How to Run an In-Depth YouTube Competitor Analysis: Tips and Tools That Will Help You Achieve Greater Growth

Learn how to run an insightful YouTube competitive analysis with our in-depth guide. Discover tips and tools that will help you get better growth.

YouTube marketing is a lot of work and a pinch of luck: you post, you tweak, you analyze, you hope for the best. And sometimes, the results just don’t match the effort. When that happens, I drop the lucky charm and turn to data — specifically, to what my competitors are doing.

A YouTube competitor analysis is one of the quickest ways to understand what works in your niche, what your audience responds to, and where your own video marketing strategy might need a little extra love.

I’ve put together a simple step-by-step guide to walk you through the entire process. Read on to learn how to analyze your competitors’ YouTube content, spot opportunities, and turn all that research into practical moves for your own channel!

Key takeaways

- YouTube competitor research helps you spot what your channel is missing, find fresh content ideas, and benchmark your performance with more accuracy.

- Keep your competitor list focused. Five to seven channels are enough if you mix direct, indirect, and aspirational competitors of different sizes.

- Analyzing competitor content goes beyond likes and views. It includes reviewing content pillars, SEO tactics, storytelling choices, formats, and more to improve your channel’s visibility.

- Competitor monitoring is an ongoing task. A social media analytics tool like Socialinsider makes it easier to track performance, compare channels, and maintain a consistent workflow.

How can competitive analysis help channel growth?

Growing your YouTube channel can feel like a challenge, especially when you’re putting in the work but not seeing the results you want.

That’s where competitive analysis comes in. By looking at what others in your industry are doing—especially those who are seeing real success—you can pick up on strategies that actually work with your audience. It’s a way to spot new ideas, avoid common missteps, and stay aligned with what viewers want.

In the end, learning from those who are already winning can help you adjust your strategy and boost your own channel’s growth.

Here are the ways in which running a competitive analysis can help you grow your brand on YouTube:

- Identify top-performing content and formats in your niche. This gives you an idea about what’s flying in your industry and inspires your own content strategy.

- Reveal gaps in your competitor’s offerings. Some of them are doing better than you, some are doing worse. But either way, keeping an eye on what they’re offering the audience can highlight new opportunities and underexplored topics.

- Spot visibility hacks. By analyzing your competitors’ content on YouTube, you can extract their main keywords, SEO tactics, and thumbnail techniques, which you can use to improve your own reach.

How to perform an insightful YouTube competitor analysis?

Analyzing your competitors on YouTube can feel daunting. Where do you start, what do you track, and which things are worth your attention?

Let me break it down for you in a simple and efficient 6-step guide to YouTube competitor analysis below:

Set goals for your analysis

Setting goals is always the first thing I do when I begin any sort of research, including YouTube competitor analysis.

I always start by asking myself: what kind of answers do I want eventually? Do I want content inspiration? Or examples of effective seasonal campaigns? Or maybe I want to benchmark the growth and see whether my channel is on par with similar channels?

That's because your goals will always define the YouTube metrics you’ll track and the nature of insights you’ll get.

Establish your competitor’s list

Before getting into a nitty-gritty analysis, like views, comments, or thumbnails, you need a solid list of who you’re actually comparing yourself to.

When it comes to YouTube, I usually choose competitors out of three big buckets:

Direct vs indirect competitors

Direct competitors are those who do what you do. Same industry, similar products, same target audience.

Say, you’re a fitness gear brand. In this case, other fitness brands posting home workout content are your direct competitors. You’re probably fighting for the same audience with more or less similar needs.

Indirect competitors, on the other hand, might not be selling the same stuff, but they still talk to your audience.

Think of sports coaches, personal trainers, or wellness influencers vs. fitness gear brand. Their content overlaps with your niche, and they influence what your potential customers are watching and expecting.

Aspirational brands

And then there’s a third type I always like to include in my list: aspirational brands.

These are the YouTube channels you look up to, not because they’re in your space, but because they’re crushing it.

They might have the most engaging editing style, creative formats, or top-notch storytelling. You might be a fan of their mascot or the way they use their brand ambassador in their content. Whatever they’re doing, it’s working, and you want it to work for you, too.

Even if you’re not directly competing with them, you can learn a lot just by watching what they’re doing right.

Set the key data points that you’ll track

Tracking every single move your competitors take? That’s a little excessive.

Instead, I recommend choosing specific YouTube analytics data points relevant to your goals and focusing on tracking them.

Here’s my list of the most useful all-rounders:

Audience growth patterns

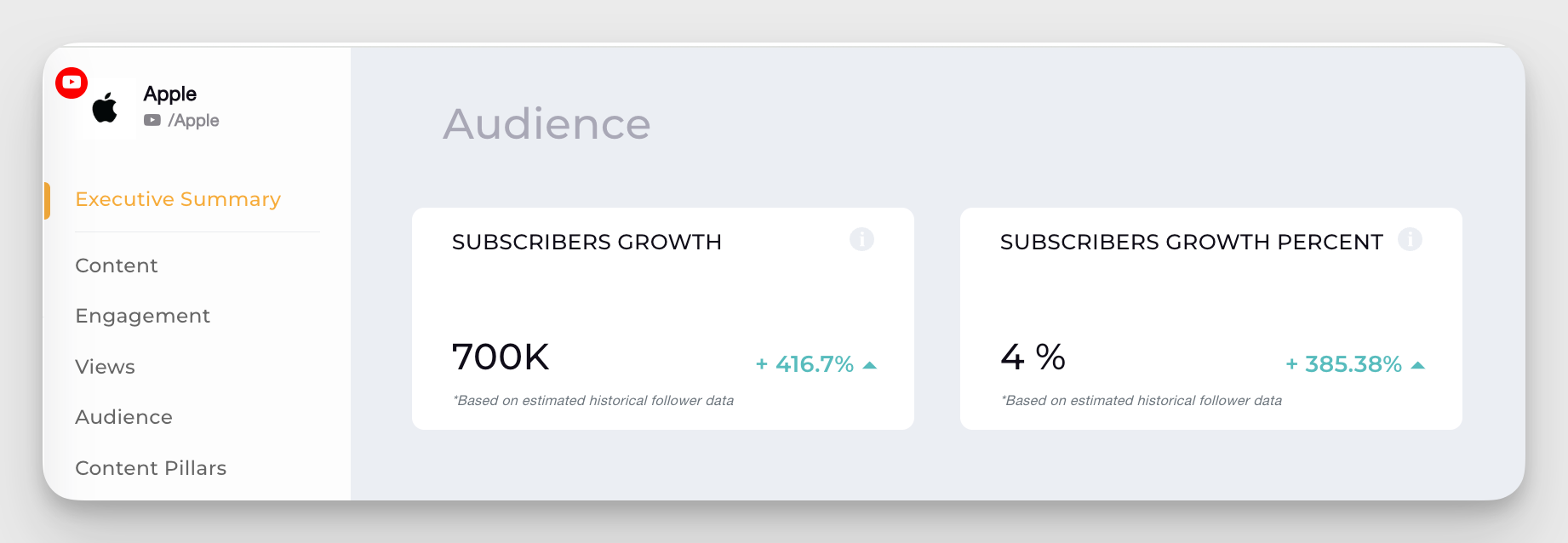

Subscriber count and growth rate aren’t just vanity metrics. They show you whether a competitor’s channel is growing and at what pace.

The key is to know your lane and watch how others are moving in it. Let’s say a competing brand is gaining 4% more subscribers every month. That’s a solid indicator of healthy growth.

If your channel is in a similar niche or has a comparable audience, that number can become a realistic benchmark for your own performance.

Now, if that 4% comes from Apple, and you’re not a multinational multi-billion-dollar tech company, that same number might serve more as a long-term goal than a fair comparison.

Engagement analysis

YouTube’s algorithm loves binge-watching. That’s why views and watch time are two of the most telling metrics in your competitor monitoring.

These numbers help me understand how well a channel is holding people’s attention. Are viewers sticking around? Clicking through to more videos? Does it affect other metrics somehow?

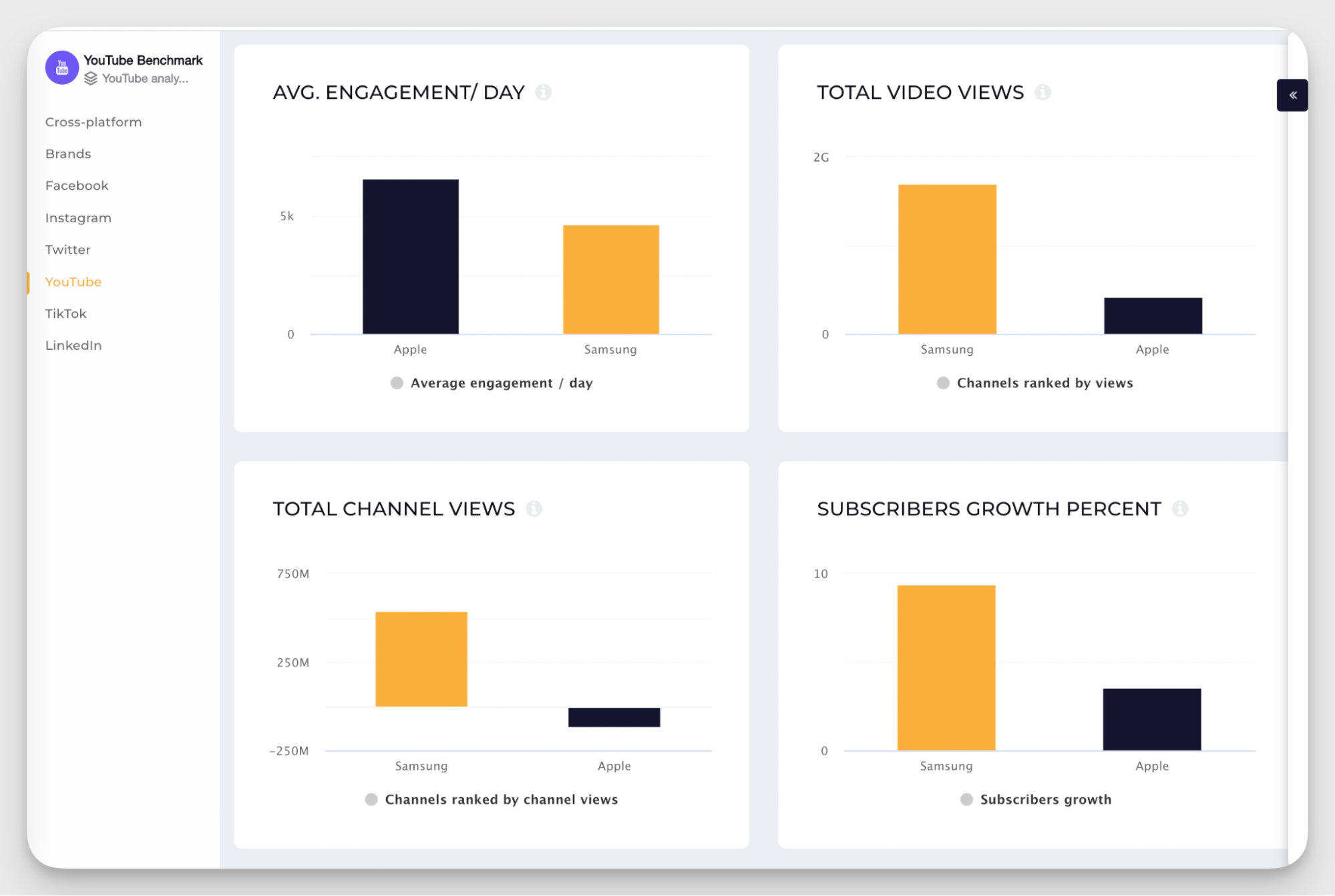

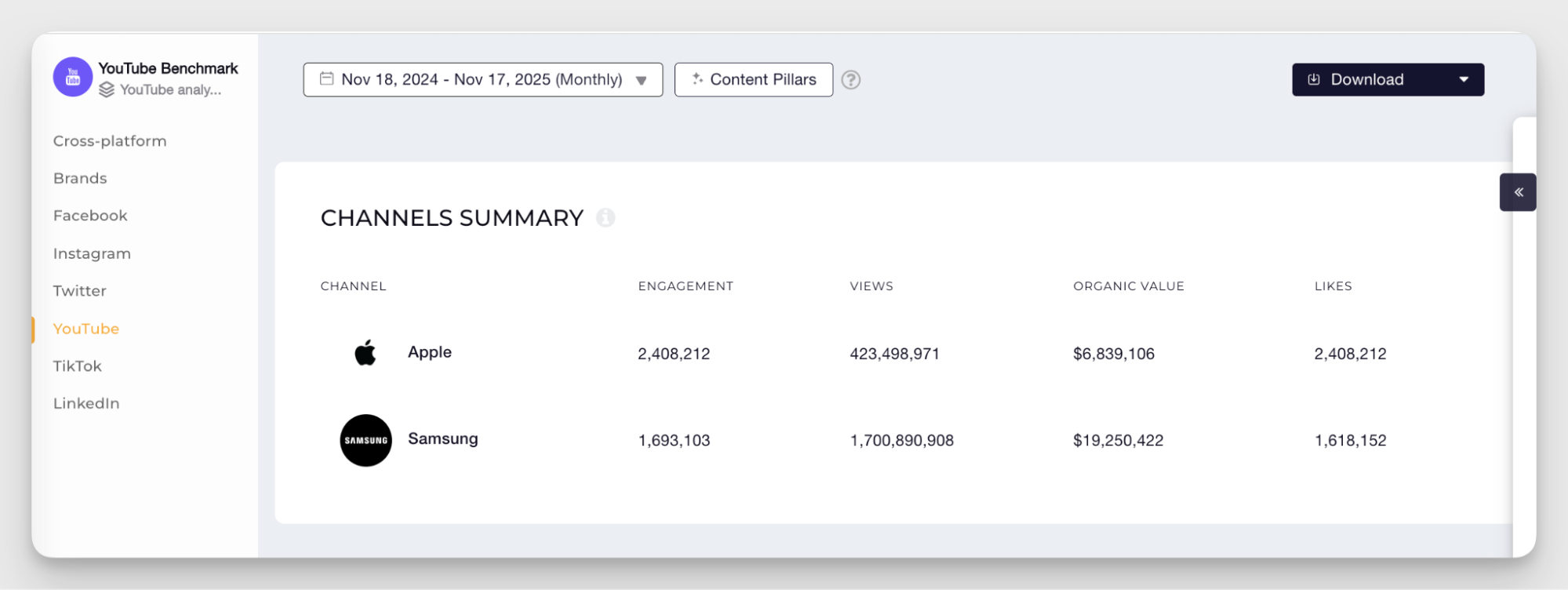

Check this out: Apple’s YouTube channel has over 20M subscribers, while Samsung has around 7.8M. And yet, Samsung’s total video views are significantly higher.

That means they’re getting more traction, more watch time, and likely more exposure across YouTube, even with a smaller audience. And this consistent visibility also fuels subscriber growth. In fact, Samsung is currently growing faster than Apple on the platform.

Besides that, we need to keep an eye on engagement data — likes, comments, and shares. These numbers give me a sense of how the audience is reacting to the content. Here, I look for patterns and correlations between engagement and other performance metrics, such as growth rate or view counts.

It gets easier to see the connections if you’re using competitor analysis tools like Socialinsider. You can select specific engagement metrics you want to track and compare multiple YouTube channels side by side in one dashboard.

Not sure whether you should focus on views or engagement in your specific case? Read more on how to choose your core metric in Socialinsider’s article.

Content approaches

Ultimately, content is the main thing that drives your brand’s performance on YouTube. Algorithms and thumbnails matter, but content is the dealbreaker.

If something’s working for my competitors, I want it too. And if it’s not, I look into why. Maybe they approached the topic or format the wrong way, and there’s still room for me to make it work. Or maybe it’s just an angle our shared audience doesn’t care for — in that case, I skip it altogether.

So I break content down from a strategic angle in two main steps:

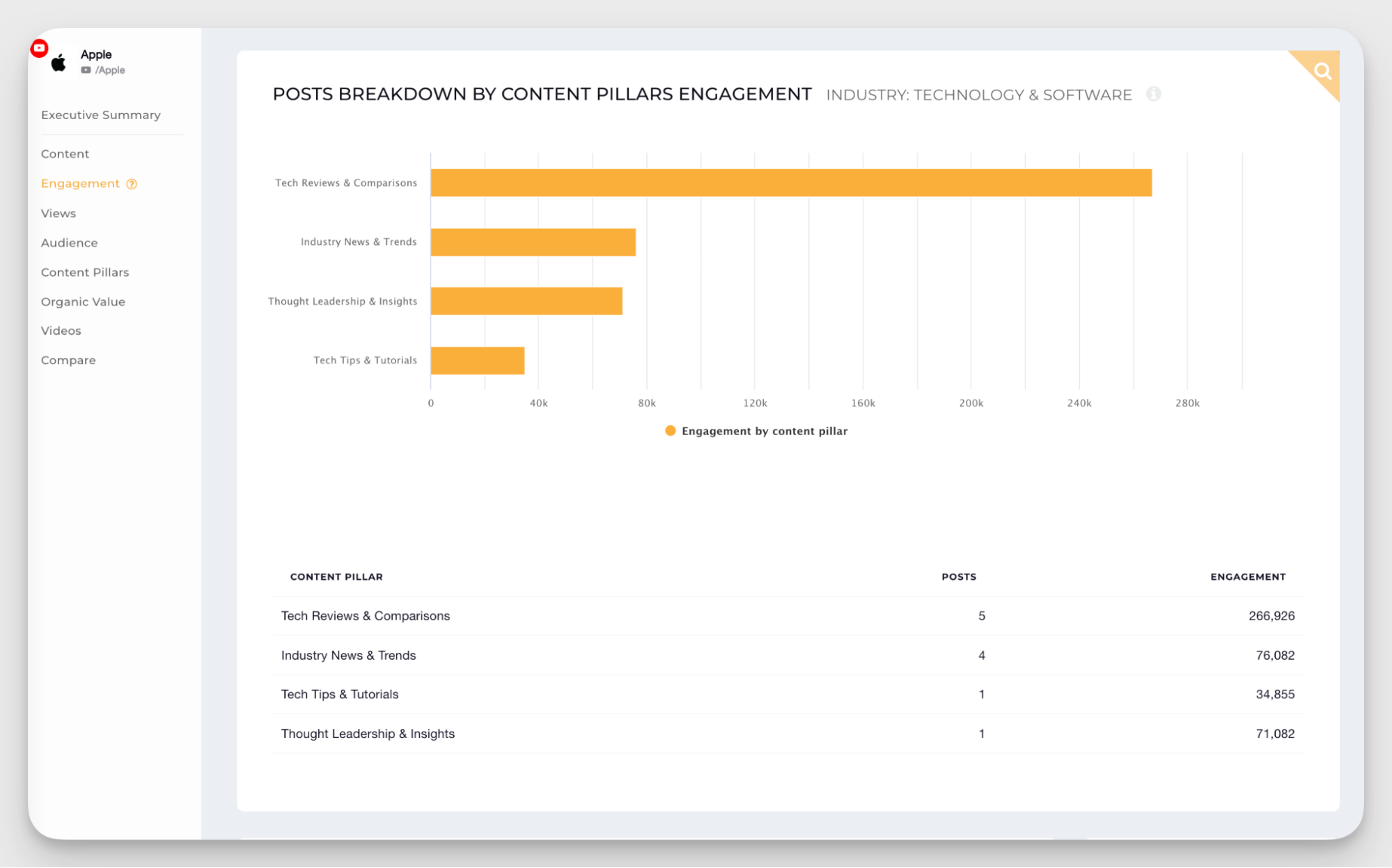

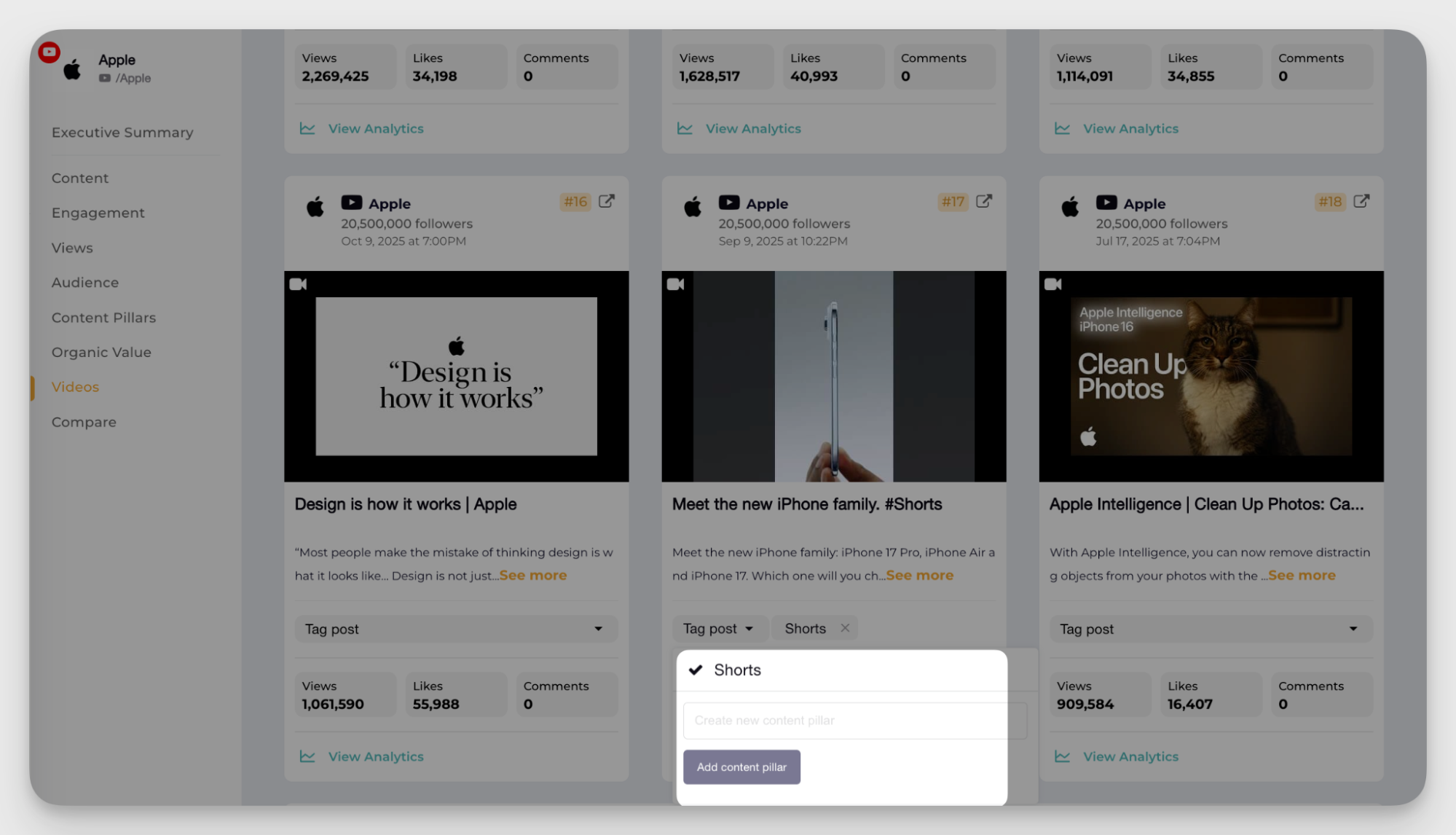

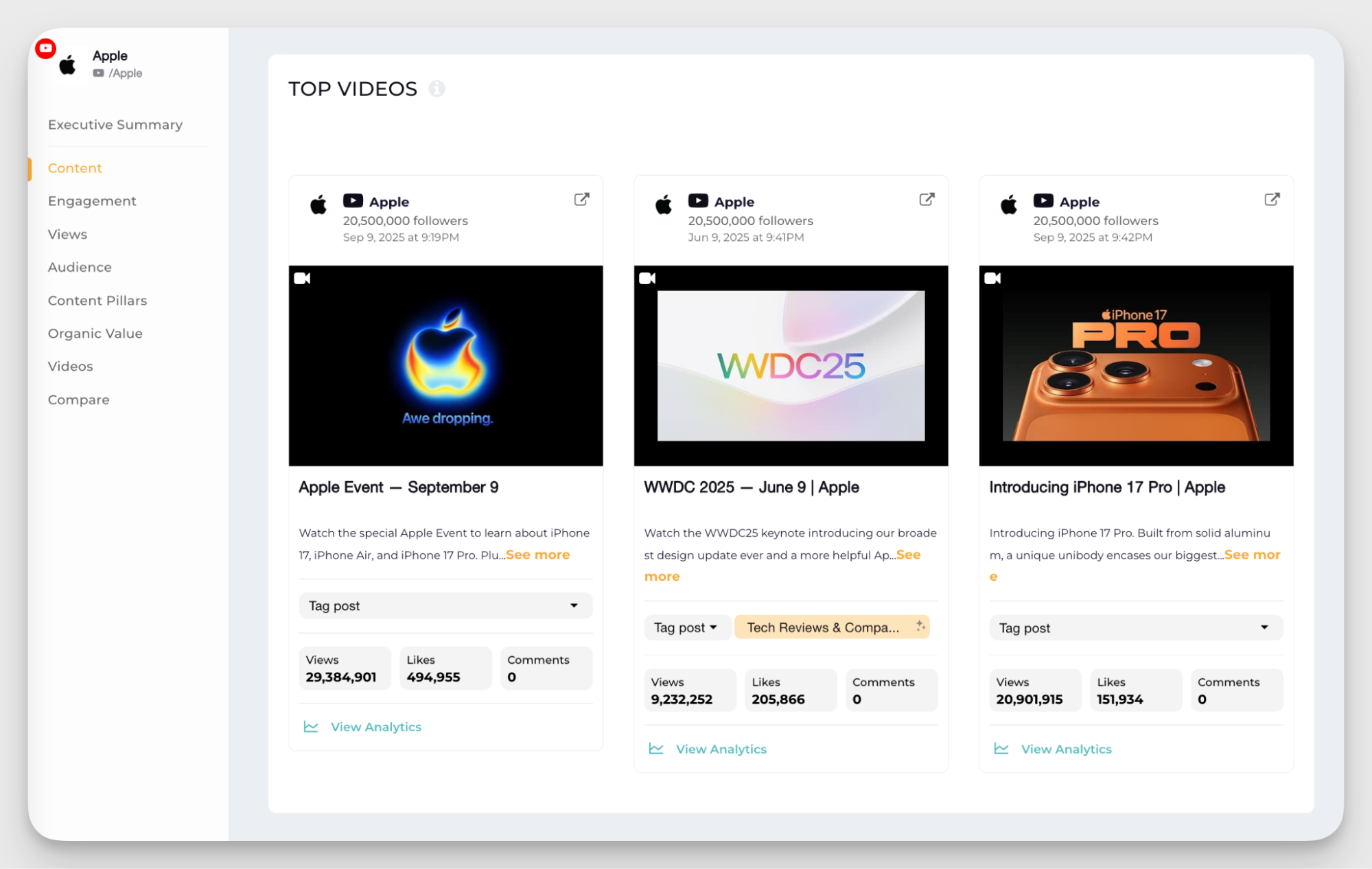

Step one is identifying the video topics that consistently perform better (or worse) than others. I analyze which content pillars my competitors use — interviews, how-tos, case studies, memes, testimonials — and compare their performance to see what drives the most engagement.

Socialinsider helps a lot here. You can look at each brand’s content pillars and see which ones perform best on your specific channel.

You also get access to industry-wide content pillar analysis, which shows what performs well in your niche overall.

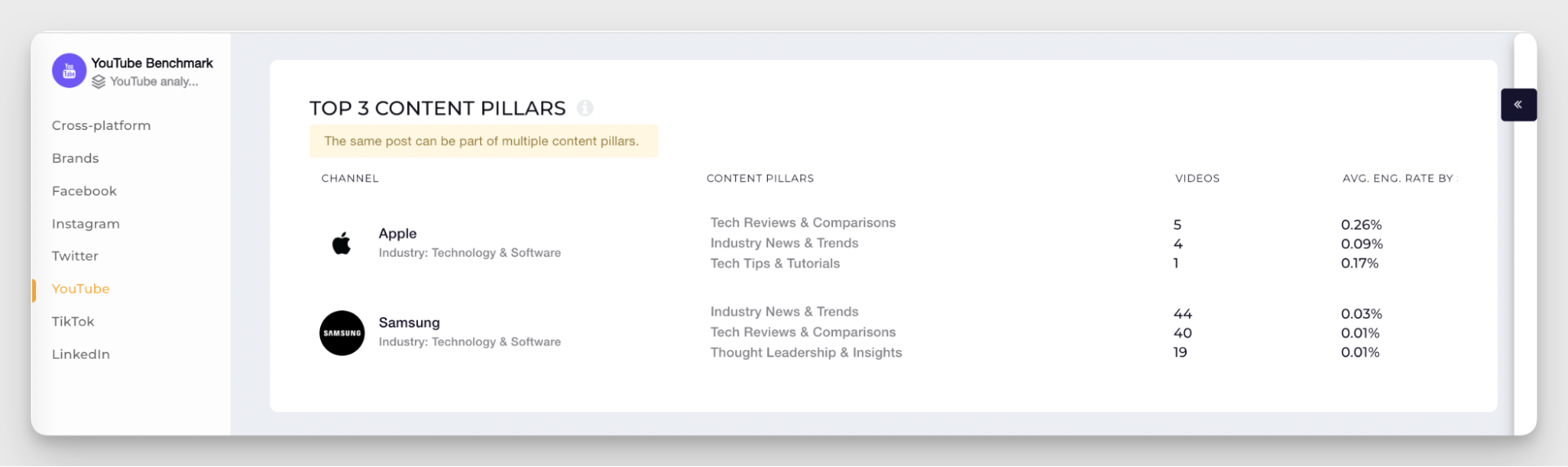

Back to Samsung and Apple example — see how both brands have similar top content pillars? But here’s the interesting bit: Apple posts less, and that “less is more” approach works. Judging by the engagement, their leaner strategy is more effective.

Step two is about analyzing the video formats.

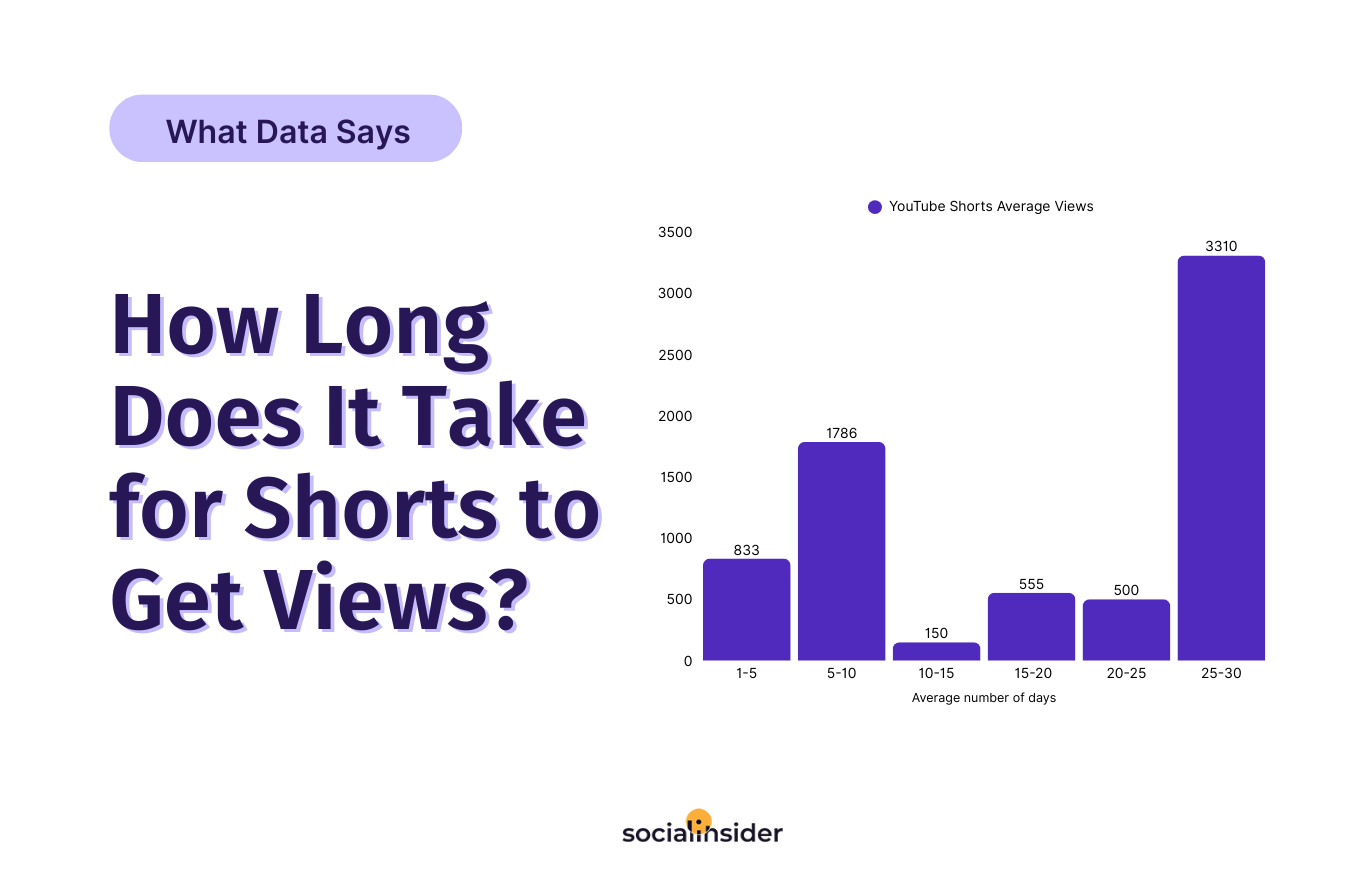

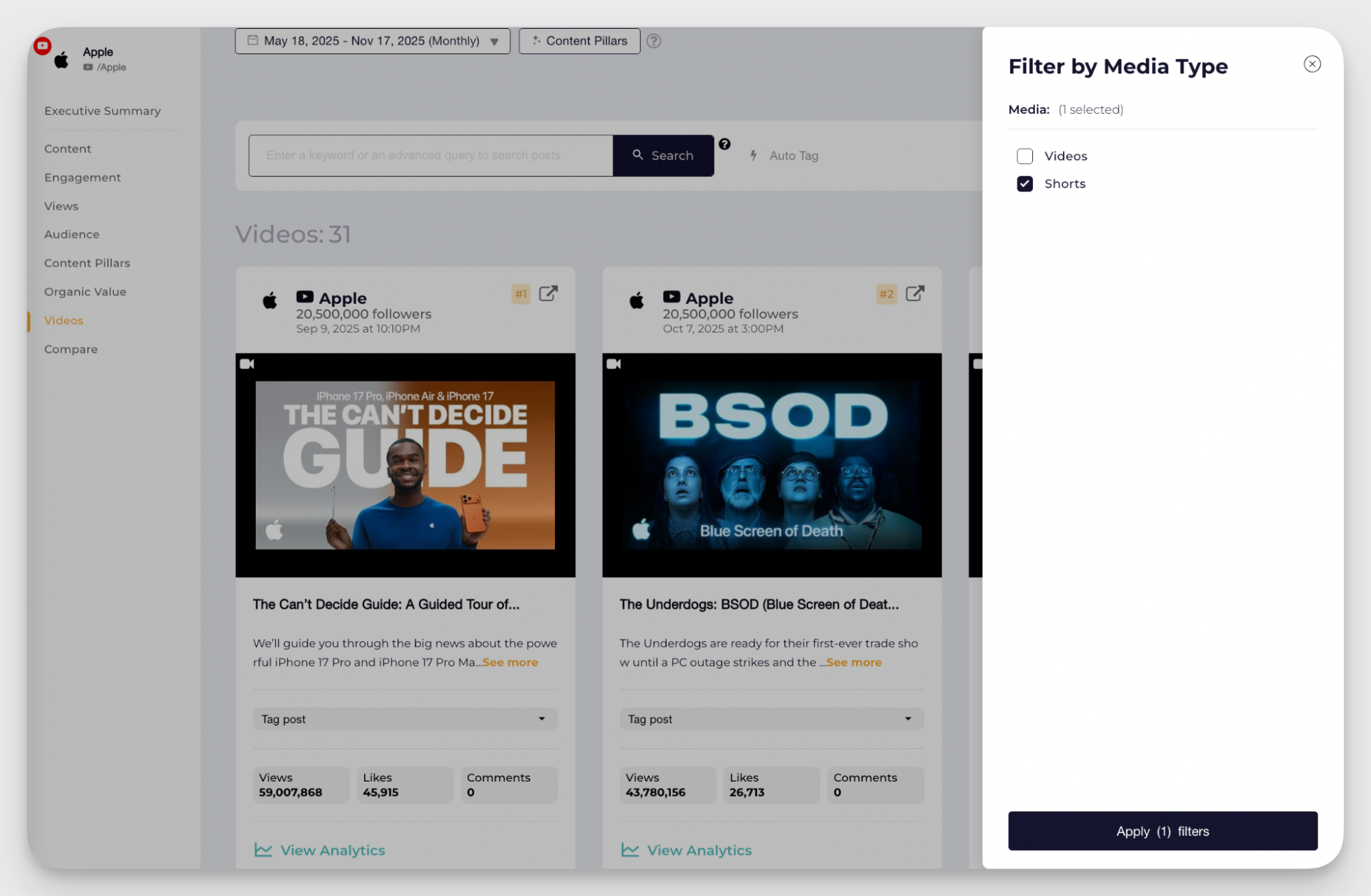

Long videos, when done right, perform incredibly well and drive serious watch time. Shorts, on the other hand, are ideal for top-of-funnel traffic. I always check what formats my competitors rely on most, how often they post them, and what results they’re chasing with each.

With Socialinsider, you can segment performance by content format, so it’s easy to compare long vs short-form performance across channels.

You can also tag Shorts manually as a content pillar and get aggregated data on their performance. Check out this YouTube Shorts analytics guide for more data hacks.

Explore qualitative insights

When I analyze the content my competitors post on YouTube, I don’t just look at numbers. I dig into how they present their content, how they structure it, and how they speak to their audience, too.

This qualitative data can explain why their videos are gaining more views or their channel is growing faster.

I divide my qualitative research into four main groups based on what kind of video tips they can give me:

Content presentation and storytelling

This group helps me understand how top-performing videos are structured, framed, and designed to keep attention. It doesn’t have to be about the content itself, but rather the form it takes.

- Video framings and storytelling techniques. Are they using jump cuts, first-person storytelling, humor, or emotional pull? I analyze how the story unfolds and what hooks keep people watching.

- Title formulas and keyword patterns. Are the titles specific and descriptive or more clickbait-y and ambiguous? Do my competitors use numbers, questions, or viral hooks? These patterns give insight into what drives clicks in that niche.

- Thumbnail styles that generate action. I look at text vs no text, colors, facial expressions, consistency, and branding. Thumbnail is among the most decisive factors for whether some’s going to watch a video or not, so knowing what performs helps improve the CTR.

A good way to gather these insights is to look at the top-performing videos of each competitor and find patterns that unite them.

SEO tactics

SEO on social media is a real deal. This group covers how discoverable and searchable a competitor’s content is. Here, I spy on everything that they do to boost their visibility, from description copy to channel structure.

- Description optimization. I check how my competitors write video and channel descriptions. Some go heavy on keywords, others focus on tone and context. I also check if they use links, timestamps, or hashtags.

- Call-to-action placement and effectiveness. CTAs show up in different ways: early in the video, midway, right at the end, or in the description only. Some are verbal, some show up as overlays, others are pinned in the comments. Tracking how competitors do it gives me ideas on what to try and where to improve.

Here's what marketing expert Nia Patel says about that:

Your competitors' comment sections can also be a good place to go to because they might their audience members suggesting ideas that the competitor hasn't posted yet.

- Series and playlist strategies. I pay attention to how videos are grouped and whether there’s a clear structure. Playlists that guide the viewer through a series of related videos often drive more watch time and better SEO. If it works well for my competitors, I look for ways to adapt the format to my own channel.

Community-building tactics

This group is about how competitors build trust and loyalty, whether that’s through collabs, creator cameos, or just showing their audience they’re paying attention.

- Collaboration and guest appearances. Some channels bring in influencers or niche creators to boost credibility and reach new audiences. I watch for these partnerships and consider whether similar moves could work in my space.

- Community requests and engagement patterns. I track how often competitors act on content requests or respond to audience prompts. This shows how closely they’re listening and what their audience is consistently asking for.

- How competitors handle negative feedback. Not everything has to be answered, but ignoring all the negative feedback is also not an optimal way to go. Tracking how and when my competitors engage helps me understand how they manage their reputation and how reactive I can be with my similar audience.

Audience voice and sentiment

This group brings me to the comment section. It’s a goldmine of unfiltered feedback that shows how people feel about the content, brand, and topics.

- Comment sentiment. Are people excited, annoyed, confused, or supportive? Gathering sentiment helps me analyze emotional response and the quality of the engagement. The video might have 1000 comments, but if most of them are bot activity or ragebait, the quality ranks low.

- Audience questions and pain points. Recurring questions or complaints often highlight what’s missing. If people keep asking for clarification or more detail, I know there’s a gap that I could fill with my content.

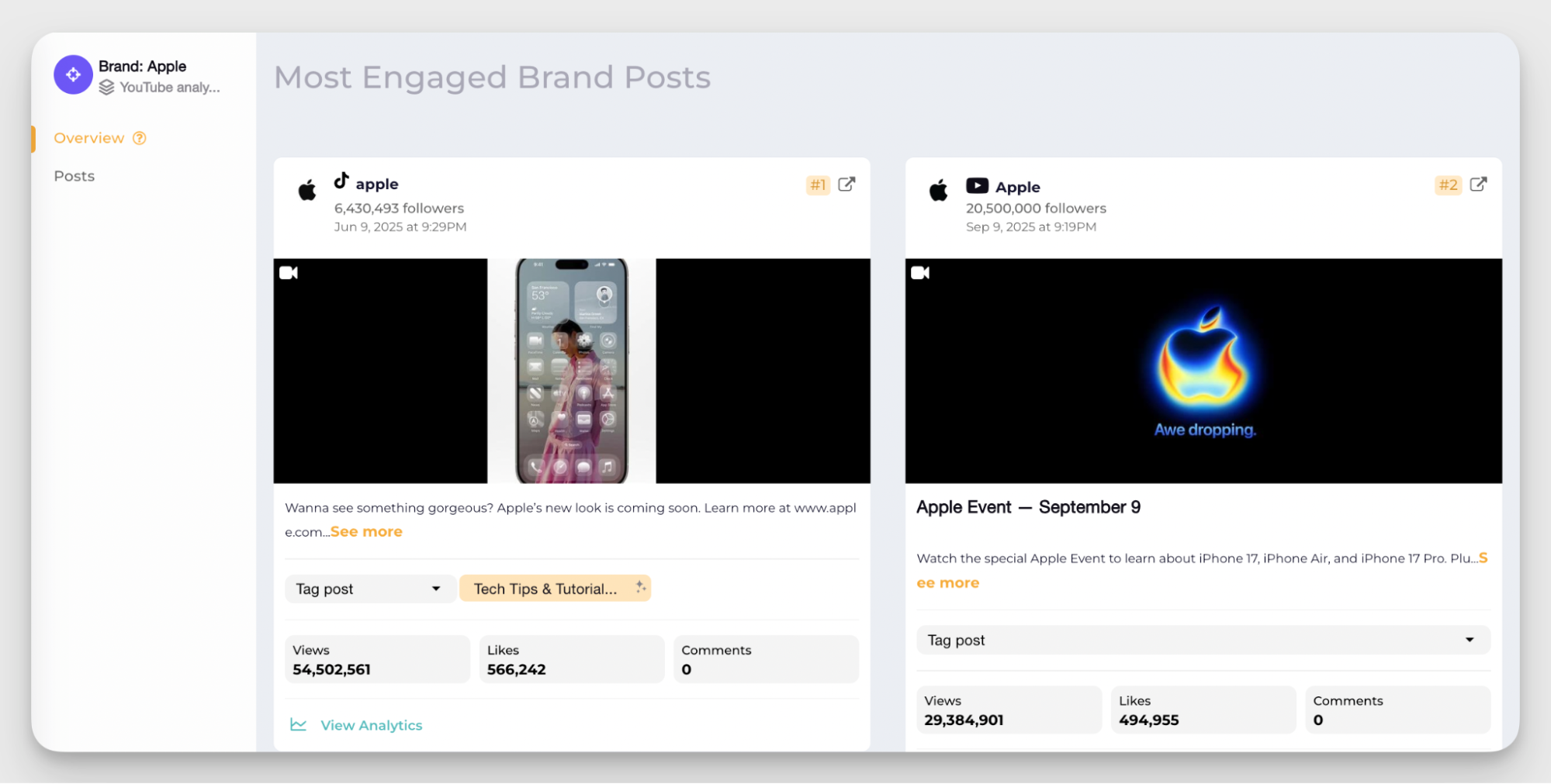

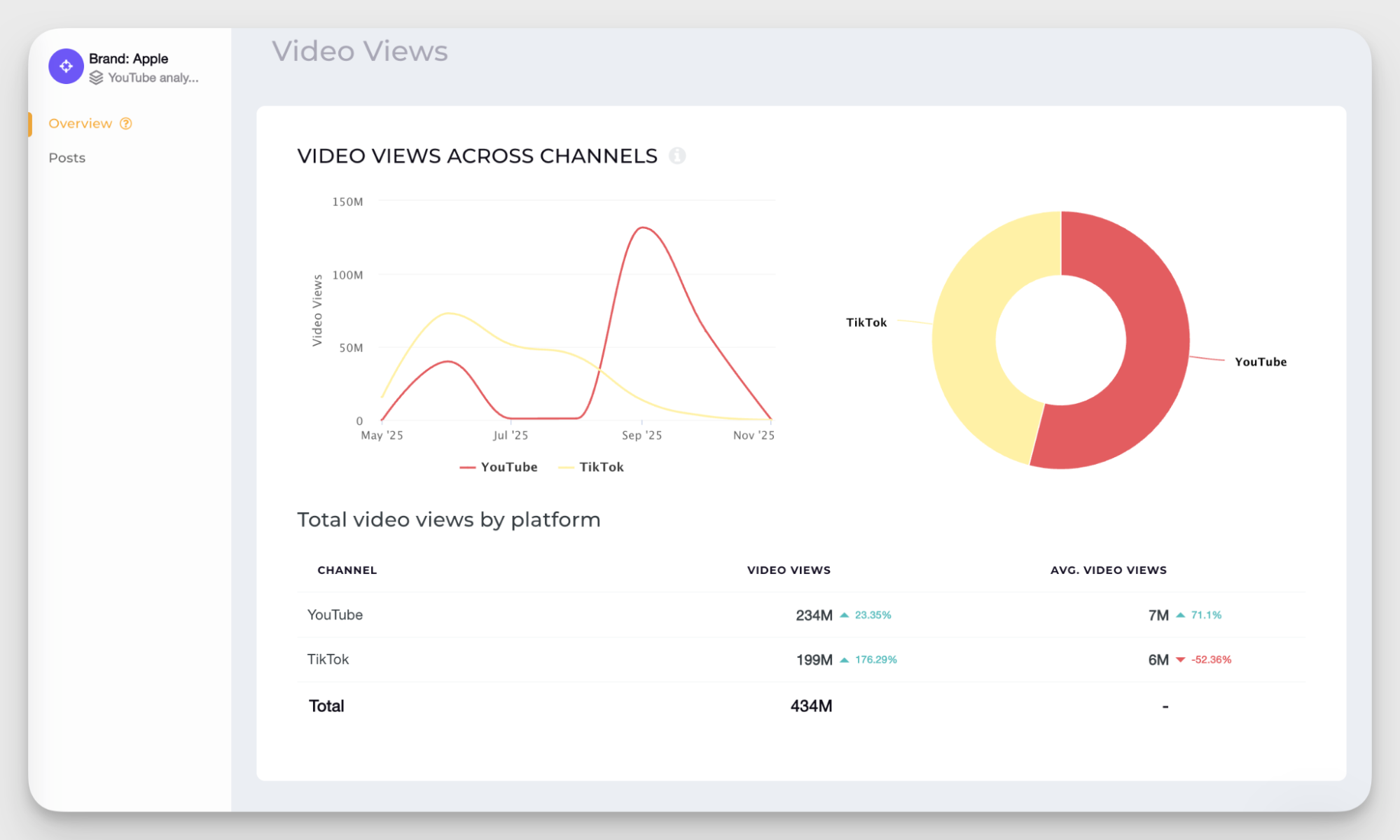

Run a cross-platform analysis

Even though we’re focusing this analysis on YouTube, it doesn’t mean I ignore other platforms. Most brands don’t post in a vacuum, and video content travels.

Instagram, TikTok, and even LinkedIn are packed with short-form and repurposed videos. That makes them useful data sources, especially when a piece of content goes viral outside YouTube first. I often check my competitors’ viral videos across platforms to see what’s resonating and whether I can use those insights to fuel my YouTube strategy.

With Socialinsider, I can also see how different platforms contribute to a competitor’s overall visibility. Sometimes, what doesn’t perform on YouTube takes off on another channel, and that shift can highlight some content angles I didn’t think of before.

Analyzing viral videos outside YouTube is also a great way to find content gaps and use them to my advantage. If something’s doing well on Instagram but never made it to their YouTube channel, that might be a topic worth picking up before they do.

Create an improvement plan based on your findings

Data is only as useful as what you do with it. Once I wrap up a YouTube competitor analysis, I focus on turning those insights into concrete steps.

That doesn’t mean changing everything at once. In fact, I try to limit the action points to 3-4 key moves I’ll test or implement over the next 2–3 months. These are answers to a simple question: “What are we trying next to improve our position?”

To turn raw data into a strategy, I run the findings through a set of practical questions:

- What video format should we try more of — Shorts, long videos, YouTube Community posts?

- Is there a content topic or pillar that seems underused in our channel but overperforms for competitors?

- Are there any title or thumbnail patterns we can experiment with?

- Should we restructure our playlists or series so they’re more binge-worthy to watch?

- Is there a competitor’s CTA approach we could test in our videos?

- Are we missing out on cross-posting opportunities that others are using well?

- Did we notice any gaps in competitor content that we can fill before they do?

Say I’m managing a YouTube channel for a skincare brand. In my competitor analysis, I notice that one competing brand is posting ingredient breakdown Shorts covering one skincare ingredient per clip.

These videos consistently outperform their other formats in both views and engagement. They use clean, minimal thumbnails with one bold word (like “Niacinamide”) and title formats like “What does niacinamide really do?”

Meanwhile, we’ve mostly been doing long-form tutorials and promo videos. Shorts are pretty inconsistent and don’t follow a specific pattern.

Here’s what I’d pull out of that:

- Launch a new Shorts series focusing on ingredients, posted weekly

- Adopt the title structure: question-based, 3-6 words max

- Add a CTA in the description pointing viewers to long-form tutorials for deeper info

That’s three changes that are actionable, doable, and measurable. They fall neatly within a 2–3 month window for implementing, testing, and reviewing early results.

Final thoughts

Running a YouTube competitor analysis is one of the most reliable ways to get unstuck when your effort isn’t matching your results. It gives you fresh video content ideas, real industry benchmarks, and practical tactics you can test. And the best part is that it's all based on what’s already working in your space.

And it’s not a one-and-done job. Treating competitor research as an ongoing habit keeps your strategy grounded and responsive instead of reactive.

If you want to make the process easier, give Socialinsider a try. With advanced analytics and executive reports, you can track multiple YouTube channels, compare their performance, and pull insights faster. Start your 14-day free trial and make your next competitor analysis your strongest one yet!

FAQs on competitive analysis on YouTube

How do I avoid mistakes in data interpretation?

My main advice on how to interpret social media analytics is not to take the data personally. It’s tricky to separate yourself as a social media professional from yourself as a content consumer, but try to stay cool and as unbiased as possible. Treat data as numbers, not a reflection of your personal value.

How often should I run a YouTube competitor analysis?

You can hold a YouTube competitor analysis as often as it makes sense for your workflow. However, try to avoid having big breaks because the data may become outdated pretty fast. My approach is a full-scale competitor analysis every quarter, with ongoing check-ins on competitor content in between.

How many competitors should I include?

Some social media managers recommend a range of 5-10 competitors. I usually work with 5-7 competitive brands to stay more focused. Keep the list balanced with direct, indirect, and aspirational channels, and mix accounts of different sizes for a fuller picture.

What should I look for in a YouTube analytics tool?

The best YouTube analytics tools go beyond traditional engagement metrics. Look for features like engagement breakdowns, content pillar insights, competitive benchmarking, and clear growth tracking. Socialinsider offers all of these, plus advanced reporting that makes it easy to turn data into actionable steps.

Kseniia Volodina

Content marketer with a background in journalism; digital nomad, and tech geek. In love with blogs, storytelling, strategies, and old-school Instagram. If it can be written, I probably wrote it.

Analyze your competitors in seconds

Track & analyze your competitors and get top social media metrics and more!

You might also like

Improve your social media strategy with Socialinsider!

Use in-depth data to measure your social accounts’ performance, analyze competitors, and gain insights to improve your strategy.