2026 Social Media Content Trends Across 16 Different Industries

Discover data-based top content themes and social media content trends across different industries and platforms. Learn how to shape an effective strategy.

Social media is always shifting, with each industry navigating its own trends and audience expectations. Just entering 2026, understanding which content truly connects is essential for brands wanting to stand out and engage more meaningfully.

This study offers a snapshot of content trends on Facebook and Instagram across 16 major industries. By tracking engagement around key content pillars in each sector, we reveal what inspired audiences, how trends evolved during the year, and where the best opportunities lie for marketers today.

Use these findings as a practical guide for planning, benchmarking, and sparking inspiration as you shape your social strategies for the year ahead.

Executive summary

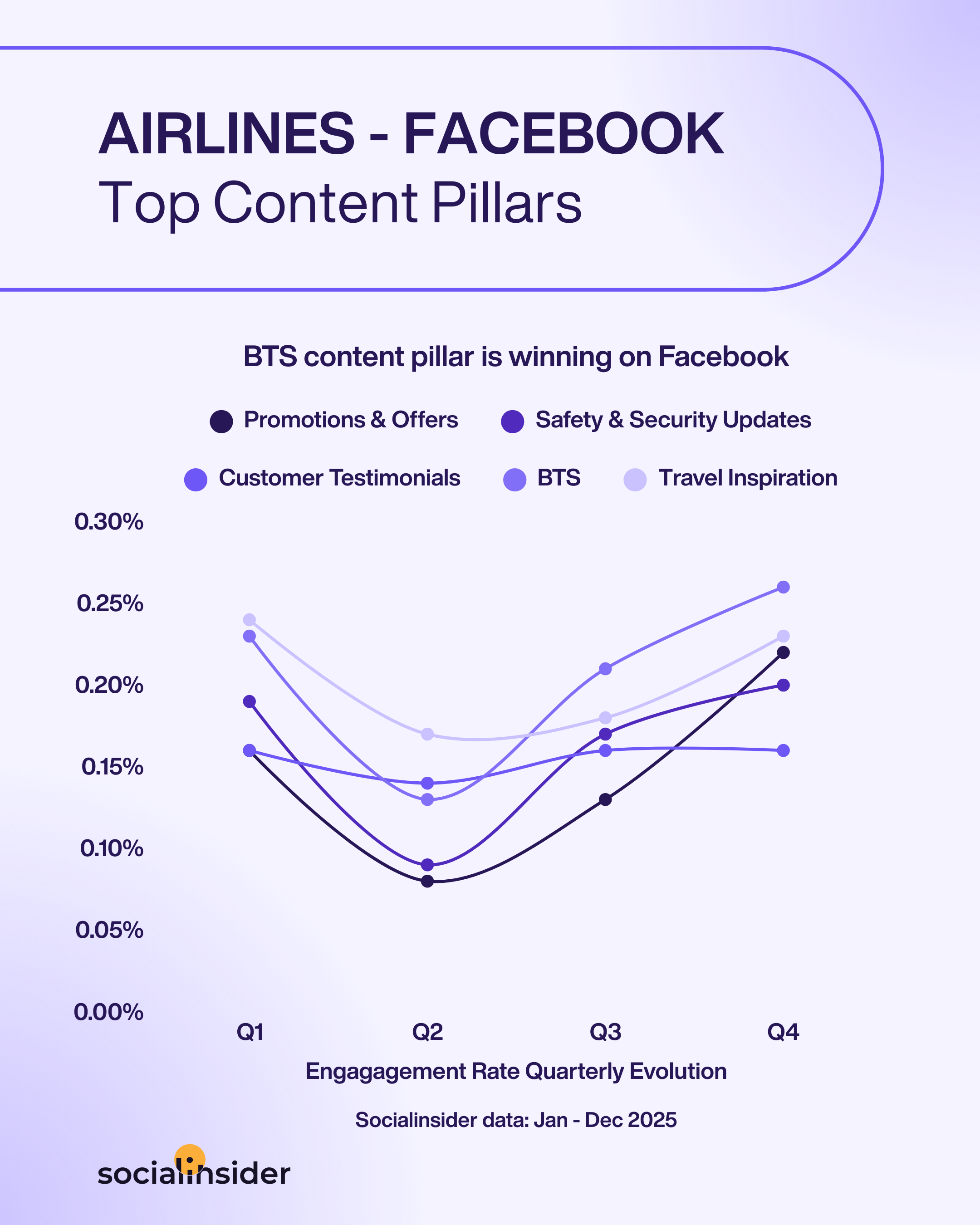

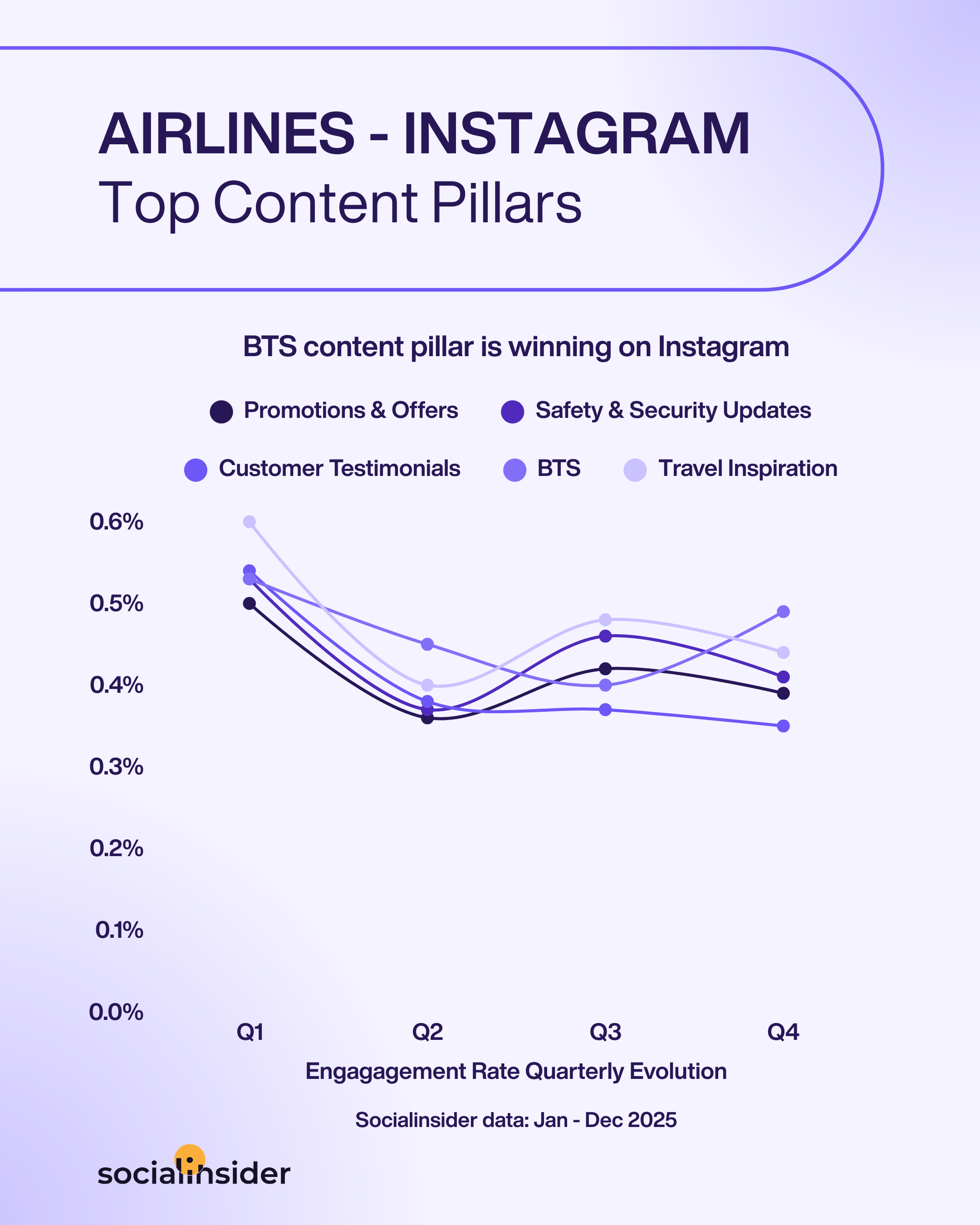

Airlines

- Engagement for airlines on Facebook dropped over Q1 across all content themes, but started increasing over Q2. At the moment, the most engaging topic is represented by Behind-the-scenes content, scoring an average of 0.23% engagement rate.

- Similarly to Facebook, there industry saw a decrease in engagement on Instagram as well, and a raise statrgin with Q2, with the most engaging content theme being also Behind-the-scenes.

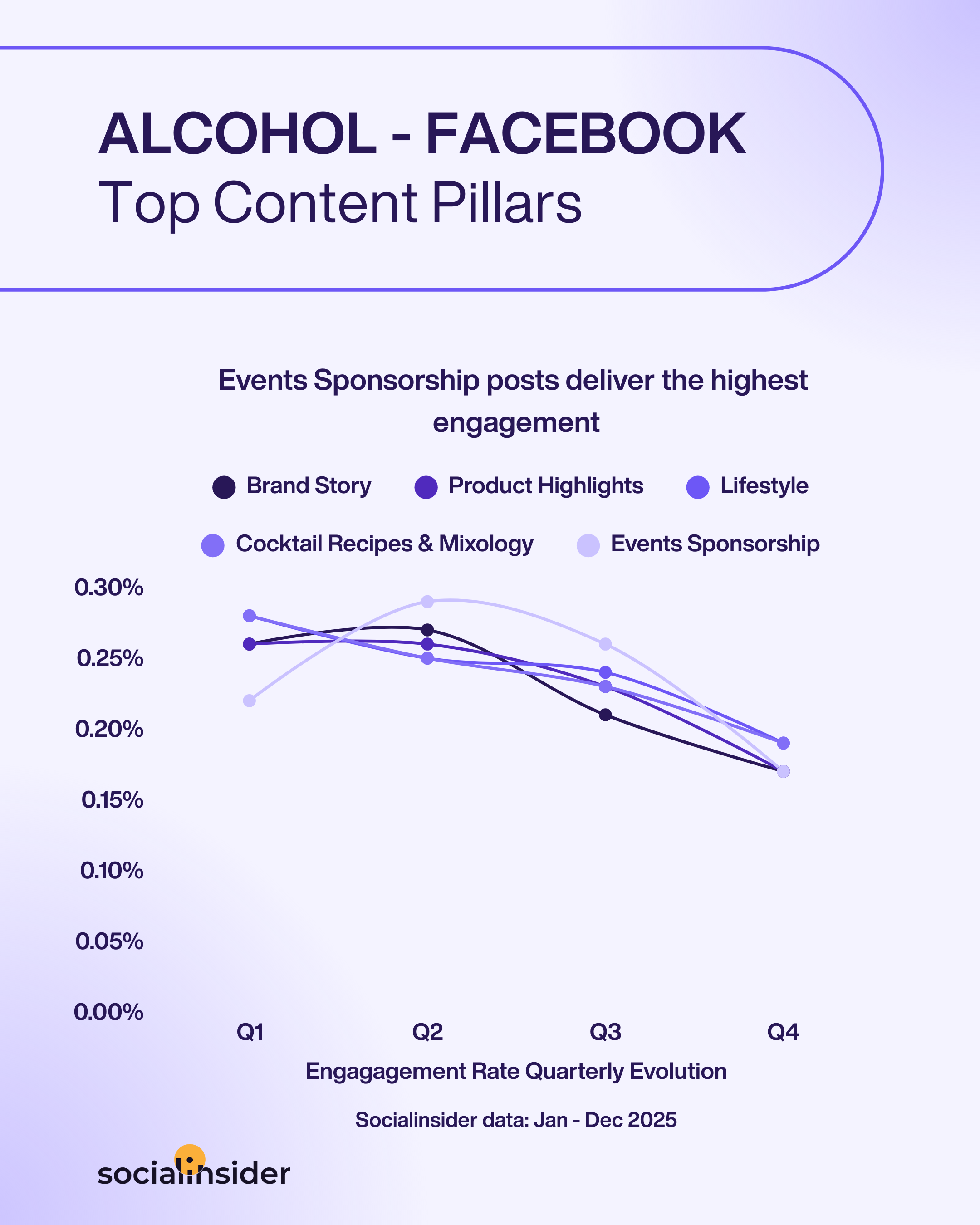

Alcohol

- On Facebook, since the beginning of Q2, Events & Partnerships, despite being the highest performing content pillar has decreased the most, from 0.29% to 0.17% average engagement rate. Brand story-related content also declined from 0.27% to 0.17%.

- On Instagram, the content pillar with the highest engagement drop was Pairing & Food Collaborations, going from 0.45% at the beginning of the year to 0.39% at the end of the year.

Education

- On Facebook, the highest engaging content pillar for this industry is represented by Student Achievements & Alumni Stories, which scores an average engagement rate of 0.15%.

- On Instagram, there was a decrease in engagement throughout the entire year, for all the industry’s best-performing content themes, including: Educational Tips, Admissions & Scolarships, Classroom Activities & Programs, Campus Life , Student Achievements & Alumni Stories.

Entertainment

- On Facebook, across this industry, Exclusive Content represent the highest engaging content theme (with an average engagement rate of 0.21%), while Celebrity Features the lowest (with 0.17% avere engagement rate)

- On Instagram, Memes & Viral Moments, make for the most engaging content pillar, despite having a significant decrease over Q2.

FMCG food

- On Facebook, during Q2 the educational content pillar ranked the lowest among the industry’s top content categories and higher over Q3.

In Q4, on Facebook, the FMCG Food industry saw a decrease in engagement across all its best-performing content pillars - On Instagram, for this industry, the only content pillar that was not impacted by a drop in engagement over Q3 and Q4 was Contests & Giveaways

FMCG Beverages

- Starting with Q3, on Facebook, the industry saw a decrease in engagement across all its main content pillars, with the biggest impact being registered by Collaboration & Influencer Partnerships - related posts, which decreased from 0.18% to 0.11% average engagement rate.

- A similar engagement decrease happed on Instagram as well, but it started earlier, from Q2.

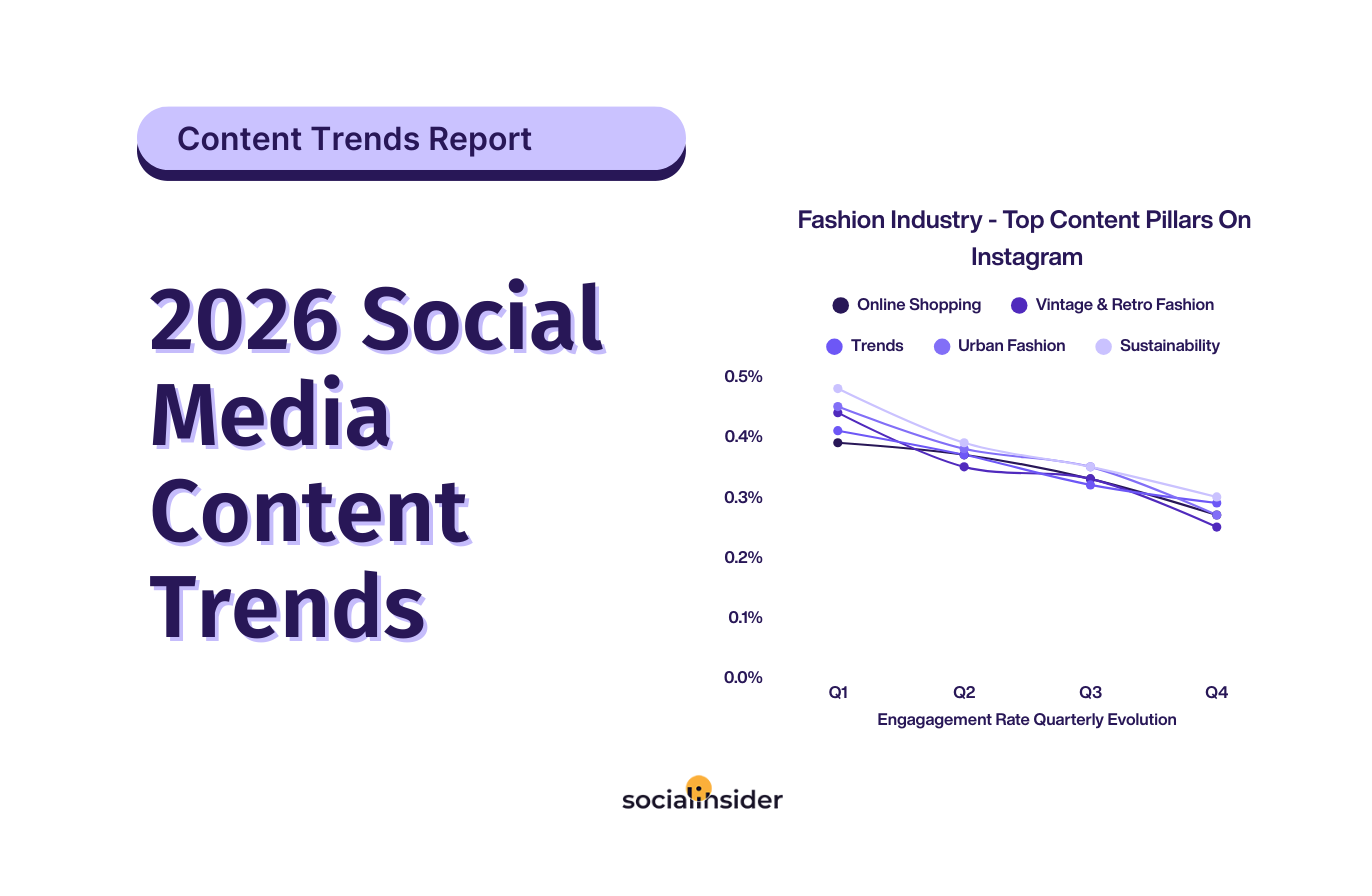

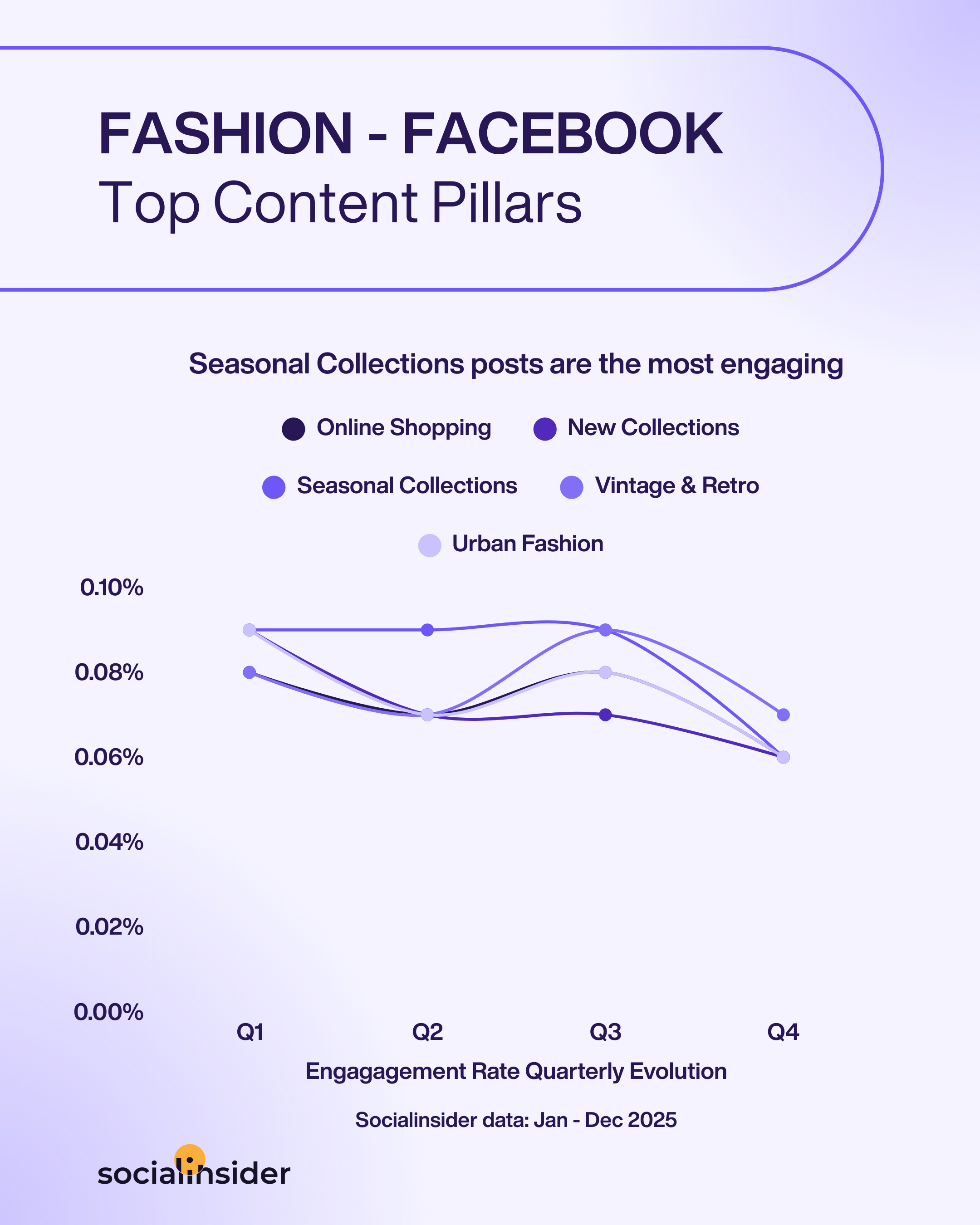

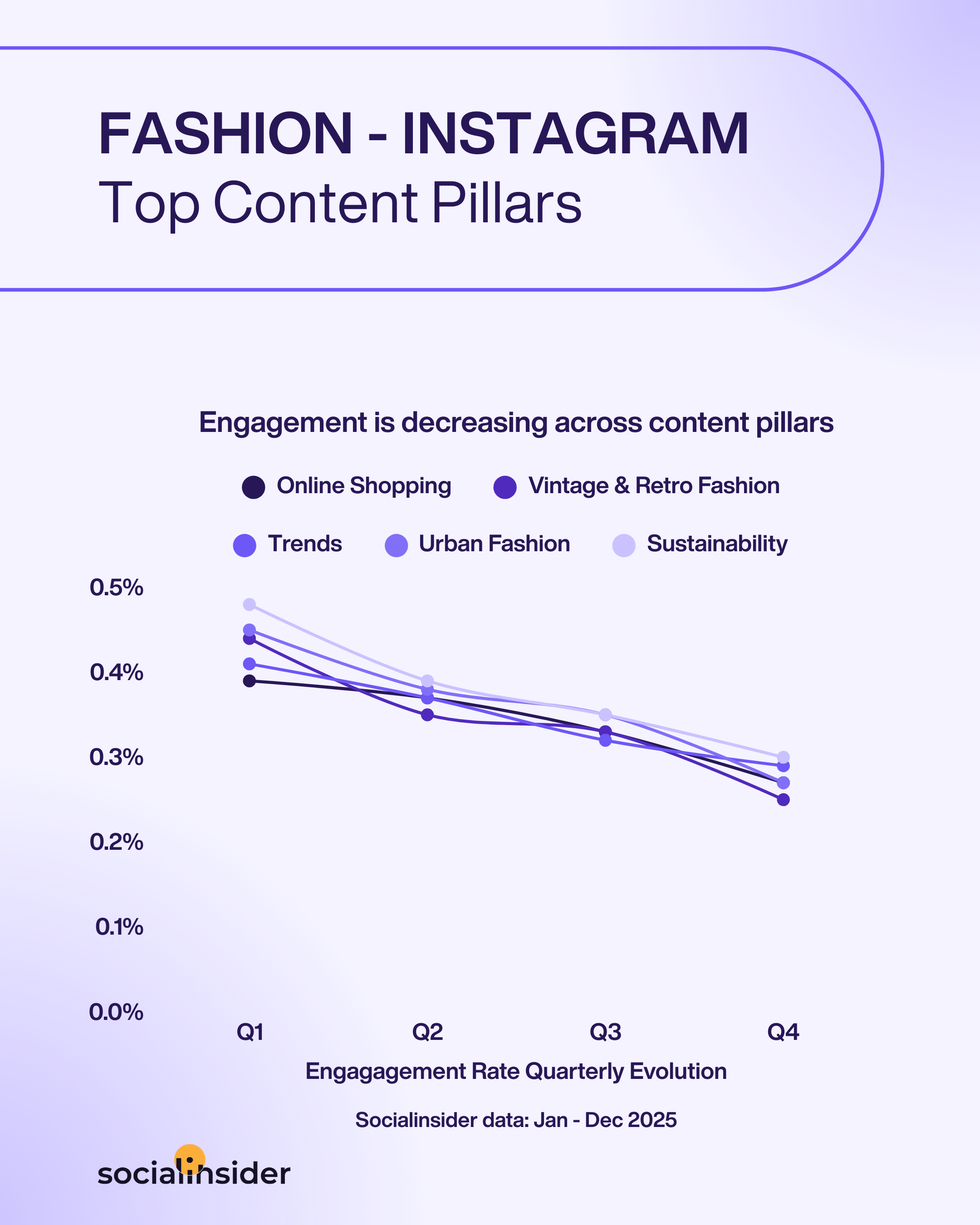

Fashion & Apparel

- Over Q3, on Facebook there was a drop in engagemet registered across all content pillars, at the moment, the best performing one consisting of Vintage & Retro Fashion.

- The same engagement decrease was registered on Instagram, with posts related to Sustainability ranking the highest in engagement.

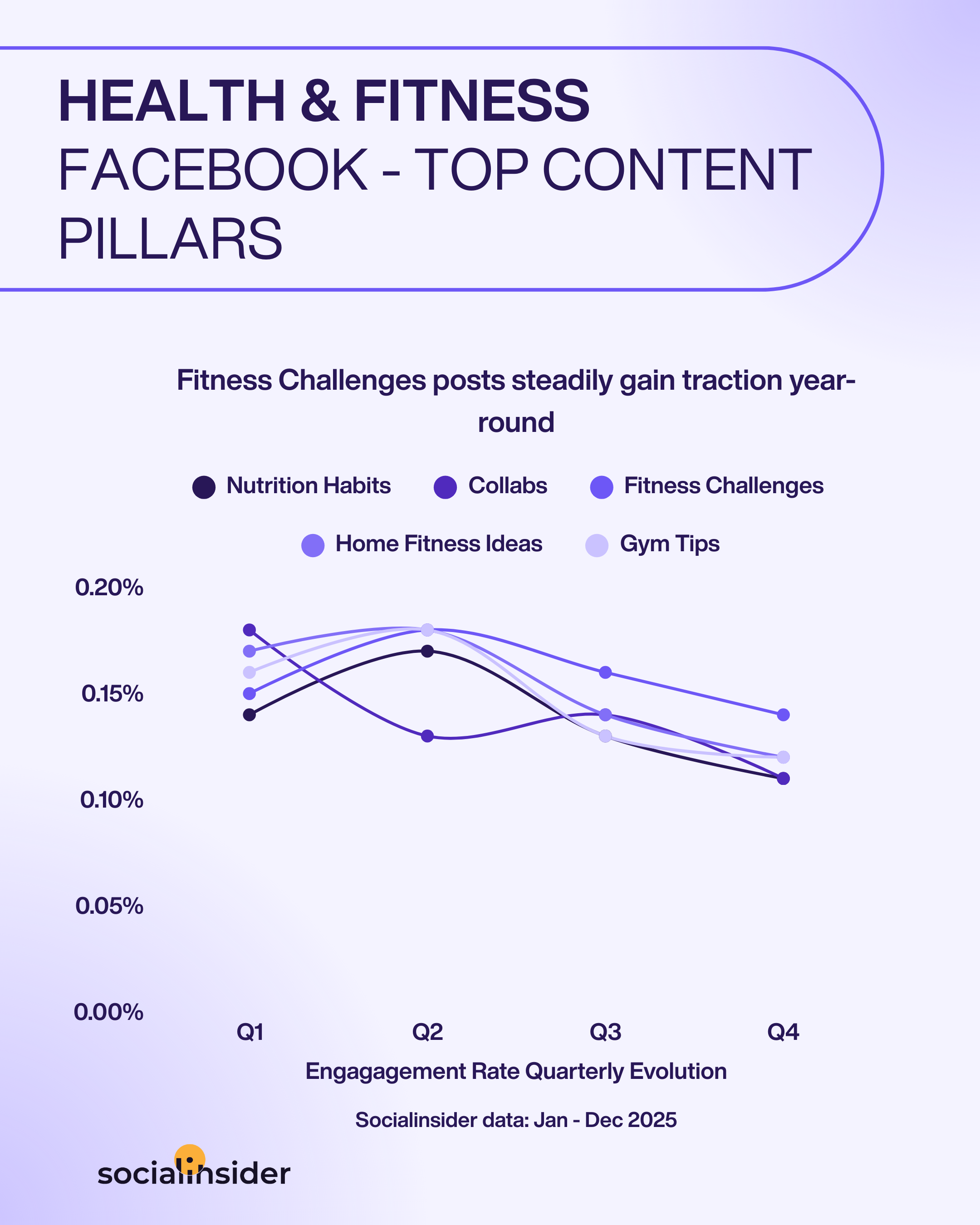

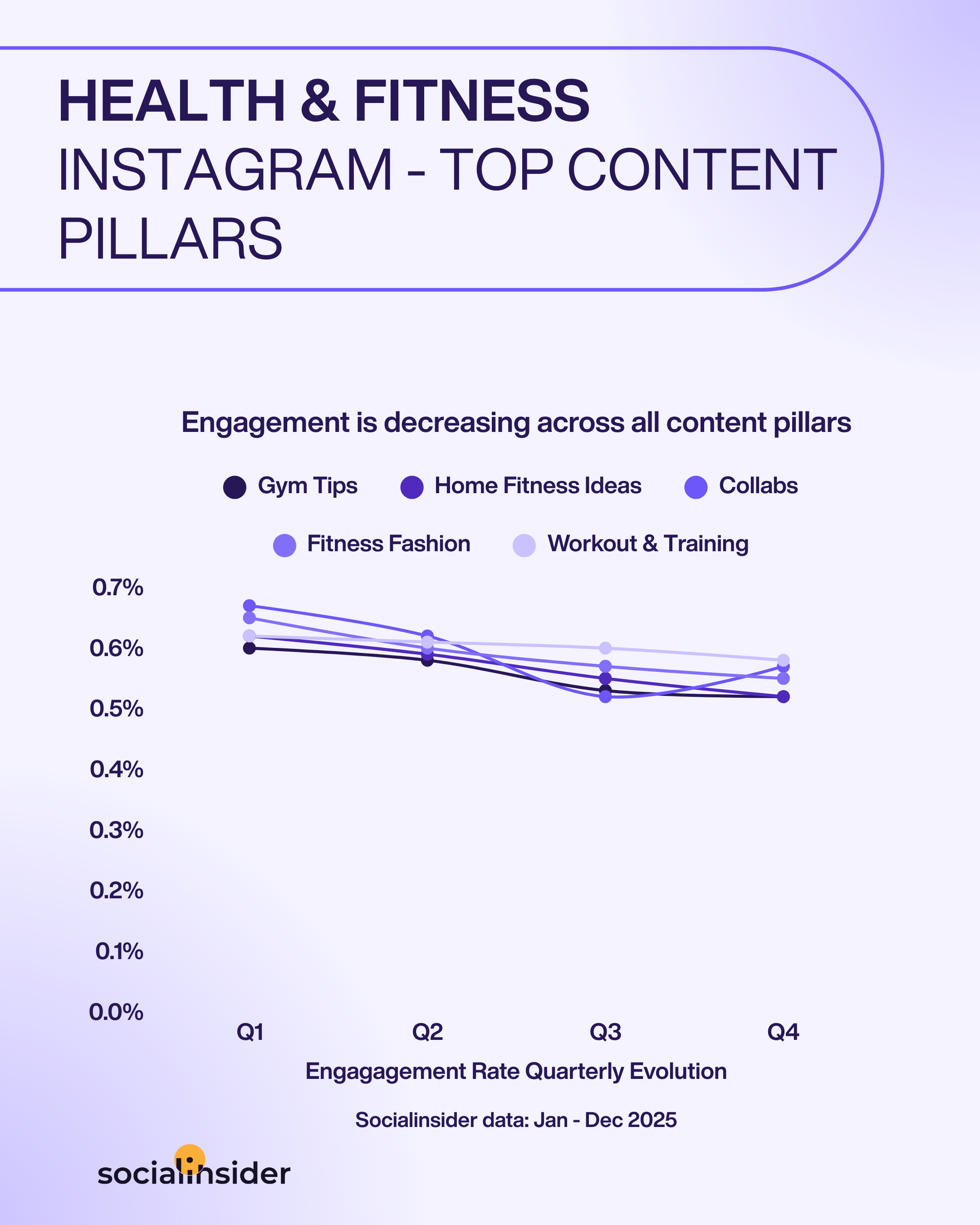

Health & Fitness

- For this vertical, on Facebook the best-performing content pillar is Fitness Challenges & Events, scoring an average engagement rate of 0.14%. Starting with Q2 there was a notable decrease in engagement across the industry, with Collaborations - related posts having the biggest fluctuations in engagement.

- On Instagram as well, the Collaborations content pillar was the one scoring highest engagement drop, going form 0.67% to 0.57% average engagement rate.

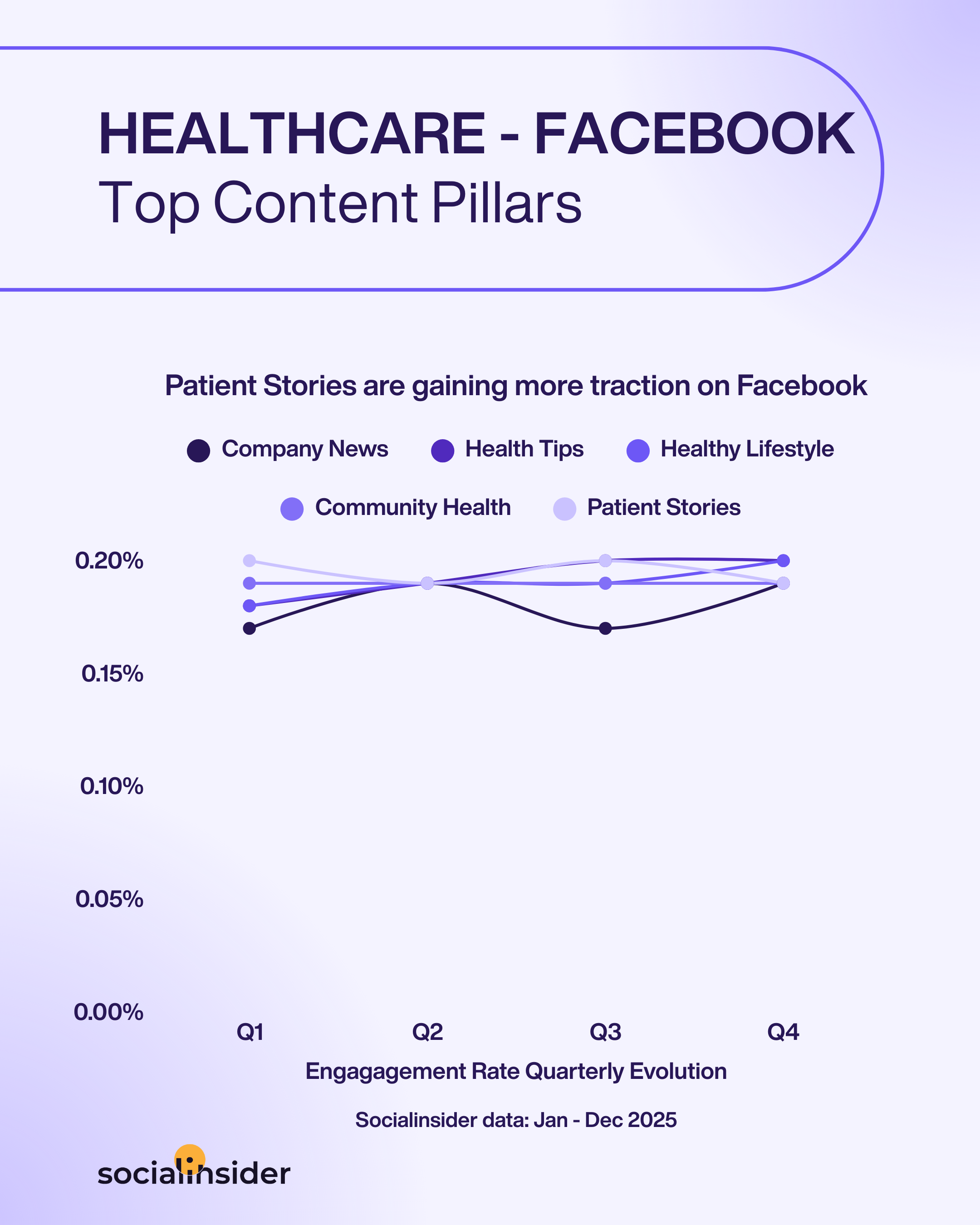

Healthcare & Pharma

- Over Q2, the content pillar Company News & Updates scored a drop in engagement, going from 0.19% to 0.17% on Facebook.

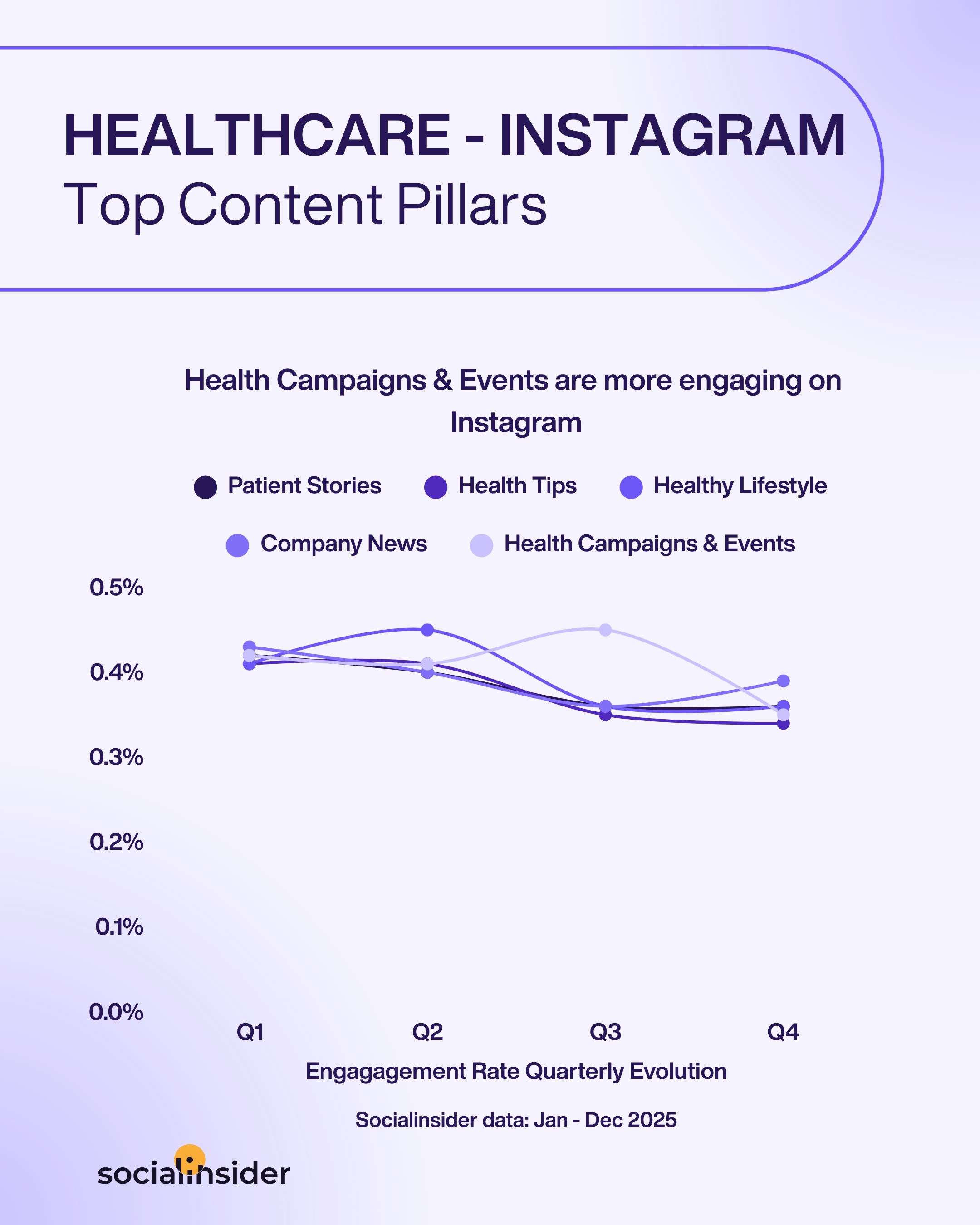

- On Instagram, over Q2, the topic Healthy Lifestyle & Myths registered a decrease in engagement, while the topic Health Campaigns & Awareness Events scored an increase

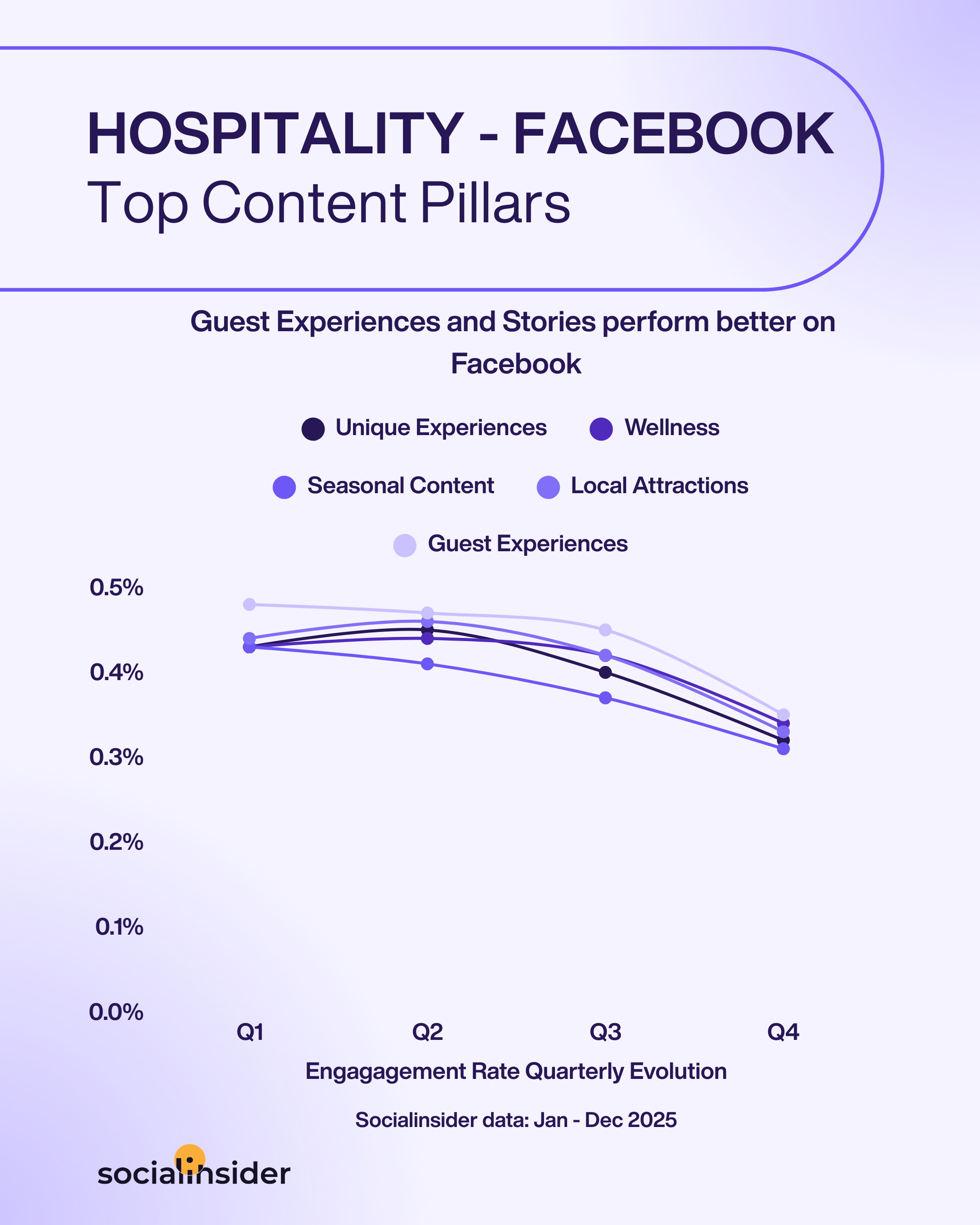

Hospitality & Hotels

- On Facebook, the content related to Local Attractions & Activities, and Guest Experiences & Stories has faced a drop in engagement over the last Q of 2025.

- On Instagram, the industry overall saw a decrease in engagement, despite the content pillars leveraged, the best performing one though remaining Guest Experiences & Stories.

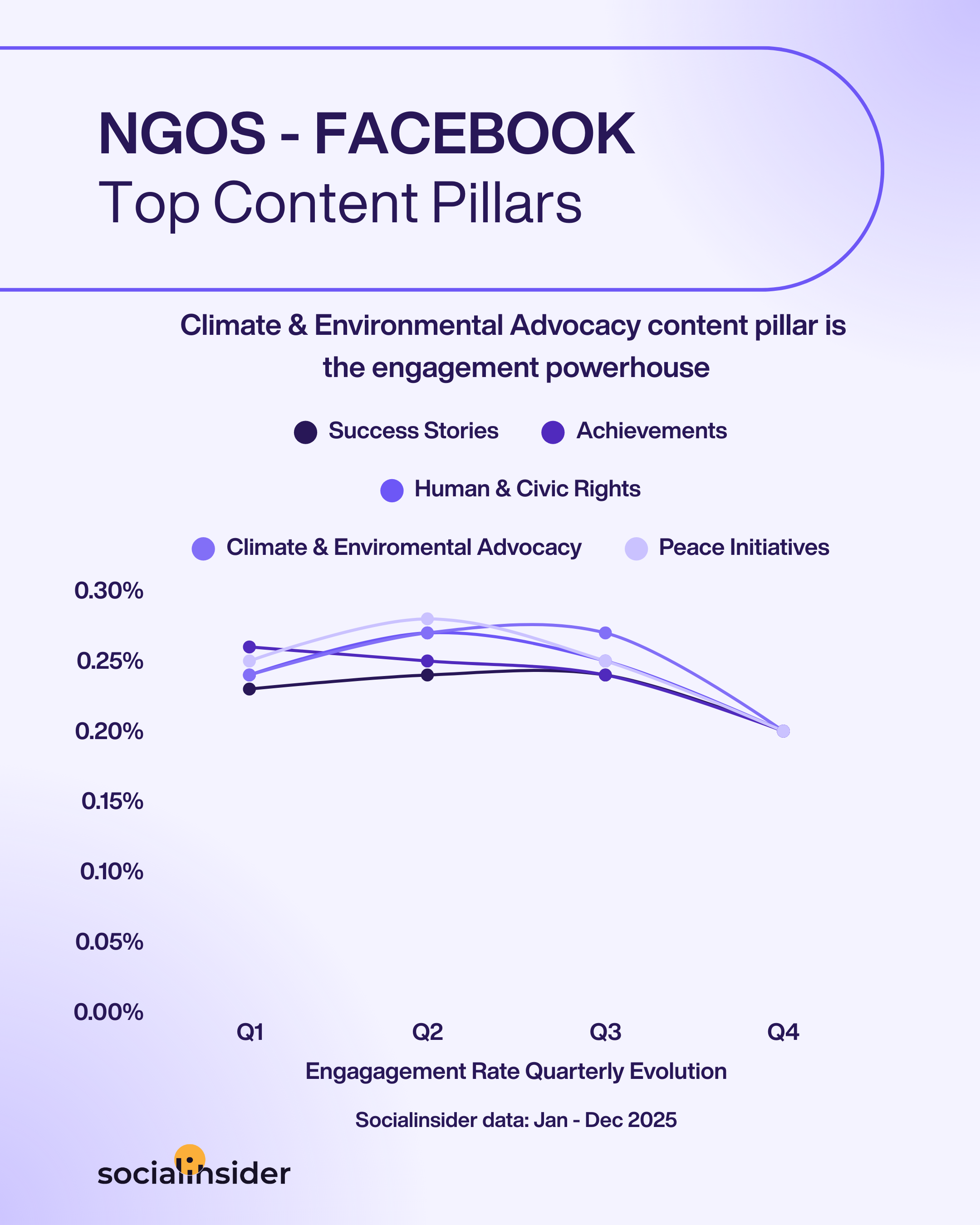

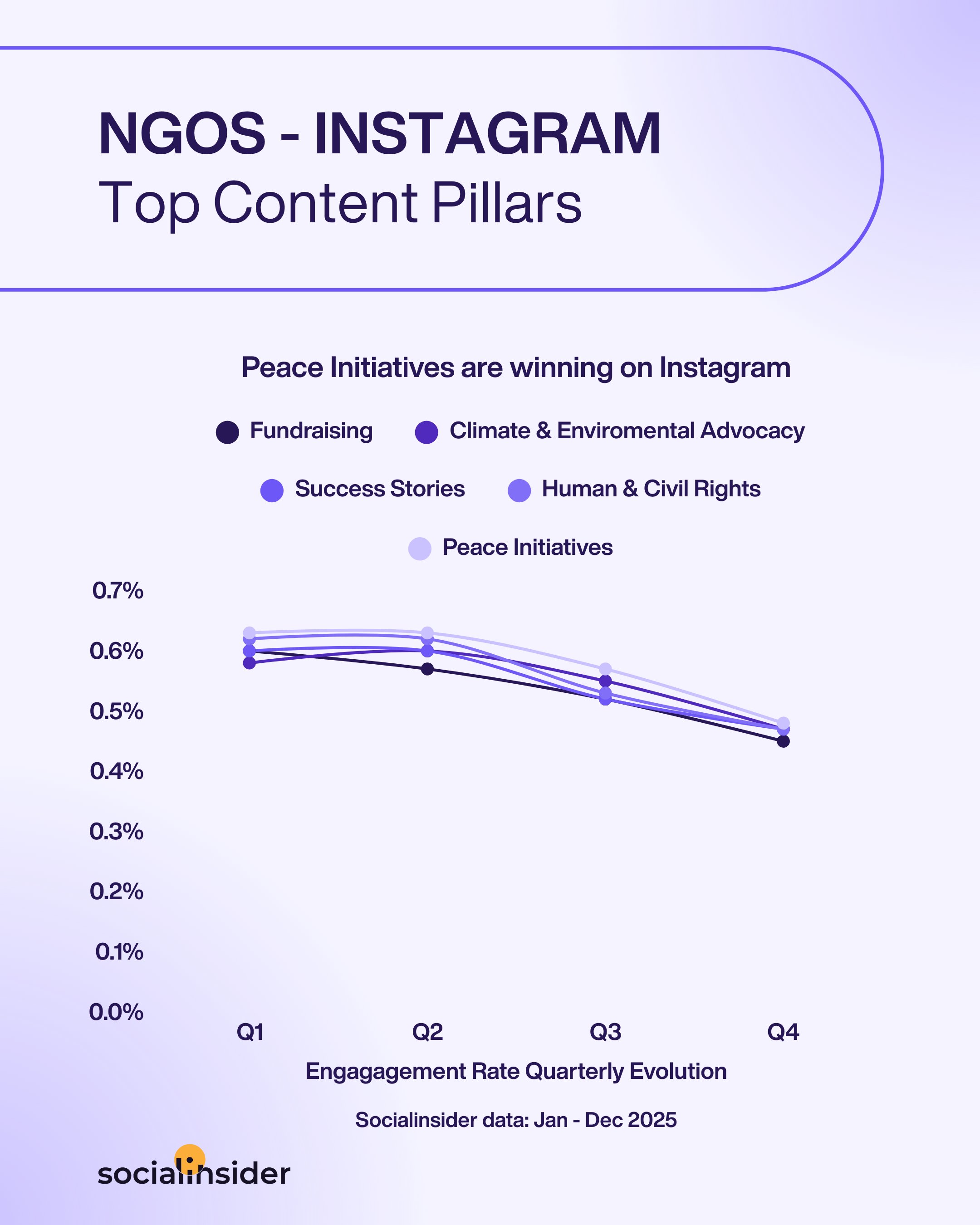

NGO

- Climate & Environmental Advocacy - related content represents the best performing topic for this industry on Facebook, despite facing significant drops in engagement over Q2 and Q3.

- The industry faced a decrease in its Instagram engagement across all its main content themes, Fundraising - related posts being the most impacted.

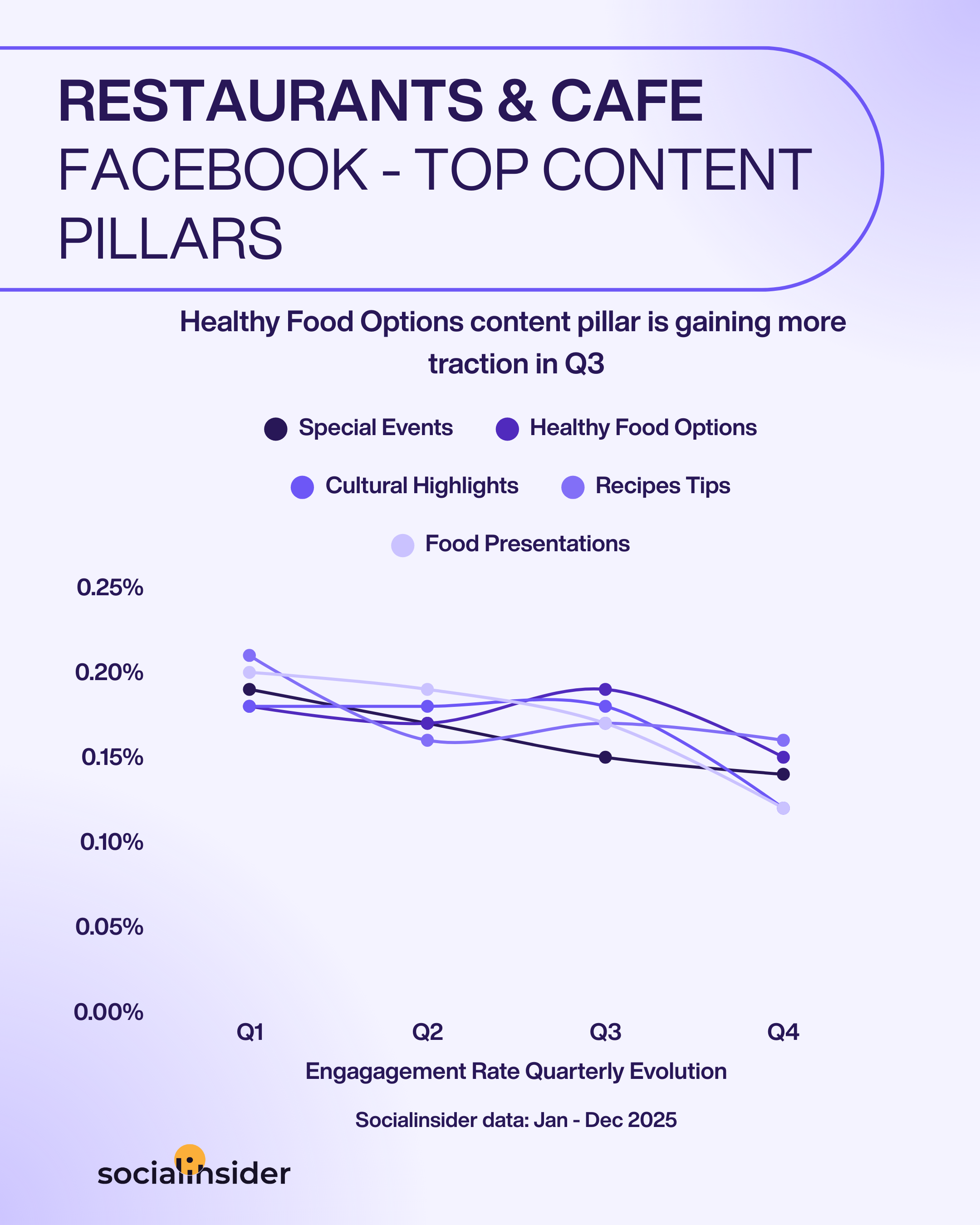

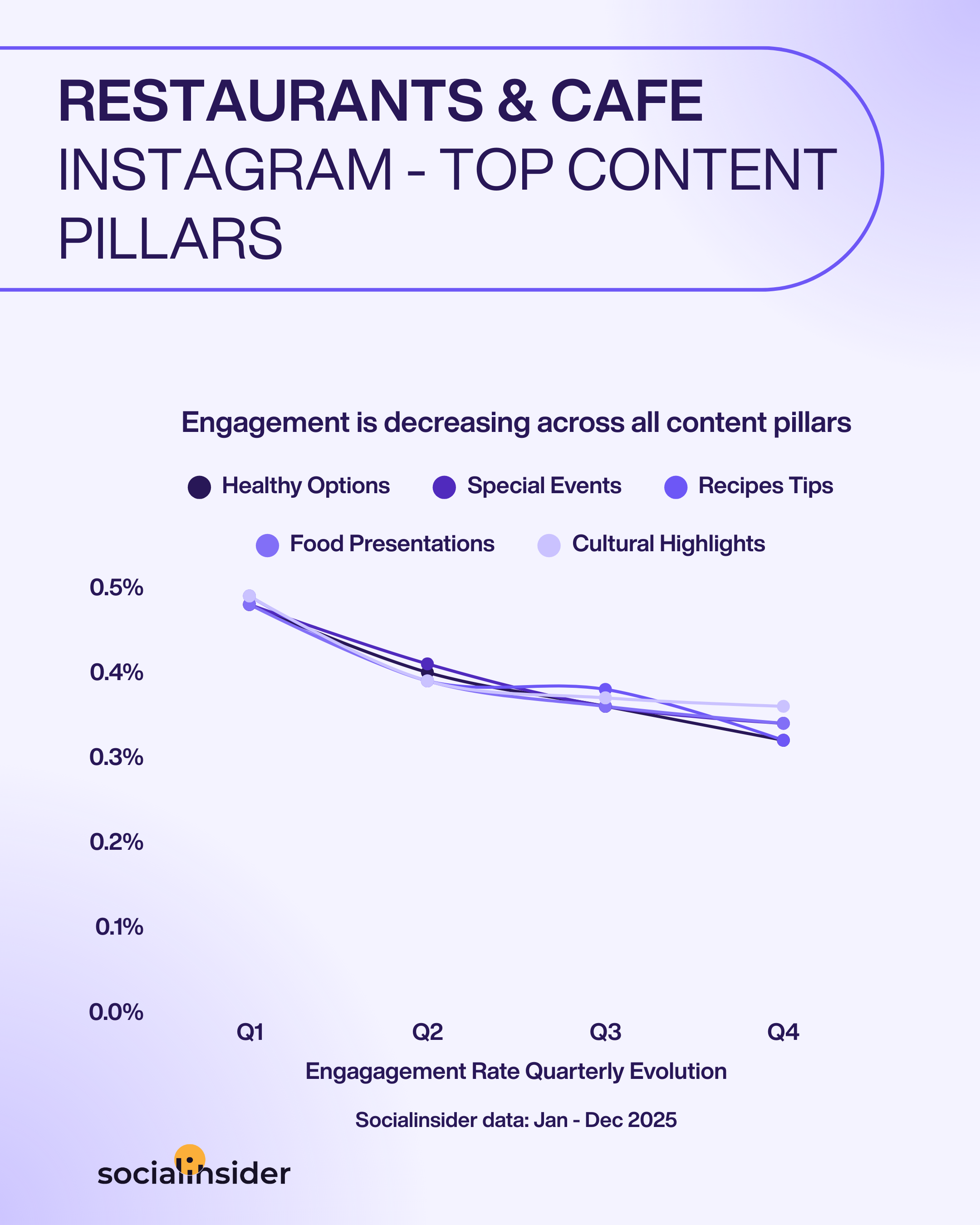

Restaurants & Cafes

- For this industry, there were two notable changes in terms of best-performing content pillars across 2025 on Facebook: Cuisine & Cultural Highlights decreased in engagement over Q4, with Food presentations & Signature dishes and Special events & Announcements having a continuous decline throughout the year.

- On Instagram, there was a sesizable drop in engagement across the industry starting with Q2, at the moment, the most engaging content pillar being Cuisine & Cultural Highlights

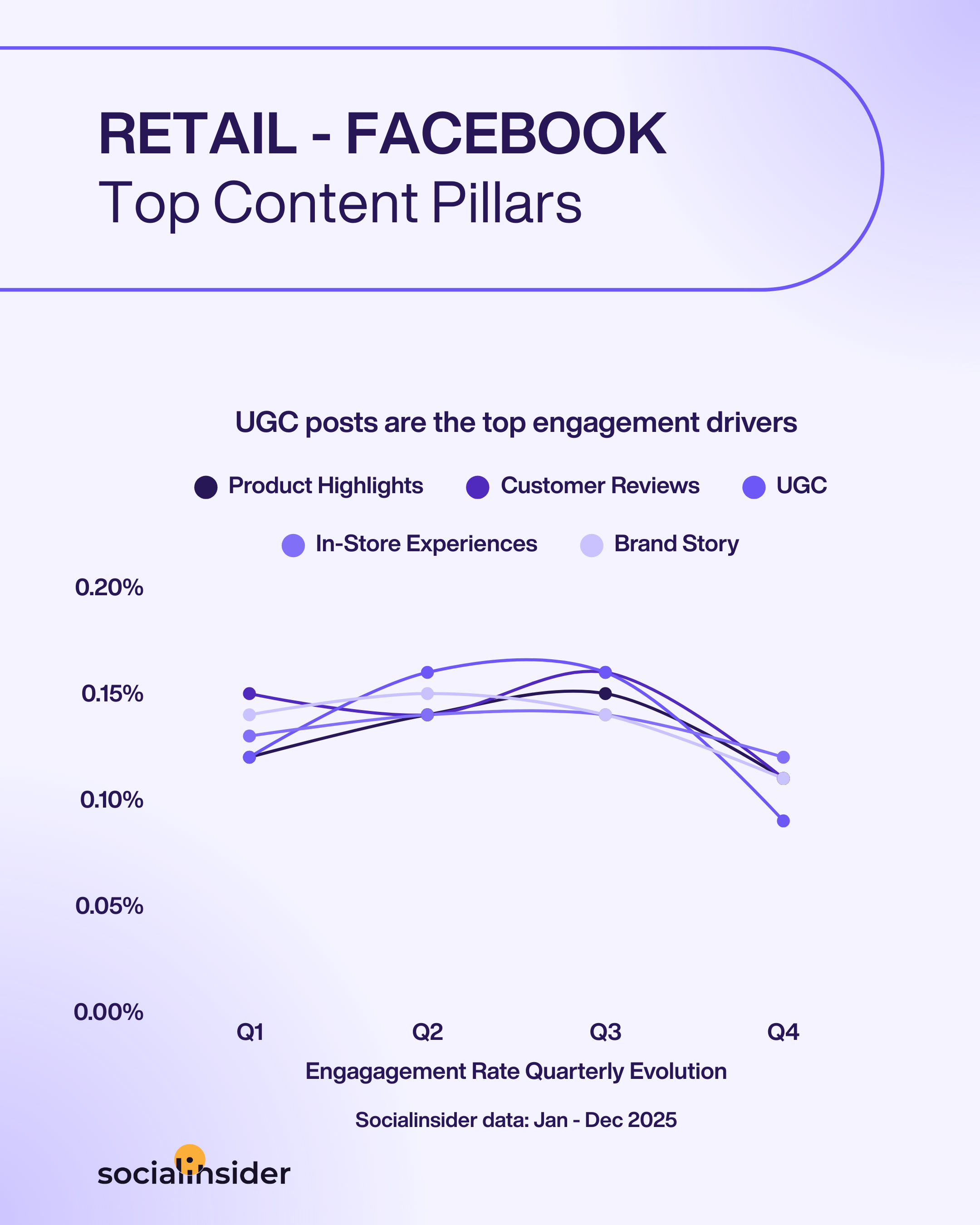

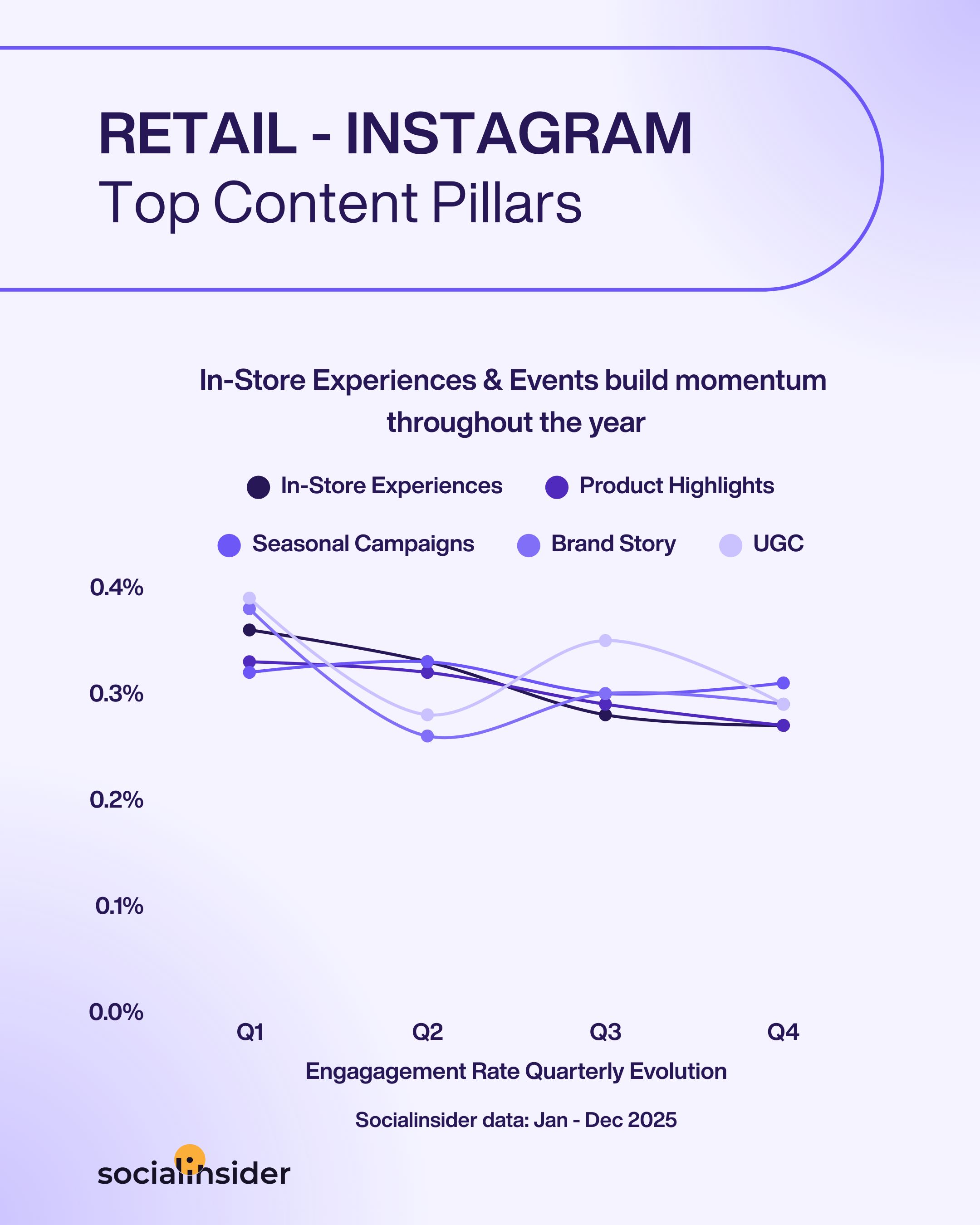

Retail

- On Facebook, despite scoring the highest engagement increase over Q2 and Q3, over Q4, UGC’s engagement drop significantly (from 0.16% to 0.09%), being replaced as the best performing content pillar by the themes In-Store Experiences & Events.

- On Instagram, UGC and Brand Story & Values-related content registered decrease over Q1, an increase over Q2 and a further decrease over Q3.

Technology & Software

- On Facebook, the most engaging content theme for this industry is New Launches, averaging an engagement rate of 0.14%.

- On Instagram, the best performing content pillar for this industry is Tech tTips & Tutorials, scoring an average engagement rate of 0.40%.

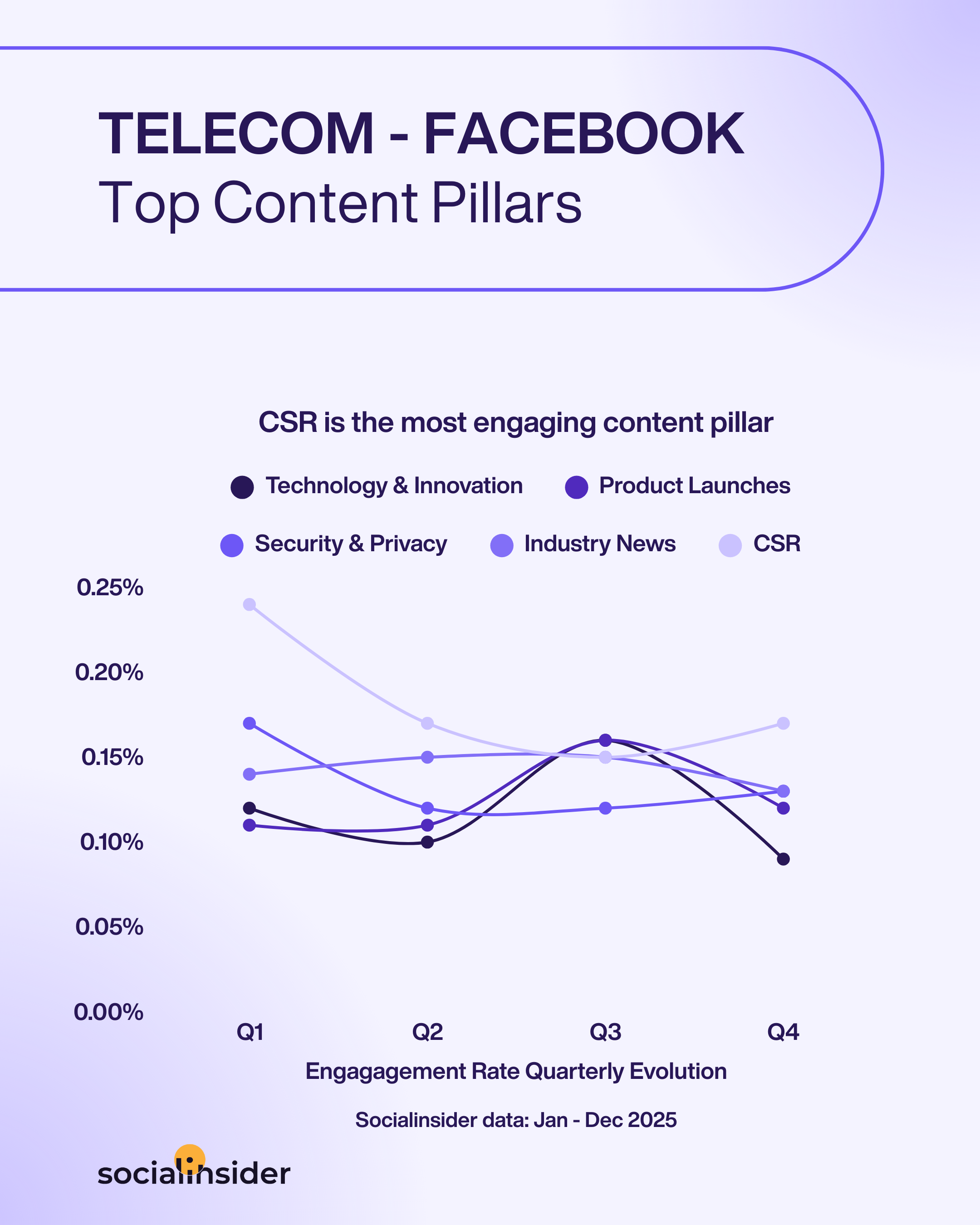

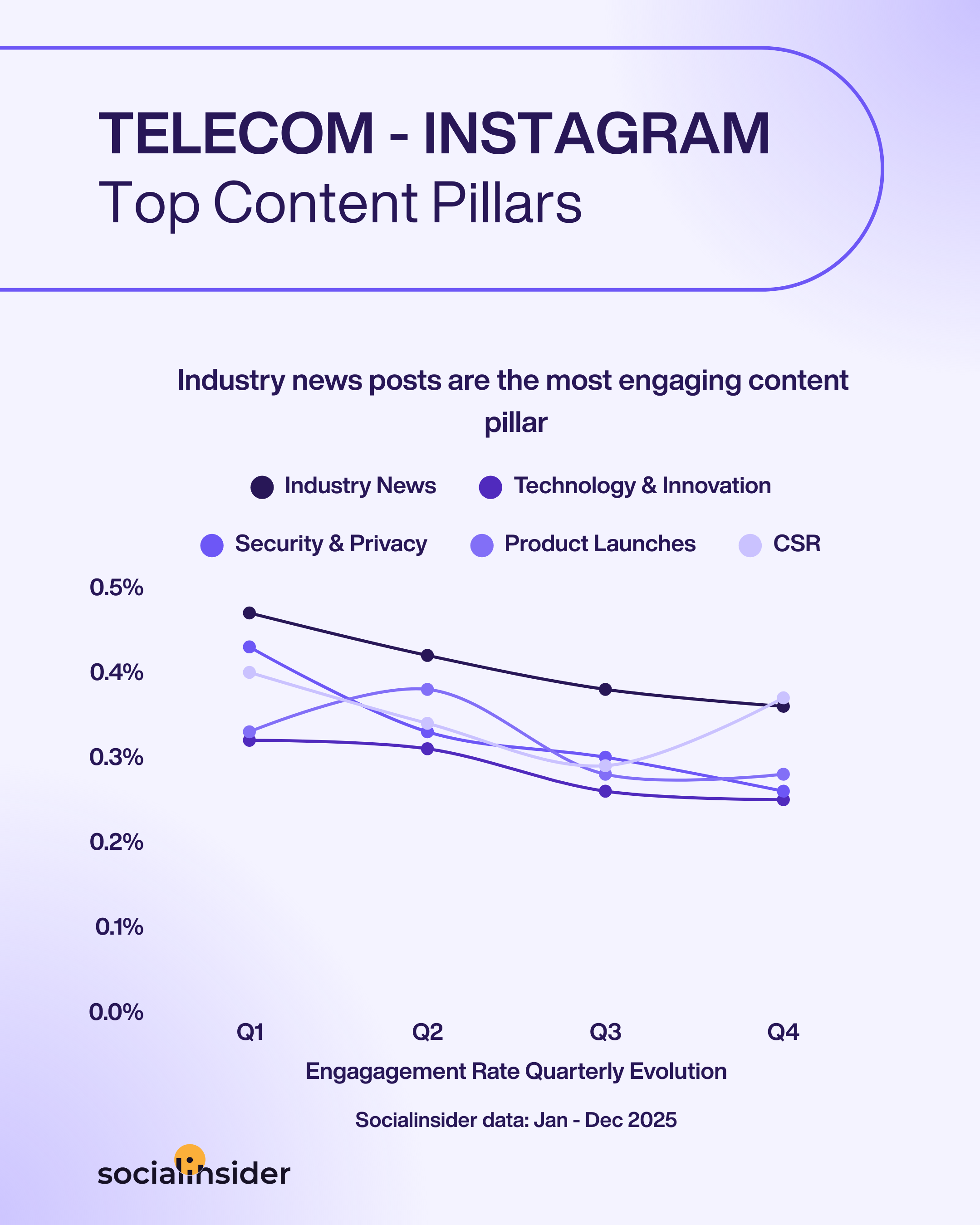

Telecom

- Over Q2, the topics related to Security & Privacy, and CSR have seen a drop in engagement, while the topics Product & Service Launches and Technology & Innovation have spiked. However, over Q4, on Facebook, the only theme that has seen an upward engagement trend was the CSR-related one.

- On Instagram, posts related to Industry News & Trends tend to perform best, scoring an average engagement rate of 0,36%, still following Instagram’s decreasing engagement tendency.

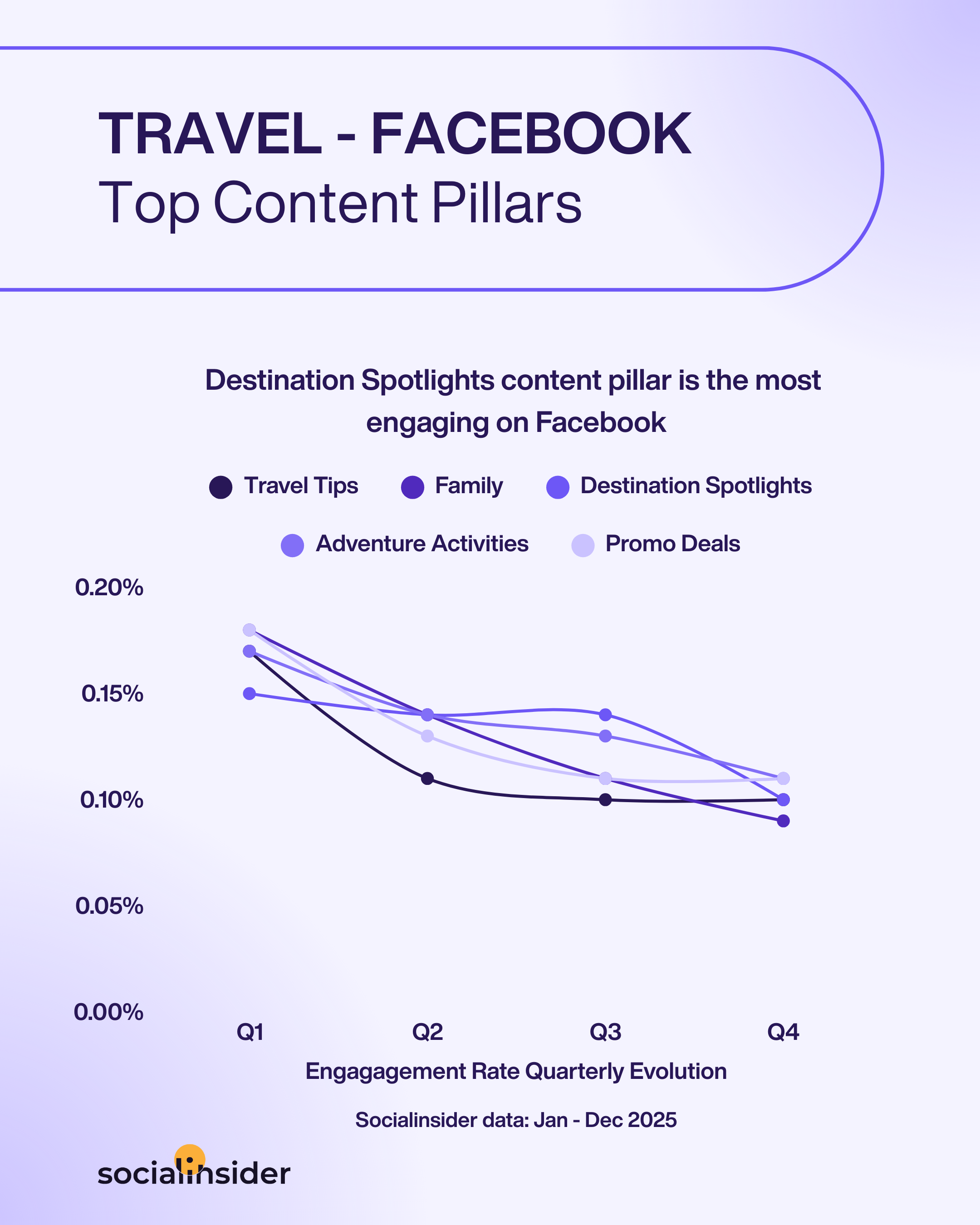

Travel

- Starting with Q2 2025, the content related to Travel Tips & Guides had an engagement drop on Facebook, getting from 0.17% to 0.11% engagement rate on average.

- Overall, in 2025, there was a theme that had a continuous decrease in engagement, and that was Family & Group Travel, across Facebook and Instagram as well.

Airlines content trends

Facebook content trends for airlines industry

Throughout 2025, airlines on Facebook experienced some interesting shifts in what audiences engaged with most. Early in the year, content that gave followers a glimpse behind the scenes or inspired them to dream about new destinations captured the most attention. However, there was a dip across all categories in Q2— reflecting shifting audience priorities as the year began to unfold.

As the year picked up, so did engagement, especially toward the end. Promotions and offers made a real comeback in Q4, nearly tripling their engagement rate from the spring, which makes sense as airlines ramp up their year-end deals.

Meanwhile, behind-the-scenes stories maintained their steady charm, peaking in the last quarter. Overall, the data shows that airlines can count on both aspirational and authentic content to capture their community’s interest—especially as people look toward new adventures at key points in the year.

Instagram content trends for airlines industry

The story on Instagram is all about visual storytelling and connection. In Q1, audiences loved feeling part of the airline world, enjoying the most content related to travel inspiration. A noticeable dip emerged in Q2, with engagement sliding across the board, but this was followed by a gradual resurgence. As the year progressed, BTS content recovered well, and safety updates became more prominent again in the final quarter.

What stands out is just how much Instagram followers value authenticity and exclusive access—they consistently connect with brands that invite them behind the curtain and keep them inspired, no matter the season.

Alcohol content trends

Facebook content trends for the alcohol industry

In 2025, alcohol brands on Facebook navigated a gradually shifting engagement landscape. At the beginning of the year, lifestyle-focused posts stood out, capturing the highest engagement rates as followers looked to start the year with inspiration and new experiences. Q2 brought a subtle change, with event sponsorships and partnerships peaking, likely tapping into seasonal gatherings and festivals.

However, engagement steadily decreased through the second half of the year across all pillars. By Q4, every content type saw its lowest engagement, highlighting a significant dip in interaction as the year ended. This pattern suggests that while audiences are keen on vibrant stories and social-oriented content early on, maintaining momentum requires fresh approaches as novelty fades.

The data indicates that periodic reinvention and aligning campaigns with specific events can help alcohol brands sustain engagement over the course of the year.

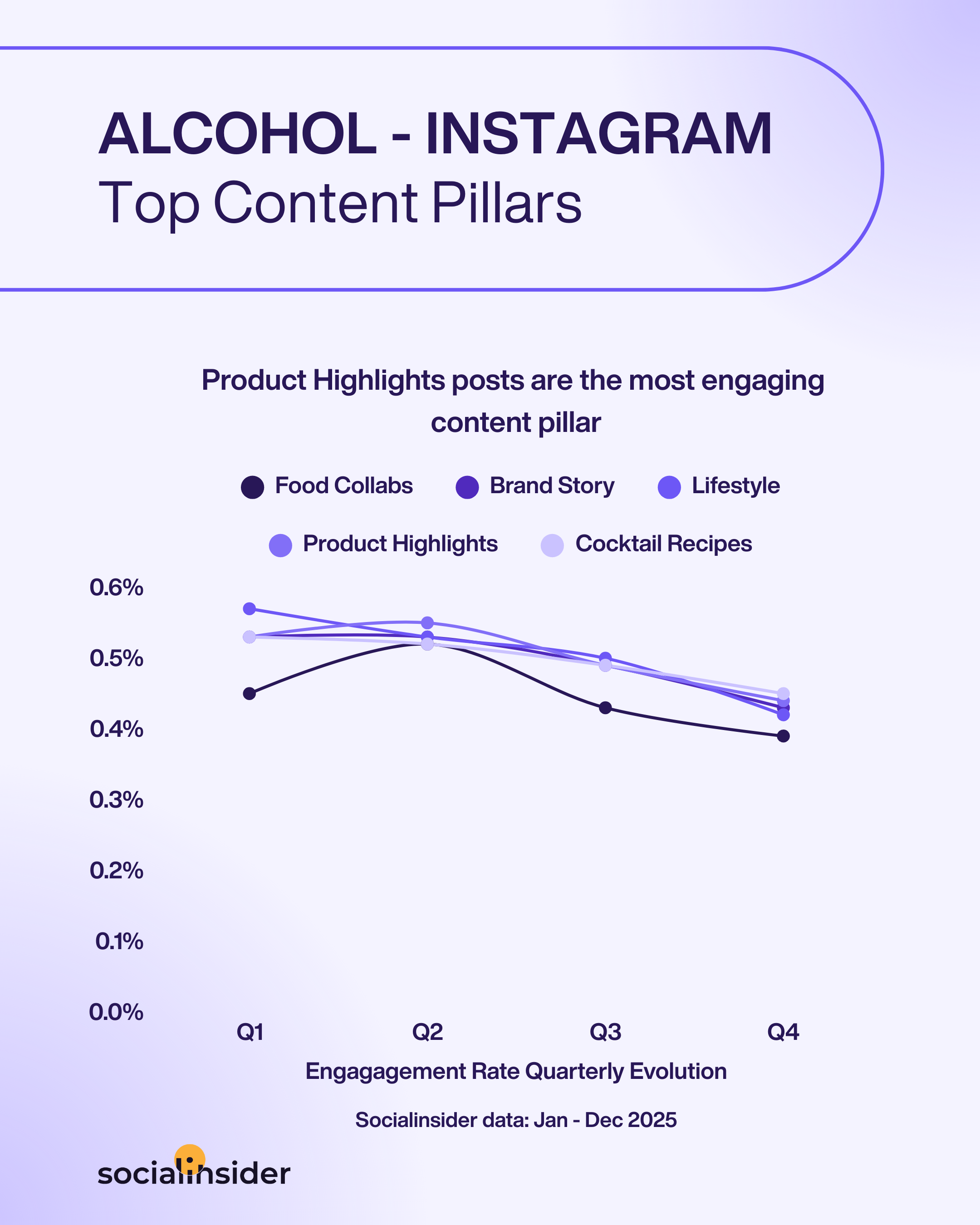

Instagram content trends for the alcohol industry

For alcohol brands on Instagram, 2025 was defined by strong, consistent engagement—especially in the first half of the year. Lifestyle and social occasion posts led the way in Q1, setting a lively and aspirational tone.

Q2 saw a slight boost for food collaborations and product highlights, but as the year progressed, engagement gradually eased for every content type. Despite this softening, lifestyle stories, heritage-focused posts, and creative recipes continued to resonate, sustaining higher engagement rates than those seen on Facebook. The overall trend suggests that Instagram audiences respond best to content that inspires, educates, and brings social experiences to life—especially when brands highlight new ideas or seasonal connections throughout the year.

Education content trends

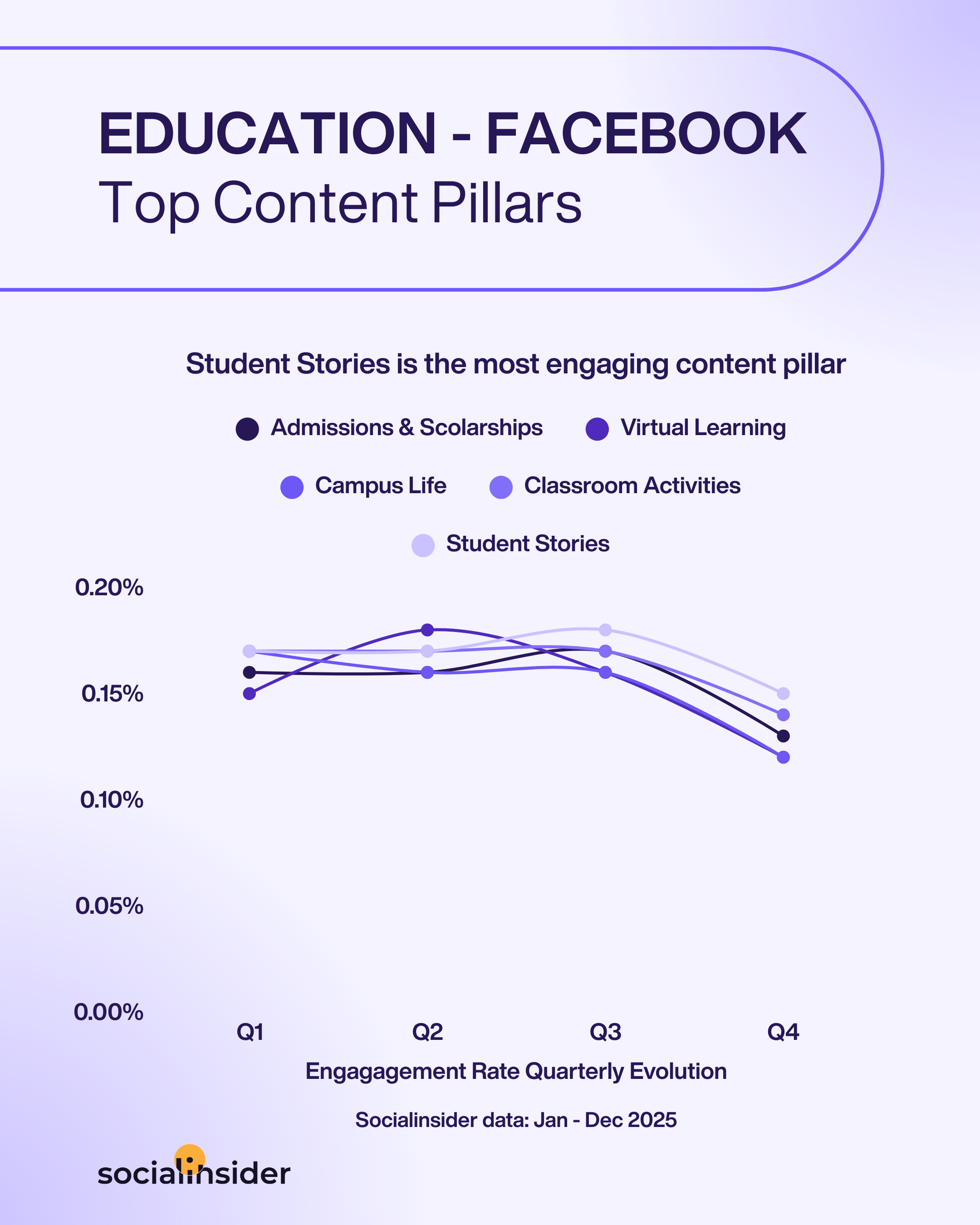

Facebook content trends for the education industry

In 2025, educational institutions on Facebook saw steady engagement early in the year, with consistent interest in campus life, classroom programs, and student achievements.

Spring brought a notable bump for virtual learning and educational technology, likely as schools highlighted digital offerings and accessibility. Throughout the summer, engagement held strong, with a modest rise in posts spotlighting student achievements and admissions stories—a nod to graduation season and prospective students exploring opportunities.

As the year wound down, however, engagement dipped across all content pillars. The decline in Q4 suggests a typical year-end slowdown, possibly due to students and families focusing on holidays.

The pattern highlights how educational audiences remain most engaged when content coincides with academic milestones, achievements, and timely updates—while year-end periods may require extra creativity or strategic campaigns to sustain attention.

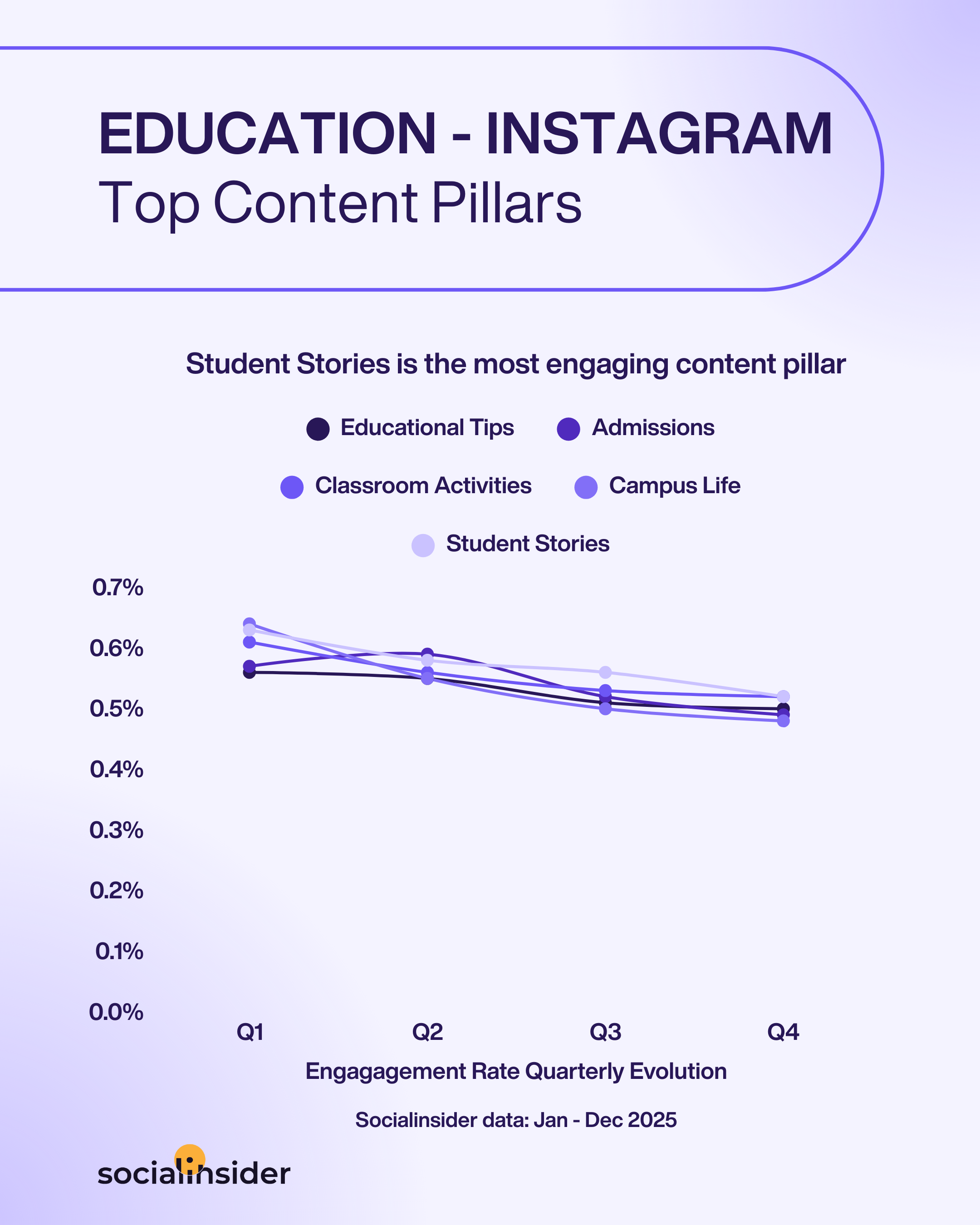

Instagram content trends for the education industry

On Instagram, education brands enjoyed notably high engagement throughout 2025, particularly around the start of the year.

Campus life, classroom activities, and student achievements all performed strongly in Q1, reflecting the visual appeal of campus experiences and memorable student moments. Admissions topics and educational tips also drew audiences, showing sustained interest among both prospective and current students.

As the year progressed, engagement softened slightly, but remained robust across all content pillars. By Q4, all topics experienced a gradual decline—though classroom activities, achievements, and educational tips continued to outperform, underscoring the power of authentic, informative, and people-centric posts. This trend suggests that audiences on Instagram consistently value content that highlights real experiences, successes, and helpful information, especially when paired with strong visuals and storytelling.

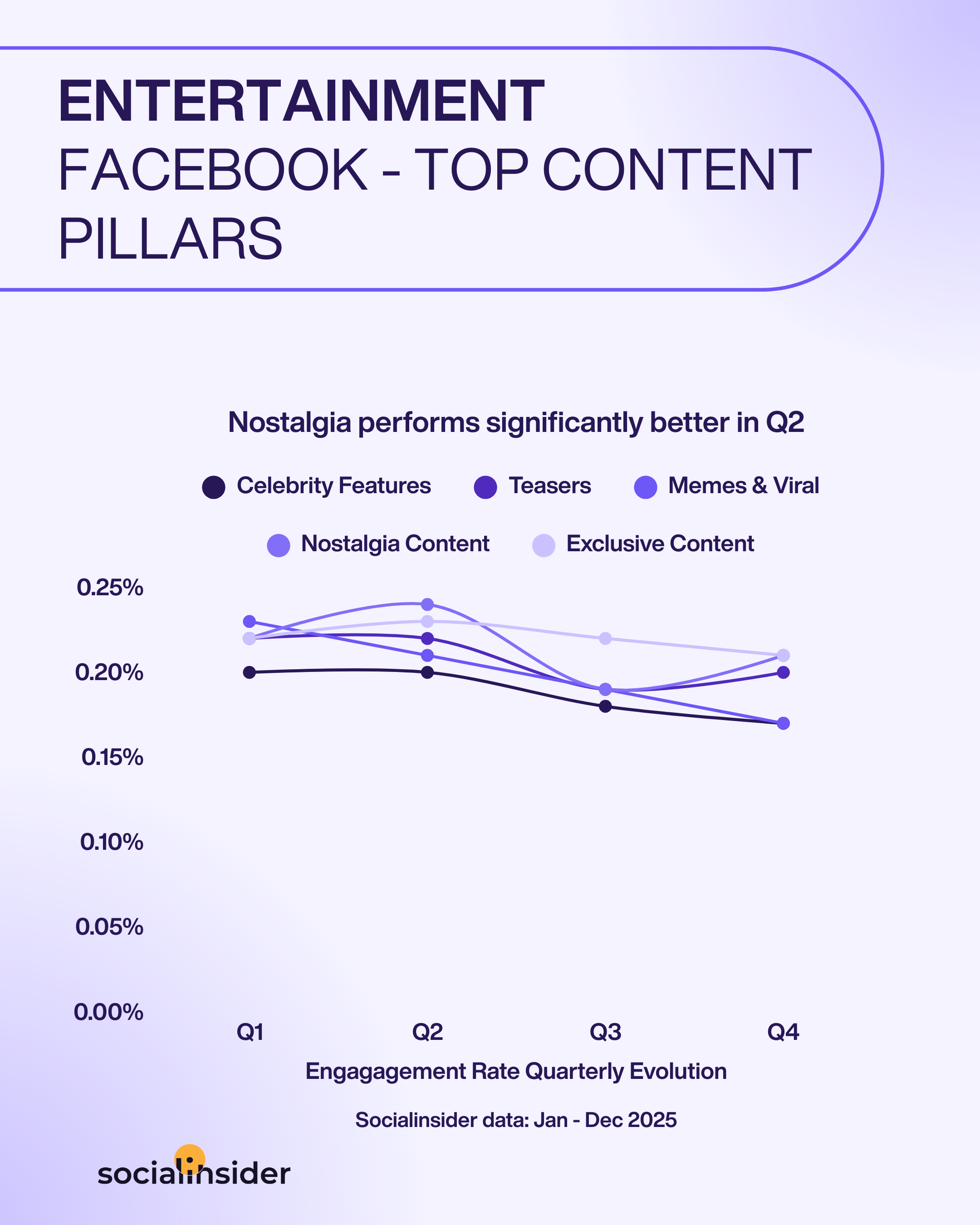

Entertainment content trends

Facebook content trends for the entertainment industry

For entertainment brands on Facebook in 2025, engagement rates started high across all content types, especially with memes, viral moments, and nostalgic content capturing early attention.

As spring arrived, nostalgia content gathered more momentum, suggesting audiences were drawn to familiarity. However, starting in Q3, engagement saw a slow but steady drop for most pillars. By Q4, while exclusive content dominates, celebrity features and viral content settled at their lowest rates of the year.

This pattern highlights that timely, trend-driven content wins early, but sustaining audience interest requires refreshing the mix—especially as novelty wears off and the year progresses.

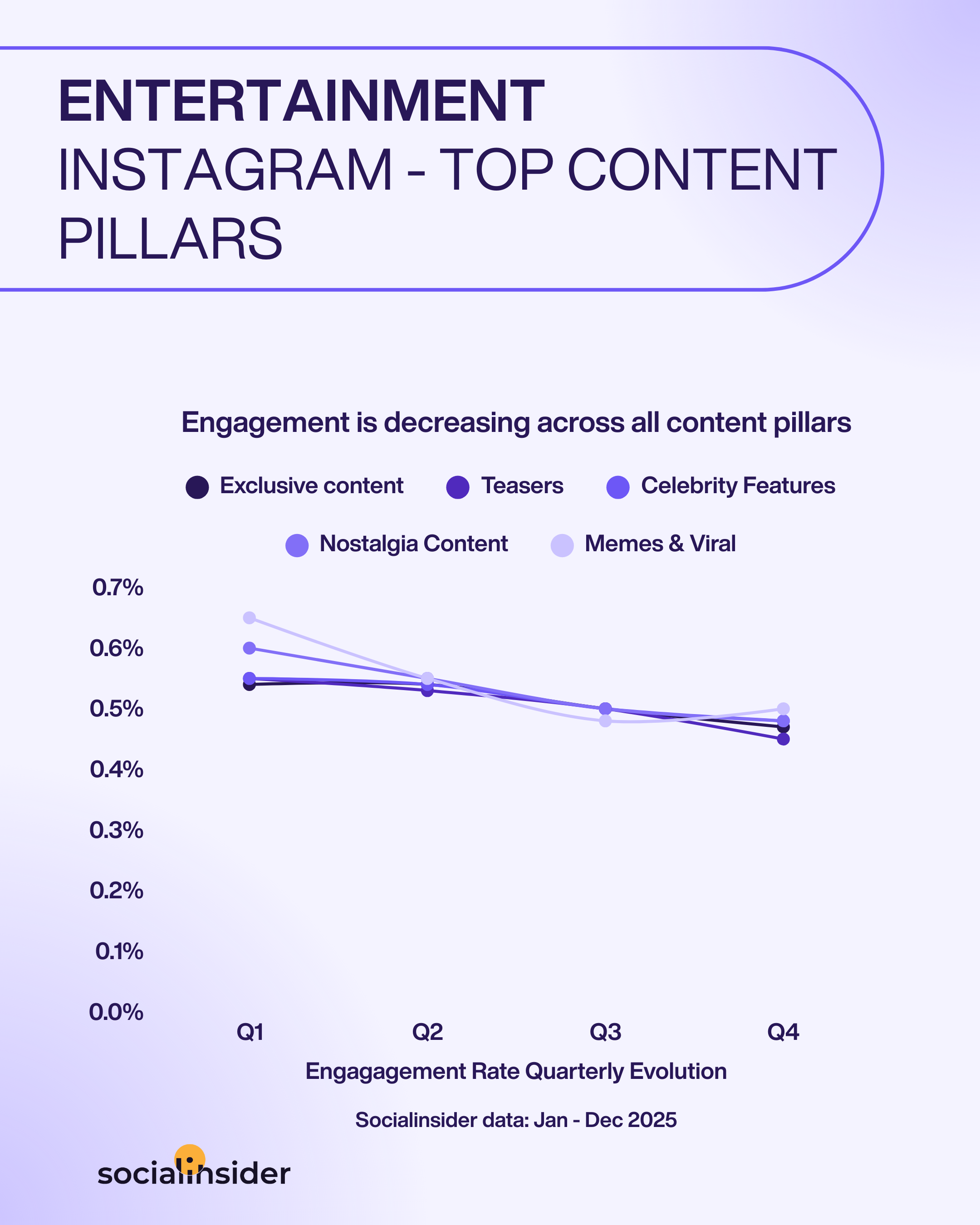

Instagram content trends for the entertainment industry

Instagram engagement for entertainment brands was especially strong at the start of 2025, with memes, viral moments, and nostalgia content generating the highest excitement.

Audiences clearly enjoyed sharing laughs and tapping into retro vibes, all while being drawn to teasers and exclusive glimpses behind the scenes. As the year moved forward, engagement figures edged downward, but consistently performing content pillars such as nostalgia and memes remained favorites, even as newer posts competed for attention.

The softer Q4 results suggest the need for fresh creative formats to keep feeds lively, but overall, Instagram’s visual-first format keeps entertainment audiences coming back for content that entertains, surprises, and connects to pop culture moments.

FMCG - Food content trends

Facebook content trends for the FMCG - food industry

Throughout 2025, FMCG food brands on Facebook experienced a dynamic engagement pattern. The year began with stable rates across all pillars, with nutrition tips drawing steady interest. Engagement rates dipped modestly in Q2, consistent with typical seasonal fluctuations. By Q3, educational posts and sustainability content saw a notable uptick—likely driven by seasonal campaigns or back-to-school wellness initiatives.

However, Q4 recorded the sharpest decline across every content type, reflecting a common year-end slowdown as consumer focus shifted elsewhere. The data suggests that while a mix of informational, user-driven, and lifestyle content performs well, brands need to refresh their approach and introduce new incentives in the later part of the year to combat engagement fatigue.

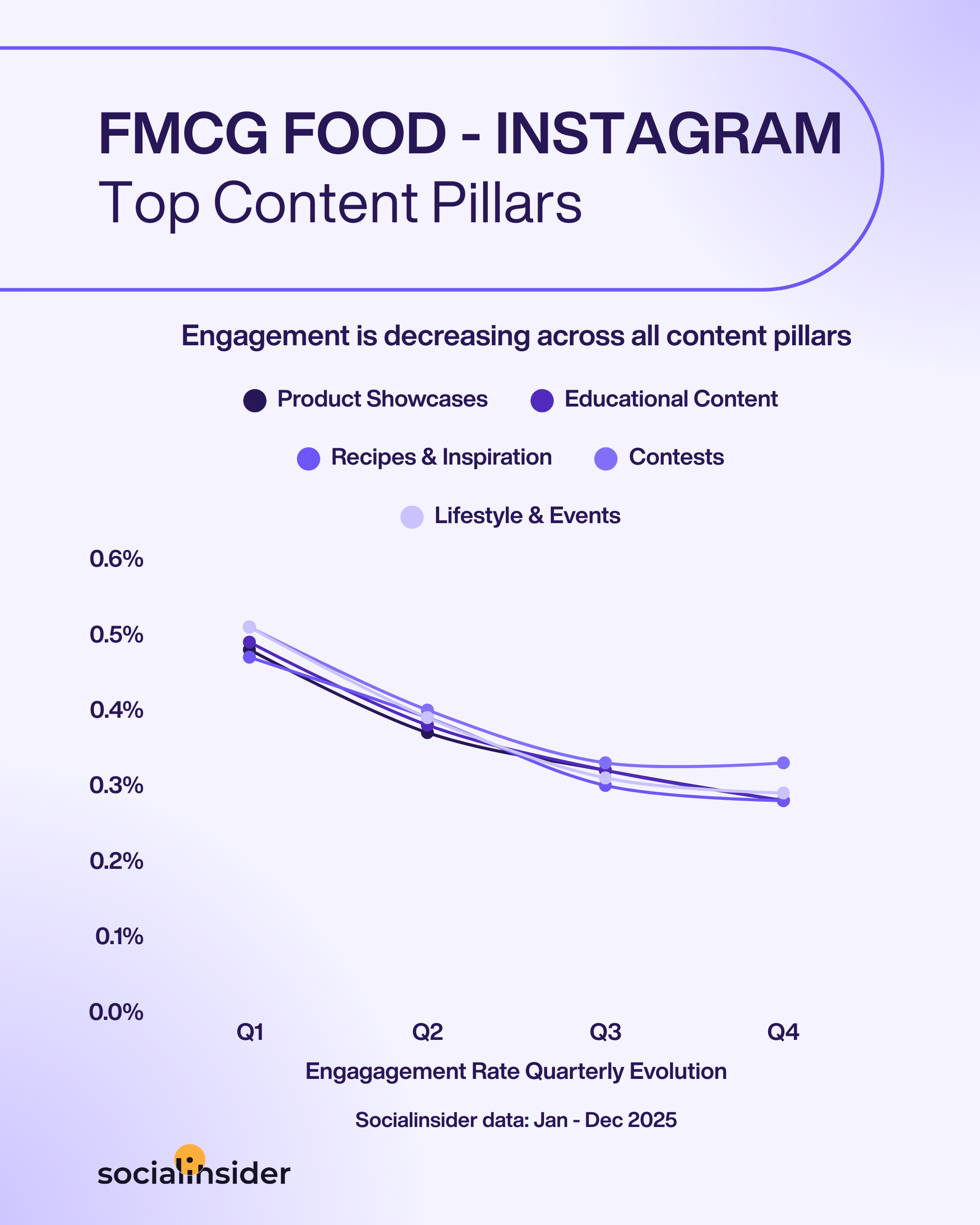

Instagram content trends for the FMCG - food industry

For FMCG food brands on Instagram, 2025 started on a high note with strong engagement for lifestyle and events-related content. As the year progressed, engagement gradually declined, hitting lower levels by Q4 across all types, with contests and giveaways remaining the best performing content format, thanks to their highly interactive nature. These results signal the need for consistent innovation and timely campaigns to keep engagement from slipping as the year advances.

FMCG - Beverages content trends

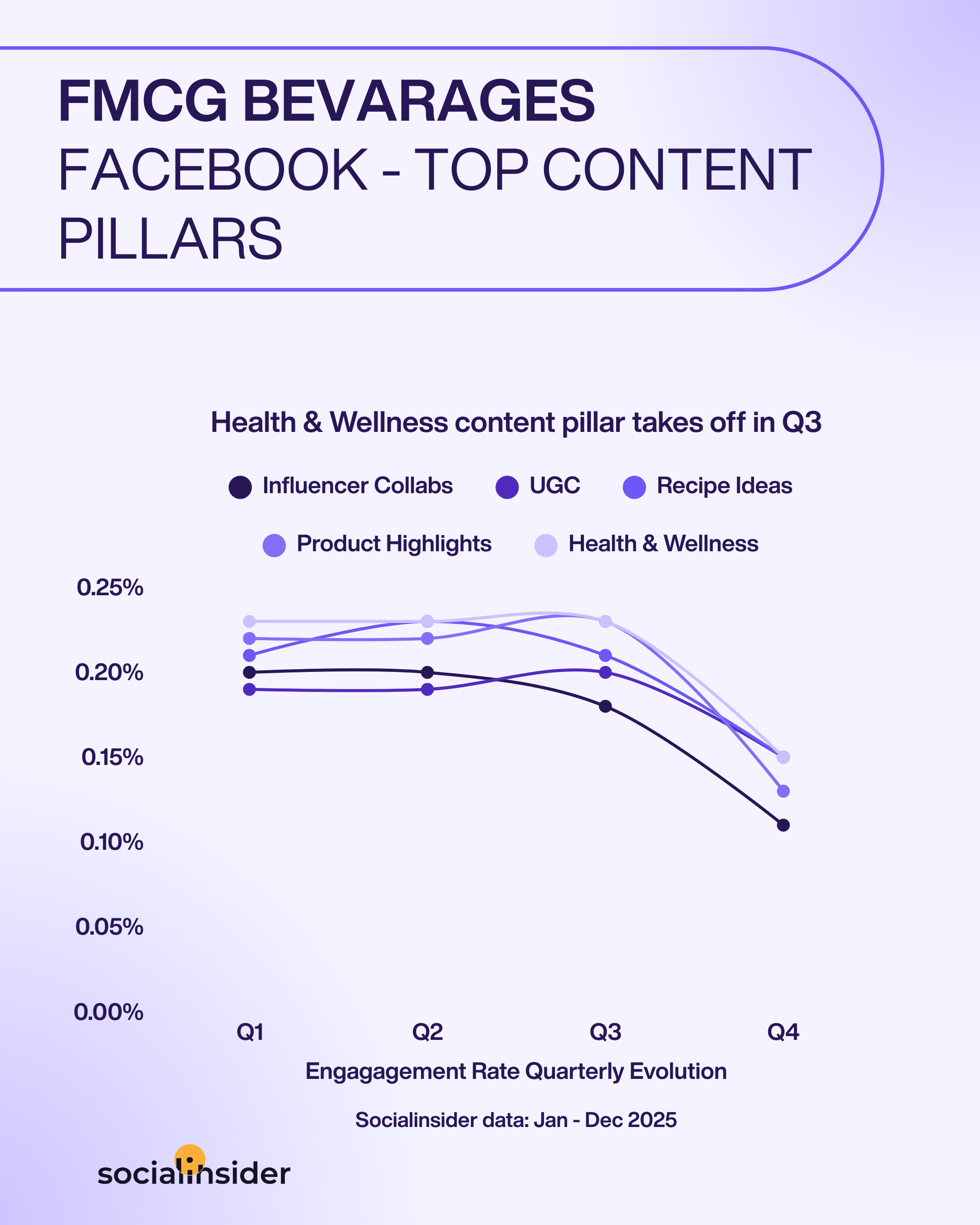

Facebook content trends for the FMCG - beverages industry

Throughout 2025, FMCG beverage brands on Facebook experienced fairly steady engagement for most content pillars in the first three quarters. Health & wellness benefits, were consistent favorites, reflecting an ongoing audience interest in a healthy fifestyle.

However, the last quarter of the year brought a sharp decrease across the board, particularly in collaboration-related posts. Q4’s dip suggests that as the year turns toward the holidays, beverage audiences may become saturated or distracted, making it more challenging for brands to maintain top-of-mind interest.

Overall, the data indicates that while educational content works well most of the year, brands need to find creative ways to keep engagement strong as end-of-year fatigue sets in.

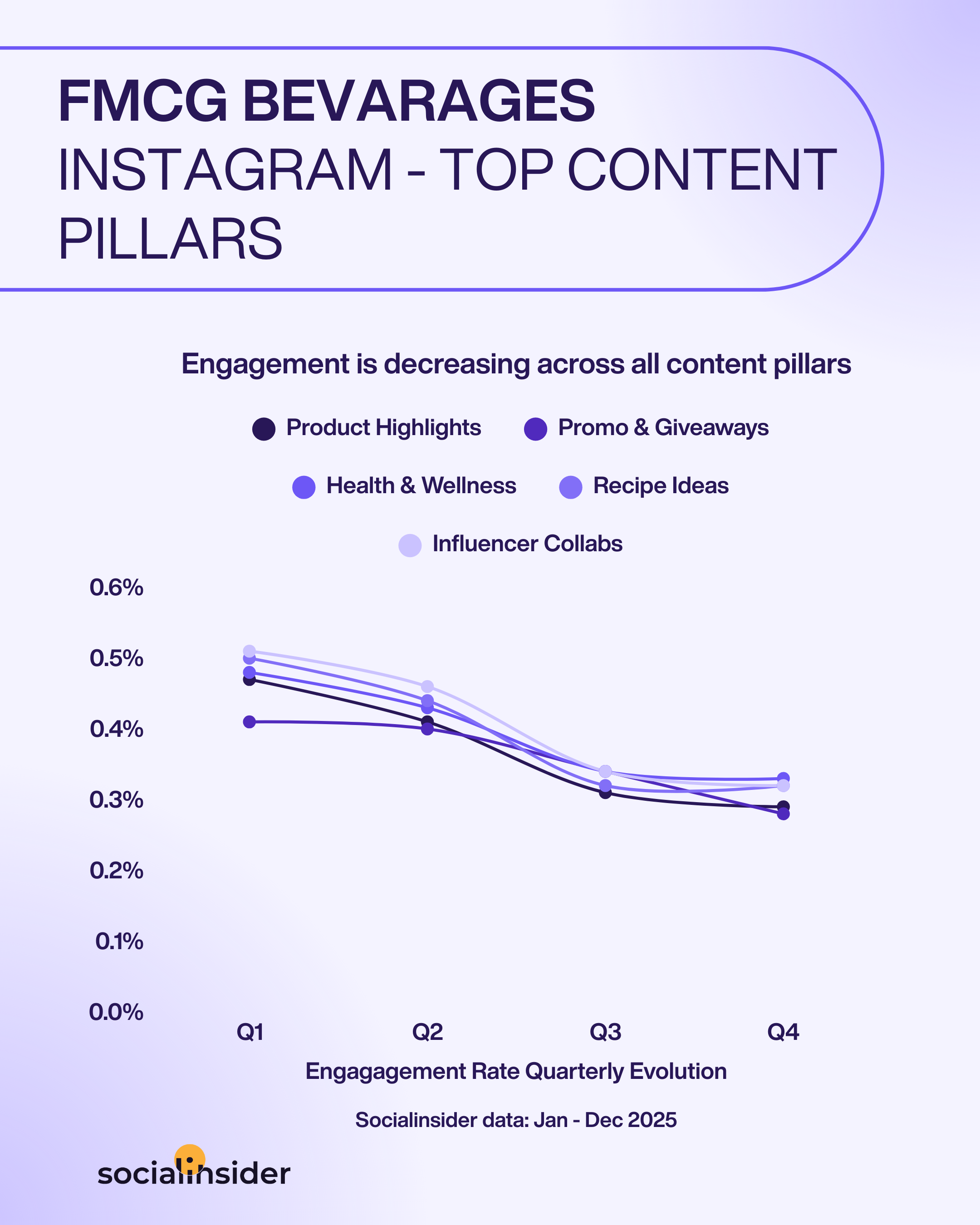

Instagram content trends for the FMCG - beverages industry

On Instagram, beverage brands started 2025 with high engagement across all content pillars, especially for influencer partnerships, creative recipes, and wellness-related posts.

As the year progressed, engagement gradually declined, dropping most noticeably after Q2. Despite the softer numbers, content highlighting wellness benefits and collaborations—especially with influencers—remained resilient, signaling that audiences continue to value authenticity and inspiration.

By Q4, the drop leveled off, suggesting a new baseline where only the most dynamic posts manage to sustain attention.

The pattern points to the importance of ongoing product innovation, partnership-driven content, and wellness messaging for brands aiming to keep their Instagram communities engaged all year long.

Fashion & apparel content trends

Facebook content trends for the fashion industry

Fashion and apparel brands on Facebook saw modest engagement in 2025, with all content pillars performing at relatively similar levels throughout the year.

Early on, new collections, seasonal collections resonated slightly more, but engagement dipped softly in the spring and again toward the end of the year.

Notably, there was a small lift for vintage and retro content in Q3, likely as brands leaned into nostalgic trends during late summer and fall fashion cycles.

By Q4, however, engagement for all categories reached their lowest points—signaling a need for renewed creativity to keep audiences’ interest during the busy holiday shopping season. The consistency of lower engagement across the board suggests that audiences expect fresh takes and innovative content to break through the noise on Facebook.

Instagram content trends for the fashion industry

On Instagram, fashion and apparel brands saw stronger audience engagement overall—especially with sustainability-focused content in Q1.

Engagement softened as the seasons progressed, with every pillar seeing a gradual decline through Q4. By the end of the year, engagement with online shopping experiences and trend-focused posts was noticeably lower, reinforcing the idea that constant innovation is needed to hold audience attention in this fast-paced industry.

Notably, sustainability remained one of the top-performing themes, indicating an ongoing shift in consumer priorities. Brands that paired fresh visuals with relevant values and evolving trends were best positioned to keep their communities engaged across the year.

Health & fitness content trends

Facebook content trends for the fitness industry

In 2025, health and fitness brands on Facebook saw engagement fluctuate around a multitude of content pillars, such as collaborations, nutrition habits or gym tips.

The first quarter set a positive tone, with collaborations and home fitness ideas drawing notable attention. Spring saw a lift in engagement for practical tips, like nutrition, home workouts, and gym advice, likely tied to seasonal wellness resolutions and new routines.

By Q4, engagement across all topics softened further, reflecting the perennial challenge of keeping audiences motivated as routines wane and holiday distractions grow.

This trend highlights the ongoing need for fitness brands to re-energize their communities year-round—specifically with fresh, interactive challenges and accessible advice that fits seasonal shifts in motivation.

Instagram content trends for the fitness industry

On Instagram, health and fitness brands maintained impressive engagement throughout 2025, with collaborations leading all pillars, especially at the start of the year.

Spring and summer brought a gentle softening, but by Q4, the numbers remained high compared to most other industries, with workout content stabilizing and even seeing a slight late-year boost.

These results confirm that Instagram audiences connect deeply with content that brings personality, expertise, and relatability—from trainers, influencers, and brands alike.

Healthcare & pharmaceuticals content pillars

Facebook content trends for the healthcare industry

Healthcare and pharma brands on Facebook maintained steady engagement across almost all content pillars throughout 2025.

Patient stories and community health initiatives consistently performed well, reflecting audiences’ interest in real experiences and impactful programs.

The most notable decrease in interactions was over Q3, for company news-related content, pointing to the ongoing public appetite for more reliable wellness information.

Across all quarters, the differences between content types remained modest, suggesting that a well-rounded mix of wellness advice, and inspiring stories is most effective in keeping audiences informed and involved year-round.

Instagram content trends for the healthcare industry

On Instagram, healthcare and pharma brands saw engagement peak at the start of 2025 for all pillars—most notably with awareness campaigns.

While there was a gradual dip in engagement through Q3 and Q4, health campaigns and lifestyle-related content, highlighed the appeal of real-life impact. These trends reinforce the value of building trust and community through authentic, informative posts.

Hospitality & hotels content trends

Facebook content trends for the hospitality industry

In 2025, hospitality and hotel brands on Facebook found their audiences most intrigued by guest stories.

By summer, all pillars showed steady performance, with guest stories and local experiences maintaining their appeal into Q3. However, engagement softened in Q4 for most themes except guest experiences, which remained a reliable performer through the year’s close.

Overall, these results highlight the timeless value of personal guest stories, immersive experiences, and timely, location-driven content to keep travelers and guests engaged throughout the year.

Instagram content trends for the hospitality industry

Hospitality and hotel brands saw a strong start to 2025 on Instagram, with guest experiences leading engagement across Instagram as well. A notable surprise here was that local attractions attracted increased attention during Q3, swocasing the need for authentic experiences.

Engagement across all pillars fluctuated as the year progressed, but guest stories remained the greatest performer overall.

The data points to the ongoing importance of combining unique experiences, with local attractions, and a strong narrative voice to keep the hospitality community engaged and inspired, no matter the season.

NGOs content trends

Facebook content trends for NGOs

NGOs on Facebook in 2025 saw engagement rates build momentum in the first half of the year, peaking in Q2 for posts on peace initiatives, climate advocacy, and human rights.

These trends suggest a strong audience appetite for mission-driven stories and tangible impact—particularly as global awareness days and campaigns rolled out in spring.

The third quarter maintained solid engagement, though the upward trend leveled off slightly. By Q4, however, engagement dipped to its lowest levels of the year in every content category, highlighting a common challenge for NGOs: sustaining attention and action as the year winds down.

The data underscores how periodic highlights of impact, fresh advocacy, and milestone celebrations can help organizations rally their communities, though new strategies may be needed to energize audiences in the final months.

Instagram content trends for NGOs

On Instagram, NGOs achieved high engagement at the start of 2025, with peace initiatives, human rights, and impact stories all resonating deeply with audiences.

Climate advocacy and fundraising posts also drew significant interaction, reflecting the platform’s strength in amplifying social causes visually and emotionally.

Engagement remained robust into Q2, but a gradual decline set in during the second half of the year.

By Q4, while numbers had softened, fundraising and advocacy content continued to outperform, suggesting that timely campaigns and transparent storytelling keep communities involved and motivated.

The data highlights the importance of using Instagram for high-impact, shareable storytelling—putting faces and stories to causes, especially when momentum naturally wanes in the year’s final stretch.

Restaurants & cafes content trends

Facebook content trends for the horeca industry

For restaurants and cafes on Facebook in 2025, engagement started off balanced across most content types, with recipes, food presentations, and event announcements performing slightly stronger in Q1.By spring, rates eased somewhat, but food presentation held steady, being the top performing content pillar at the moment.

Over Q3, there was a significant increase in engagement for healthy food options, showcasing how audiences pay special attention to their eating habits before winter, when the harvest is the most abundant, trying to add balance before the holiday spirit kicks in.

By Q4, all pillars recorded their lowest engagement of the year—especially for special events. This decline signals the challenge of keeping audiences engaged late in the year and points to the importance of refreshing content and leveraging interactive campaigns.

Instagram content trends for the horeca industry

On Instagram, restaurants and cafes enjoyed strong engagement during the first part of the year, with all content pillars—recipes, events, food presentations, and healthy options—performing nearly equally well in Q1.

As the year continued, engagement levels gradually softened, with a steady decline across spring and summer.

Notably, recipes and signature dishes maintained relatively higher rates even as others declined, indicating a sustained appetite for culinary creativity and presentation.

In Q4, cultural content remained resilient compared to other pillars, highlighting the value of educational and visually rich posts in inspiring audiences as the year closes.

Retail content trends

Facebook content trends for the retail industry

Retail brands on Facebook started 2025 with notable engagement around customer reviews, brand values, and in-store experiences—demonstrating the appeal of authenticity and personal connection.

Spring and summer months saw a bump for UGC and product highlights, with Q2 and Q3 marking the strongest quarters for these content pillars. These periods likely reflect seasonal purchases, new product drops, and the power of community storytelling.

However, by Q4, all engagement rates dropped, with UGC and reviews seeing the sharpest decline.

This year-end slowdown signals the challenge of maintaining momentum amidst holiday saturation and highlights the value of rotating content formats and spotlighting customer stories as ways to renew audience attention.

Instagram content trends for the retail industry

On Instagram, retail brands saw the strongest engagement at the start of the year, particularly for UGC, brand story content, and in-store experiences.

During Q2, audiences responded well to campaigns spotlighting community involvement and new product moments. Also, engagement dippedespecially for brand narrative posts, but recovered somewhat by Q3 as themed campaigns and user stories regained traction.

The pattern points to the continued importance of engaging customers in both physical and digital spaces while capturing the authentic moments that foster ongoing loyalty, done through UGC for example.

Technology & software content trends

Facebook content trends for the software industry

In 2025, technology and software brands on Facebook saw engagement rates begin at modest levels and remain fairly steady, with slight gains mid-year. New launches drew the highest engagement, particularly in Q1 and Q3, reflecting audience excitement around innovation cycles and fresh tech offerings.

However, Q4 saw engagement slide back to lower levels for every pillar, possibly due to the saturation of year-end announcements as well as holiday distractions.

These patterns highlight the ongoing necessity for tech brands to synchronize their biggest reveals and innovations with moments when their communities are most receptive, while also keeping content practical and forward-looking as excitement ebbs in the final quarter.

Instagram content trends for the software industry

On Instagram, 2025 brought strong engagement for technology and software brands, especially for product updates and tutorials. Q1 set a high benchmark as audiences looked for the inside scoop on new tech and practical how-tos.

Engagement tapered gradually through the year, with a more noticeable dip in Q3 and Q4, but tutorials and product updates continued to stand out by year’s end.

This sustained interest in actionable, easy-to-digest content reflects Instagram audiences’ preference for visually engaging, educational, and news-driven tech posts.

Overall, brands that mixed up timely reveals, accessible insights, and guidance positioned themselves best to build loyalty and excitement—even as broader industry buzz quieted in the final months.

Telecom content trends

Facebook content trends for the telecom industry

For telecom brands on Facebook in 2025, engagement started on a high note for corporate responsibility while technology and product launches saw more modest interest.

The first quarter emphasized how trust and transparent practices drive conversations in this sector. Engagement dropped across nearly all pillars in Q2, aligning with a typical seasonal lull, though industry news maintained steady attention.

A noticeable recovery for technology and product launch content appeared in Q3, likely reflecting back-to-business cycles and new service rollouts, before a further decline settled in during Q4.

Throughout the year, corporate responsibility remained a key engagement driver for telecom audiences, pointing to the growing importance of values-driven storytelling.

These trends suggest that while seasonal and product-focused content remains crucial, maintaining trust and demonstrating broader impact are essential for standing out in the competitive telecom landscape.

Instagram content trends for the telecom industry

On Instagram, telecom brands saw robust engagement around industry news, security, and corporate responsibility at the start of 2025. Notably, security and privacy posts outperformed technology and product updates, highlighting a strong audience desire for reassurance and clarity in a fast-moving digital space.

Engagement softened incrementally by Q2 and continued to slide through Q3, except for a brief lift in product launches during the spring.

As the year drew to a close, corporate responsibility saw another uptick, reclaiming attention and underscoring the ongoing priority of social and ethical values for this audience.

Industry news and trends remained steady performers across the year, proving the value of timely, informative updates. Overall, these trends reinforce the importance of aligning visually engaging and educational content with key trust and responsibility themes, especially when product cycles or seasonal effects make it harder to keep audiences engaged month after month.

Travel content trends

Facebook content trends for the travel industry

Travel brands on Facebook in 2025 saw the strongest engagement at the beginning of the year, with family & group travel and promotional content drawing the most attention as audiences started planning their next getaways.

By spring and summer, a decline set in across all categories, with travel tips and destination spotlights seeing the gentlest drop—evidence that evergreen advice and inspiration continued to hold some audience interest.

Q3 and Q4 marked the lowest points of the year, likely due to market fatigue, changing travel patterns, or shifting priorities as holidays approached.

The data suggests that while seasonal spikes in wanderlust can ignite audience activity, travel brands must adapt their storytelling and incentive-driven content to retain attention as the year winds down.

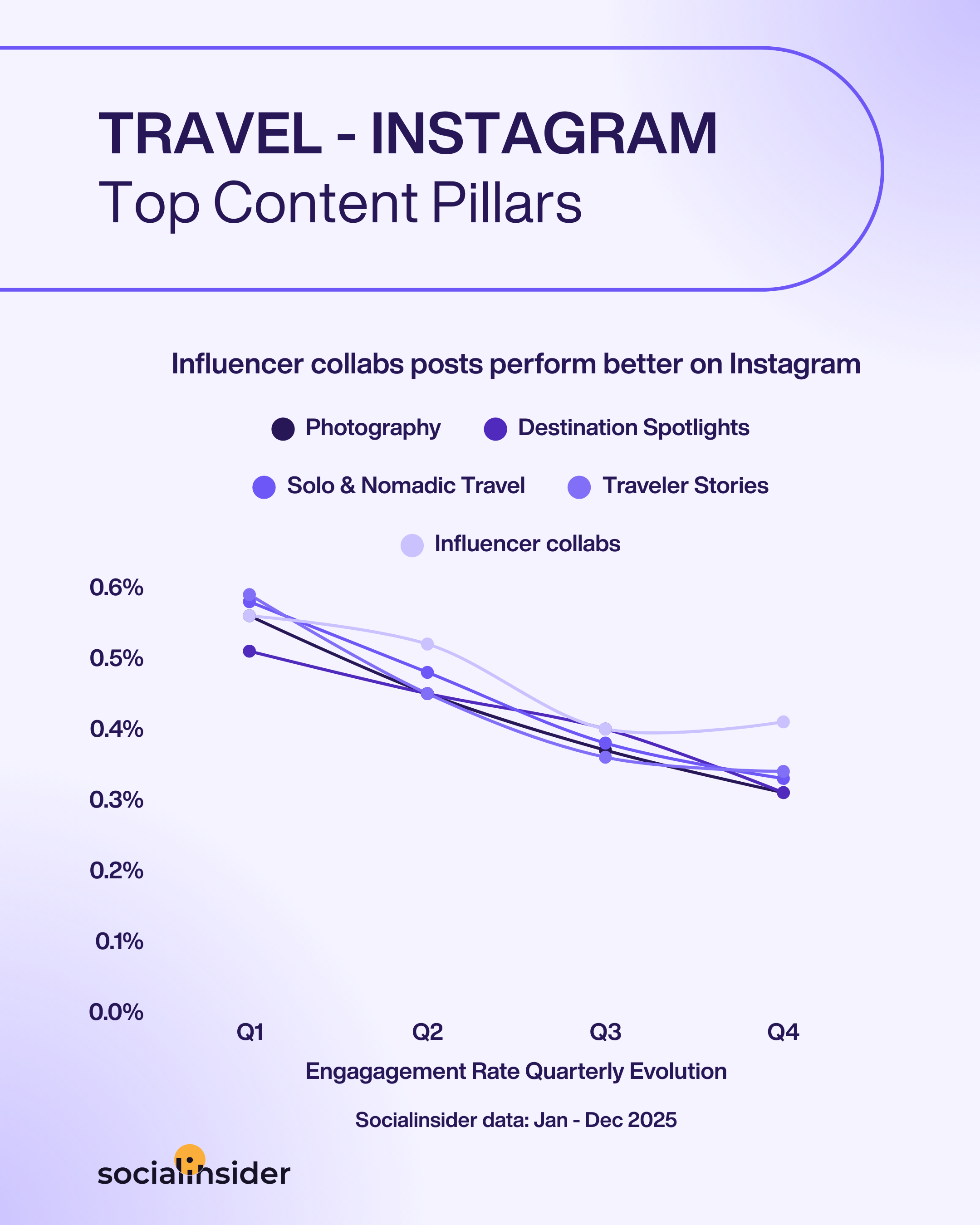

Instagram content trends for the travel industry

Travel brands on Instagram demonstrated vibrant engagement at the start of 2025, with traveler stories and solo adventures performing exceptionally well. Audiences flocked to content that both inspired new journeys and showcased aspirational experiences, while influencer collaborations added further momentum.

Through the year, engagement gradually dipped across all themes, but influencer content retained relative strength late into Q4, reflecting ongoing trust in peer recommendations and experiential storytelling.

Although all pillars softened by year’s end, visuals and personal stories continued to spark meaningful interaction.

These trends highlight the ongoing power of inspirational, beautifully curated travel content, but also signal the need for travel brands to refresh their approach as audience wanderlust ebbs and flows with the seasons.

Methodology

The findings of this study are based on the analysis of 23M Facebook posts and 33M Instagram posts from brands belonging to the mentioned industries and that had an active presence across Facebook and Instagram between January - December 2025.

Analyze your competitors in seconds

Track & analyze your competitors and get top social media metrics and more!

Ready to improve your social media strategy with real-time insights?

Get strategic insights, analyze the social performance across all channels, compare metrics from different periods and download reports in seconds.