Competitive Insights: How to Collect and Use Them Effectively

Learn how to get and leverage competitive insights to improve your social media presence, knowing exactly what works best in your industry.

When I look at how most B2B companies execute their marketing and sales strategies, it feels like almost everyone is running the same playbook: find in-market leads, get their contact info, and hit them with outbound campaigns and ads.

The problem? By then, the game’s already decided—80–90% of buyers have a vendor list before they even start searching, and 90% choose from it.

The only way to change the odds is to step in earlier, and that starts with competitive insights. If I can see where my competitors are active, what kind of content they’re pushing, and how well it’s performing, I can identify the gaps–and opportunities. More importantly, I can position my brand earlier in the buyer journey, long before the vendor shortlist is formed.

In this blog, I walk through how I gather and interpret competitive insights, the key layers I track across product, marketing, and sales, and how these insights help me position my brand earlier in the buyer journey.

Key takeaways

-

How to gather valuable competitive insights and turn data into growth strategies? Define clear objectives, identify and categorize competitors, and combine digital and traditional research to turn raw data into actionable growth strategies.

-

Important layers of competitive insights that can fuel business growth: Analyzing product features, pricing, marketing, sales, and customer experience uncovers opportunities to differentiate and capture market share.

-

Best practices for getting valuable competitive insights: Use a continuous cycle of assessing, analyzing, acting, and adapting to turn insights into lasting competitive advantage.

What are competitive insights, and why are they critical for competitive advantage?

If you’ve ever wondered why a competitor’s campaign outperformed yours, or why a new brand suddenly started dominating your niche on social media, the answer will almost always be found in competitive insights.

Competitive insights is all about systematically collecting and analyzing competitor and market data so you can see where your competitors are winning and where they’re falling short.

For marketers like you and me, especially those managing multiple channels like social, SEO, and paid campaigns, competitive insights are important. They help:

- Spot emerging competitors before they become market leaders;

- Understand what’s driving growth in your industry;

- Benchmark your own campaigns against your competitors;

- Identify what content types drive the most engagement.

How to gather valuable competitive insights and turn data into growth strategies

Take a look at the process I use (and recommend) to set up a competitive insights framework that actually drives growth.

Set up your competitive analysis objectives and KPIs

Before I even open a tool, I ask myself: Why am I gathering this information?

- Am I trying to get more engagement on socials?

- Am I trying to figure out why a competitor’s ads are killing it?

- Am I looking for gaps in their content?

My objective defines the KPIs I should be measuring. Here’s what I usually track, depending on my goals:

Define strategy segments to identify your competitors

Here’s how I discover competitors:

- Search engines: I start with keywords that matter to my business and see who consistently ranks on page one. Even if I find a brand that isn’t my direct competitor, I still look into them because, at the end of the day, they’re competing for the attention of my audience.

- Social listening: I track brand mentions, hashtags, and trends using social listening tools. Often, it helps me discover new startups in the space that I didn’t even know existed.

- Customer feedback: I make it a habit to ask prospects if they’re considering other options. If they are, I dig into who those competitors are and why they’re being considered. First-party data like this is always the most reliable, and when multiple people mention the same competitor, I know I’ll need more insights about them.

How to classify your competitors?

You can’t track every brand in your space, and you shouldn’t even have to. That’s why I break down competitors into three categories:

Direct competitors are the ones offering the same product or service to the same audience. I keep an eye on them to benchmark my brand’s performance and spot immediate threats.

Indirect competitors serve a similar audience but with slightly different solutions, which gives them the ability to potentially pull attention away from our brand.

Substitutes are the ones offering a completely different product to the same audience. These are often the hidden competitors that can catch you off guard if you ignore them.

Once I have identified and categorized competitors, I use market share analysis to quantify their presence in the market. By comparing revenue, user base, social followers, or other measurable metrics, I can see who holds the largest share in the market and who’s growing fastest.

From there, I create a positioning map to visualize where each competitor stands relative to my brand. I typically plot market share on one axis and strategic positioning, like price, product quality, or brand perception, on the other to spot leaders and disruptors in the industry.

What data collection methods and sources can you use?

When I’m gathering competitive intelligence, I split my approach into digital intelligence and traditional research. Both give me a complete picture of the market, but digital is where I usually start first.

Digital intelligence gathering

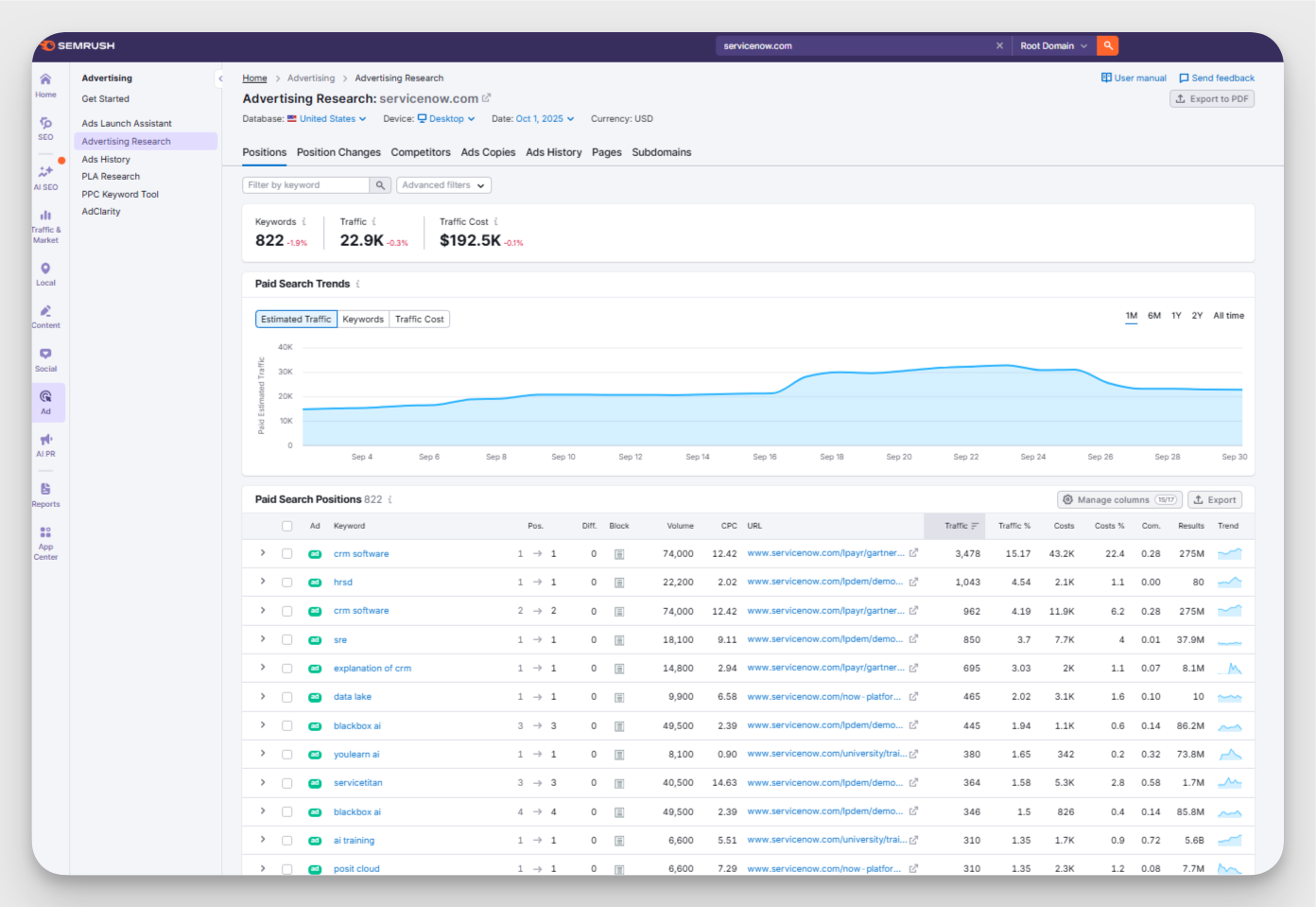

- Website and SEO competitive analysis: I use SEO analysis tools like SEMrush and Ahrefs to get a clear view of what kind of data is driving traffic to competitor sites. I look at search rankings, keyword strategies, and backlinks for all of the major competitors. Most importantly, I look for their keyword gaps and missed opportunities.

- Social media monitoring and engagement tracking: I rely heavily on Socialinsider for competitive cross-platform social media insights. I can track follower growth, engagement, and content performance over time and benchmark the metrics against competitors to see who’s outperforming and why.

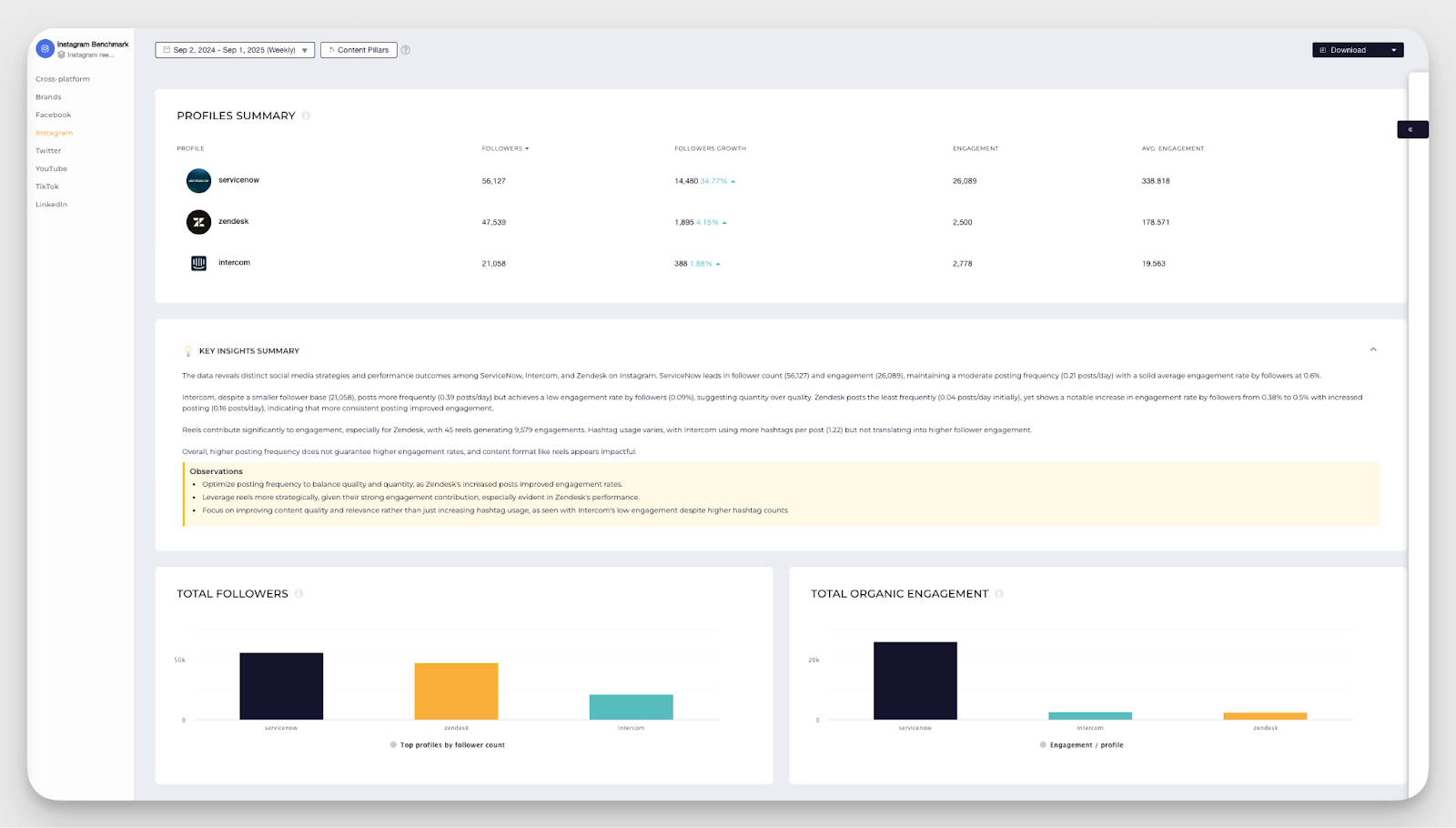

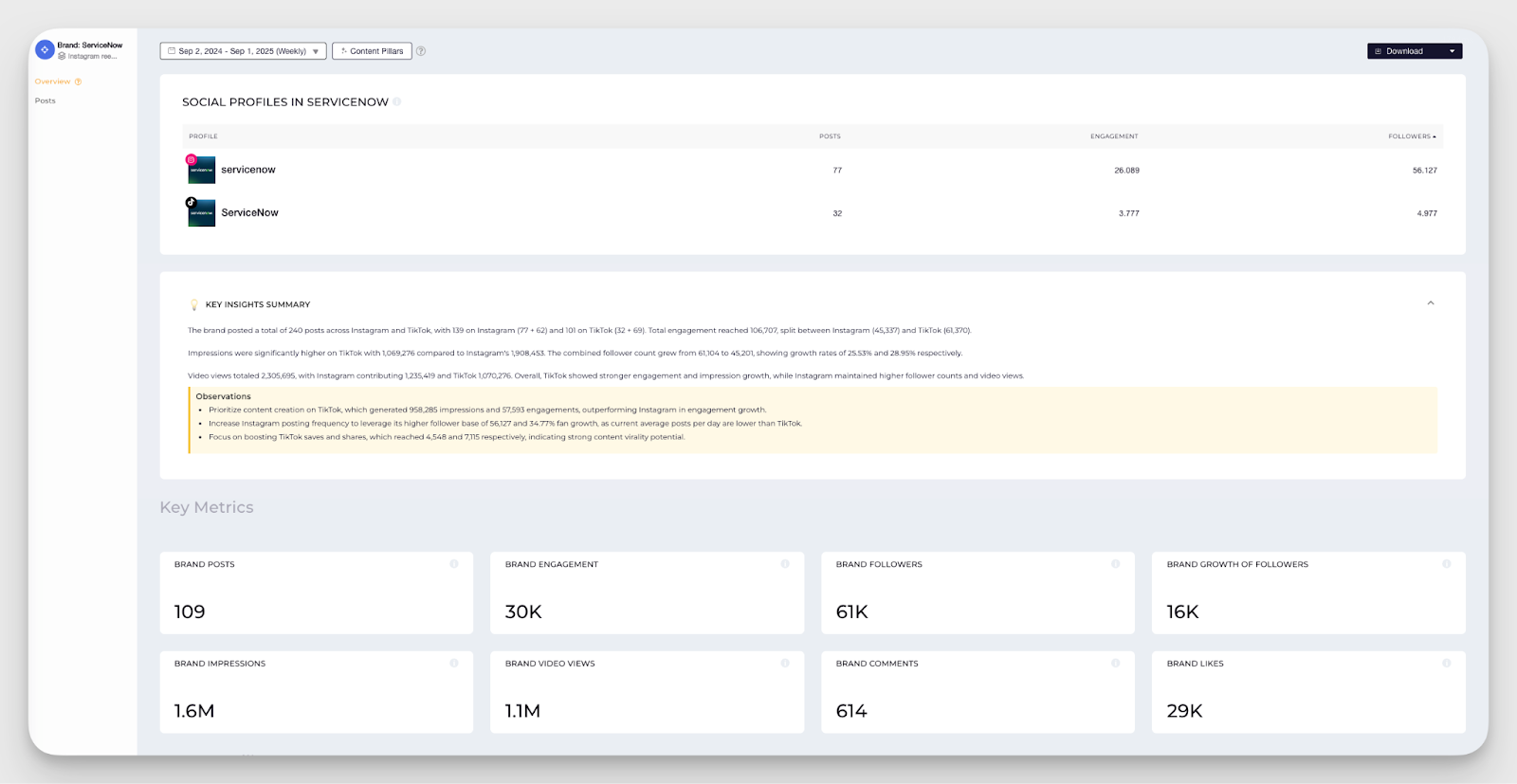

For instance, when I analyzed enterprise SaaS brands on Socialinsider, I discovered ServiceNow consistently outperforms Zendesk and Intercom in both follower growth and engagement.

- Email marketing and content strategy analysis: I subscribe to competitor newsletters as well as their company blogs to monitor their content output. I especially look into their frequency, messaging style, CTAs, and topics they cover. Are they using content to educate and nurture leads, or mostly to push promotions?

- Mobile app and user experience benchmarking: If competitors have mobile apps, I examine their ratings, reviews, and UX. Customer complaints often reveal missing features and pain points, which I can use to offer a better experience.

Traditional market research integration

- Survey-based competitive research: I conduct surveys to ask my audience directly which competitors they consider and why. This is again invaluable first-party data as it helps me identify who’s actually my main competitor and what factors influence my customers’ purchase decisions.

- Focus groups and interviews: Running small group sessions or one-on-one interviews helps me learn more about why my main competitors win or lose deals, which of their features resonate most with prospects, and which gaps in their offerings can potentially give my brand an edge.

- Industry reports and analyst insights: I use third-party reports and analyst insights to validate my research and sometimes highlight trends or competitors I might have missed.

Specialized tools by category

Social media

Socialinsider

Socialinsider is an AI-driven competitive analysis tool I use to analyze a competitor's social media performance, compare multiple competitors across various social platforms, or dig into industry-specific data to spot opportunities.

With Socialinsider, I can:

- Track follower growth, post engagement, and social media content performance over time

- Social media benchmark metrics against competitors to see who’s leading and why

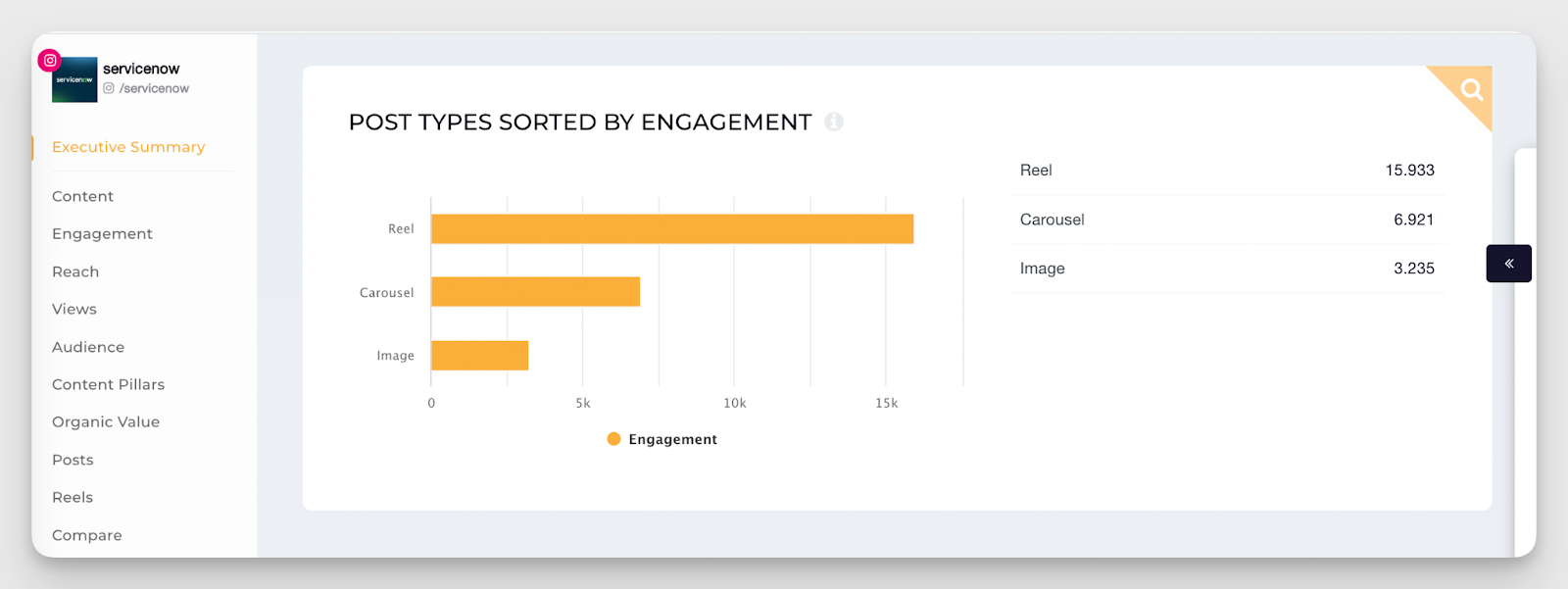

- Identify which content formats, such as videos, carousels, or images, drive the most interaction

- Spot trends in posting frequency, hashtags, and timing that boost engagement

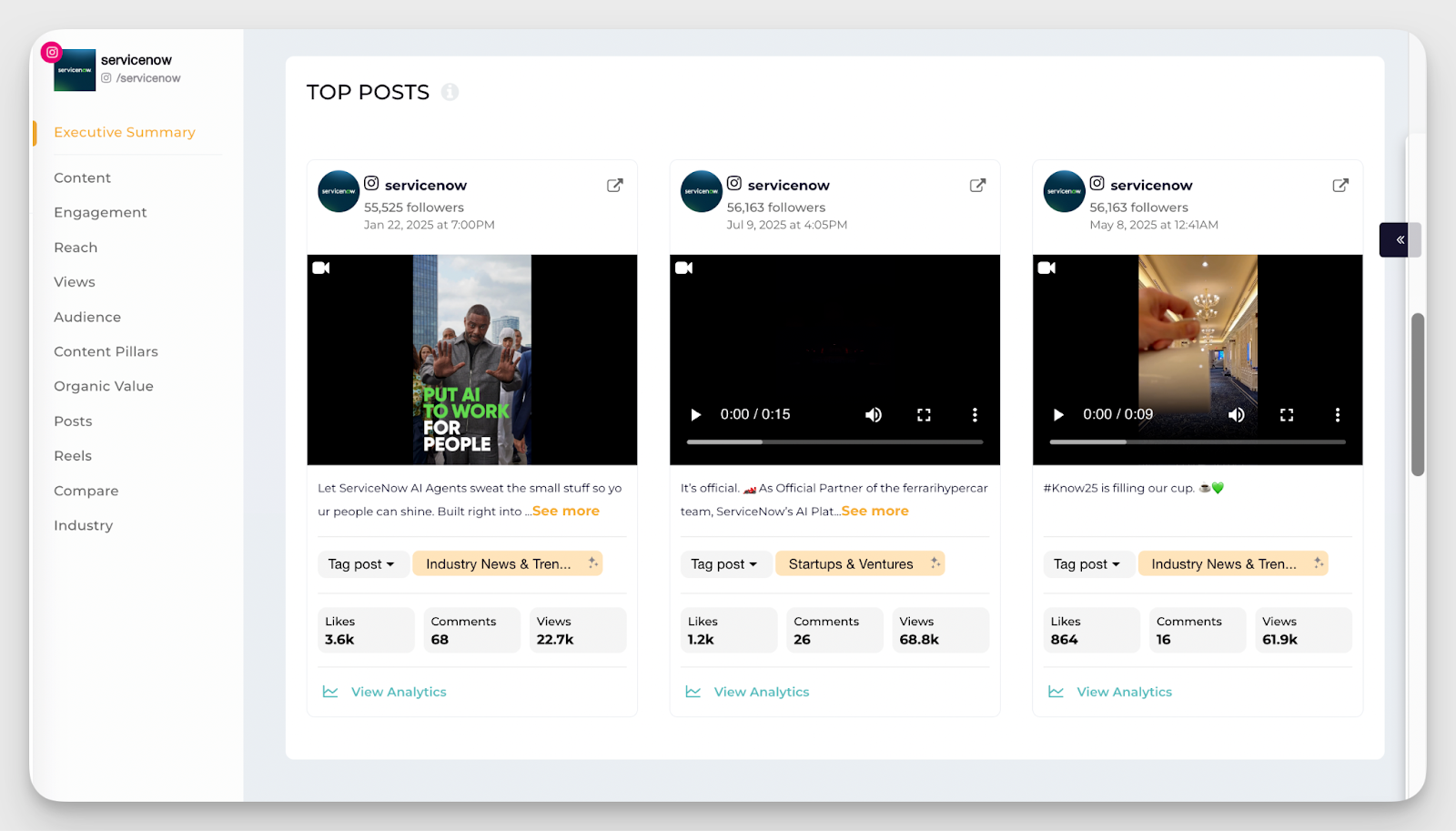

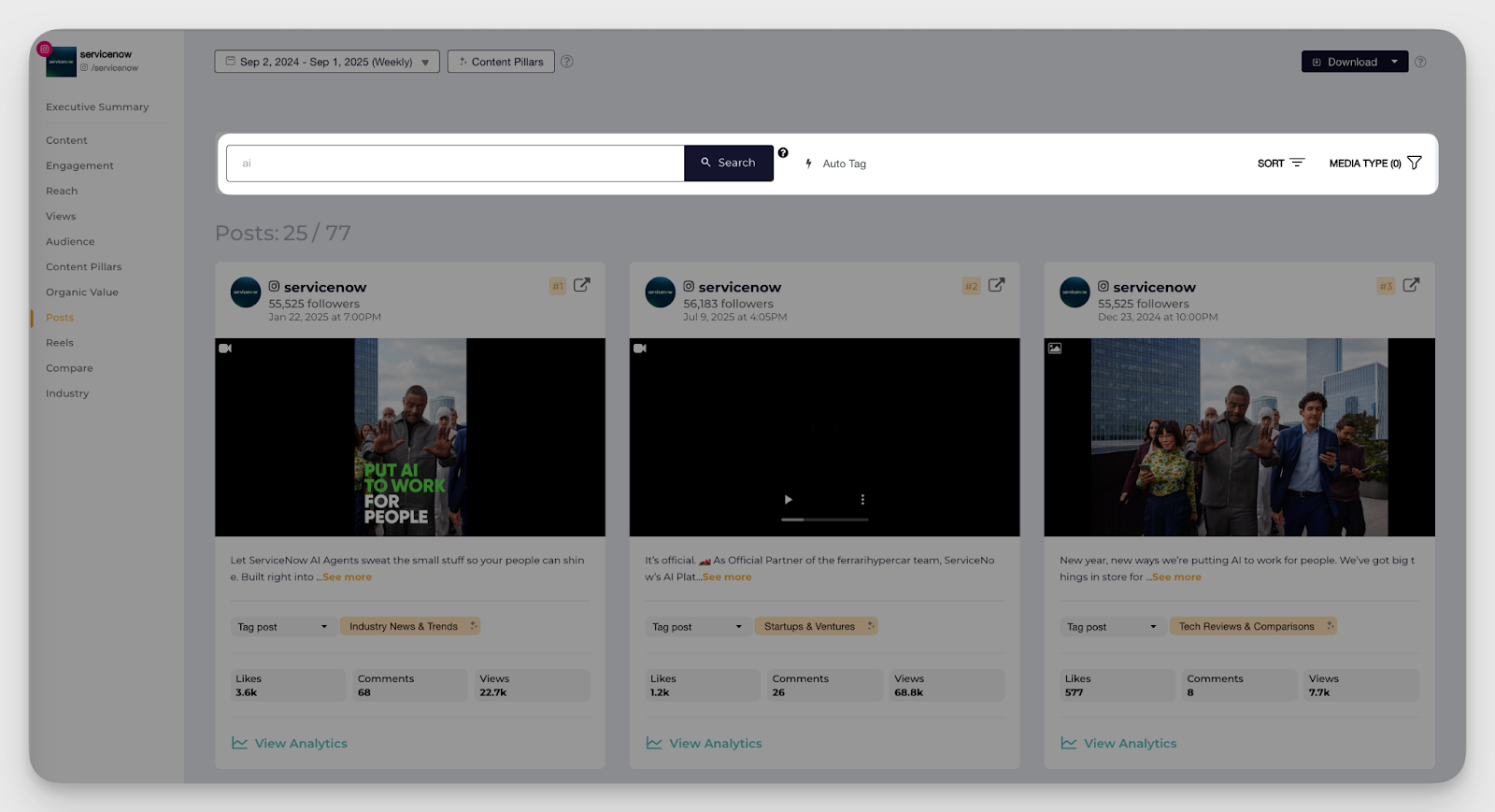

For example, by analyzing ServiceNow’s cross-channel performance on Socialinsider, I can check which content types get the most engagement.

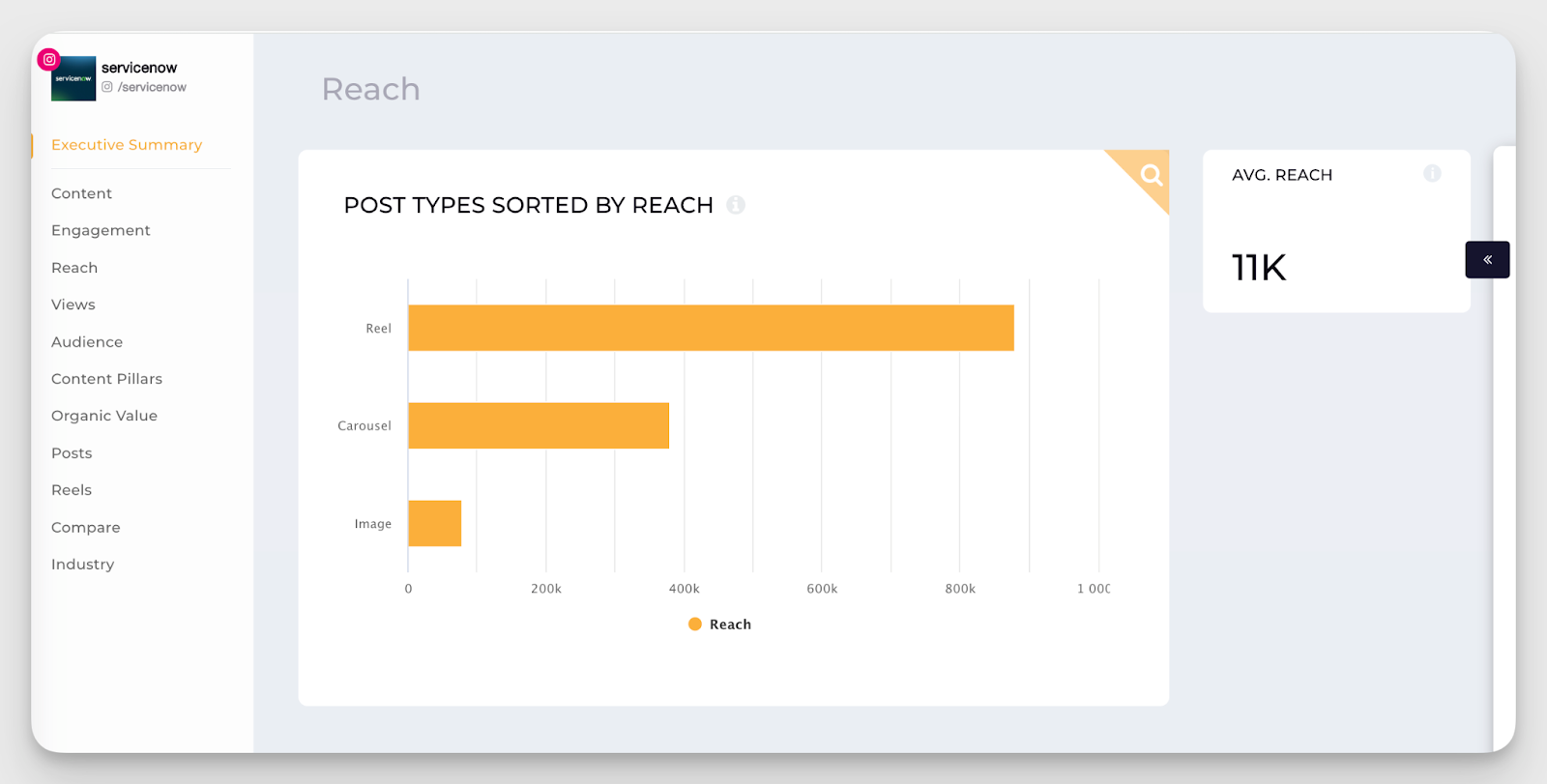

It's also possible to identify the best-performing content types by reach. So for ServiceNow, it's pretty clear that Instagram Reels are the best format, both in terms of reach and engagement.

Socialinsider pulls historical data to help me identify the top-performing posts by the brand. That way, I don’t need to doom scroll a competitor’s Instagram account just to find posts with the most likes, views, or comments–Socialinsider pulls together all the research for me.

Paid advertising

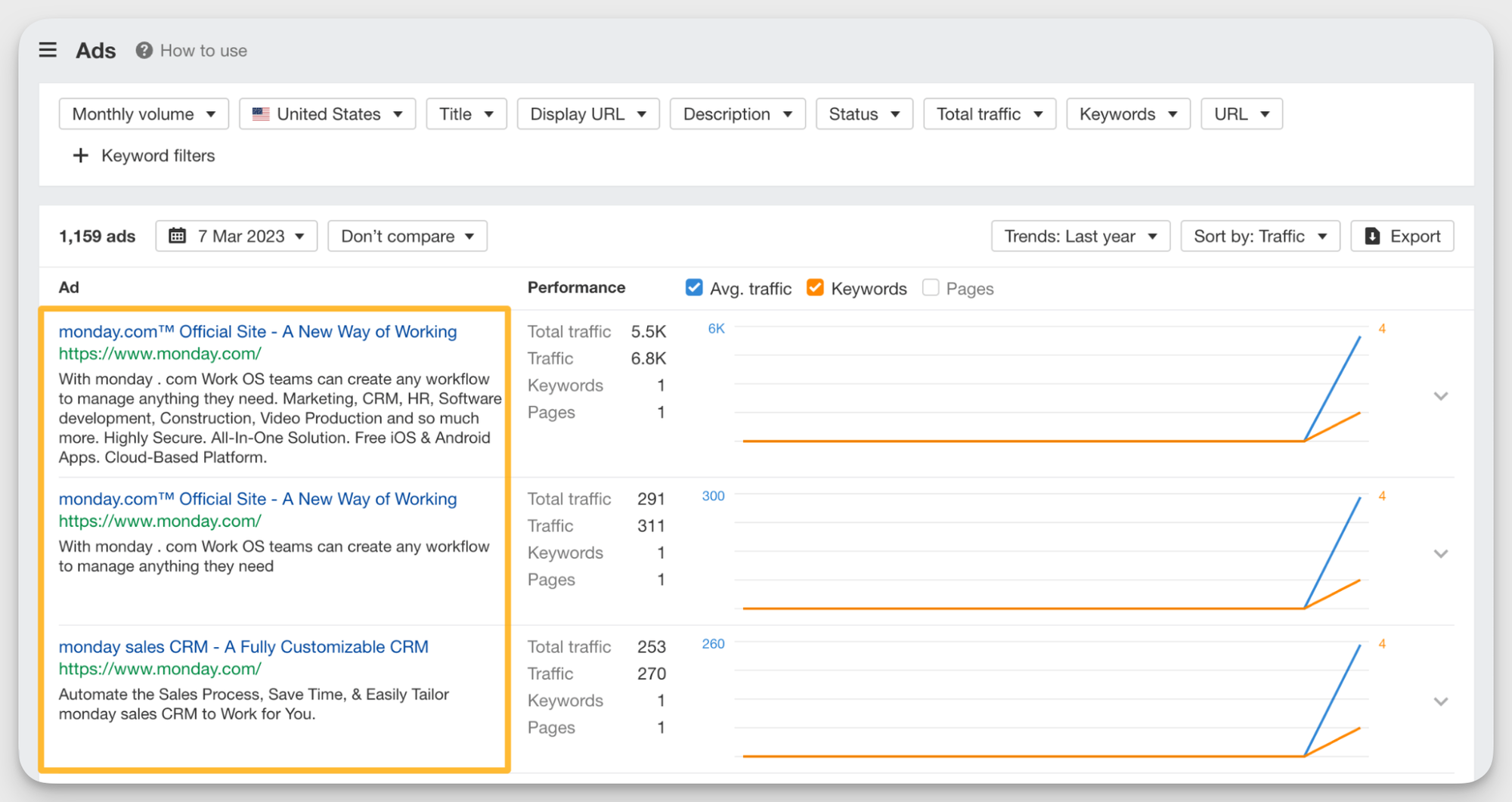

I use a mix of tools depending on the channel and depth of insight I need for paid ads:

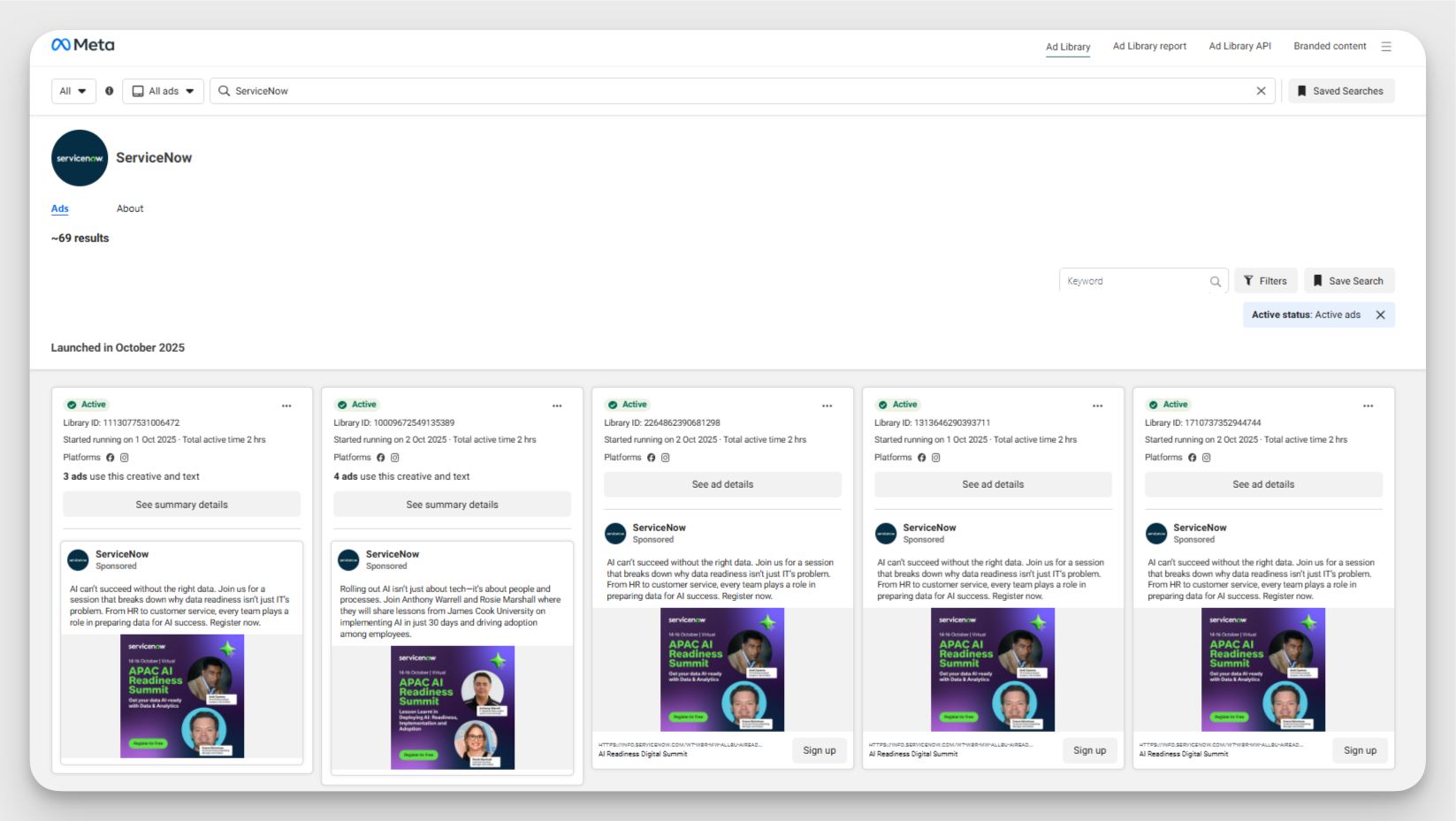

Facebook Ad Library

This free tool lets me see the active ads my competitors are running on Facebook and Instagram. I can filter by country, ad type, medium, or keywords, and even track branded content partnerships. It’s not 100% transparent as Meta doesn’t always show every single ad, but it gives me a solid view of messaging, creative trends, and campaign focus of my competitors.

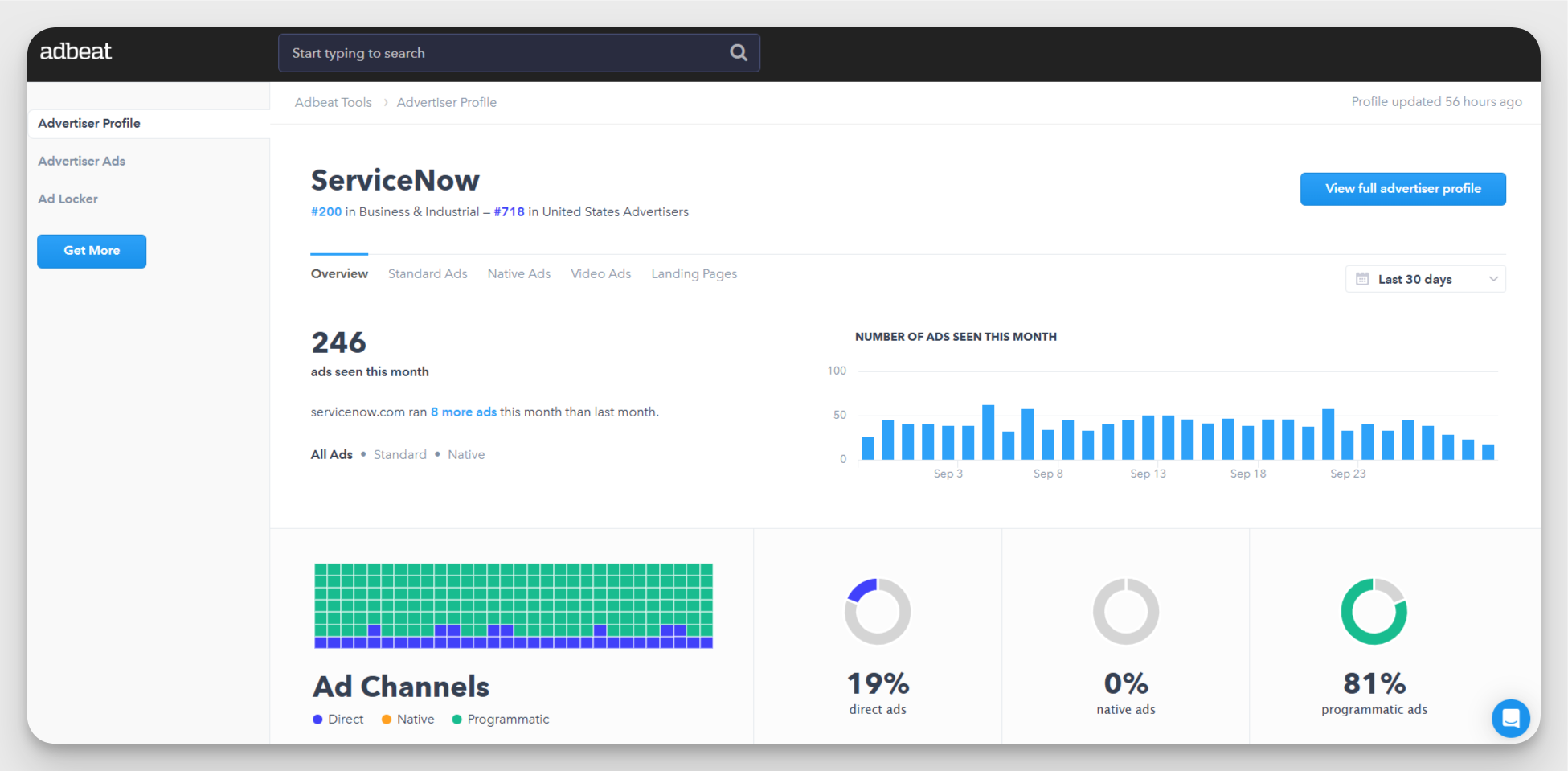

AdBeat

Adbeat gives insights into display advertising on Google Ads and native ad networks like Taboola and Outbrain. It shows me which ads my competitors are running, where that traffic comes from (publisher sites, media sources, and placement types). The only downside I’ve noticed is that larger datasets can take time to load, and it doesn’t provide much Facebook ad data.

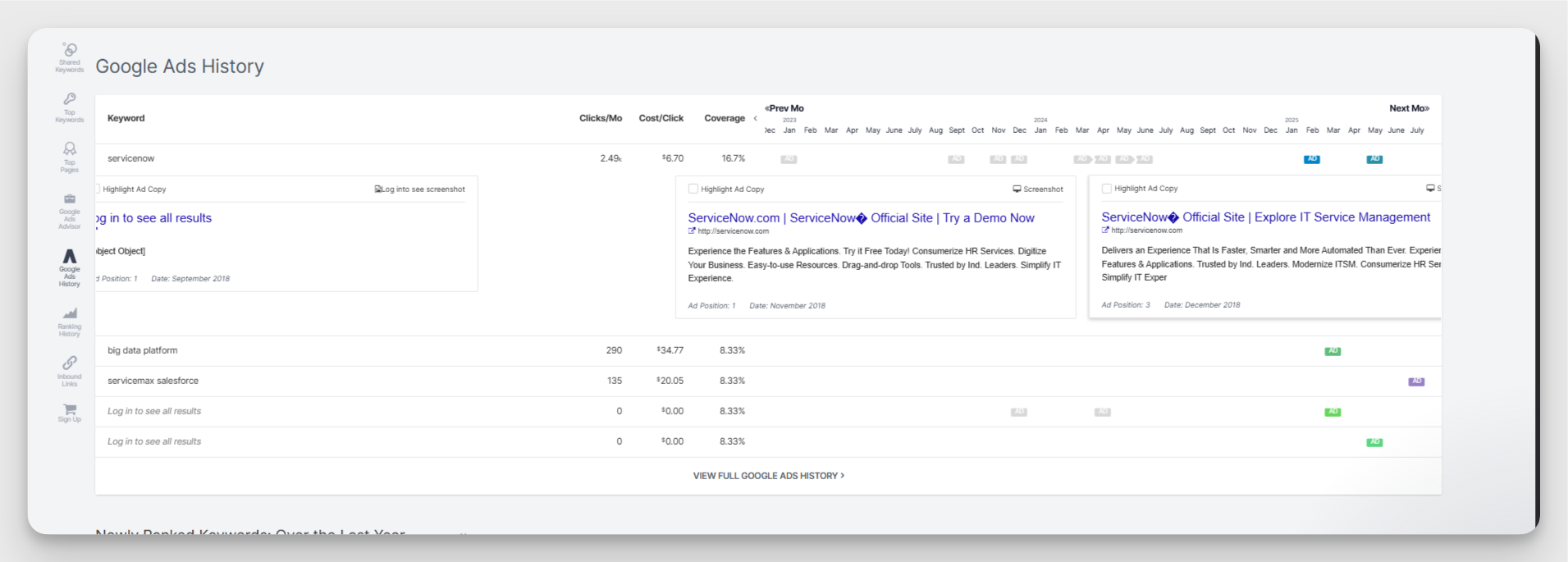

SpyFu

SpyFu is another competitive search and display ad intelligence tool that lets me see which keywords competitors are buying for Google Ads, and how much they’re spending. Though it’s not perfect, as sometimes the data can lag slightly or be incomplete. In fact, when I researched competitor ads on Spyfu, I noticed the interface has some formatting issues. You also cannot view all the results without signing up for a paid account.

SEO

Here are the main SEO tools I use:

SEMrush

It lets me see what keywords competitors rank for, their top-performing content, and their backlink profile. It’s great for spotting high-intent terms I might be missing, but sometimes the volume estimates can be a bit generous.

Ahrefs

It helps me dig into backlinks and domain authority. It has a vast database, and it gives me a solid picture of competitors’ link-building strategies. I do find its keyword data slightly less comprehensive than SEMrush, so I usually use them together.

Pricing

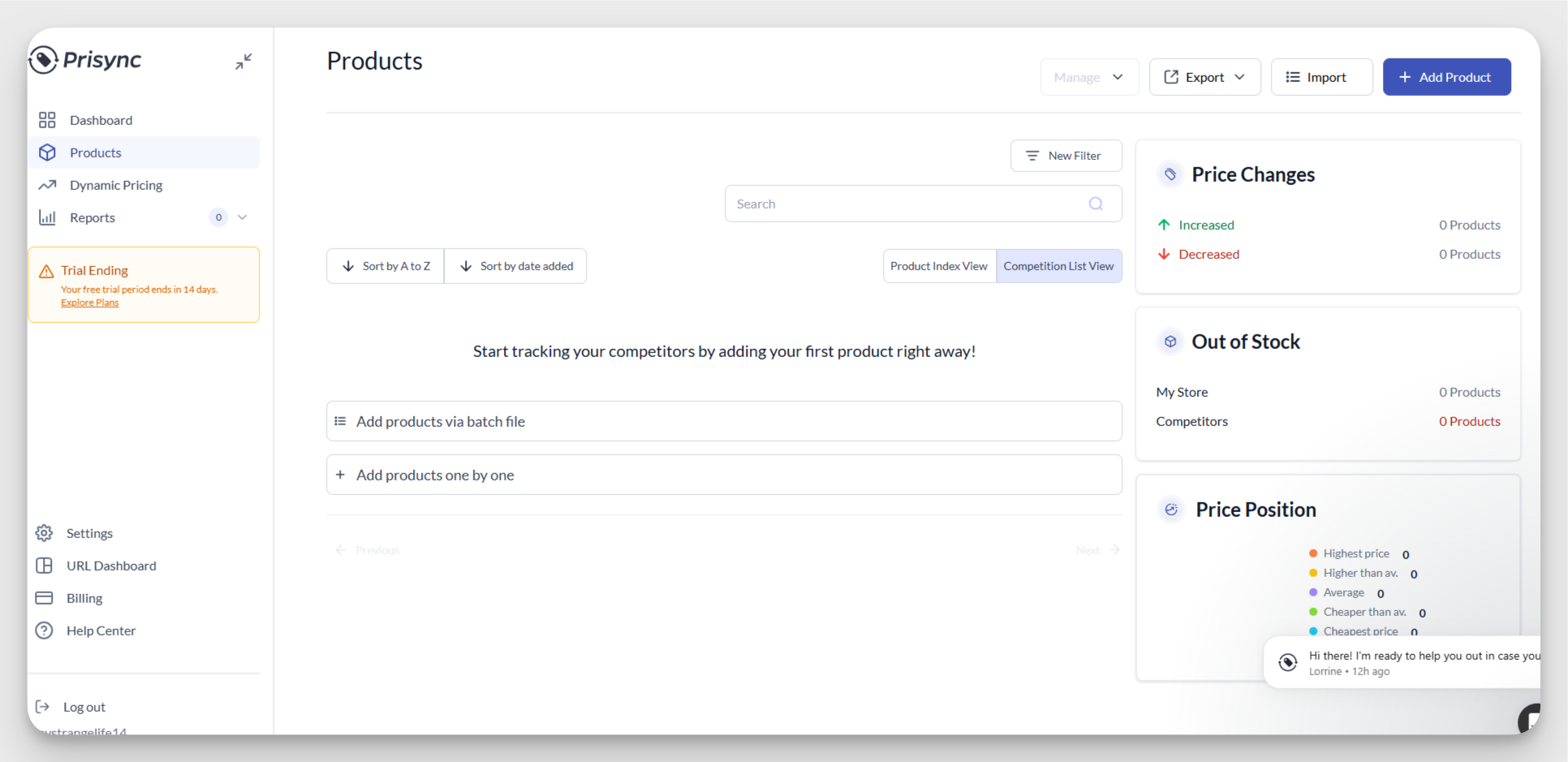

Prisync

It tracks product prices and stock availability across multiple competitors in real-time. The automation is good, but occasionally I need to manually sort out missing URL issues or pricing changes on competitor websites. Still, it’s far more efficient than checking competitors’ websites manually each time, and I can set alerts for any price changes that affect my positioning.

The major issue with Prisync is that the entire setup takes a lot of time and workarounds. It isn’t as easy as copying and pasting a competitor’s pricing page and tracking it right away.

Important layers of competitive insights that can fuel business growth

Product competitive insights

Feature comparisons

I regularly track which features my competitors highlight in campaigns. Are they emphasizing AI, integrations, pricing transparency, or something else entirely? By comparing feature sets, I can see where my product stands and identify opportunities to differentiate my brand. I also:

- Monitor feature launch announcements and release notes

- Identify unique value propositions competitors emphasize and benchmark against our messaging

- Track feature adoption trends through social media mentions, reviews, and customer forums

Highlight features missing in competitors’ offerings that I can emphasize in campaigns.

Pricing strategy analysis

I pay attention to patterns in competitor pricing. Do they offer seasonal discounts or free trials? Do they offer bundles or tiered pricing models? Understanding these patterns helps me shape my own pricing strategy and position my product effectively.

I also:

- Track competitor pricing across geographies if they operate globally

- Observe promotional cycles and correlate them with marketing campaigns

- Benchmark the value proposition of pricing tiers vs the features offered

- Identify opportunities to reposition or introduce new pricing experiments.

Marketing and advertising competitive insights

Cross-channel performance tracking and organic value calculations

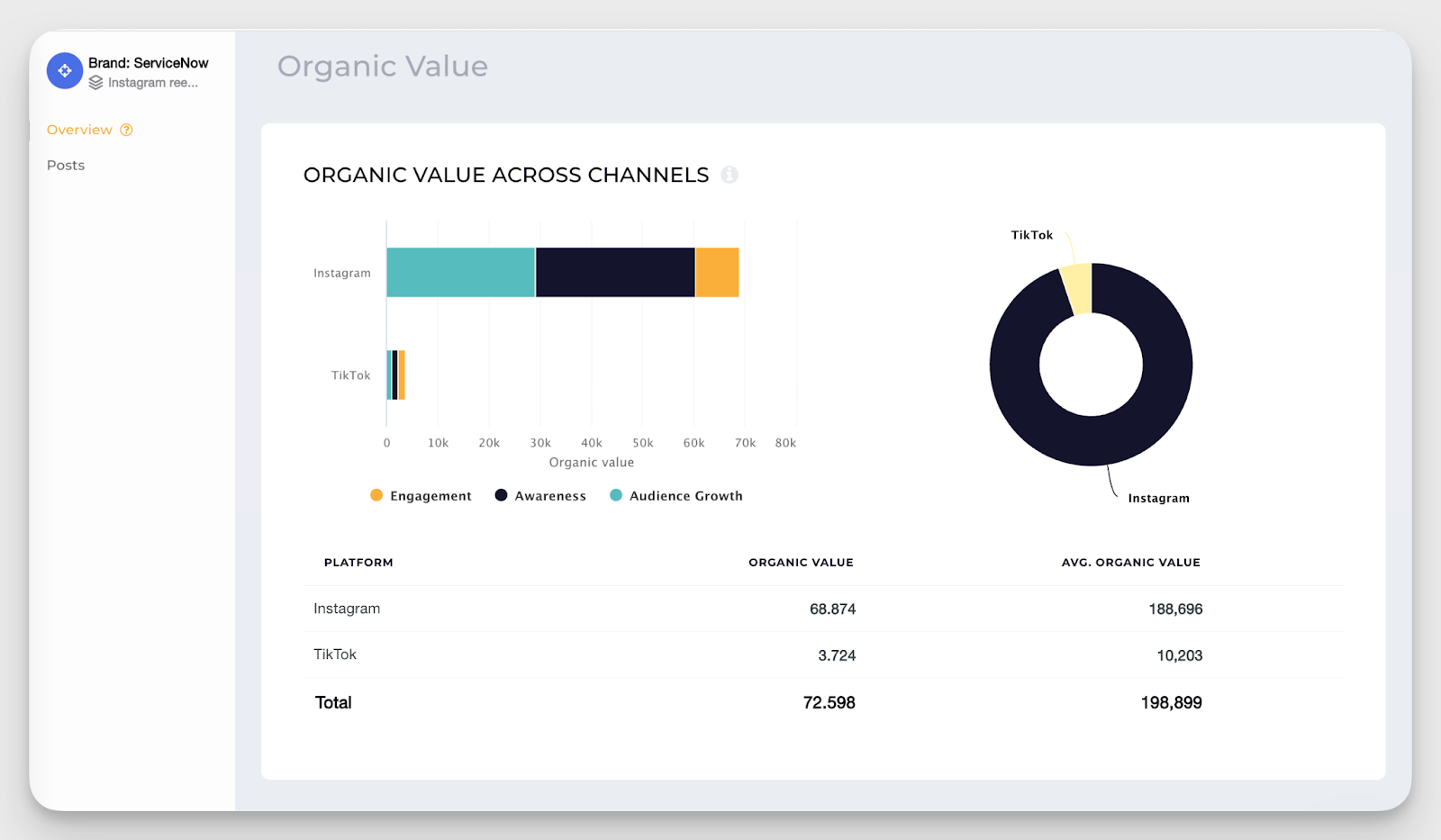

I use Socialinsider to benchmark competitors across multiple channels. I can track performance on LinkedIn, Instagram, X, TikTok, and Facebook, and see which channels deliver the most engagement and growth.

Socialinsider also has the brand feature, which lets me put all the social media profiles of a competitor under the same brand to clearly analyze its cross-channel performance.

I can also check the organic value for brands, which basically calculates the dollar value of the unpaid results for a brand, based on ad benchmarks. It tells me how much my competitor’s content is worth in social media value.

Content strategy analysis and gaps identification

Socialinsider’s content pillars feature uses AI to automatically tag posts under different content themes. I can also create custom content pillars and manually tag posts to make sure I track exactly what matters to my brand.

With this, I can:

- Identify top-performing content themes across competitors and platforms

- Compare which pillars competitors focus on and which ones they neglect

- Spot gaps in competitor strategies and adjust my content to fill those gaps

Influencer partnership monitoring

I also track the creators and influencers my competitors partner with using influencer analysis tools. This helps me understand which audience segments they are targeting or trying to expand into. I also monitor engagement and reach of influencer campaigns to see ROI patterns and analyze content formats and messaging styles used in sponsored content.

Before I forget, here's a tip that Kassandra Quinn, Social Media Strategist at ModSquad shared with me:

Create a sense of authenticity. Competitive data is helpful but it’s not the whole story. I like to know what others in the space are doing, especially if we’re benchmarking. It can give you insight into trends, tone, and how other brands are positioning themselves.

That said, I treat it as context, not the blueprint. Just because a competitor is posting five times a week or using a certain format doesn’t mean it’s right for your brand.

Sales and customer service competitive insights

Sales process analysis through customer journey mapping

I map competitor funnels step by step to understand how prospects move from awareness to conversion. To create the entire competitor funnel, I visit their website and sign up for demos, trials, or newsletters. This helps me:

- Identify bottlenecks or drop-off points in competitor signup flows

- Compare sales cycle lengths to benchmark my own process

- Observe lead nurturing methods and follow-up frequencies, including email sequences, call timing, and retargeting

- Detect how competitors leverage demos, webinars, free trials, and gated content to convert leads, and note where their approach succeeds or falls short.

Customer service quality assessment

I test competitors’ support channels, including chatbots, ticketing, and escalation processes. Seeing where they succeed or fail helps me understand customer expectations and find areas where I can deliver better experiences. I also track response times and personalization of support interactions.

Review and reputation monitoring strategies

I track competitor ratings on G2, Trustpilot, App Store reviews, and other platforms to analyze their strengths and weaknesses. I also segment reviews by feature mentions to understand brand perception and look for recurring customer pain points.

Best practices for getting valuable competitive insights

I rely on the 4-Phase Competitive Response Framework to turn insights into action:

- Assess: I gather raw data such as mentions, rankings, ads, features, and engagement metrics to understand the competitive landscape.

- Analyze: I identify trends, categorize competitors, benchmark performance, and spot gaps or opportunities.

- Act: I use competitive insights to optimize my own campaigns, launch new features, adjust pricing, or reposition messaging.

- Adapt: I track results and refine my strategy as the market shifts and competitors make new moves.

Final thoughts

The more I track my competitors, the clearer it becomes where opportunities lie. Competitive insights let me position my brand earlier in the buyer journey, engage the right audience, and make data-backed decisions.

Tools like Socialinsider help me benchmark performance, track best-performing competitor content, and analyze cross-channel trends.

Analyze your competitors in seconds

Track & analyze your competitors and get top social media metrics and more!

You might also like

Improve your social media strategy with Socialinsider!

Use in-depth data to measure your social accounts’ performance, analyze competitors, and gain insights to improve your strategy.