How to Do a Powerful B2B Competitor Analysis: A Detailed Guide

Learn how to run an effective B2B competitor analysis: from social media data tracking to pricing strategies, get powerful strategic insights.

Steering a business forward means keeping a close eye on the competition. It’s not just about reacting—it’s about understanding the bigger picture and spotting the best opportunities for growth.

Over the years, I’ve found that the most successful leaders use competitor analysis as a strategic tool, not just a checklist.

In this article, I’ll share practical ways to turn competitor insights into real advantages for your company.

Key takeaways

-

How does a competitive analysis inform strategic decisions in B2B marketing? A competitive analysis informs strategic decisions in B2B marketing by revealing the topics competitors prioritize, the channels and messages that resonate with buyers, and the market gaps you can confidently own across product, content, social, and the funnel.

-

How to run a competitive analysis as a B2B company? Running a competitive analysis as a B2B company means following a structured workflow that uncovers who your buyers truly compare you to, evaluates competitors’ products and marketing in depth, and translates those insights into actionable opportunities for differentiation and growth.

What is a B2B competitor analysis?

A B2B competitor analysis is a structured way to understand who your buyers compare you to and what those companies are offering. It’s the process of looking closely at the products, messages, pricing, marketing, and customer experience of other businesses that are trying to solve the same problems you are.

In B2B, buyers rarely choose a solution without exploring multiple options. They look at features, pricing pages, case studies, review sites, social media activity, and how clearly each company explains what they do. A competitor analysis brings all of that information together so you can see your market through the same lens your potential customers use.

A thorough B2B competitor analysis usually covers:

- Who your direct and indirect competitors are

- What each competitor’s product includes, and how it compares to yours

- How they price and position their offering

- What they highlight on their website and landing pages

- What topics they focus on through SEO and content

- How they show up on social media and how their content performs

- What their lead generation and nurture process looks like

- How they handle demos, support, and onboarding

The goal isn’t to copy anyone. It’s to understand how your market is evolving, where your product fits, and where you have opportunities to differentiate.

How does a competitive analysis inform strategic decisions in B2B marketing?

A strong B2B competitive analysis does more than show you what other companies are doing. It helps you make clearer, more confident decisions across every part of your marketing strategy. When you understand how competitors present their product, communicate with buyers, and perform across channels, you can adjust your approach based on real evidence — not assumptions.

For many B2B teams, this research becomes the missing link between planning and execution. It gives you a reliable way to answer questions like:

- What topics matter most in our industry right now?

- How do competitors position their product compared to ours?

- Which channels are they prioritizing — and are those choices paying off?

- Where are the gaps we can fill with stronger messaging or better content?

This matters because B2B buyers pay close attention. They compare solutions carefully, often across months-long cycles. A thoughtful approach to competitor research and analysis helps you show up in a more relevant and compelling way throughout that journey.

Here are the core areas where competitive insights shape better decisions:

Product strategy and prioritization

When you analyze competitor products — features, capabilities, limitations, and messaging — you can identify meaningful gaps in the market. This isn’t just “competitor product research.” It’s a way to understand what buyers expect today and where you can create real differentiation.

Positioning and messaging

Understanding how competitors describe their product, the pain points they emphasize, and the value they claim helps you refine your own narrative. You can choose stronger angles, avoid sameness, and highlight what actually sets you apart.

Content and SEO focus

A competitive analysis shows you:

- Which topics your competitors invest in

- Which keywords drive traffic in B2B markets

- Where content gaps or underdeveloped topics exist

- How to do a competitive analysis in digital marketing B2B teams care about

This makes your content strategy more intentional and reduces guesswork.

Social media strategy and creative direction

By benchmarking social performance, you can see which platforms drive results for your competitors and what type of content resonates with your shared audience. When you research competitors consistently — looking at engagement, follower growth, content pillars, and top-performing posts — you get a clearer sense of how to adjust your own strategy.

Lead generation and funnel decisions

Competitor insights show you what kinds of offers, formats, and experiences others use to convert and nurture leads. This can influence:

- Landing page structure

- Resource formats

- Webinar topics

- Demo positioning

- Email sequence style

Understanding their approach doesn’t mean copying it; it helps you strengthen your own.

Sales enablement and customer experience

If you know how competitors structure demos, communicate value, and support new customers, you can build a smoother, more differentiated journey — one aligned with your strengths.

How to run a competitive analysis as a B2B company?

Running a B2B competitive analysis doesn’t have to be overwhelming. The key is to follow a structured process built around the questions your teams need to answer — across product, marketing, content, sales, and customer experience.

Below, I shared a practical, repeatable workflow used by modern B2B teams who want to understand their competitive landscape deeply and turn those insights into strategy.

Identify Your Competitors

Before you begin any form of competitive landscape research, you need a clear list of who you’re analyzing. Don’t limit yourself to the obvious players — your buyers often compare you to companies you don’t expect.

Here are three reliable sources to build a comprehensive competitor list:

Review sites and B2B marketplaces (G2, Capterra, etc.)

Platforms like G2 or Capterra, and show you:

- Direct category competitors

- Adjacent products with overlapping features

- Rising or emerging players in your space

Because these platforms organize tools by specific use cases, they’re a simple entry point for identifying who your buyers see as alternatives.

Social media hashtag and content research

Hashtags make it easy to uncover competitors who are active in your space but not always visible in traditional categories.

Search for:

- Industry hashtags

- Problem-focused hashtags

- Feature or workflow hashtags

This often surfaces fast-growing companies that don’t yet appear on review platforms.

Customer interviews and sales input

Your customers and sales team are your best source of truth. When you ask prospects which alternatives they considered, you uncover hidden competitors — companies that may not be direct rivals but show up repeatedly during evaluations.

I'll give you an example from our own case.

While we don't necessarily see Talkwalker as a competitor, with this being a tool focused more on social listening, one of our clients, Chris, from Axel Springer made us question this when he told us in a customer interview that he went on a search journey and discovered Socialinsider because he needed an improvement of some features already existing in its primary tool: existing primary tools (like TalkWalker) were not great for quick snapshots/exports or did not support LinkedIn.

Research your competitors’ products and offerings

Once you know who your competitors are, the next step is competitor product research. This phase helps you understand how each product works, what it includes, and how it’s positioned.

Features comparison

Document:

- Core features

- Emerging capabilities

- Integrations

- Platform limitations

- Unique differentiators

This gives your product team clarity on where the market is heading and where opportunities for differentiation exist.

Pricing strategy analysis and positioning

Pricing reveals a lot about how a company sees itself:

- Are they premium or budget?

- Do they emphasize simplicity or customization?

- Are there hidden fees or onboarding costs?

Take it from me, this is essential for doing a competitive landscape analysis that actually informs product and sales decisions.

Value proposition differentiation

Review homepages, product pages, and messaging frameworks.

Identify:

- The primary pain points they emphasize

- Their promised outcomes

- How they explain ROI

This is especially important for aligning your own messaging so it stands out rather than blending into the category.

Analyze your competitors’ marketing and content strategy

Understanding how your competitors communicate with the market is one of the most valuable parts of any B2B competitive analysis. This is where you uncover how they attract attention, the problems they emphasize, how they educate buyers, and the tactics they use to nurture demand.

In many B2B markets, content is the primary entry point for prospective customers — so analyzing it gives you a direct view into their priorities and their long-term strategy.

A structured look at competitors’ marketing efforts helps you understand:

- What topics they want to “own”

- Which audience segments they’re targeting

- How sophisticated their buyer education is

- How frequently they publish and where

- What formats they rely on (and avoid)

- How clearly they explain their product and value

This is the backbone of conducting competitor research in modern B2B marketing, because it ties directly into pipeline generation, product positioning, and overall visibility.

Content audit and topic gap analysis

A content audit is not just counting blog posts or skimming a competitor’s resource library. It’s a structured review that reveals the story they’re telling your shared audience — and where that story is incomplete.

When performing this audit, look at both the volume and the quality of the content they publish. Review:

- Blog topics:

What do they write about most often? Are they covering beginner topics, advanced strategy, technical how-tos, or thought leadership? The mix tells you exactly where they believe demand is strongest. - Whitepapers and guides:

These show you how they educate higher-intent buyers. Pay attention to whether their guides are product-focused, industry-focused, or pain-point-focused. This reveals their approach to lead generation and authority building. - Webinars and virtual events:

Webinars indicate the themes they consider important enough to explore in depth. They also reveal who they position as experts — internal members, partners, or external influencers. - Case studies:

Case studies show their most successful use cases, the industries they want to grow in, and the results they highlight. They also help you understand their strongest value propositions. - Product updates and announcements:

These indicate where their roadmap is heading. Are they investing in AI? Integrations? Analytics? Workflow automation? This helps your product team align or differentiate strategically.

What to look for in the audit

As you go through these assets, pay attention to patterns:

- Which themes are repeated across formats?

- Which product capabilities do they highlight most often?

- What pain points do they focus on — and which ones do they ignore?

- Do they lean more toward educational content or promotional content?

- Are they consistent across all platforms, or is messaging fragmented?

- How up-to-date is their content? Do they maintain or abandon certain topics?

Finding content gaps

Topic gap analysis is one of the most impactful outcomes of competitor content research. This is where you identify areas your competitors haven’t fully addressed — or haven’t addressed well.

Look for gaps in:

- Common search queries your buyers care about

- Topics related to your strengths that competitors never mention

- Product use cases they overlook

- Industry verticals they don’t speak to

- Emerging trends they haven’t adopted

- Buyer pain points they don’t address directly

- Technical or tactical topics they avoid

These gaps become your opportunities. They guide your content roadmap and help your team create assets that are genuinely more useful, more relevant, and more comprehensive than what competitors currently provide.

SEO competitive analysis

SEO is one of the most revealing parts of a B2B competitive analysis because it shows you where competitors are intentionally trying to capture demand — not just through visible content, but through the keywords and topics they commit to ranking for.

In B2B markets, search behavior is a direct signal of customer intent, especially for complex products. Understanding how competitors approach SEO helps you shape your own content strategy with far more clarity.

A strong SEO competitive analysis tells you:

- Which keywords drive the most visibility for your competitors

- What topics they prioritize across the funnel

- How they structure SEO pages to educate, convert, or differentiate

- Where they’ve established authority — and where they haven’t

- Which opportunities your team can own before the rest of the market catches on

What to evaluate in a B2B SEO competitive analysis?

Keyword targeting and ranking patterns

Identify the keywords your competitors consistently appear for. Look at:

- Industry terms

- Product-specific keywords

- Pain-point queries

- Integration or comparison keywords

- Long-tail technical topics

Examine which keywords they rank well for, which ones they try to rank for but struggle with, and which ones they seem to ignore entirely. These patterns reveal both their strategy and their blind spots.

![seo competitve analysis example]](https://blog-cms.socialinsider.io/content/images/2025/11/seo-competitve-analysis-example-.png)

Content structure and depth

Review the structure of their ranking pages:

- Are they writing surface-level listicles or deep technical resources?

- How well do they explain processes, workflows, or frameworks?

- Do they include data, examples, graphics, or industry insights?

- Are they addressing the full buying committee or just one persona?

In B2B markets, content depth often correlates with search performance. This shows you where your own content needs to be more detailed or more actionable.

Search intent alignment

Not all traffic is equal, especially in B2B. Check whether your competitors actually satisfy the intent behind keywords.

For example:

- Informational intent: Do they genuinely teach something?

- Product intent: Do they clearly explain capabilities?

- Comparison intent: Do they address alternatives transparently?

- Transactional intent: Do they offer demos, pricing, or compelling CTAs?

If they rank without truly matching the intent, you have an opportunity to outperform them with better-aligned content.

Page experience and on-page optimization

Technical and on-page factors play a major role:

- Page load speed

- Internal linking

- Clear subheadings and scannable structure

- Use of schema

- Image optimization

- Strong meta descriptions

- Clean URLs

A competitor with strong content but weak page optimization is vulnerable — and that’s where you can win visibility more quickly.

Backlink quality and authority signals

Backlinks are often overlooked in competitor research and analysis, but in B2B SEO, authority matters.

Study:

- Which domains link to their content

- What types of publications feature them

- How frequently they earn backlinks

- Whether backlinks go to thought-leadership, product, or tactical content

If a competitor has strong authority in one topic cluster but weak in another, that gap becomes your opportunity to build a foothold.

Content update frequency

Search engines favor fresh content, especially in fast-evolving industries like SaaS or data analytics.

Ask:

- How often do competitors update cornerstone content?

- Do they refresh annual reports or “state of” resources?

- Are they actively expanding or consolidating content clusters?

- Do they let older content become outdated?

If they rarely update high-traffic pages, you can outperform them with a more consistent, refreshed strategy.

Social media strategy benchmarking

Social media performance reveals a huge amount about your competitors — not just what they post, but what they prioritize, how they communicate, and which messages are actually resonating with your shared audience. In B2B markets, social channels have become a core part of how companies build trust, demonstrate expertise, and humanize their brand.

A thoughtful social media benchmarking process helps you understand:

- Where competitors focus their attention

- How their content performs across channels

- Which formats help them reach or engage their audience

- How consistently they publish

- Which topics or content pillars get the strongest response

- How their performance compares to industry standards

Below I will show you complete breakdown of what to analyze and how to turn the insights into strategy.

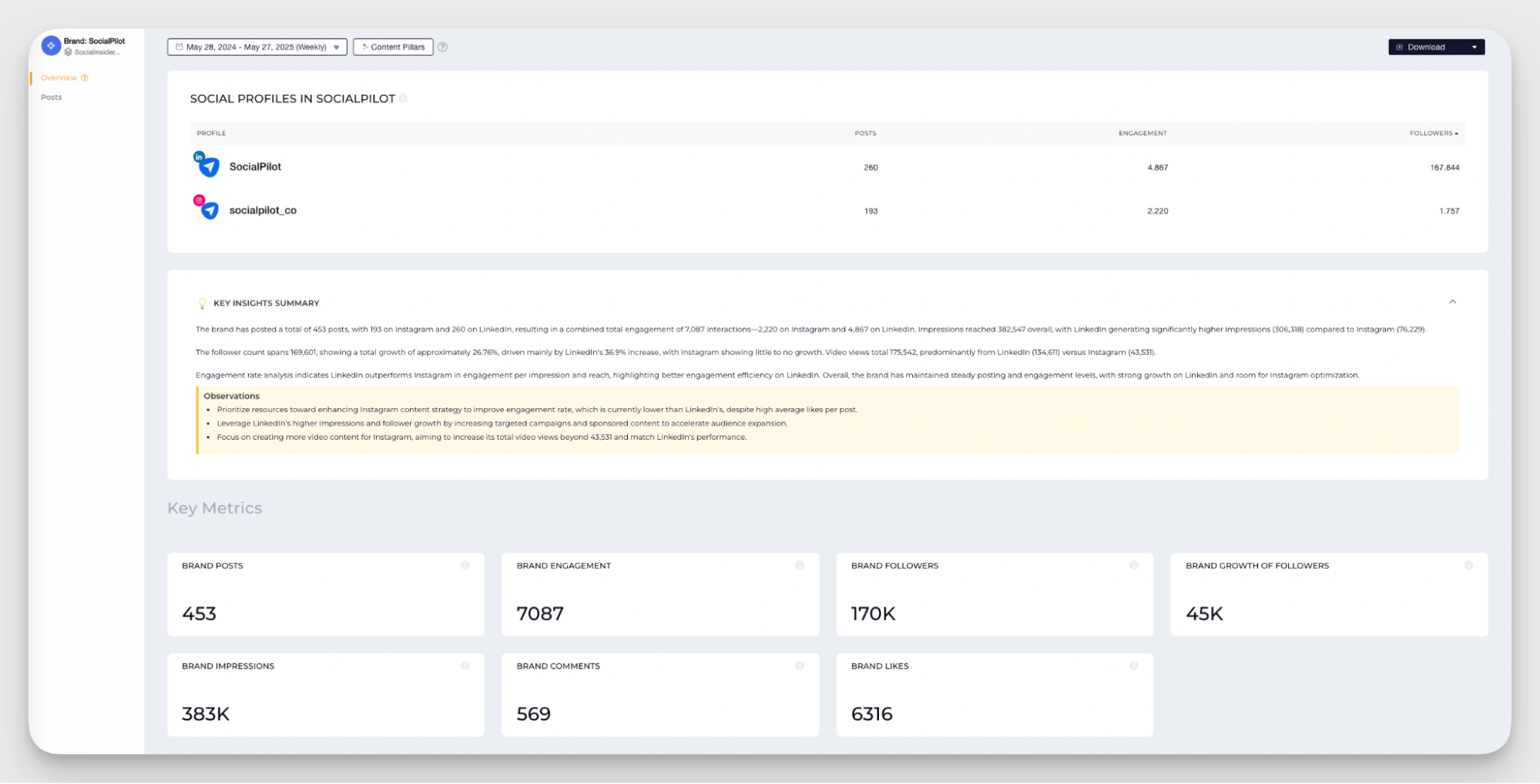

Overall social performance

Start by gathering baseline insights across your competitors’ main social channels (typically LinkedIn, X, Instagram, Facebook, and sometimes TikTok or YouTube depending on the industry).

Track key metrics such as:

- Total followers

- Follower growth (month-over-month or quarter-over-quarter)

- Posting frequency

- Average engagement rate

- Reach or impressions

- Audience growth patterns

These metrics help you understand their level of maturity on each channel and give you a sense of how established their presence is.

A company operating in B2B with high consistency and predictable performance often has a more advanced content engine behind it — this is an important signal when you’re mapping your competitive landscape.

Benchmarking against competitors and industry standards

Looking only at direct competitors can be misleading. Sometimes an entire industry has lower engagement patterns; other times, a fast-growing niche outperforms typical benchmarks.

That’s why you should compare:

- Competitors vs. each other

- Competitors vs. your full industry benchmark

This is where Socialinsider’s benchmark reports are incredibly helpful, especially for channels like LinkedIn where B2B activity is highest:

This gives you a realistic performance baseline so you can tell whether a competitor is genuinely outperforming — or simply benefiting from broader industry trends.

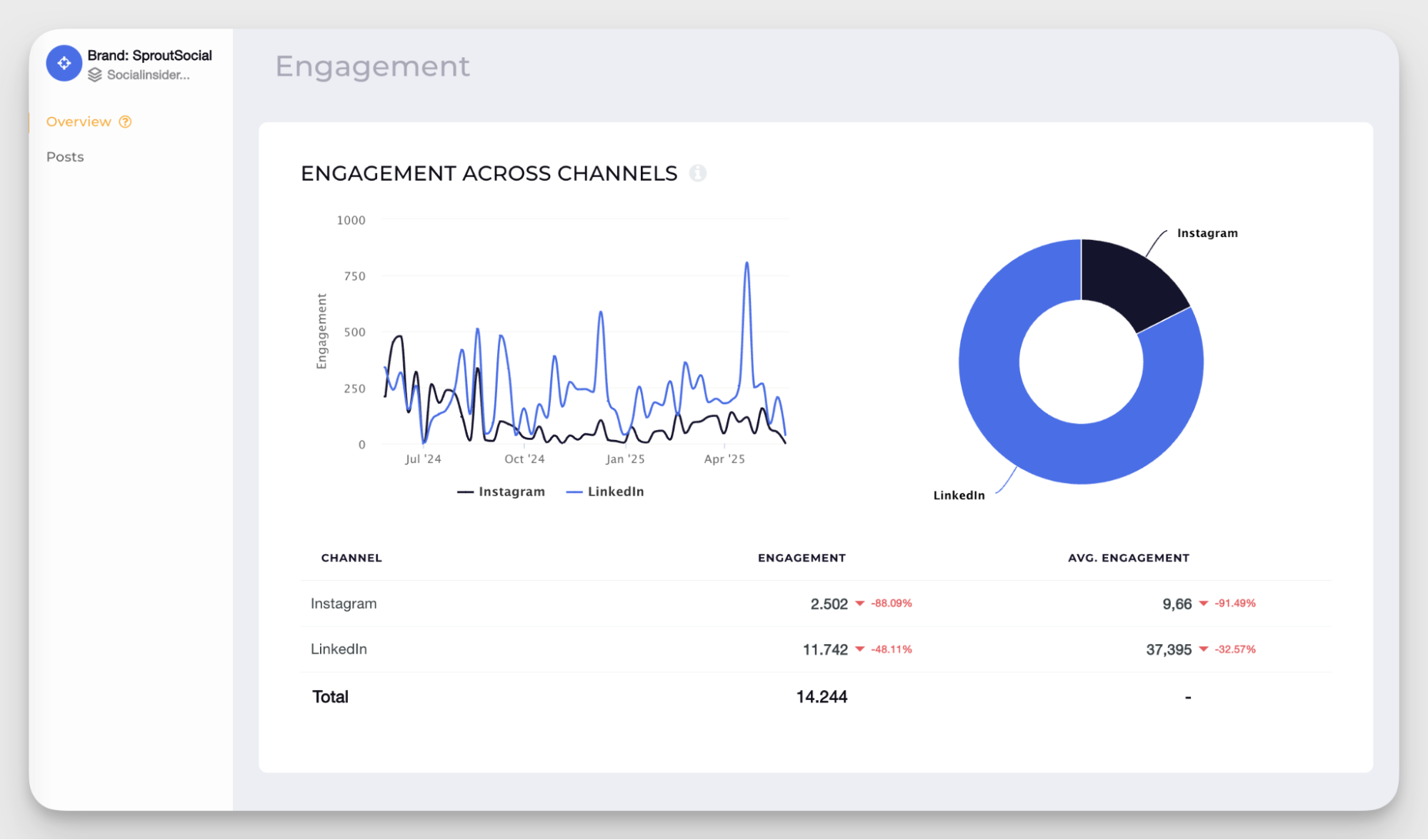

Individual competitor strategy by channel

Your competitors may not treat every channel equally. Some prioritize LinkedIn because it aligns with their buyers. Others invest heavily in YouTube for product education or TikTok for employer brand visibility.

Analyze:

- Where they post most frequently

- How their messaging shifts across platforms

- Whether they adjust tone or content format by channel

- How they use video vs. static graphics

- Whether they involve employees or leadership voices

This gives you a clearer view of where competitors are investing time and budget — a core part of any competitive landscape research.

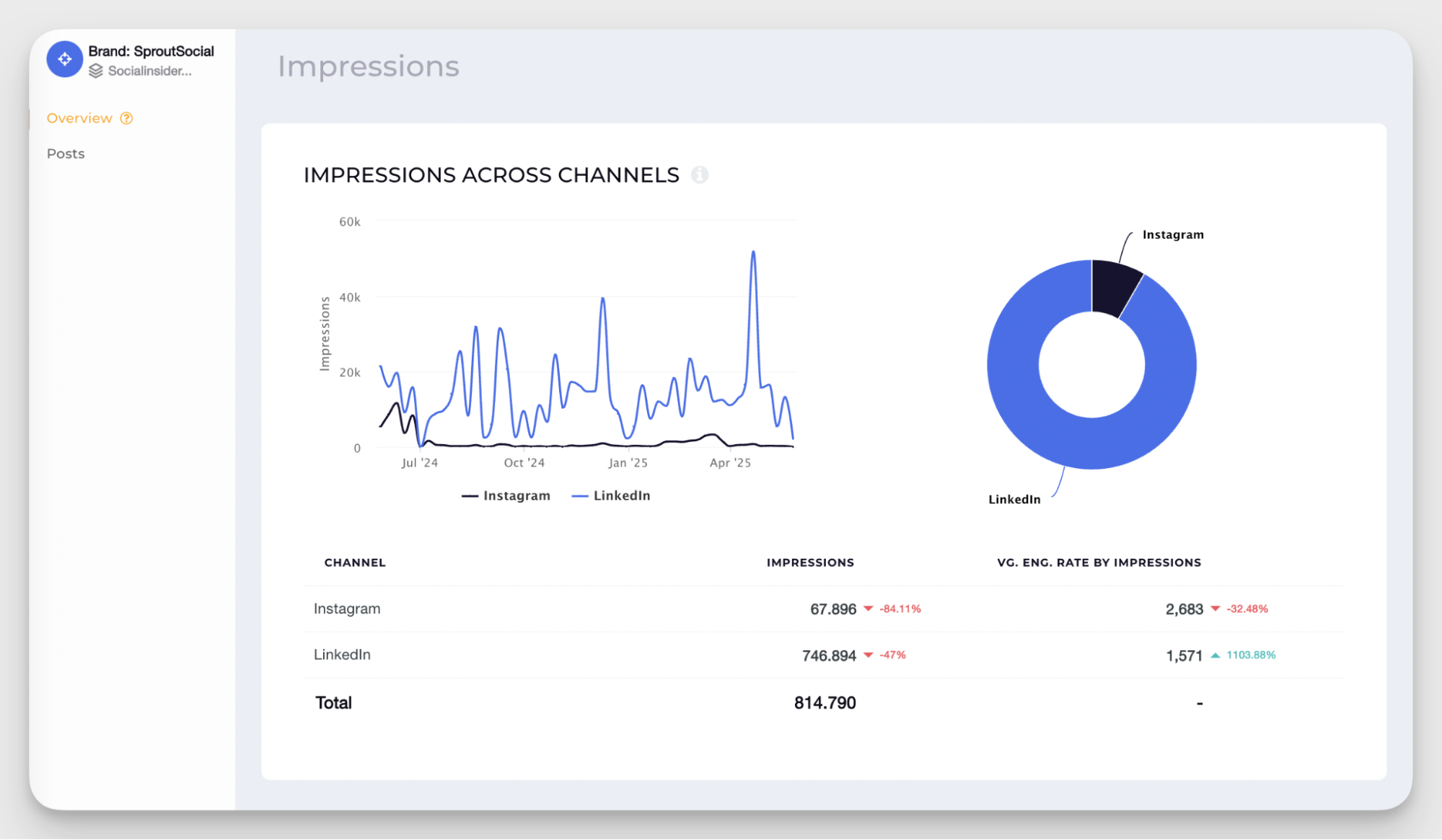

Distribution of specific metrics across channels for each competitor

After understanding each competitor’s channel priorities, the next step is to analyze how their content actually performs. This part of the B2B competitive analysis helps you see what’s working for them, where they allocate the most effort, and which channels drive meaningful results.

Posts and posting strategy

Look at how often each competitor publishes across channels, and how that frequency aligns with the results they generate. Posting volume often reveals internal priorities — but effectiveness comes from how those posts perform, not how many they publish.

Follower count and follower growth

Follower trends help you understand competitor momentum. Sudden increases often indicate paid campaigns, viral content, or product announcements.

Engagement

This is an essential metric to track as it shows you which competitors are building a relationship with their audience — and which ones rely on surface-level visibility.

Impressions and reach

Impressions show how widely competitor content is distributed. If a competitor achieves high reach with a relatively small audience, they may have a strong content format, algorithm-friendly approach, or an effective paid strategy.

Top content pillars and their performance

Content pillars reflect how a competitor chooses to position their brand and the topics they believe are most likely to influence buyers. Analyzing these pillars isn’t just a labeling exercise — it helps you understand their strategic narrative, the needs they’re prioritizing, and the areas where you can differentiate.

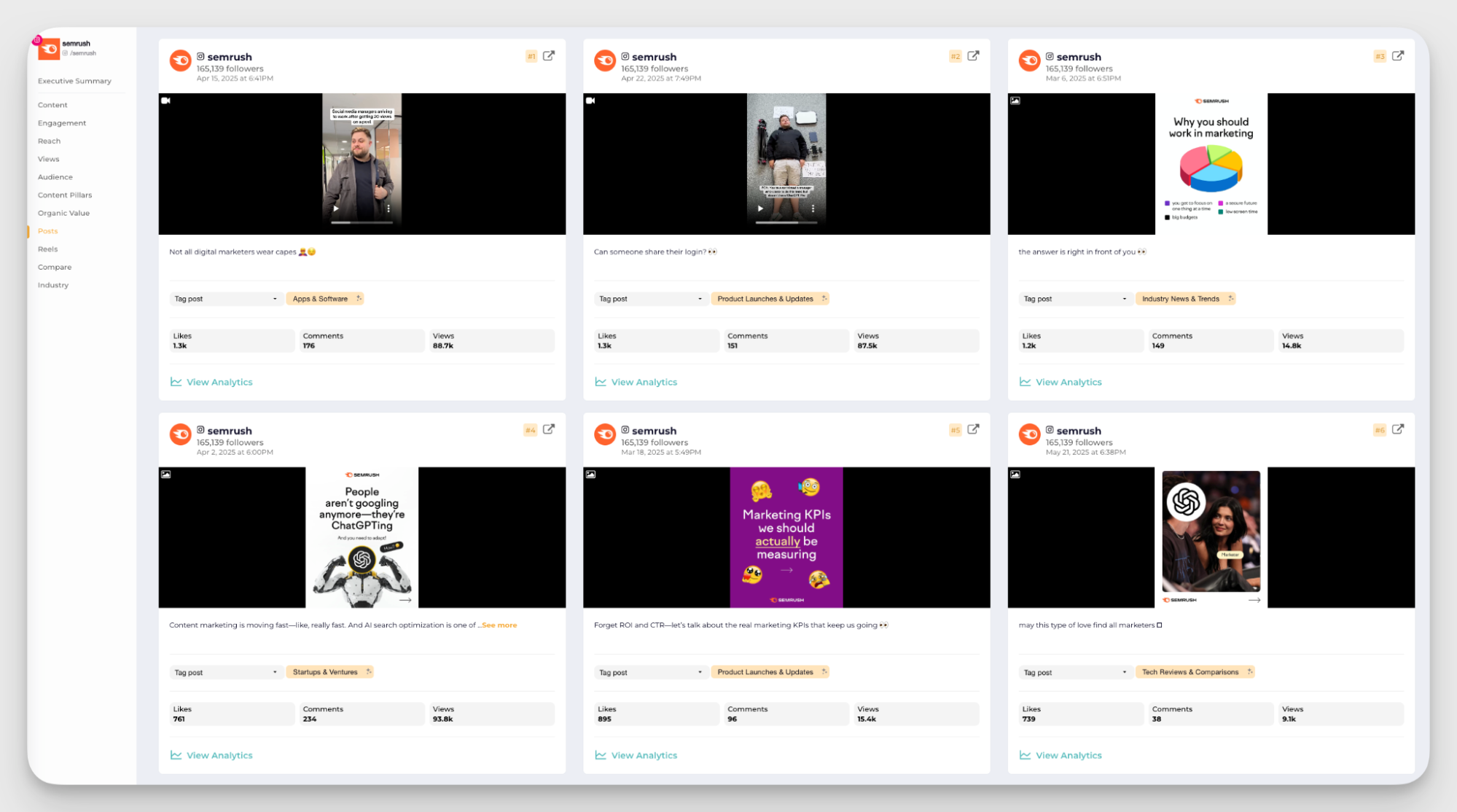

Top posts

Top posts provide a clear window into what captures your audience’s attention right now. Unlike averages or industry benchmarks, these posts reveal specific creative choices competitors make — choices that consistently deliver results, and that you can draw insights from.

For example, for Semrush, on Instagram, over the past three months the best-performing posts were thos featuring real humans.

And knowing this, we decided to run an experiment to see how this type of content (with real people) could work for Socialinsider ar well - across Instagram and LinkedIn as well (PS: it just started, so for the moment we don’t have a conclusion - but this is an example of how a competitive analysis cab be used to optimize the content strategy)

To replicate this kind of approach, you need to use Socialinsider’s manual tagging feature (create a tag and then assign posts to that specific tag).

Lead generation and nurturing funnel analysis

A competitor’s lead generation and nurturing funnel shows you how they turn awareness into pipeline — and how effectively they move prospects from initial interest to a sales conversation.

In B2B markets, where buying cycles are longer and involve multiple stakeholders, this part of a B2B competitive analysis provides crucial insight into how competitors structure their demand engine.

Analyzing their funnel helps you understand:

- How they capture leads

- What type of value they offer upfront

- How they qualify and segment prospects

- What the buyer experiences between signup and sales conversation

- How they maintain engagement in longer cycles

- Where they invest most heavily (content, ads, email, product-led flows, etc.)

Understand your competitor's sales process and start a customer experience analysis

A competitor’s sales process and customer experience tell you more about their maturity and long-term sustainability than any marketing campaign. This part of the B2B competitive analysis focuses on how competitors guide prospects after they express interest — and how they support them once they become customers.

B2B buyers have increasingly high expectations, and customer experience plays a major role in a company’s perception of value. A well-structured competitive analysis in this area helps you deliver an experience that stands out from the category.

Here's what I advise you to look at:

- The B2B buyer journey and competitive touchpoints: This is relevant because it shows you how competitors guide prospects through the early stages of evaluation. By understanding how quickly they respond, how they structure demos, and how clearly they communicate value, you can identify where their process is strong or lacking — and adjust your own buyer experience to be more helpful, more efficient, and more aligned with what customers expect.

- Customer onboarding experience evaluation: Onboarding is a critical moment in the customer lifecycle, and evaluating competitors’ onboarding processes helps you understand how smoothly new users are introduced to their product. If competitors make setup easy and supportive, that becomes part of their advantage. If they create friction, that becomes an opportunity for you to differentiate with a clearer, faster, or more guided experience.

- Support and customer success program benchmarking: Ongoing support and customer success efforts reveal how well competitors maintain long-term relationships. Strong support resources and proactive customer success programs improve retention and satisfaction — while weak ones create churn risk and negative sentiment. Benchmarking these areas helps you position your own company as more responsive, more reliable, and more committed to customer outcomes.

Advanced B2B competitive intelligence techniques

Advanced competitive intelligence techniques help you move beyond surface-level comparisons and uncover how your competitors operate behind the scenes.

These methods give you deeper visibility into their priorities, growth plans, and strategic direction — insights that can guide smarter decisions across product, marketing, and sales.

- LinkedIn Sales Navigator for competitive research: LinkedIn Sales Navigator is relevant because it helps you see how competitors are growing, hiring, and positioning their teams. Changes in headcount, new roles, and shifts in seniority often signal upcoming product investments, target market expansion, or new strategic priorities. This gives you a forward-looking view of where your competitors may be heading before those moves become visible in their marketing or product updates.

- Partnership and integration strategies: Analyzing competitor partnerships and integrations matters because these relationships shape how their product fits into the broader ecosystem your buyers rely on. New integrations often indicate a push into new workflows or industries, while strategic partnerships reveal their expansion goals. Understanding this landscape helps you identify where you need to strengthen your own ecosystem or highlight differentiators in areas competitors can’t match.

Create an actionable optimization strategy based on the insights gathered

Once you’ve collected and organized your B2B competitive analysis, the next step is to translate those insights into practical, focused improvements. The value of competitive research isn’t in the volume of data you gather — it’s in how effectively you turn that data into decisions that help your team differentiate, prioritize, and build a stronger position in the market.

Below are the three core areas where competitive intelligence should directly shape your strategy, followed by clear explanations of why each one matters.

Product development prioritization based on competitive gaps

Product insights from your competitor research help you understand where your solution is already strong and where meaningful opportunities exist. When you identify gaps in competitor capabilities — whether missing features, weak integrations, or overlooked use cases — you can prioritize development that addresses real market needs. This ensures your roadmap supports differentiation instead of reacting to noise.

Marketing message differentiation strategies

Competitive analysis shows you how your competitors describe their product, which problems they emphasize, and where their messaging sounds repetitive or vague. By reviewing these patterns, you can craft clearer, more distinctive messaging that communicates your unique value more effectively. This is especially important in B2B markets where many companies sound similar; differentiation becomes a measurable advantage.

Pricing strategy adjustments

Understanding how competitors price, package, and position their product allows you to evaluate whether your pricing aligns with buyer expectations and market standards. This helps you determine if you should simplify your packages, add a new tier, emphasize specific value points, or refine your overall pricing narrative. Clear, strategic pricing supported by competitive insight positions your product more confidently and reduces friction during sales conversations.

Industry-specific B2B competitor analysis considerations

While the core principles of B2B competitive analysis stay the same across markets, the way you apply them depends heavily on the industry you operate in. Buyer expectations, sales cycles, regulatory complexity, and product technicality vary enough that your analysis should be tailored accordingly.

Below are key considerations for the most common B2B categories.

SaaS and technology companies

Competitive analysis is particularly important in SaaS and technology because the landscape evolves quickly and product differentiation changes month to month.

Why it matters:

SaaS buyers compare features closely, rely on self-serve research, and expect clear proof of value. A competitor who releases a new capability, improves UI, or shifts positioning can influence market perception almost immediately.

What to focus on:

- Product roadmap signals (feature releases, changelogs, AI capabilities)

- Integration ecosystems and API maturity

- Freemium or trial experiences

- Technical documentation and developer resources

- Product-led growth elements

- Depth and frequency of product education content

SaaS requires more frequent monitoring because competitor movements happen fast — and buyers notice.

Professional services and consulting

Competitive differentiation in services isn’t about features; it’s about expertise, trust, and demonstrated outcomes.

Why it matters:

For service companies, buyers judge credibility through case studies, thought leadership, pricing models, and the perceived quality of people delivering the work. This makes analysis far less about product specs and far more about reputation.

What to focus on:

- Depth and specificity of case studies

- Niche expertise positioning

- Client logos and industries served

- Analyst reports, certifications, and awards

- Proposal structure and value framing

- Team visibility (LinkedIn, speaking engagements, content output)

Here, social proof and thought leadership carry more weight than traditional feature comparison.

Manufacturing and industrial B2B

Manufacturing has long, complex buying cycles with heavy emphasis on reliability, compliance, and operational efficiency.

Why it matters:

Buyers care deeply about production capabilities, supply chain stability, product durability, and the total cost of ownership. The competitive landscape is often more stable, but the stakes are high when evaluating alternatives.

What to focus on:

- Product specifications and technical differentiators

- Certifications, standards compliance, and safety requirements

- Reliability claims and operational performance data

- After-sales support and maintenance programs

- Lead times, logistics capabilities, and distribution network strength

- Industry-specific content (manuals, technical sheets, training)

In this space, clarity, documentation quality, and operational proof matter as much as marketing.

Healthcare and regulated industries

Healthcare, biotech, and regulated industries require a unique approach because compliance isn’t optional — it shapes every buyer’s decision process.

Why it matters:

Even if your product is superior, buyers cannot adopt it unless you meet strict regulatory standards. Competitors who invest early in compliance, security, and certifications hold a significant advantage.

What to focus on:

- Certifications (HIPAA, GDPR, ISO, HITRUST, FDA approvals, etc.)

- Data security posture and privacy documentation

- Clinical or scientific validation

- Evidence-based results and research-backed claims

- References in highly regulated environments

- Support for multi-stakeholder decision processes

- Risk mitigation resources and implementation guidance

For regulated industries, competitive analysis is as much about risk and compliance as it is about product value.

Final thoughts

Keeping tabs on competitors isn’t about imitation—it’s about staying agile and informed. The insights you gather today can shape smarter decisions tomorrow.

By making competitor analysis a regular part of your strategy, you’ll be better equipped to lead your business confidently into new opportunities.

Remember, it’s the steady, thoughtful moves that set you apart in the long run.

Analyze your competitors in seconds

Track & analyze your competitors and get top social media metrics and more!

You might also like

Improve your social media strategy with Socialinsider!

Use in-depth data to measure your social accounts’ performance, analyze competitors, and gain insights to improve your strategy.