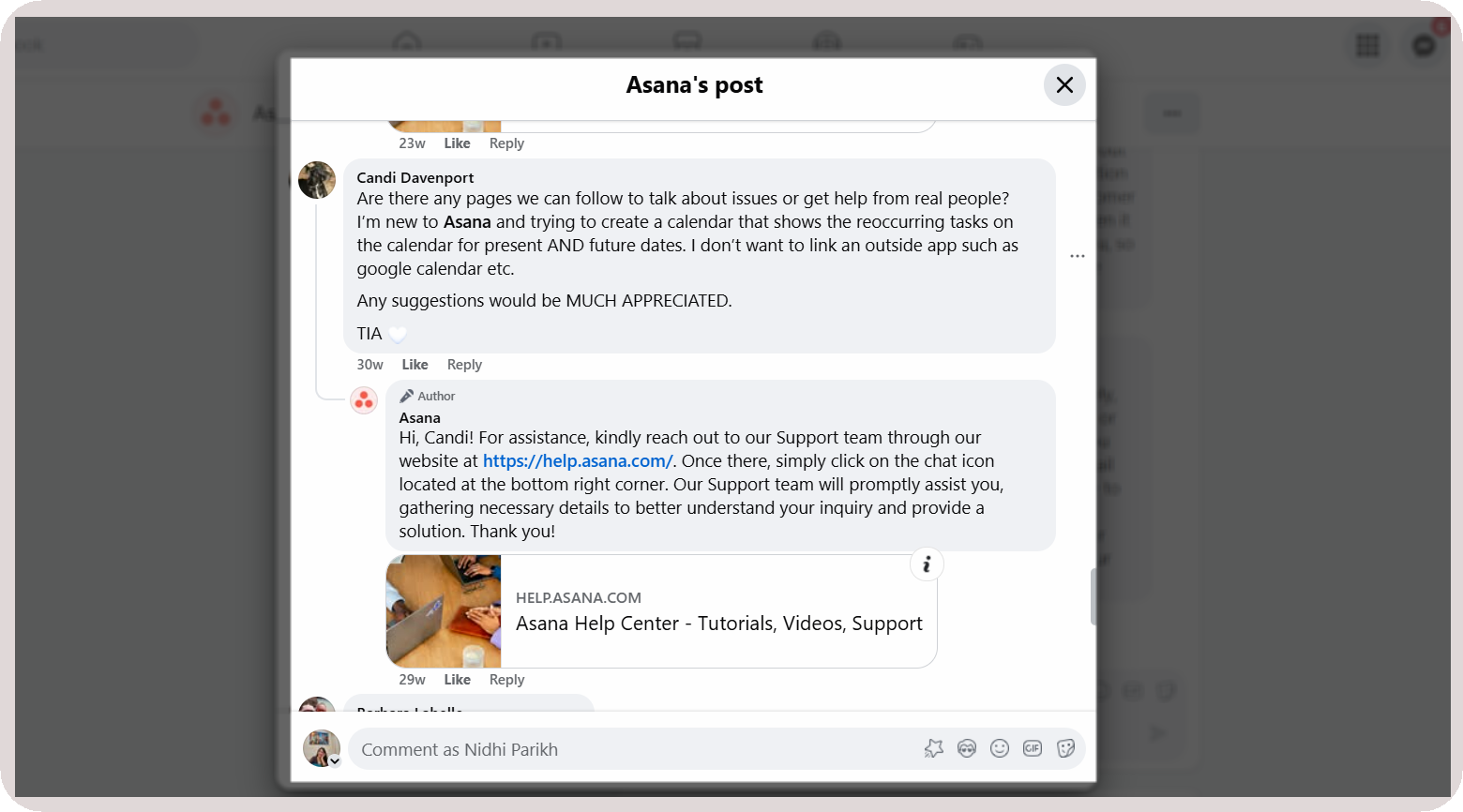

- Community management strategies: How long do your competitors take to reply to comments or ongoing discussions? What tone and approach do they follow when tackling discussions like complaints or feedback?

For example, here’s the approach Asana follows.

Step 3: Run an analysis on your Facebook competitor’s content

Content is the foundation of any social platform. This is why it will be our most important step of the Facebook page analysis, giving you enough insights to refine your content strategy.

Run a content pillar analysis

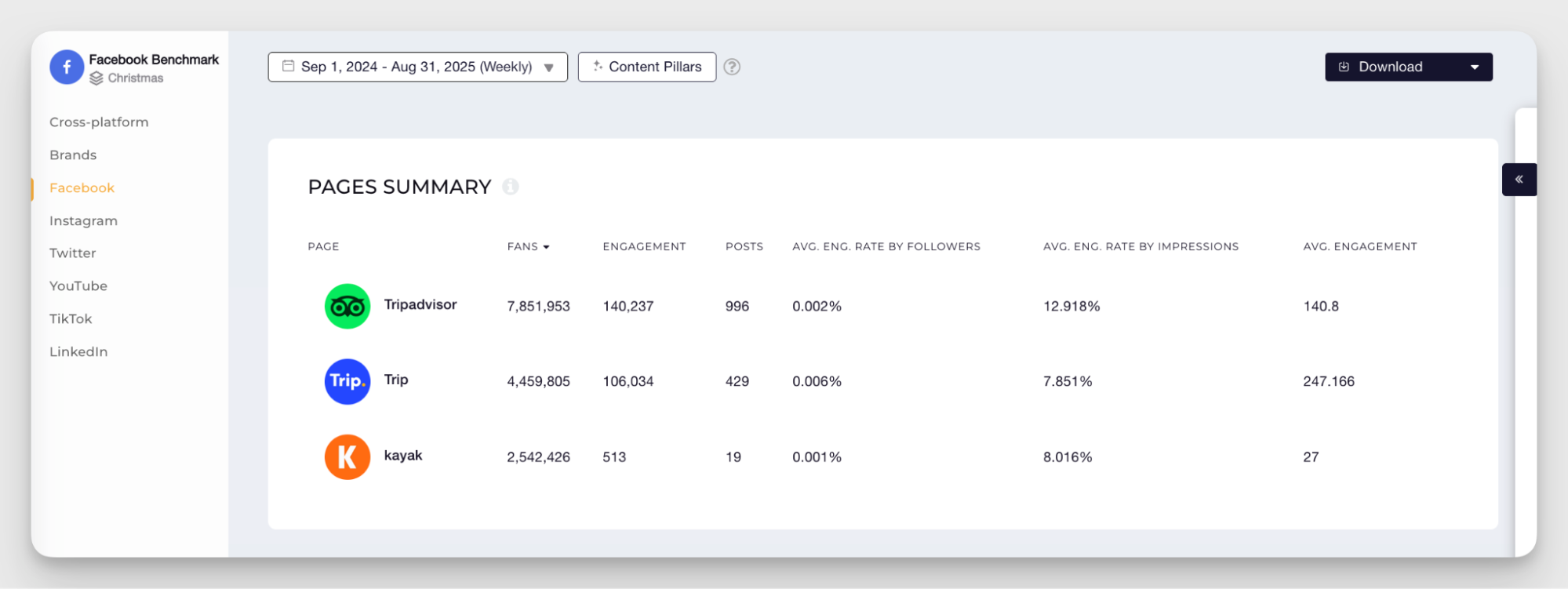

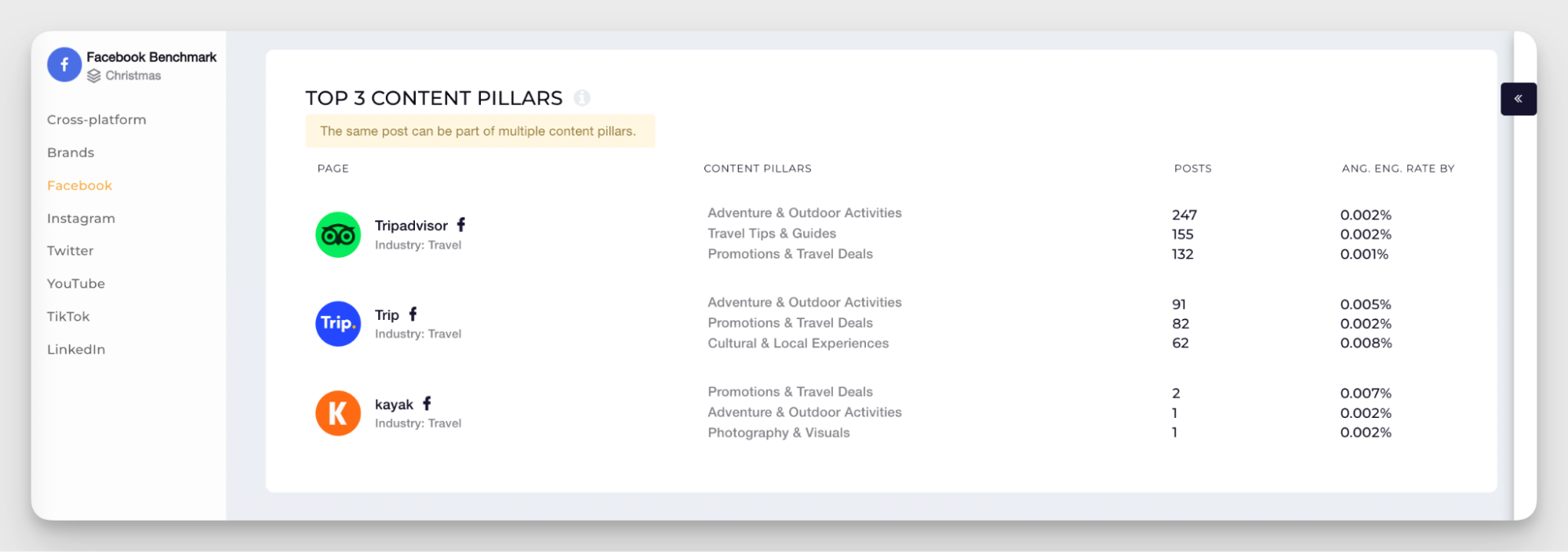

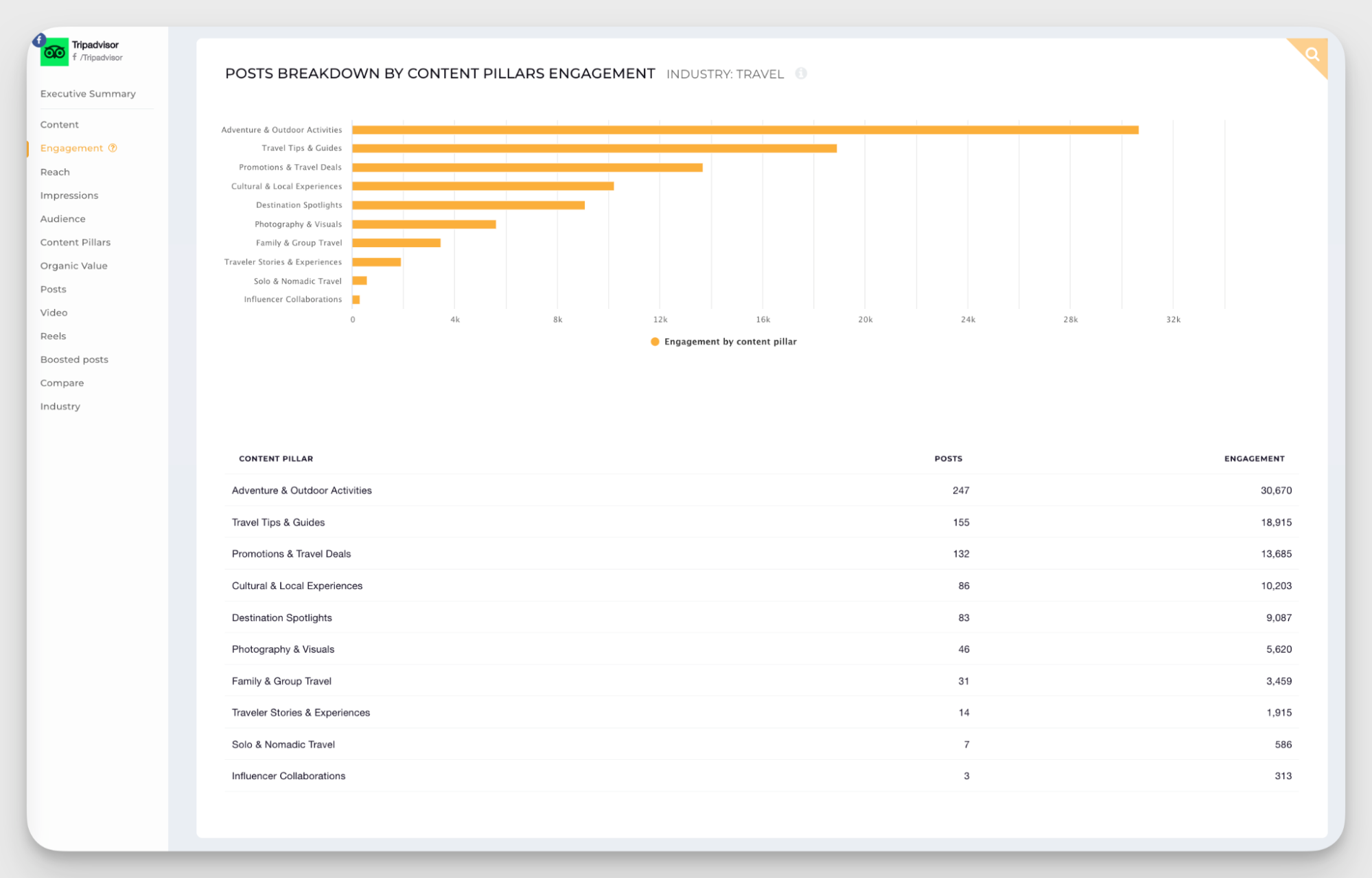

Start by doing an industry-level analysis on Socialinsider that shows the top content pillars for each competitor.

Then, Adina mentions running a competitor-level analysis for each brand —“This helps us understand which content pillar/s generated higher engagement rates. Just as important, we note which pillars don’t perform well, so we don’t replicate what isn’t working in our industry.”

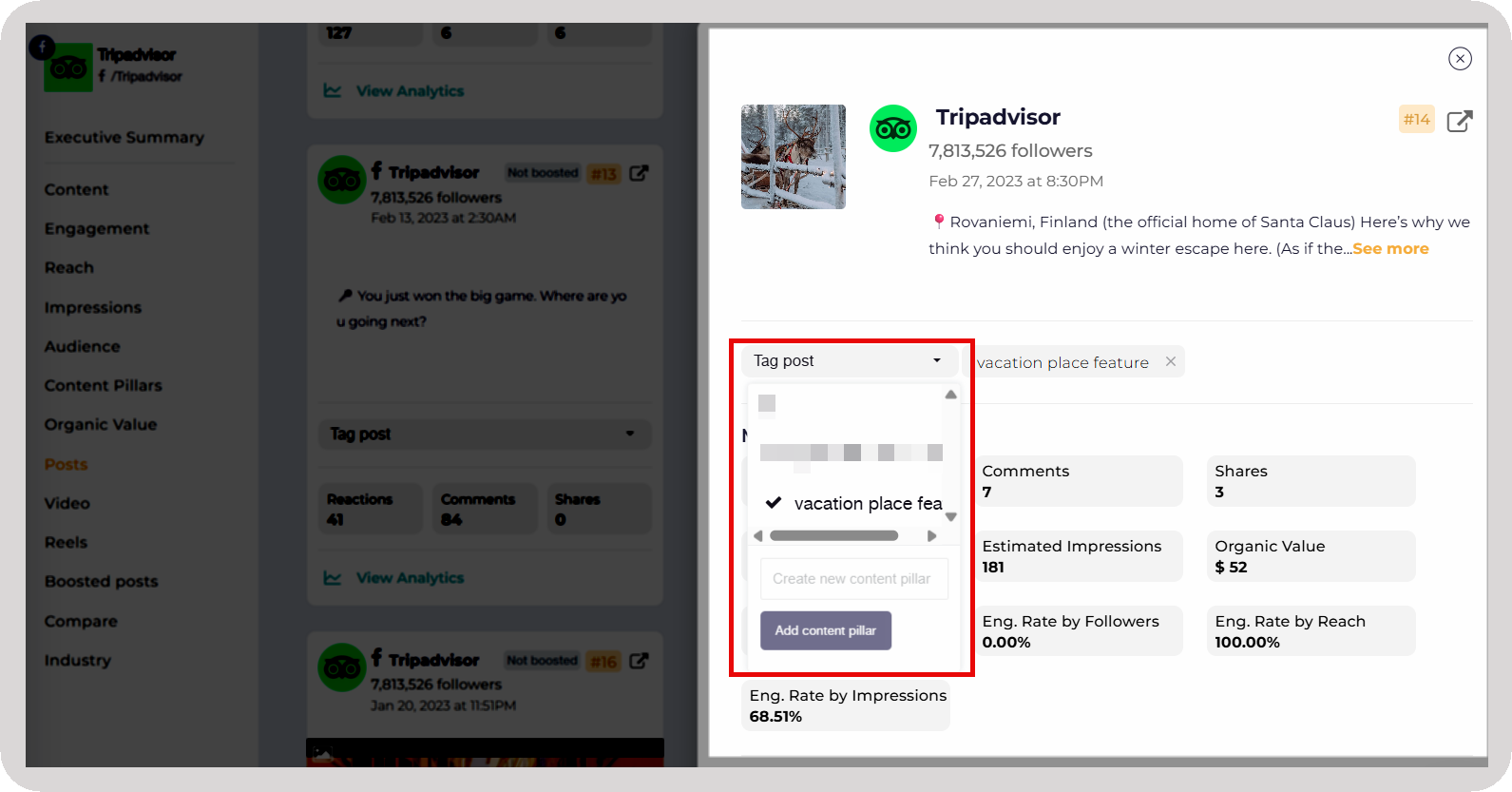

That’s not it. At Socialinsider we use the content pillars feature for a general view, but in-house we also create more specific sub-pillars by manually tagging posts. That gives us a deeper layer of insights.

For example, you can mark ‘vacation place feature’ content for your brand and each competitor and see if your engagement rate matches theirs.

Next, look at pillar-specific strategies.

Then we break it down further, looking at what content formats work best within those pillars, how often competitors post them, and even the timing of when they’re shared. The goal is to get as much context as possible, so we understand not only what works for competitors, but also why their audience responds to it.

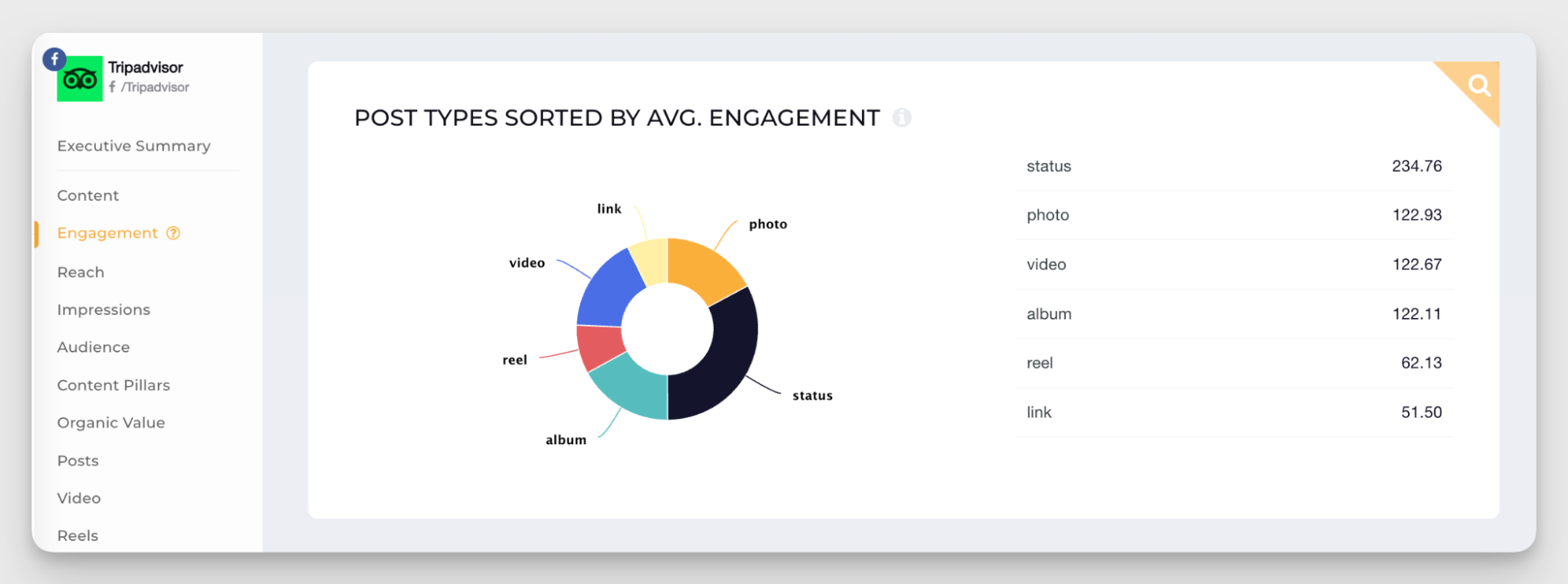

Check their best-performing content formats

Facebook is fueled by multiple content formats: status, photo, Reel, and album.

Look at the ones working the best for each competitor. Are there common patterns you observe? For example, status posts being one of the top-performing format for each competitor.

This gives you insights into what is working at the industry level and if you need to optimize your social media strategy.

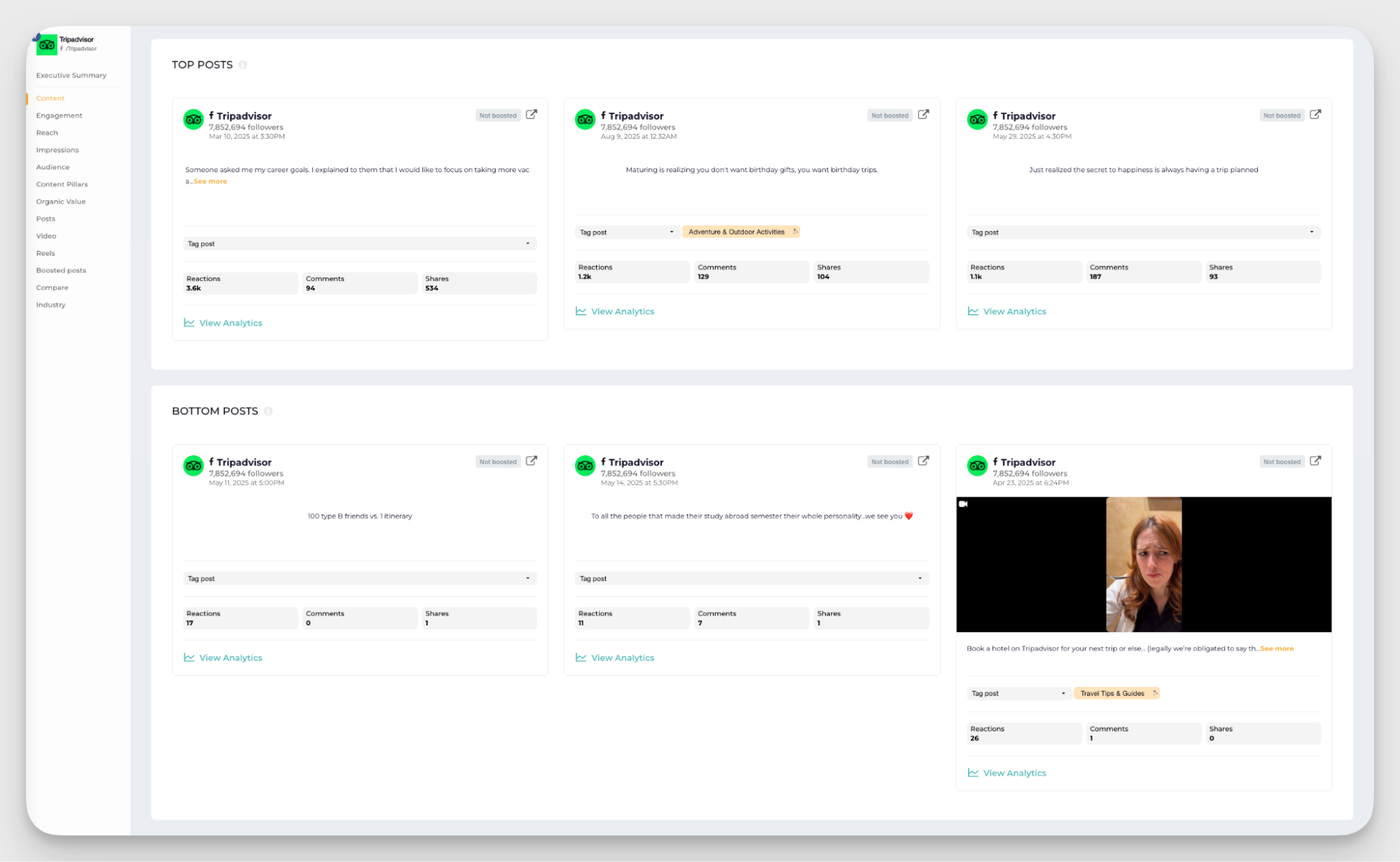

Get insights from their top and bottom posts

Instead of manually finding these posts, I go to the Content section in Socialinsider and find the top and bottom posts for each competitor.

How do I analyze them further? I ask these three questions:

- Is there a common pattern in the top-performing posts, such as the tone or the kind of captions used? Can we replicate it for our brand?

- Which format did they use — image, Reel, or album post? Are they following a particular format for specific content pillars?

- How did the audience respond in comments, reactions, and shares? What triggered engagement (or lack of it)?

These insights will help optimize your content strategy.

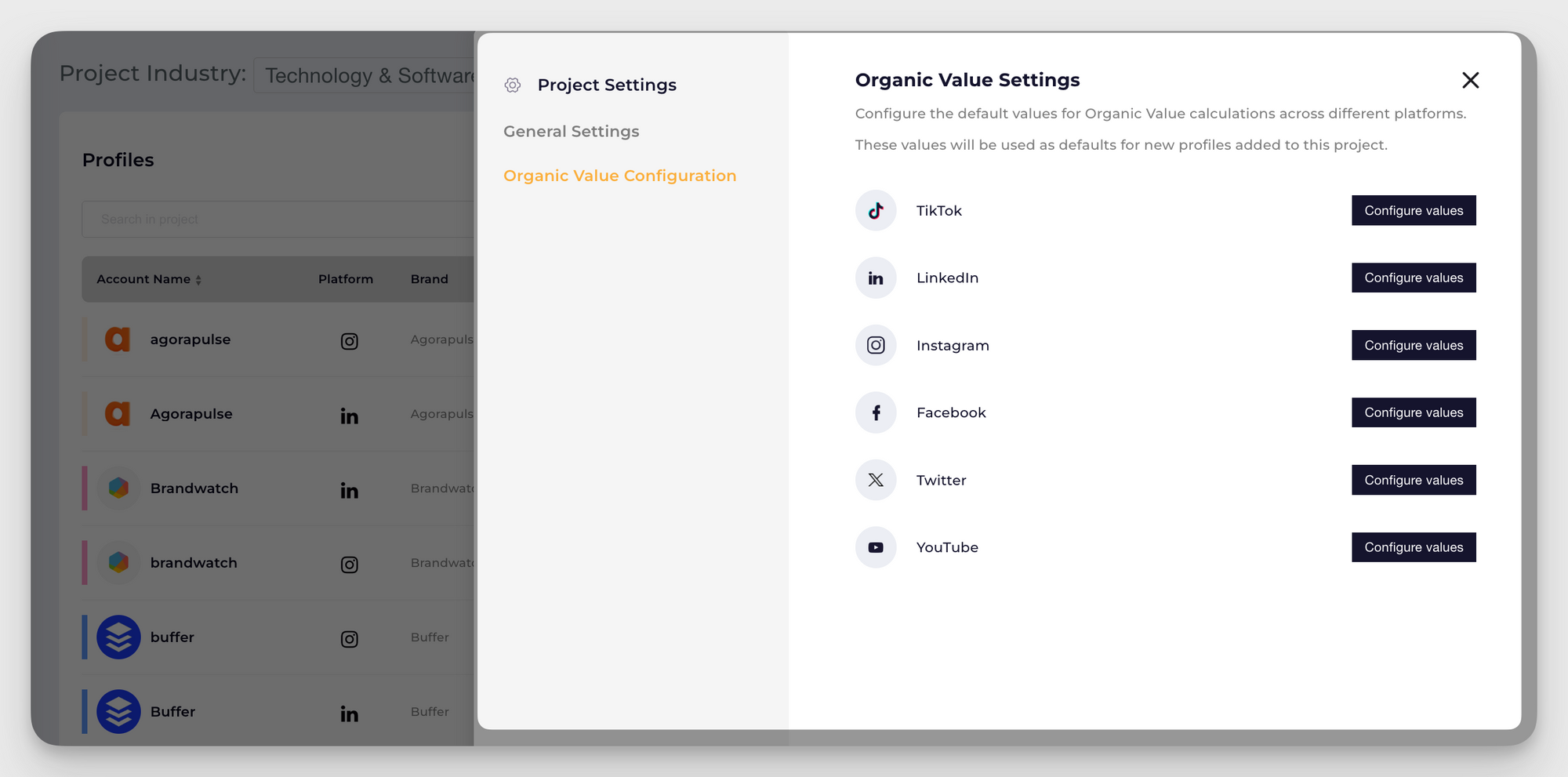

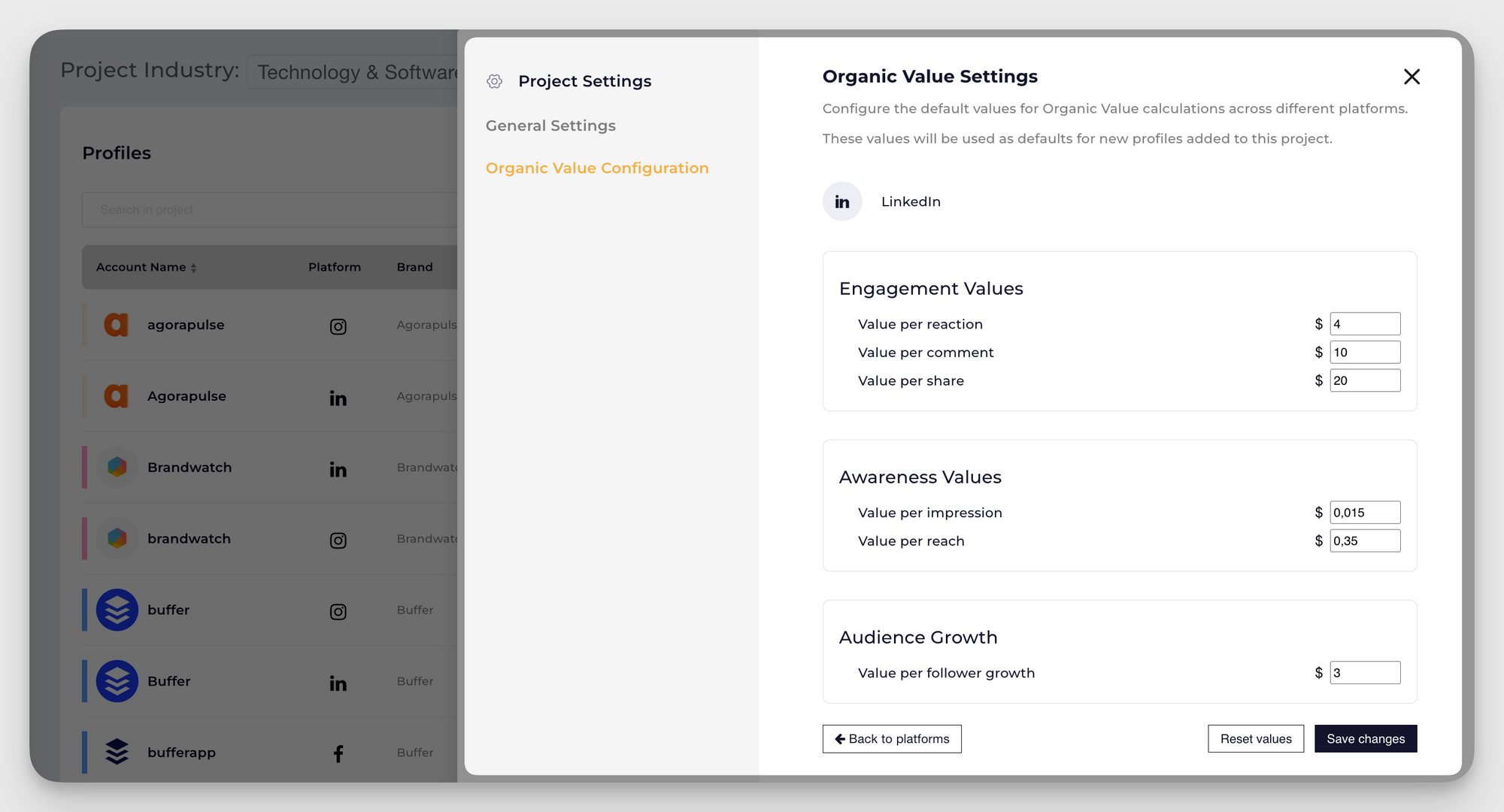

Steal a peek at their organic value

Ever wondered what your competitors’ Facebook page performance would be worth if they had paid for it?

That’s what Socialinsider’s organic value feature shows. Instead of only seeing likes, comments, or shares, you can measure what those interactions would be worth if they had been driven by paid ads.

You can even assign customized values to these metrics to get a more realistic, niche-specific figure.

Why does this matter? Because it helps brands:

- Quantify competitor success: You can finally compare Facebook page performance in dollars, not just percentages.

- Spot efficiency gaps: A competitor might be generating $10K in organic value from a single campaign. If you’re spending the same amount in ads to reach similar results, that’s a red flag.

- Prove ROI internally: Showing the 'ad spend equivalent’ of your own organic performance makes it easier to secure budget and justify strategy.

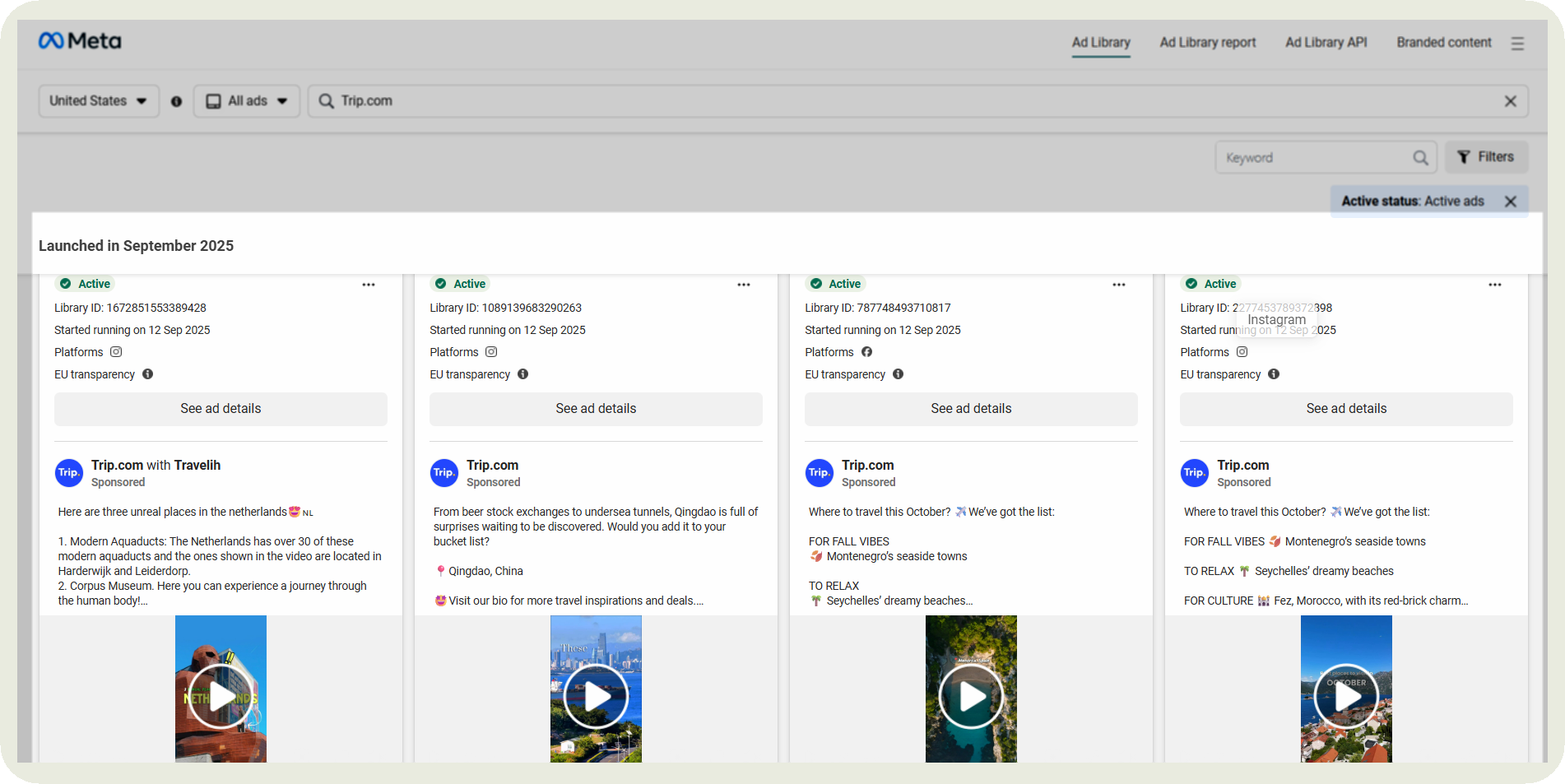

Look at their advertising performance

The most straightforward and cost-free way to spy on your competitors ads is Facebook Ad Library. It shows you all the active campaigns your competitors are running.

For example, I can see all the present ad campaigns by Trip.com.

Adina suggests running these checks regularly.

If you do this every month or quarterly, you begin to see patterns from your competitors. For example, when summer is coming, you might notice a competitor starting to run sales promotions. Or let’s say Black Friday is coming in the autumn: if you’ve searched their ads in the past, you already know when they usually start pushing Black Friday campaigns.

This way, you can build a calendar and map that information against your own campaigns to see whether you should replicate, adapt, or anticipate your competitors’ moves.

Other than that, we usually check for three main things:

(1) Ad visual elements

- Image/video style and quality: Notice whether competitors invest in high-production visuals or rely on simple, quick-turnaround creatives.

- Product presentation methods: Pay attention to how products are showcased. Do they use demo videos, unboxings, flat lays, or in-use scenarios?

- Lifestyle vs. product-focused imagery: See if the ads highlight the product in isolation or place it within a lifestyle context (people using it, aspirational settings). This tells you how they position their brand.

- Use of text overlays and graphics: Check if ads use bold text, captions, or design elements to reinforce messaging and make the creative stand out.

- Video length and pacing: If they use videos for ads, analyze how long they run and how quickly they deliver key messages.

(2) Ad copy analysis

- Headlines and primary text patterns: Look at how competitors structure their main message. Do they keep it short and bold, or go for detailed explanations? Headlines often reveal the hook they rely on most.

- Emotional triggers and pain points addressed: Notice if the copy leans on humor, fear of missing out, inspiration, or problem-solving. This shows what emotional levers they use to connect with their audience.

- Call-to-action language: Track whether CTAs are direct (‘Buy now’) or softer (‘Learn more’).

- Value propositions emphasized: Pay attention to the benefits they highlight: price, quality, convenience, exclusivity, and how consistently those appear across campaigns.

- Urgency and scarcity tactics: Watch for phrases like “limited time,” “only today,” or countdowns that push immediate action. These can reveal how often competitors lean on short-term tactics.

- Brand voice and tone: Evaluate whether the copy feels formal, conversational, playful, or authoritative. Tone shows how competitors want to be perceived and what resonates with their audience.

(3) Technical elements

- Aspect ratios used: Check whether ads follow platform best practices – square (1:1), vertical (4:5 or 9:16), or horizontal (16:9). The ratio competitors choose shows how mobile-first or cross-platform their ad strategy is.

Formats used: Look at whether they run static images, carousels, stories, or reels. Tracking formats reveals how diverse their creative strategy is and which ad placements they prioritize.

Step 4: Create a SWOT analysis based on your findings

Once I’ve gathered all the competitor data, I put it into a SWOT framework : strengths, weaknesses, opportunities, and threats. This step forces me to go beyond numbers and actually translate insights into strategy.

Here’s how I do it:

- Strengths: I note where competitors consistently outperform. Maybe they have higher engagement on video content or faster response times in comments.

For example, Tripadvisor is great at community engagement. Their audience not only leaves reviews but actively answers each other’s questions, which strengthens their brand credibility. That’s a clear strength.

- Weaknesses: Then I highlight the gaps. If a competitor has high reach but weak engagement, that’s a weakness.

With Trip.com, for instance, I noticed they often post promotional deals that get plenty of impressions but limited interaction. That shows an opportunity for more engaging storytelling.

- Opportunities: This is where I connect competitor gaps to my own brand. If I see a brand getting strong traction from user-generated content, but my competitors haven’t tapped into it, I add ‘UGC campaigns’ as an opportunity for us.

- Threats: Finally, I look at what competitors do that could limit our growth. If a brand dominates paid campaigns during seasonal spikes, say, Black Friday travel deals, that’s a threat I need to plan around.

Step 5: Make a final optimization plan

You now have all the insights you need.

You just need to put them in a way your team can quickly understand and implement.

Adina recommends backing your strategy with data to help everyone trust the strategies you’re proposing.

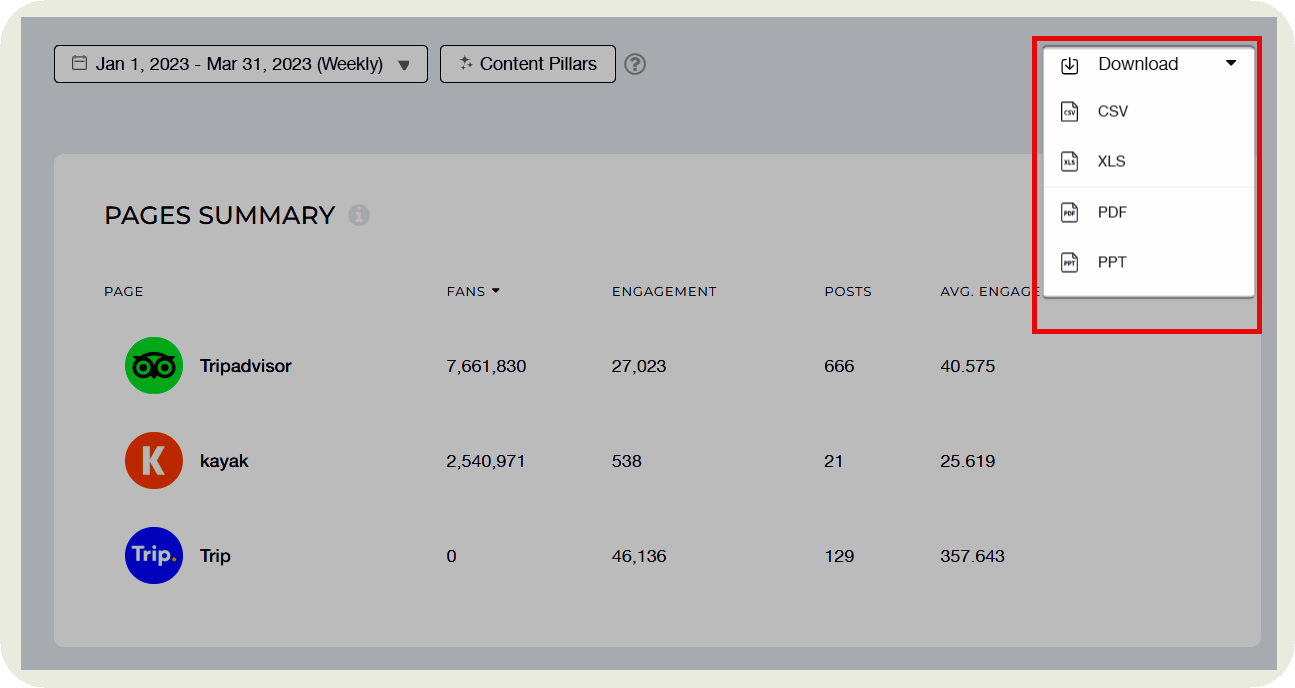

One way to show this data is by generating a benchmarking report through Socialinsider.

The best part about these benchmarking reports is that you can add them to your presentations or even send them directly to managers or clients. The key is to do this consistently (every few months) so you can compare your progress against competitors

This way, you can say: here’s where our strategy outperformed, here’s where we’re falling behind, and here are the insights I’ll apply next month or next quarter.”

You can also segment your optimization plan in three ways: identify quick wins (things you can achieve in 1 month), establish medium-term improvements (can take up to 3 months) and think of long-term strategic shifts (can take till 6 months)

Top Facebook competitive analysis tools

Let’s be honest: keeping an eye on competitors can be time-consuming. And doing it manually often means missing the bigger picture.

To make this process quicker and data-backed, it’s smarter to lean on Facebook competitive analysis tools. Here are three worth checking out.

Socialinsider takes the guesswork out of Facebook competitors analysis. Just add your competitor profiles and instantly see how they stack up against you.

This means seeing:

- Their content performance compared to yours

- Content distribution by format and content pillars

- Their engagement rate and other key social media metrics like follower growth, impressions, reach, and post-level metrics

- Their posting frequency and cadence by engagement

The best part: it shows you patterns, content gaps, and organic value so you can prove ROI with confidence.

Keyhole

Keyhole tracks competitor performance in real time and shows you what drives their engagement. You can monitor hashtags, keywords, and campaigns alongside follower growth and content performance.

It’s predominantly a social listening tool that can help you spot trends, measure sentiment, and see how your brand stacks up.

Quintly

smallest detail. You can compare performance, spot trends, and build reports tailored to your team or clients.

It may take a bit of setup, but once running, it gives a structured view of how you and your competitors perform over time.

Mistakes to avoid while conducting your Facebook competitive analysis

With so much data to sift through, it’s easy to slip up without even realizing it. Here are four common mistakes to watch out for.

Blindly following competitors

While talking to Adina about the mistakes brands often make, one clearly stood out: never take any competitor strategy at face value.

She says:

It should never be a copy-paste. We never recommend taking what competitors are doing and applying it one-on-one to your own page. The key is to use insights from your own audience. For example, ask them how they want to receive information: animated videos, Reels, or face-to-camera posts. Combine that with industry-level insights, and then adapt it to your strategy.

Let’s understand it with an example. Imagine your competitor starts posting memes, and their engagement shoots up. It’s tempting to copy that and flood your page with memes.

But here’s the catch. Your audience might not come to you for jokes. They may value practical tips or behind-the-scenes content instead.

A smarter move is to test the idea in your own style. Maybe turn complex insights into light, shareable visuals. That way, you ride the trend but still stay true to what your audience wants.

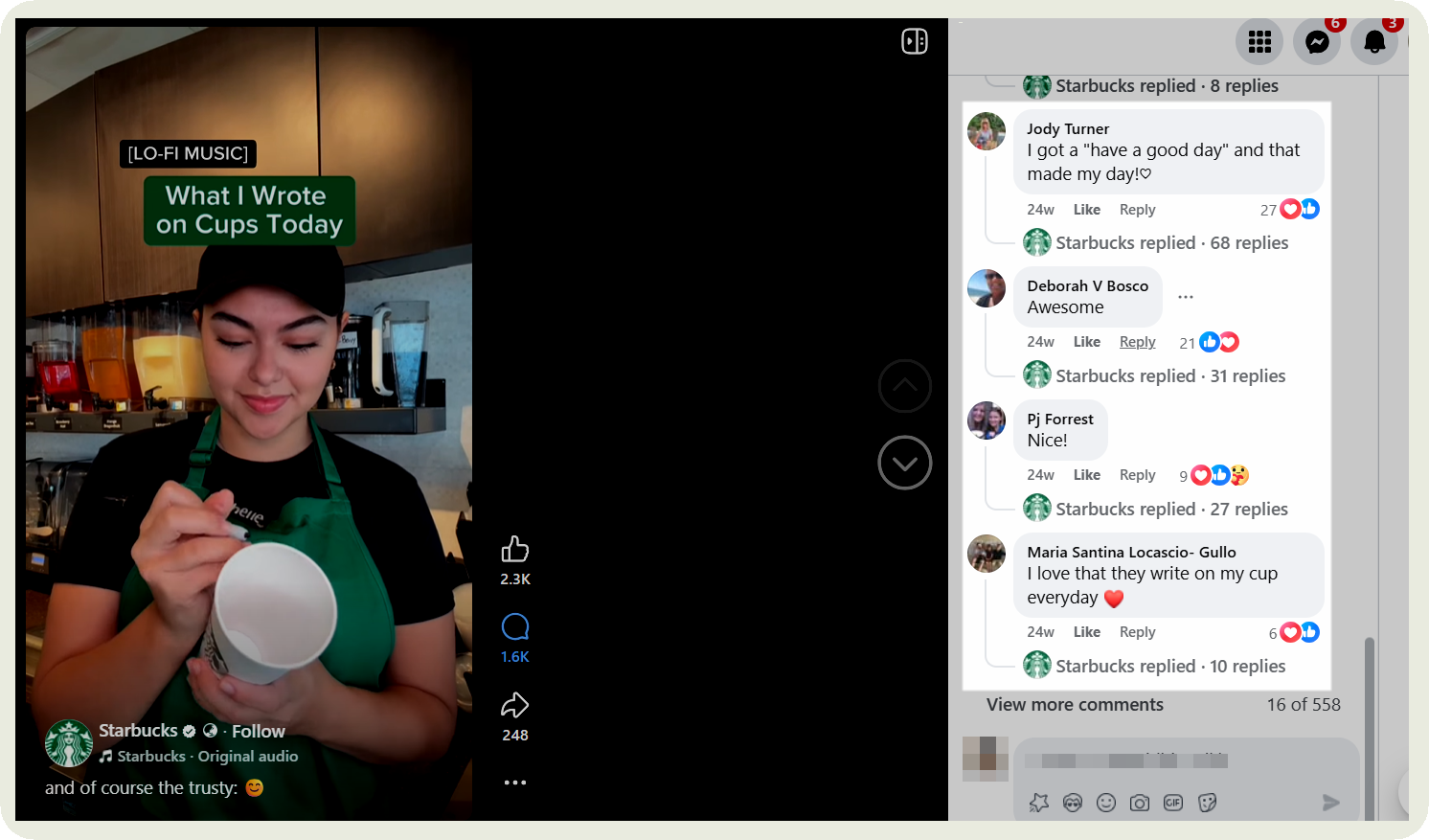

Ignoring comment threads and conversations

Looking at comments and discussions on your competitor’s Facebook can give additional insights that raw metrics won’t be able to.

You might discover which product features customers actually like, what pain points they want solved, or what makes them tag friends.

For example, I know for a fact that so many people love Starbucks for their different range of drinks. But while going through the comments on this post, one thing popped up — people went crazy over baristas writing little notes on their cups. It’s a small gesture, but the comments showed just how much those personal touches matter to the audience.

Don’t overlook the context behind numbers

Metrics are the backbone of a competitive analysis. We all know that. But too often, we take those numbers and not the story behind them.

As Adina explained, numbers are only the starting point:

You need to add context. What generated that spike in followers? What post triggered the jump in engagement? In Socialinsider, for example, you can click on a spike and instantly see which posts drove it. That context turns raw numbers into real insights.

I also recommend looking for patterns by combining different metrics. It takes more time, but the clarity you gain is worth every second.

Final thoughts

We get it. Everybody wants to outperform their competitors on social media. Instead of going all guns blazing, start small. Pick your competitors, track the right metrics, and look for patterns instead of isolated spikes.

Keep checking in monthly so your insights don’t go stale. And remember, the goal shouldn’t be to copy competitors. Rather, outsmart them by knowing your audience better.

To make Facebook competitive analysis work for you, try out the different features of Socialinsider for free. Activate your trial period here.

Analyze your competitors in seconds

Track & analyze your competitors and get top social media metrics and more!

You might also like

Improve your social media strategy with Socialinsider!

Use in-depth data to measure your social accounts’ performance, analyze competitors, and gain insights to improve your strategy.